Crypto Academy / Season 3 / Week 8 - Homework Post for Professor @awesononso - Topic: Blockchain Rewards

Hello, guys!

This week is the 8th week in crypto academy season 3, and if I may be honest, Every activity has been fun so far. In professor @awesononso the last lecture, we understood the concept of units and measurements in the cryptocurrency ecosystem.

This week professor @awesononso took a step forward to guide us through all we need to know about blockchain rewards.

This homework post will center around the value of cryptocurrencies even as it tries to adequately respond to the tasks given in professor @awesononso's lecture post.

Question 1: In your own words, explain mining and block reward.

Mining can refer to any activity that involves extracting valuable material from a parent source. There must be three elements for mining to occur: a parent source, an action (work done ), and valuable material.

Conventionally, we see mining as the extraction of materials like gold, silver, oil, and many other valuable materials from the earth. However, this is not the case in the crypto ecosystem.

Here rather than extracting, miners add and validate transactions to the blockchain, which is regarded as the parent source of all cryptocurrencies.

These transactions sum up to form blocks after a period.

The activity or work done by miners in the crypto ecosystem is to add these blocks to the blockchain, which will show Proof-of-Work by discovering the correct Hash. Hence miners work by sacrificing their computational power, and this consumes a lot of electricity and time.

The result for every mining activity is to gain valuable material. In the crypto ecosystem, miners' functional materials are a cryptocurrency reward for being the first miner to find the correct Hash to link a block to the blockchain. This is usually referred to as "Block rewards." In the case of the most dominant cryptocurrency, "Bitcoin," miners are currently being rewarded with 6.5 bitcoins for successfully adding a block to the blockchain.

Question 2: What do you understand by the Bitcoin Halving?

One of the significant challenges faced by money, whether virtual or real fiat money, is the battling of inflation rates which negatively affects the value of money as it increases in supply.

Bitcoin halving is a deflationary process that allows the bitcoin cryptocurrency to maintain its value even as its supply increases daily.

The bitcoin halving process causes miners to start being rewarded with exactly half the amount of coins previously offered for successfully discovering the Hash of a block.

The Halving process occurs after every 210,000 blocks are being added to the bitcoin blockchain.

Since the invention of bitcoin in 2009, this halving process has occurred three times. The first was experienced in 2012 where the bitcoin rewards were slashed from 50 BTC to 25BTC, and the second time happened in 2016 where the bitcoin was halved from 25 BTC to 12.5 BTC and the third time was in the year 2020where the bitcoin was halved from 12.5BTC to 6.25 BTC. If you notice the sequence of halving events happen after every four (4) years.

Question 3: What are the effects of Halving on miners?

Even though the halving process prevents inflation and creates a subsequent

Increase in the value of Bitcoin, the halving process only affects Bitcoin miners negatively. These adverse effects are outlined below

- Increased difficulty in mining: The difficulty in mining a block of bitcoin is increased because the total number of transactions to be validated is increased to a certain level because of the total amount of bitcoin supply in circulation

- Increase in total cost needed to mine: Whenever halving occurs on the bitcoin blockchain, the difficulty needed to mine a single block increases, thereby consuming more electrical and computational power, leading to a rise in money spent on electricity bills and the maintenance of devices used in mining.

- Reduction in rewards gotten by miners: As explained earlier, the amount of coins rewarded to miners after successfully adding a block to the blockchain is reduced by half its original amount. As we all know, miners' rewards also act as an incentive for miners to keep mining.

Question 4: What is the current block height on the Bitcoin blockchain? How many more blocks before the next halving? (Screenshots and Full working)

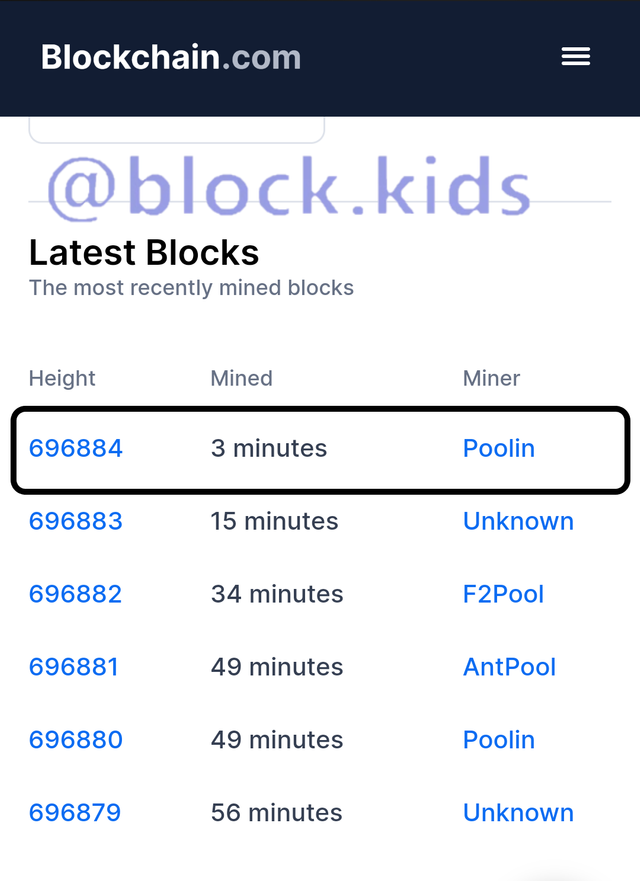

source : Screenshot from my device

The screenshot above shows the block height of Bitcoin as of writing.

