Steemit Crypto Academy Week 10 - Homework Post for @kouba01

CFD is actually an acronym for Contract for Difference; and it is a technique that grants access to individuals to trade and invest in a certain asset by entering into contract with the broker, as an alternative to setting up a position directly on a particular market.

You may be wondering who a broker is; actually a broker is someone or a firm that serve as a middle man between the investor and the securities exchange. They implement trades on behalf of a customer, but usually they don’t offer the clients with investment advice.

Both the trader and the broker will come to an agreement amongst themselves to duplicate the market conditions and resolve the difference amid them once the position is completed.

Crytocurrencies have started to develop so much interest as a substitute investment or CFD’s. Trading cryptocurrencies through CFD’s is a new way to trade this volatile market. Trading with CFD’s offers certain benefits that cannot be accessed through direct trading like overseas trading, leverage trading etc. most persons actually gain exposure to cryptocurrency by putting their funds into them – that is, purchasing the actual digital currency.

There are actually downsides to this, the processing time used for purchasing a cryptocurrency are mostly slower than the immediate fills that typify a forex trade. This concerns can easily be evaded using CFD’s to trade cryptocurrency as the CFD gives access to fast transaction time which is useful for an unstable market.

To know which cryptocurrency CFD strategy is suitable for your trade

you must have an understanding of the below listed strategies and check which of the strategies suits your type of trade.

The CFD can be used for virtually all crypto trading strategies; it is suitable for binance, bitcoin and the lot of them; there are some popular strategies that we should take note of when trading CFDs like:

The Day trading strategy: the day traders as the name of the strategy suggests ,opens and close all trades over the course of the day, they normally hold positions for just few hours, this actually curbs the risk that happens when your position is left open overnight.

The swing trading strategy: using the swing trading strategy you are looking at assets with short term price moves that can be taken advantage of. If your position is left open overnight then you are open to more risks as there is a probability that unexpected events might affect the market while your attention is somewhere else.

The scalping trading strategy: These traders have their target on the intraday price movements and wish to make small but frequent profits. The traders here only hold positions for few seconds or few minutes and then take advantage of these little opportunities while trading with the current trend.

ARE CFD’s RISKY FINANCIAL PRODUCTS

First of all, it is of utmost importance to bear in mind that every business or trading that is worthwhile comes with a certain level of risk, every form of trading can be said to be risky because your capital is at risk. Trading these instruments can be risky at times; therefore the traders must be careful and also must have a thorough risk management strategy set in place. The profits you stand to gain in CFD trading often overshadow the risk associated with it.

There are actually some risks that have overtime been overlooked in the CFD trading, risks like Client money risk, market risk, liquidity risk and also the counterparty risk. So in a nutshell, the CFDs can be financially risky at times and so the trader must ensure that adequate risk management strategies are set in place.

Do all brokers offer cryptocurrency CFDs?

Are you wondering if all brokers offer cryptocurrency CFD?, it is possible that not all brokers offer cryptocurrency CFDs since there are diverse types of brokers based on their specializations; for example we have the;

Stock broker who is a professional middle man on stock and commodity markets that sells and purchase assets in the interest of the customer on the most promising terms.

Credit broker who is a professional middle man with the needed information and connections with credit organizations, they are responsible for providing personal assistance to their customers or clients in choosing best lending options. It is also their duty to help their clients obtain the needed financing, the conversion and also the payment.

Forex broker provides access to the forex currency market.

We also have the real estate brokers, the business brokers, the insurance brokers and many others. This is to say that not all brokers offer cryptocurrency CFD as the specialization for all brokers varies.

HOW TO TRADE WITH CRYPTOCURRENCY CFDs ON ONE OF THE BROKERS USING A DEMO ACCOUNT

In this article I will be using a demo account to illustrate how you can trade cryptocurrency CFDs on one of the brokers.

Before that WHAT IS A DEMO ACCOUNT?

A demo account is an account that is offered by trading platforms and this account is funded with fake money that makes it possible for a potential customer to experiment with the trading platform and it diverse components.

Steps to trading with a demo account.

