The Bid Ask Spread (Part II)- Steemit Crypto Academy- S4W3- Homework Post for @awesononso

This is my homework task for professor @awesononso which is about bid ask spread. Let's begin the task.

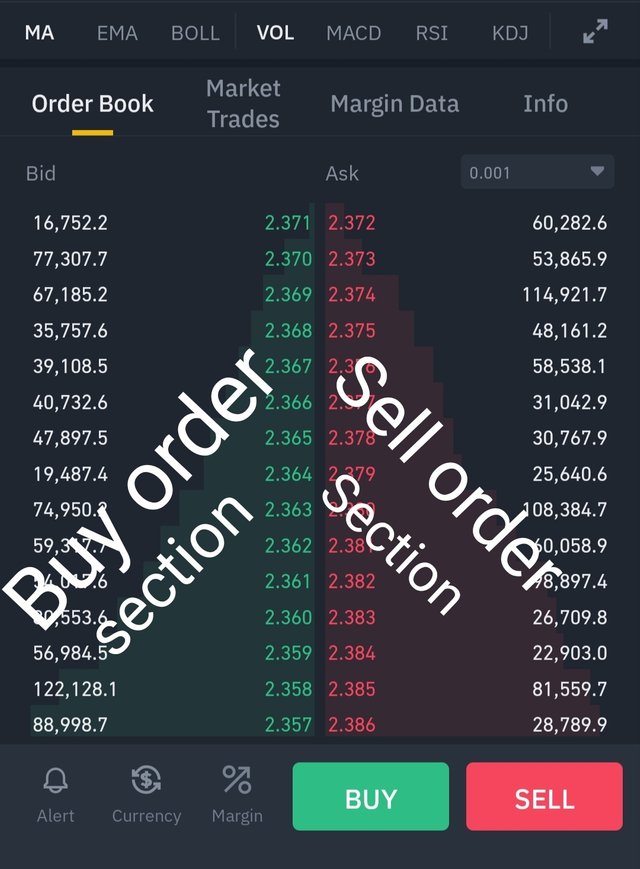

Define the Order Book and explain its components with Screenshots from Binance.

An order book is an electronic record of the buy and sell orders placed on an exchange by the traders on the target trading pairs. An order book has two sections, Bid and Ask section.

Screenshot of order book from my Binance account

Bid or buy section is recorded as green numericals where as sell section as red numericals.

Bid section contains the details of buy orders like bid price and amount. Similarly the ask section contains the sell order details like selling price and amount.

In addition to buy sell details, order book points to many other parameters as well. The worth mentioning are trend in market, liquidity, bid ask spread.

Trend is determined by the type of orders that dominate the market. If buy orders are more then sell orders , it means that the buyers are dominating the market and have potential to push the market price up towards bullish momentum and trend thereby. On the contrary, if the sellers are dominating the market, it means the trend is likely to be bearish.

Bid-Ask spread is calculated by subtracting the lowest bid price from highest aak price. We shall carry out some calculations in the forthcoming section of this task. Bid ask spread has bearing on the market as it determines the liquidity in the market . More the liquidity , lesser is the bid ask spread.

Record book is dynamic in a way that it keeps on upgrading as orders are executed and new orders are placed.

Who are Market Makers and Market Takers?

Market makers and takers are group of traders that keep markets going. Without either of these, market will collapse. Market makers are those taders that add liquidity to the market by putting their orders on specific prices different from the market price. Market maker can be a buyer or a seller. This group of traders add their tokens to the market while placing orders as they set price different from market price.

Market takers are those traders who readily square off from the market by getting their orders filled. They may be buyers or sellers willing to get their trades executed on market price and they therefore drain liquidity of the market.

What is a Market Order and a Limit order?

Market orders are those type of orders where a trader is willing to place a trade on market price. A market order can be a buy order or a sell order. Buy market order is that type of order where a trader buys an asset at the existing price of the market at the time of placing the trade. Sell market order is that type of order where a trader sells his asses at a price that is there in the market at the time of selling.

While placing market orders, a trader must know it beforehand that there may be difference in the price at which order may get executed from the price at which order is placed. It is because these orders are subjected to variation as per the volatility and liquidity of the market. If the market has low liquidity or high volatility , the price may be different depending upon the direction of the the momentum of the price rally . Suppose, i placed a buy order for 1 BTC at market price of 35000 USDT. If the market has good liquidity and order gets instantly filled, I'll get 1 BTC at 35000 USDT. If the market has low liquidity , it would take some time for order to get executed and during that time if the price of BTC is pushed up, I'll get BTC at higher price and if the price of BTC is pushed down, I'll get BTC at lower price.