Let us consider :

If Bitcoin has already halved three times, it means that the next halving will be the 4th.

It takes 210,000 blocks to be formed before a halving event occurs.

∴ Block height for the next halving = 210,000 x 4

=840,000

Current block height = 696,884 blocks

∴ Number of Blocks until the next halving = 840,000 - 696,884 = 143,116 Blocks.

Question 5: Do you think Steem's inflation rate reduction can affect other coins? Why?

source : pixabay

I believe that Steem's inflation rate reduction will not affect the value of other coins in any way because the market dominance of the Steem coin is at about 0.01 %. However, traders who have studied the relationship between the Steem coin and other Cryptocurrencies may refer to the currency's value before deciding a trade.

Question 6:What is the current block height on the Steem blockchain? How many more blocks before the subsequent 0.01% reduction? (Screenshots and Full working)

source : Screenshot from my device

The screenshot above shows the block height of Steem as of writing.

Let's consider that the Steem inflation rate reduces by 0.01% every 250,000 blocks.

Current block height = 56,563,483 blocks

∴To find the total number of reductions so far:

56,563,483/250,000 = 226.25

There have been 226 reductions so far.

Take the next whole number to calculate the block height for the next reduction:

Block height for next reduction = 227 x 250,000

= 56,750,000

∴ Number of blocks until next reduction = 56,750,000 - 56,563,483

=186,517 Blocks.

Before I conclude this homework post, I would love to respond to some questions in continuation to last week's task.

Question 1: What is the current value of BTC on the day you are performing this task?

If you purchased $2,500, then,

a.) how many satoshis would you have?

b.) what is the value of a satoshi for that day?

(Show full working and correct to 3 s.f)

(1 satoshi = 0.00000001 BTC)

source : Screenshot from my device

The value of Bitcoin as of the time of making this post is $49,156.79, according to coinmarketcap

1 satoshi = 1/100000000 x 1 BTC

1 BTC = $49,156.79

If I purchased $2,500 then I would get xBTC.

Where xBTC = 2500 ÷ $49,156.79 = 0.0509 BTC(to 3 s.f)

If I convert the value of bitcoin I bought to Satoshi, I will have x amount of Satoshi.

Where x Satoshi = 0.0509 ÷ 0.000000001 = 50,900,000 Satoshi

The value of one Satoshi for the current value of bitcoin will be;

∴ 1 satoshi = 1/100000000 x 49,156.795

1 satoshi = $0.0004915679

1 satoshi = $0.000492 (to 3 s.f).

Question 2: What is the current value of BNB on the day you are performing this task?

If you purchased $30 then,

a.) how many Jagers would you have?

b.) what is the value of a Jager for that day?

(Show full working and correct to 3 s.f)

(1 jager = 0.00000001 BNB)

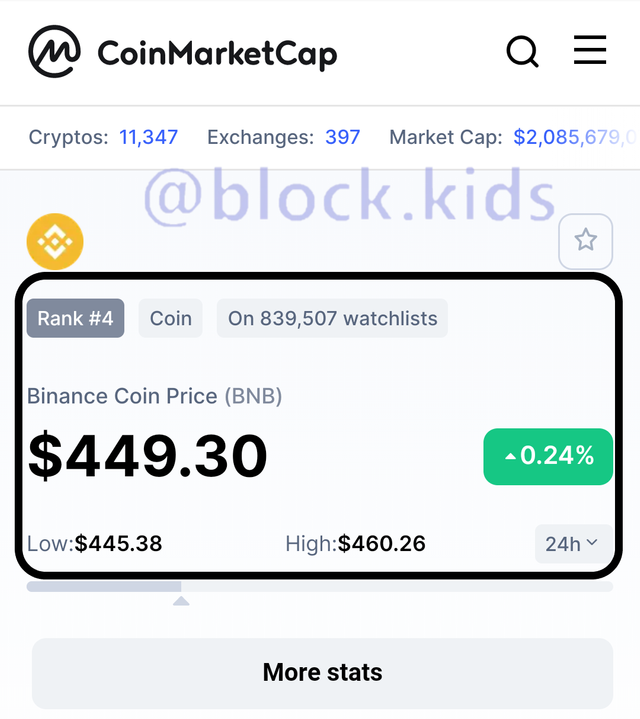

source : Screenshot from my device

The value of the Binance coin as of the time of making this post is $449.30, according to coinmarketcap

1 jager = 1/100000000 x 1 BNB

1 BNB = $449.30

If I purchased $30 then I would get xBNB.

Where xBNB = 30 ÷ $449.30 = 0.0668 BNB (to 3 s.f)

If I convert the value of the Binance coin I bought to jager, I will have x amount of jager.

Where x jager = 0.0668 ÷ 0.000000001 = 66,800,000 jager

The value of one jager for the current value of Binance coin will be;

∴ 1 jager = 1/100000000 x 449.30

1 jager = $0.0000044930

1 jager = $0.00000449 (to 3 s.f).

Conclusion

Blockchain rewards are the primary driving force for the sustainability of Cryptocurrencies in the blockchain. They act as incentives that drive miners to offer their computational power and a massive portion of their time to validate transactions on the blockchain.

To prevent these rewards from contributing to a pending increase in the inflation rate, many measures have been put in places like the halving process on the bitcoin blockchain or the subsequent reduction in inflation rate as applied on the Steem blockchain

The creation of this homework post has allowed me to research more into the technicalities surrounding mining activities related to blockchain technology.