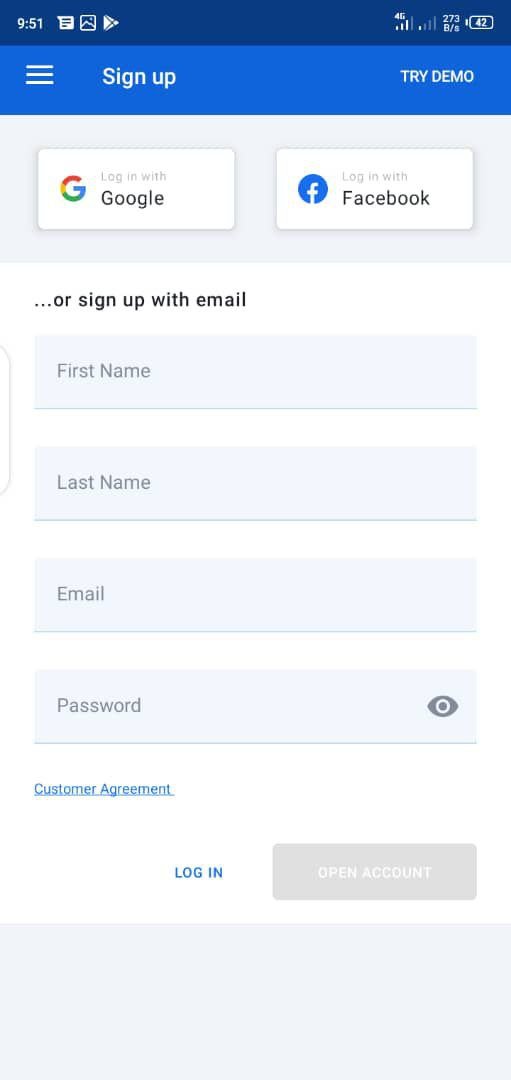

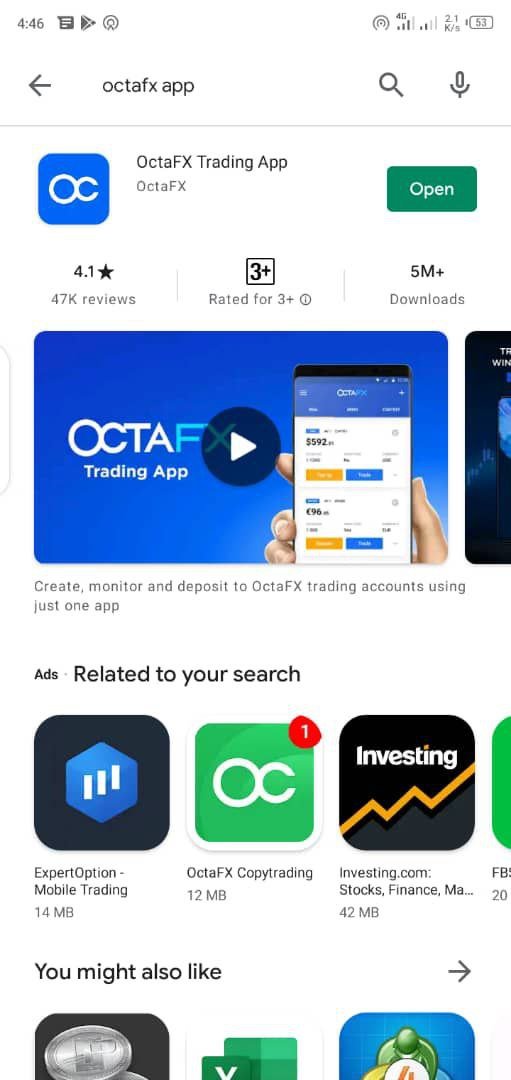

STEP 1: Download a demo trading app or you can log on to their web page. (for this demonstration we will be making use of the octafx app or you can also login to octafx.com)