Limit order may be either buy or sell type. Limit order is that type of order where a trader places an order at limit price. Limit price is different from market price. These orders take time to get executed and one has to wait for the price to move in the favourable direction.

Example, suppose I place a buy order for 1 BTC at 35000 USDT (limit price) when the market price of BTC was 34500. I'll have to wait for the price to move upwards and reach 35000 USD so that my order getS executed. Same holds true for sell limit orders.

Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

Market makers add to the liquidity of the market while as market takers take off liquidity from the market. As for order type is concerned, market makers place limit orders while as market takers place market orders.

Market makers quote their orders at limit price and add to the market. So their assets become available in the market till the time desired price is reached. At limit price, market makers act as market takers for new market markers. So they benefit from difference in bid ask spread. As market makers add to the liquidity of market, they are inturn benefited from the market by charging them l less fee compared to the market takers.

Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

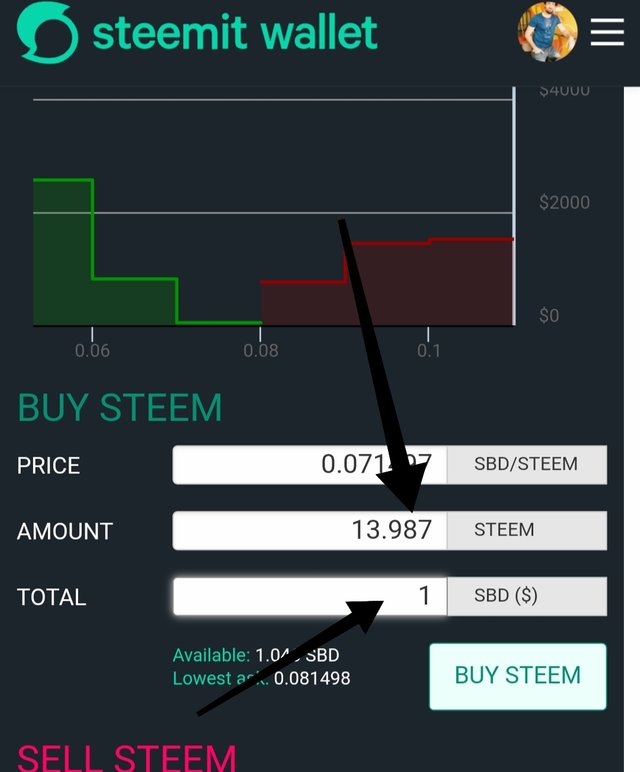

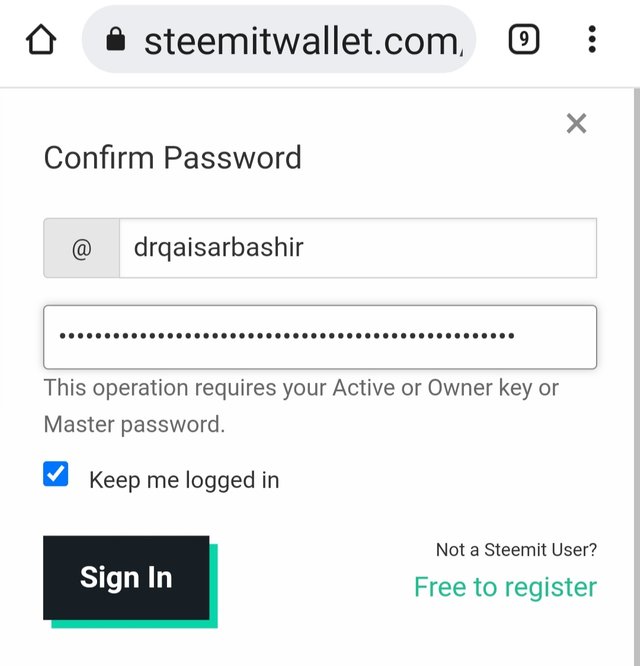

For this task, we need to log in to steemit internal market . We have the option to buy steem or sell steem. We will opt for buy steem and enter the amount of SBD as 1.

