The Bid Ask Spread ( Part II ) - Steemit Crypto Academy - S4W3 - Homework Post for @awesononso.

Introduction

I am very excited to be a part of professor @awesononso's class this week to gain more knowledge on the bid ask spread. We were introduced to the first part of the bid ask spread in the first week of season 4 and this week is the continuation of the bid spread ask.

I would now like to present my work to the task given.

The Order Book And Its Components From Binance.

The Order Book in the cryptocurrency world is a record or ledger of all the open orders ( buy and sell open orders ) arranged in order of their prices. The order book is divided into 2 parts; the bid side and the ask side. These parts are identified by their colors where the bid side or buy side is usually green and the ask or sell orders is usually in red.

The order book is always up to date as it updates or adds a new open order as and when it is made in the exchange.

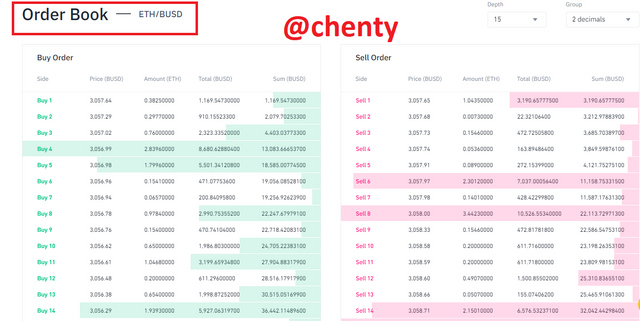

The order book is used in cryptocurrency exchanges like binance as well as other cryptocurrency platform like steemit for the trading or exchanging of one pair of cryptocurrency to the other. For example, in the screenshot below I would show the order book for ETH/BUSD pair.

In the screenshot above from Binance, the left hand side of the order book for ETH/BUSD pair indicates the buy order or the bid side. The right hand side indicates the sell order or ask side.

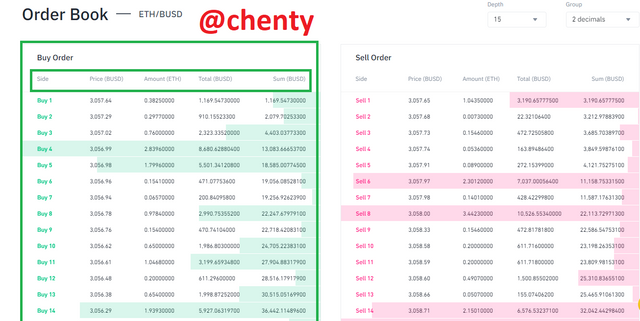

But in the screenshot below also from Binance, the left hand side of the image is the order book. The top half in red is the sell order and the bottom half in green is the buy order.

From the images above, I would now talk about the components of the order book.

Components of the binance order book.

- The Bid Side.

The bid side of the order book is the green side of the order book containing all the open buy orders. In the bid side, there are other information like price, amount, total and sum.

The price information indicates the value of the asset at which it would be traded in this case busd as the time of placing your order. As seen in the screenshot the highest price is 3057.64 which means when the value of busd reaches 3057.64 the asset would be bought.

The amount information indicates the equivalent of the other asset being traded. In this case the amount shows the quantity of ETH I would get.

The total information displays the total amount of asset you want to trade. In this case in the bid side, total indicates the total amount of busd you are trading.

- Ask Side.

The ask side of the order book is in red and is the right hand side of the order book or the upper half as stated earlier that contains all the open sell orders of an asset in an exchange. The orders are arranged in the order of highest ask orders to lowest.

Just like the bid side, there is more information like price, amount, sum and total.

Here the price indicates the amount or value at which the asset should be sold.

The amount indicates the equivalent value of the other asset that would be sold. In this case the price is in busd but amount is in eth which shows value of the eth that would be sold.

The order book apart from the fact that it makes all available open orders available thereby increasing transparency in the exchange, it has other importance as well. They include;

The order book is a liquidity indicator of an asset,

The order book indicates the direction or trend of the market and

The order book can be used to indicate support and resistance levels by using price of heavy volumes.