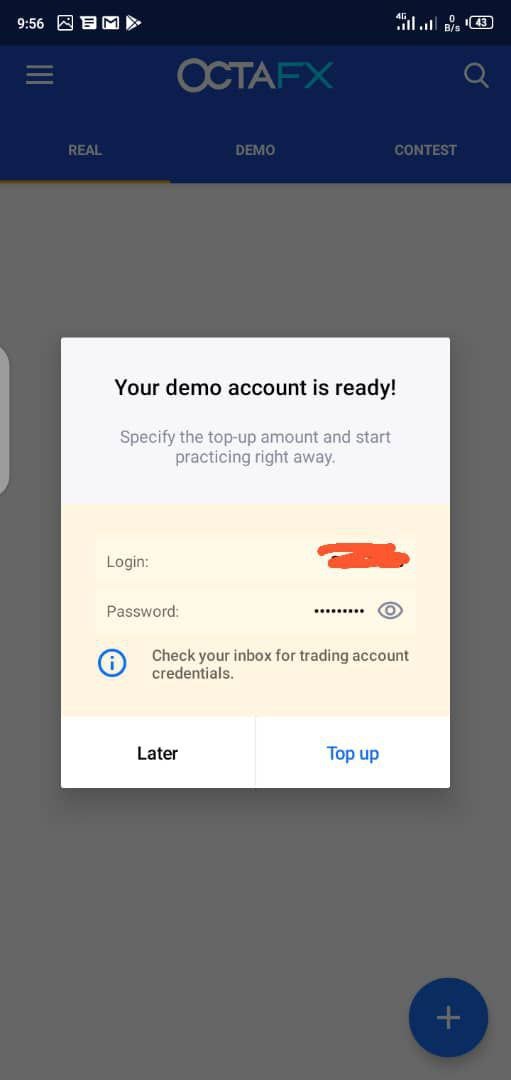

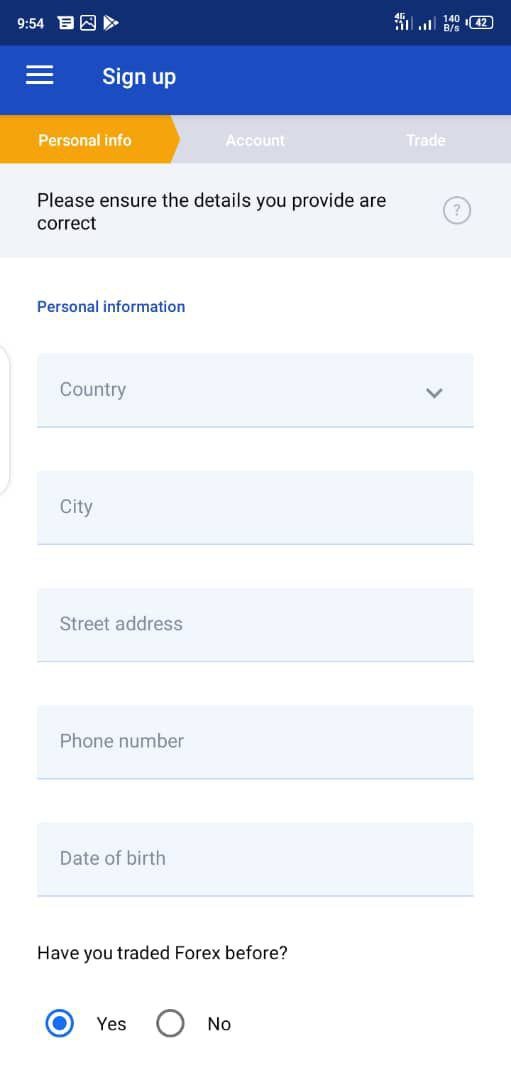

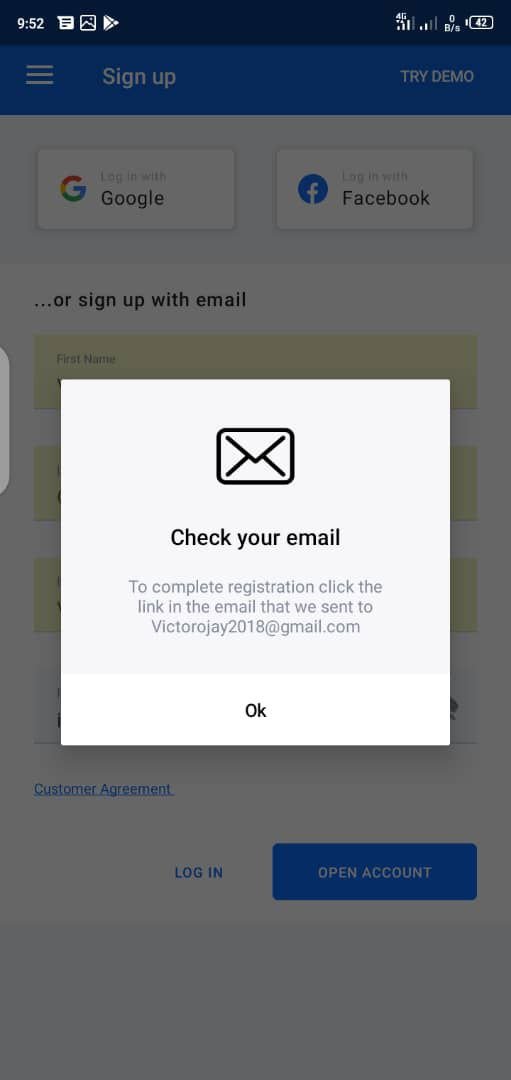

STEP 2: The next step is to open an account which will require your email and password, you will also be asked to verify your email.