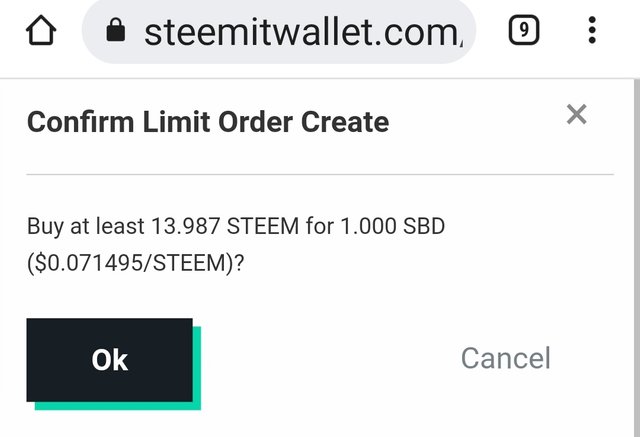

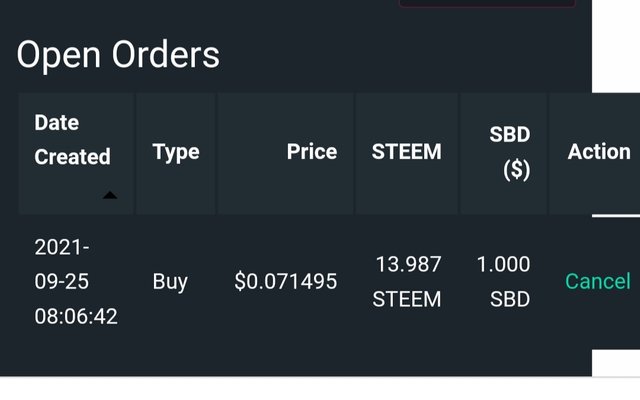

As seen in the screenshot above, for 1 SBD we will get STEEM by accepting lowest ask price of steem.

Now i tried to change price of STEEM from to and place order. Order is pending execution.

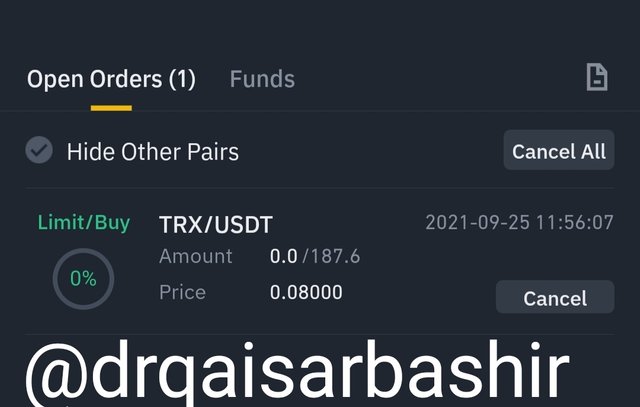

Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

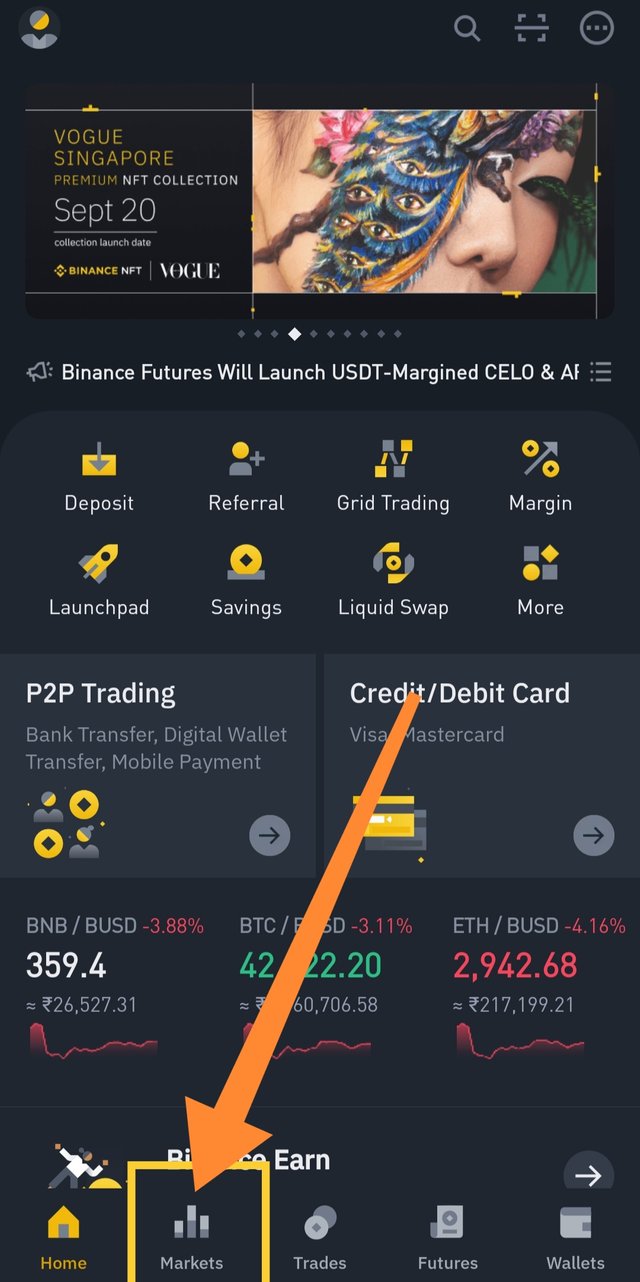

Ooen BINANCE APP. On the main interface, click on Limit order and select TRX/USDT. Click on BUY.