Market Makers And Market Takers.

The cryptocurrency market is influenced by investors and traders. These influencers are grouped into 2; market makers and market takers.

So who then are Market Makers and Market Takers?

Market Makers are traders or investors or people who make use of limit orders. Market Makers are people who input their own prices or quote the prices at which they want their assets to be traded. Market makers use limit orders and so their orders are not filled instantly. So with market makers their orders are filled only when the market moves in the direction of the order set and then that price order is matched by the market.

Market Takers are traders or investors or people who do no make use of limit orders but rather marker orders. Market orders are the current value or price at which assets are valued and so orders placed at those prices are executed or filled immediately or instantly. Market Takers are people who place their orders at those prices with the hope of getting them executed immediately. However market takers do not always have their orders filled instantly in some cases due to volatility in prices while confirming transaction. In cases where orders are not filled instantly will be explored in my answer to question 5 using steem.

Market Orders And Limit Orders

There are 2 kinds of orders used by cryptocurrency investors and traders. They are the market orders and limit orders. I have mentioned these 2 orders when talking about Market Makers and Takers and so I would now elaborate on these 2 forms of orders.

So what then are Market Orders and Limit Orders.

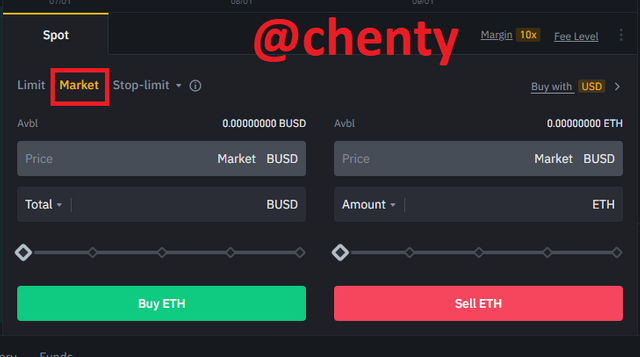

Market Orders are the instant or current prices at which assets are either bought or sold. They are usually used by Market Takers because they get executed or filled immediately and so is not listed on the order book.

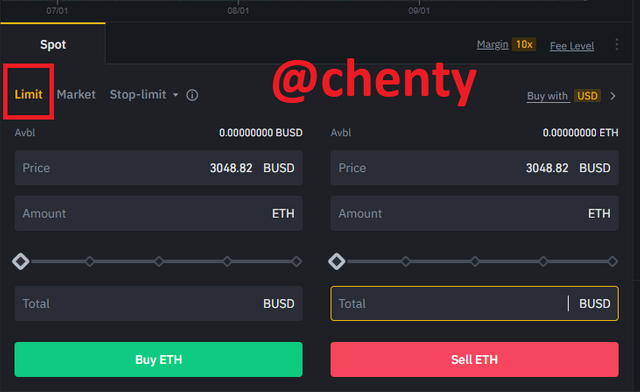

The screenshot above shows the market order feature in binance used by Market Takers.

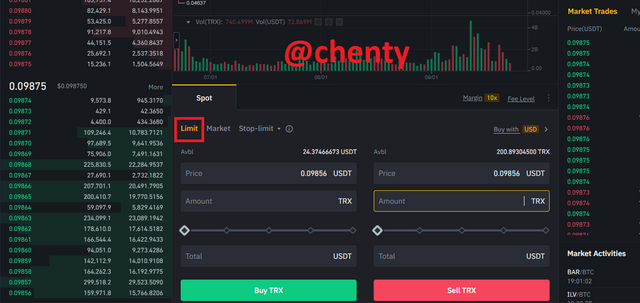

Limit Orders are open orders used by Market Makers and are listed in the order book. They are prices of asset placed below or above the market price of assets.

Limit orders get executed when the market shifts in favour of the price set. Once limit orders get executed, they are removed from the order book.

The screenshot above shows the limit order feature used by Market Makers.