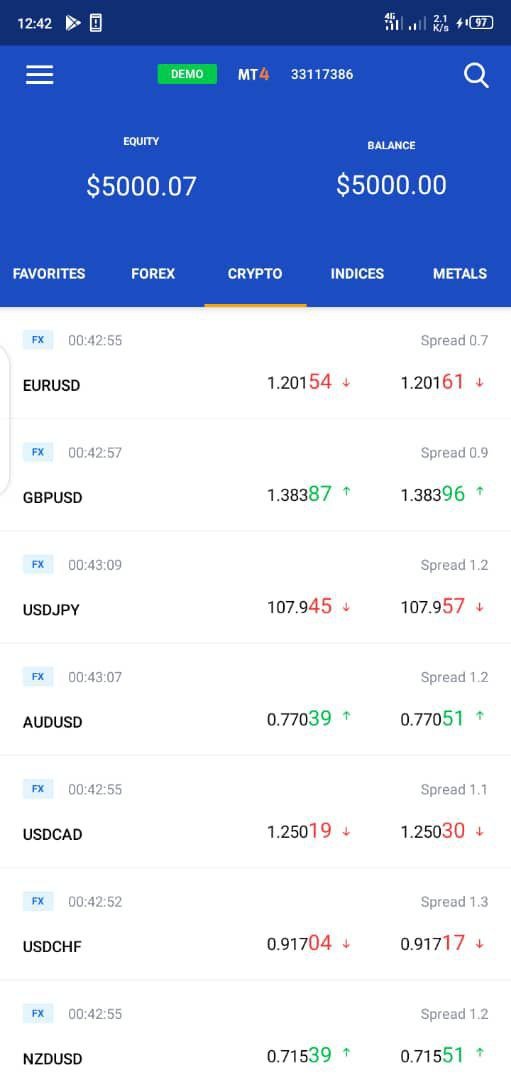

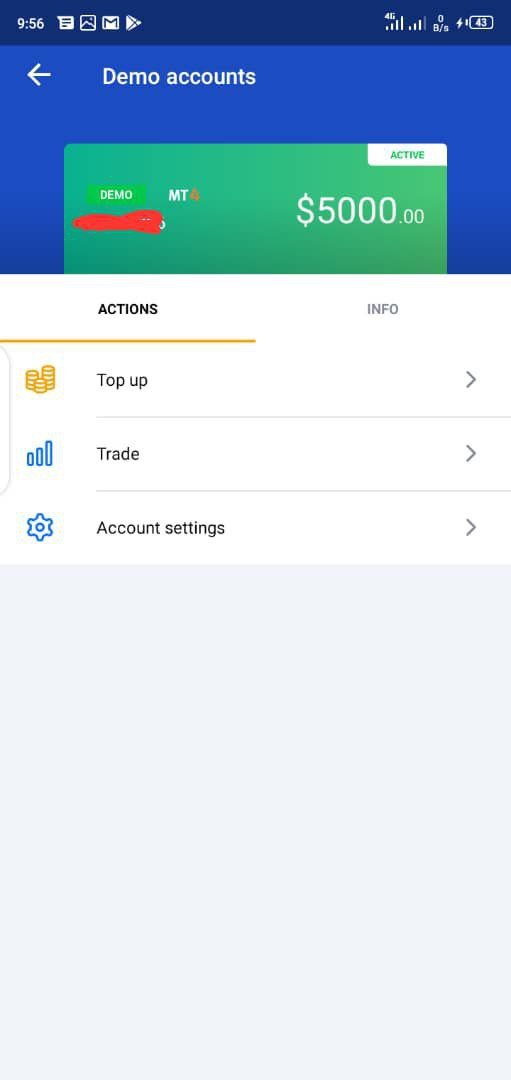

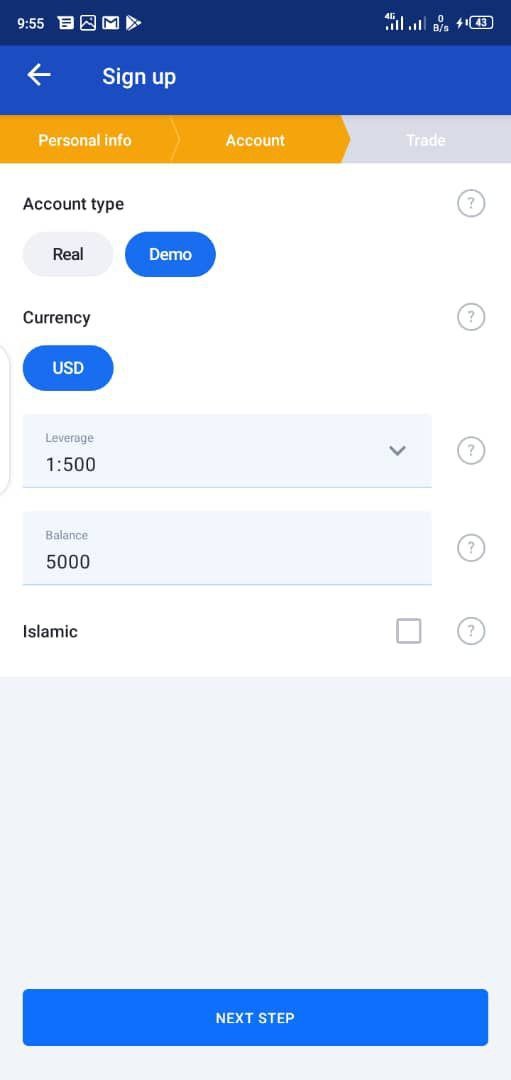

STEP 3: Select an account type (for first time users it is advisable to try out the demo account)

STEP 4: Then you select an action, whether you want to top up your account or trade.

