Crypto Academy / Season 3 / Week 3 - Homework Post for @cryptokraze | Break Retest Break (BRB) Strategy to Trade Continuation

Introduction

It's with great pleasure I am writing again at the academy for the new week that has been running smoothly. This time, I've attended the lecture presented by professor @cryptokraze as he took us on a ride about Break Retest Break (BRB) Strategy. It was indeed a great lecture to attend and I will be attending the task given by the professor with this article.

1. What is the Break Retest Break (BRB) Strategy?

To talk about the concept of Break Retest Break strategy, we would have to dig into support and resistance in the market structure. Knowing that Support in a downtrend movement mark a point where the price of the asset is triggered to go up again. Likewise, Resistance exists in an uptrend movement on the market structure where the asset's price is resisted such that it tends to continue in the opposite trend.

Having discussed support and resistance, the action of the occurrence of the duo can be for a very little time before it is reversed to continue in the previous trend. To make it clearer, the concept of Break Retest Break strategy studies a situation where the asset's price breaks a previous support/resistance, retest it and further break the new swing to continue in the previous trend. Let's take a look at Break Retest Break Strategy on support and resistance.

Break Retest Break in Uptrend (at Resistance level)

This is a situation in an uptrend movement of an asset when its price breaks (price breakout) the resistance level to create a new high and then retest the resistance level again. After the retest, the price breaks the previous high to create another high and this satisfies the Break Retest Break strategy at the resistance level. Let's see the chart below.

BTC/USDT asset- Uptrend

The above chart of BTC/USDT chart on 45mins time-frame shows how the price break at the resistance level was retested and then breaks the previous swing point to create another high in uptrend.

Break Retest Break in Downtrend (at Support level)

In a downtrend movement when the price of an asset breaks to create a new low and then retest the support and in the process breaks the previous low to create a new low thereby continuing in the downtrend movement. And this satisfies the Break Retest Break strategy. Let's take a look at the chart below.

ADA/USDT asset- Downtrend

Similarly, the chart above is ADA/USDT's where a price break at the support line in downtrend was retested and then breaks the previous swing point to create another low in downtrend.

2. Marking important levels on Crypto Charts to trade BRB strategy

For a Buy Scenerio

To proceed with the buy scenerio using the Break Retest Break strategy, let's take a look on the chart below.

DOGE/USDT chart- Uptrend

From the chart of DOGE/USDT above, in an uptrend movement of the asset where exist a price breakout at a resistance level. The resistance level was retested and there was a price breakout beyond the previous high, creating a new high thereby the previous resistance level turned to a support level that triggered the asset to continue in uptrend. On the chart, I marked out a buy entry above the break of the recent swing high.

For a Sell Scenerio

For the Break Retest Break strategy for a sell scenario, let's see the chart below and see what happened as different positions are marked out.

DOGE/USDT asset- Downtrend

The chart above is of the DOGE/USDT asset which was in a downtrend movement with a price breakout at the support line, there exist a retest of the support line and it was another break thereby creating another low below the recent swing low such that the asset continued in downtrend . One important thing to notice here is that the previous support level turned to a resistance level. I marked the Sell entry just below the break of the recent swing low (lower low).

3. Trade Entry and Exit Criteria for both Buy and Sell Positions

Entry Criteria for a Buy Position using the Break Retest Break (BRB) strategy

Just like every other trading strategies that needs proper study or criteria before entering an asset's market, so as well the BRB strategy has criteria that are to be fulfilled before entering the market. Below is the chart and a few steps of criteria that is required to be fulfilled before placing a buy position.

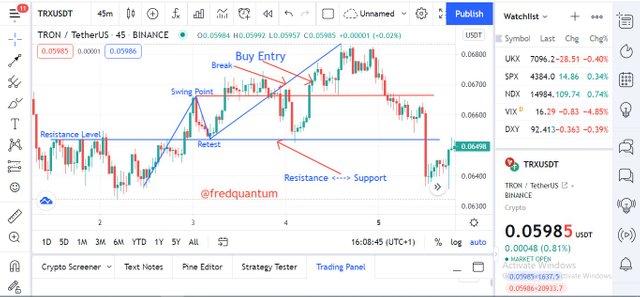

TRX/USDT asset at 45 mins time-frame - Buy entry

Criteria for the Buy Entry

Trade Entry Criteria for a Sell Position using the Break Retest Break (BRB) strategy

Similarly, I will be exploring the chart of TRX/USDT asset using the Break Retest Break strategy before placing a sell position. The criteria will be listed after the chart below.

TRX/USDT asset at 45 mins time-frame -

Sell entry

Criteria for the Sell Entry

Trade Exit Criteria for a Buy Position using the Break Retest Break (BRB) strategy

If you are entering a trade, then proper plan must be made to exit the trade when you have made some profits or to control your loss (stop loss). Let's see the criteria for exiting a trade in profit or loss in both buy and sell positions using the BRB strategy.

Criteria for the Buy Trade Exit

ADA/USDT asset on 45 mins time-frame - Buy trade exit

Criteria for the Sell Trade Exit

TRX/USDT asset on 45 mins time-frame - Buy trade exit

4. Demo trade on 2 crypto assets using the Break Retest Break Strategy

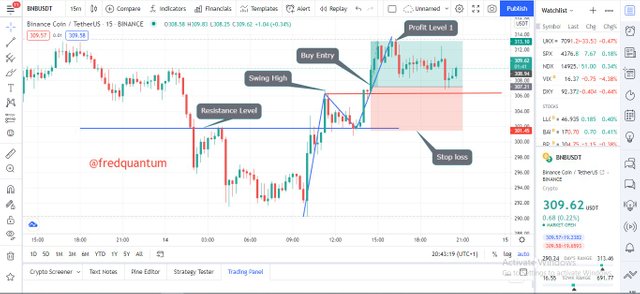

i. BNB/USDT pair- Buy Entry

I will be entering the market using the BRB strategy, the chart pattern of BNB/USDT asset in 15mins time frame was in an uptrend while I marked the resistance level. There was price breakout at the resistance level to create a new swing point (high), retested and the price breaks the previous swing point. Let's see the chart below.

BNB/USDT asset at 15 mins time frame

Details from the Chart

The buy entry was placed above the break of the swing high and the stop loss slightly below the resistance level where there was price breakout previously.

Buy Entry- Binance spot trading

Sell order placed with the profit level and stop loss

ii. ADA/USDT pair- Buy Entry

Similarly, for the ADA/USDT asset, I will be placing a buy entry after there was a breakout at the resistance level and the level was retested. Buy order was placed above the swing point. Let's see the 15 mins time frame chart below.

ADA/USDT asset at 15 mins time frame

Details of the Chart

Note that: The buy entry was placed above the break of the swing high and the stop loss was placed slightly below the resistance level. Let's see my order placed below.

Buy Entry- Binance spot trading

Sell order placed with the profit level and stop loss

Conclusion

Break Retest Break strategy is a great trading strategy that traders can utilize to trade trend continuation at the break of support/resistance level and after retest of the level, break the swing point to ascertain the trend continuation.

This trading strategy helps traders to take advantage of valid price breakout at support/resistance and it can be used at any time frame of choice. I love using the 45 mins time frame and this strategy worked well with it, in this context, I also used it for 15 mins time frame and it worked well as well, in short, it can be used at any time frame. Thanks to professor @cryptokraze for this awesome lecture. Thank you all.

Cc: @cryptokraze

Written by;

@fredquantum

Sort: Trending

Loading...