How Market Makers And Market Takers Relate With The Two Order Types And The Liquidity In A Market.

After talking about market makers, and market takers, I would like to at the relationship with liquidity.

Liquidity comes about in exchanges when there are limit orders. Limit orders are set by market makers and so when there is more and more of limit orders there is liquidity increases and subsequently an increase in liquidity.

However, when there are more market takers utilizing the market orders and getting orders immediately executed, liquidity is being used up. This means that maker takers use liquidity provided by market takers.

Therefore, market makers provide liquidity in the market but makers takers use up This liquidity. As market makers increases, there's increased liquidity but when there's more use of market takers, there's reduced liquidity.

Placing Orders Of At Least 1 SBD For Steem On The Steemit Market.

For this particular task we are required to place an order with the lowest ask and then changing the lowest ask.

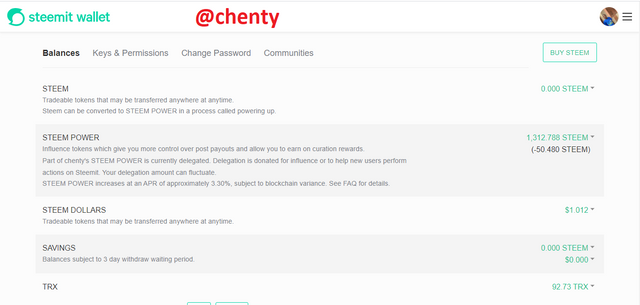

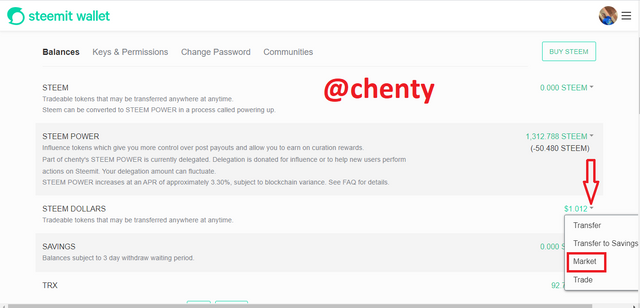

But before, I would like to show how to access the steemit market. The steps below are used;

- Login to your steemit wallet.

- Click on the drop down arrow on your steem balance or SBD balance and click on market.

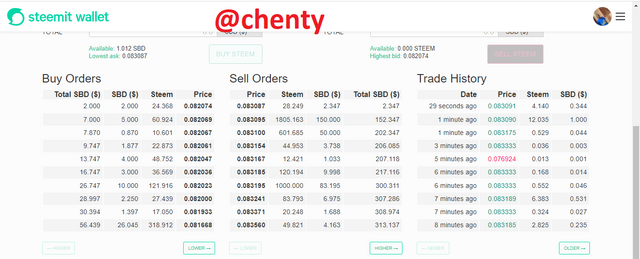

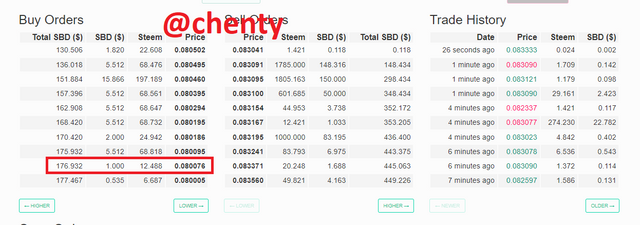

- The steemit market is opened and the order book is shown in the screenshot below.

Now that the steemit marketplace is opened, let's place the orders.

Placing an order of 1sbd for steem by accepting the lowest ask.

- At the buy steem section of the steemit market, enter 1 in the amount box and click on lowest ask. Click on buy steem.

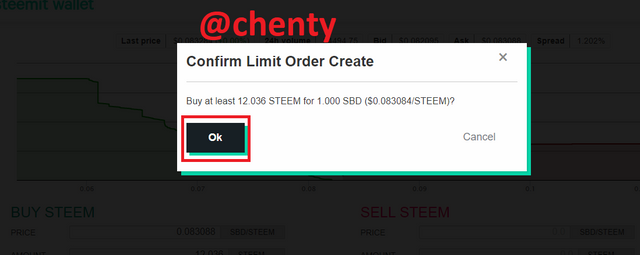

- Click on ok from the pop up.