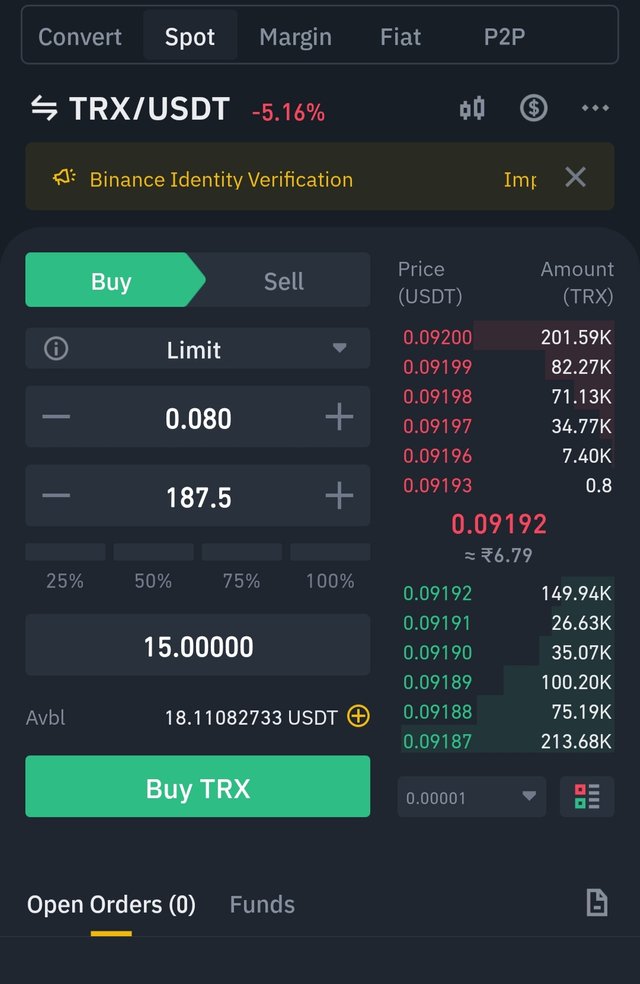

Next select order ttype as Limit order.

Change price of TRX from to

Enter amount of USDT as 15$.

We can see that we get TRX for 15$.

Click "Buy". Order is placed and pending execution.

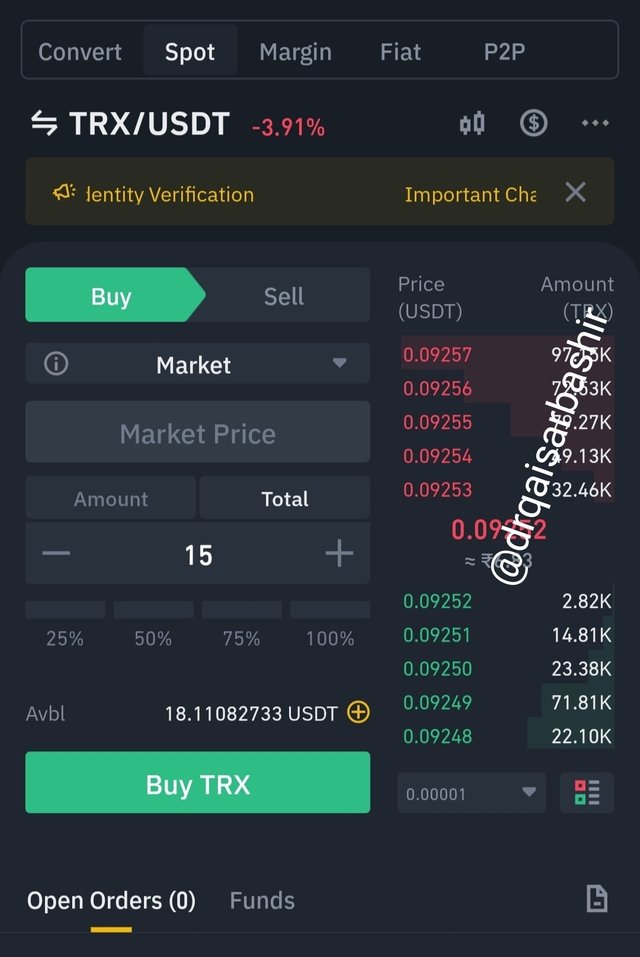

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

Open BINANCE APP. On the main interface, click on Markets and select TRX/USDT. Click on BUY.