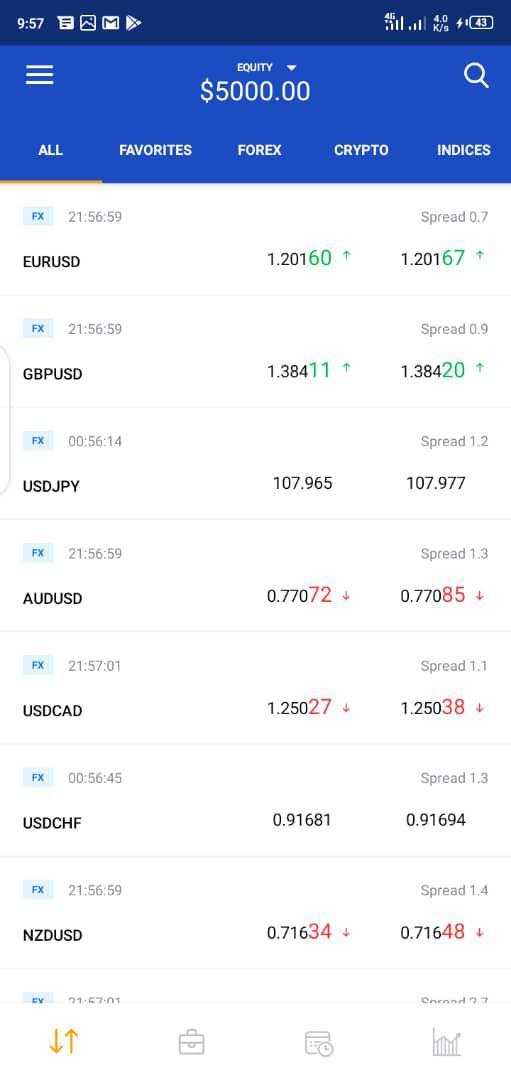

STEP 5: Select “Crypto” at the top

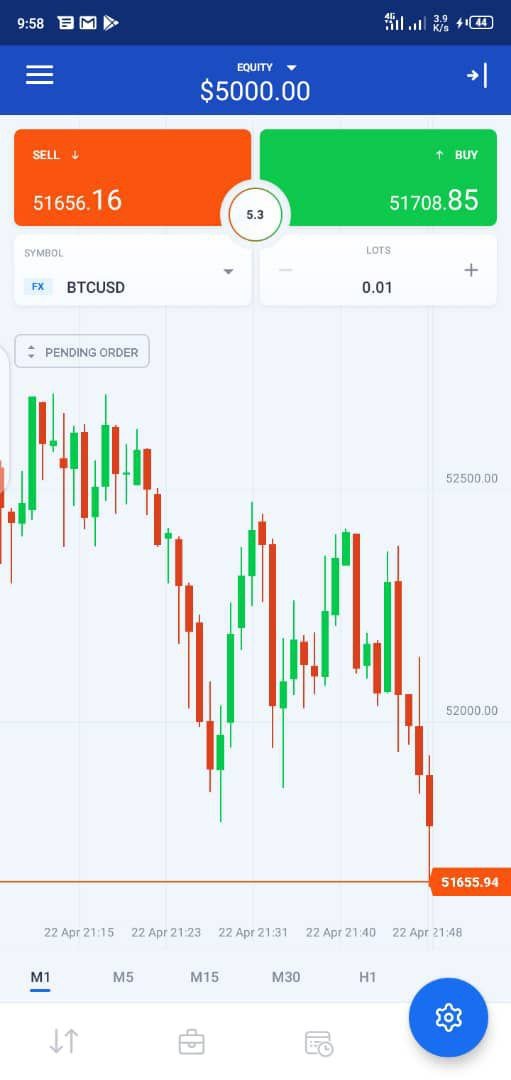

STEP 6: Select the currency you want to purchase or sell.

STEP 7: choose whether you want to buy or sell.

If these steps are duly followed then you are good to go trading on the demo account.

Hello @johnonly,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 7/10 rating, according to the following scale:

My review :

Article with good content, you were able to clearly answer the questions asked.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Thank you professor @kouba01

But please how can you delete that your comment that said i plagarised earlier so as not to serve as a stumble bloblock when the @steemcurator02 want to start upvoting.

Thank you @kouba01