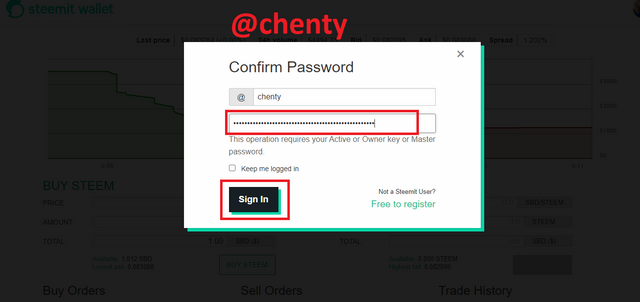

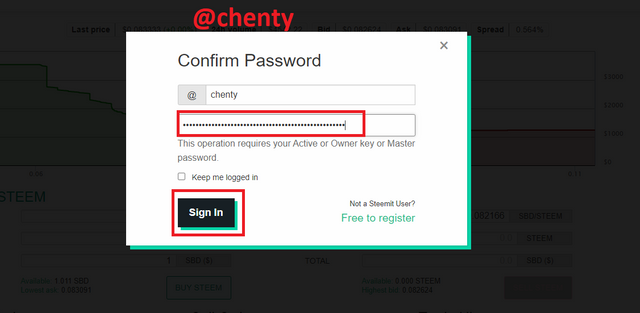

- Enter private active key and click on sign in.

- Order is placed and immediately executed.

Because we are using the lowest ask, we must bear it in mind that it is the same as the market order and so in this case we are are market takers using up liquidity.

The market order was immediately filled as shown from my steem world in the image above because at that time there was an open limit order it matched.It should be noted that during the process of entering my key, the market could shift and so the lowest ask price is changed. When this happens, the market order is not immediately filled but would have to wait until that price is reached again. When this happens you can call your order a limit order although you intended to create a market order.

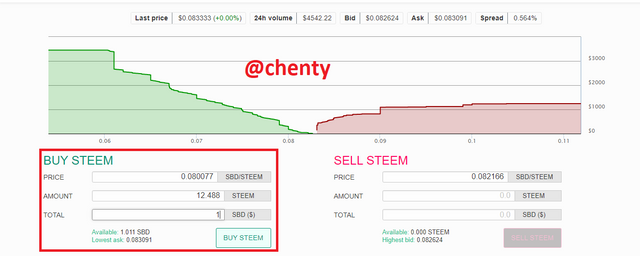

Placing an order of 1 sbd for steem by changing the lowest ask.

- From the steemit market at the sell section enter 1 in the amount box and enter the price you want. So I entered 0.080077 a lower market price set at 0.83091 and clicked on buy steem.

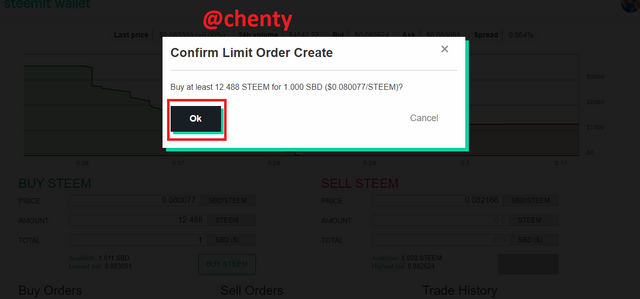

- Click on ok to confirm limit order create.

- Enter private active key and click on sign in.

- The limit order was created and recorded on the order book.

In this case because I have created a limit order, I am acting as a market maker and hence a liquidity provider.

Since the order is below the market price, it would only get executed when the market moves in favour of my order and the market takers come to take up my order.

Placing A TRX/USDT Buy Limit Order On The Binance Exchange And The Impact Of The Order.

To place the buy limit order of TRX/USDT, these steps are followed.