Next select order ttype as Market order.

Enter amount of USDT as 15$.

We can see that we get TRX for 15$.

Click "Buy". Order is placed and executed instantly.

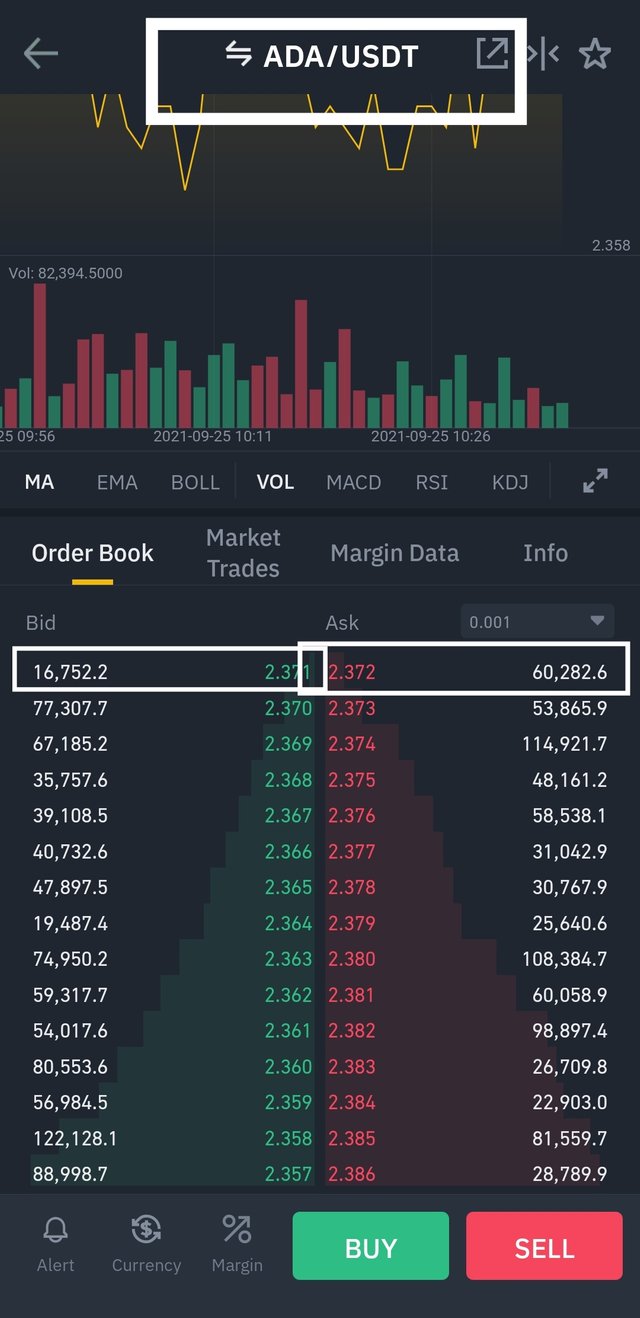

Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

Screenshot of ADA/USDT pair from Binance

From above screenshot, we can see that

From the screenshot, the highest bid of ADA/USDT was 2.271USDT and the lowest ask of ADA/USDT was 2.272USDT

Calculate the Bid-Ask

Given;

Bid price= 2.271USDT

Ask price= 2.272USDT

Required; Bid-Ask spread

Mathematically,

Bid-Ask= Ask price - Bid price

Bid-Ask =2.272 - 2.271= 0.001 USDT

Calculate the Mid-Market Price.

Mid-Market Price = (Bid Price + Ask Price)/2

Mid-Market Price = (2.272 + 2.271)/2

Mid-Market Price = 4.543/2

Mid-Market Price = 2.276 USDT

Conclusion

Order book is an electronic record keeping section of exchange meant to enlist buy and sell orders and establish trans0aremcy along with other indirect parameters like bid ask spread, market depth and trend.

Hello @drqaisarbashir,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You should improve on your arrangement and markdown use.

You did not properly answer question 5.

You did not properly state the impacts of your orders in 6 and 7.

You should have given proof of the transaction in 7 from the order history.

Thanks again as we anticipate your participation in the next class.