@steemcurator02

This article is suspected of containing plagiarism.

Hello professor @kouba01

My post is not plagarised as i wrote it by myself without no plagarised content.

Please recheck again to confirm because i am sure my post was not plagarised. I put in a lot of hours and effort in this post and i did it by myself.

You can even share screenshot for me to even see that this post was plagarised

@kouba01

@steemcurator02

@yohan2on

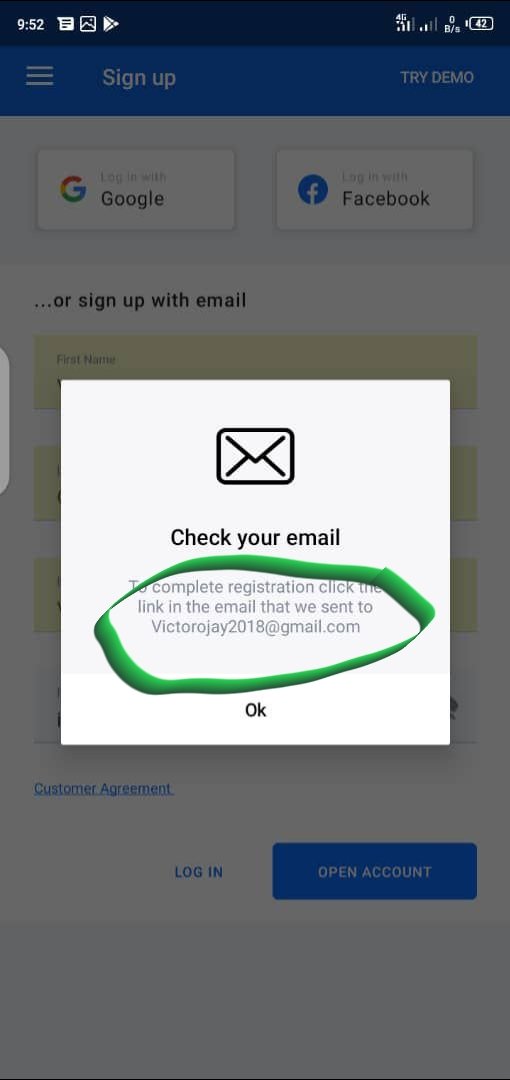

@johnonly, Can you send an email to: [email protected] from the address in the picture ??I will wait for you 24 hours, otherwise, I will consider your content as plagiarism.

Hello professor @kouba01

This is the screenshot as you can see i have send the message

Okay i will check it again.