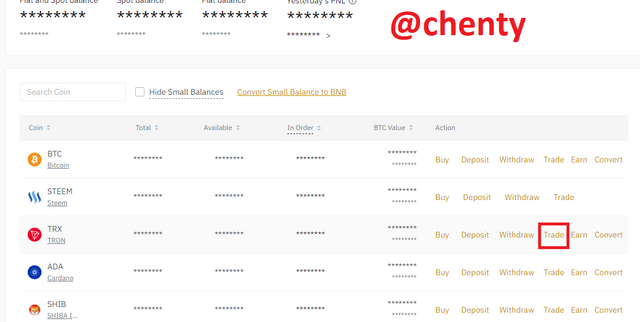

- Login to your binance account.

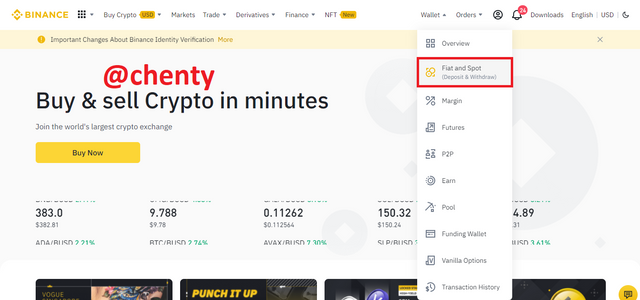

- At the top of the page, select wallet and click on fiat and spot.

- From the displayed page locate trx and click on trade.

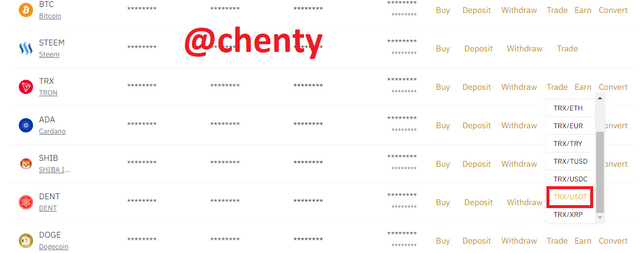

- From the list of pairs displayed, select the TRX/USDT pair.

- From the market of TRX/USDT pair displayed, scroll down the page and place your limit order. Here the set price given is 0.9856 usdt but I would change that.

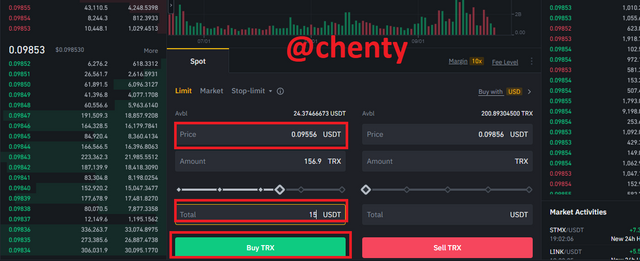

- I want to set a limit order so I set the price lower than the market price to 0.9556. Then I entered the total amount to 15 usdt which would amounts to 156.9 trx and clicked on buy trx.

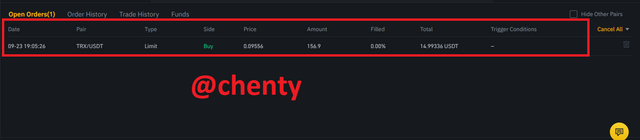

- Limit Order is placed or created as shown in the screenshot below.

The Impact Of The Limit Order Created.

First of all I placed a limit buy order and so I am serving as a market maker in this case. Because of my order created I have provided liquidity to the asset .

The price at which I set for the asset is lower than the market price which means that for it to get filled the price of the asset would have to fall lower than it's current price. This indicates that I want the value of the asset to decrease. The asset in question here is usdt which is a stable coin and so sees no significant drop or rise in value and so the order is unlikely to get filled.

Placing A TRX/USDT Buy Market Order On The Binance Exchange. And Its Impact In The Market.

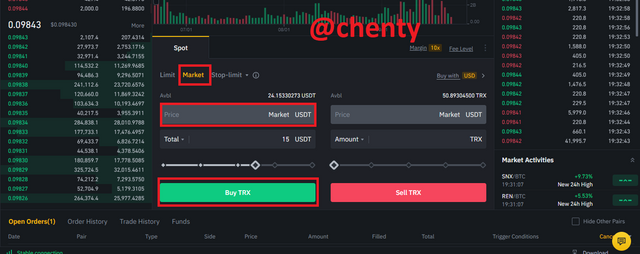

From the buy and sell market of TRX/USDT pair, select the market order feature.

Enter the amount of usdt you want to trade. In this case 15 usdt and click on buy trx.

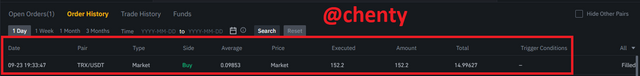

- Since it is a market order, the order is immediately filled.

The Impact Of The Market Order Created.

I created a market order which got filled immediately meaning I acted as a market taker and my order fulfilled an already open order. The market order I created used up liquidity hence I caused a reduction in the asset liquidity.

Order Book Of ADA/USDT Pair From Binance.

The order book of ADA/USDT pair from Binance as at the time of performing this task is below:

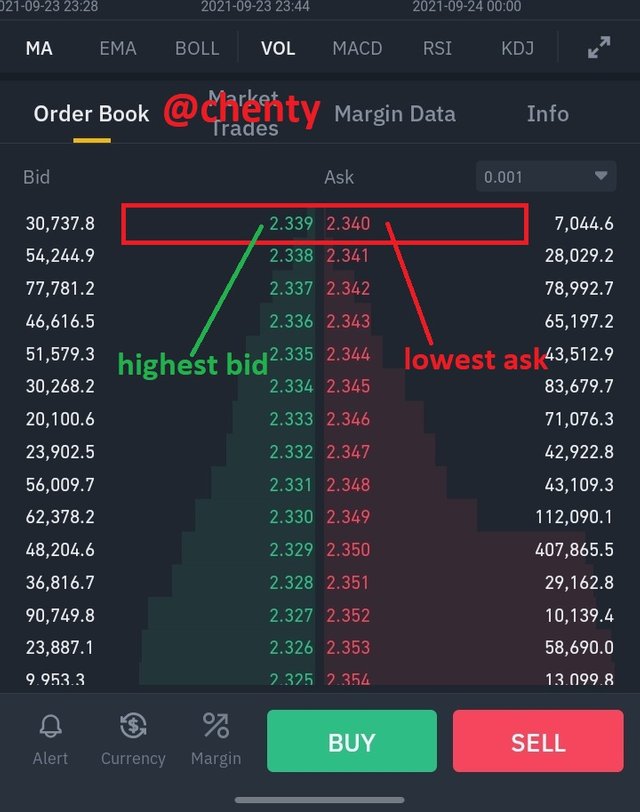

The highest bid and lowest ask prices are below;

Using the screenshot of the highest bid and lowest ask prices above,

Ask = 2.340

Bid = 2.339

Spread = Ask - Bid

Spread = 2.340 - 2.339 = 0.001

Mid - Market Price = ( Bid + Ask )÷ 2

Mid - Market Price = ( 2.340 + 2.339 ) ÷ 2

Mid - Market Price = 2.3395

Conclusion

I must say a big thank you to professor @awesononso for this informative lecture.

An order book is an electronic list or ledger that contains a list of all open orders of an asset in an exchange like binance that consists of a bid or buy side and an ask or sell side. The Bid side contains a list of all open buy orders where as the ask side is a list of all open sell orders.

A limit order is an order that is set by the trader to be executed later rather immediately but a market order is a pre determined price of current value of the asset that the trader uses to be executed immediately.

A Market maker makes of limits orders and as such adds liquidity to the asset but a market taker makes use of market orders and reduces liquidity of the asset.

Thank you.

Hello @chenty,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Thanks again as we anticipate your participation in the next class.

Thank you for your kind review prof.