Steemit Crypto Academy | Season 4 Week 1 Homework Post for @awesononso | The Bid-Ask Spread

Hello everyone. Our world has been fighting a big epidemic for almost 2 years. I hope all of you are in good health. Stay healthy!

Today I will share with you the my homework given by the professor @awesononso

1-)Properly explain the Bid-Ask Spread.

The primary goal of investors in a cryptocurrency market or other markets is to make a profit. To achieve this, investors should enter the market at the best price according to the position of the order. In other words, if the investor is going to buy a commodity, he should buy it at the best price, and if the investor is going to sell a commodity, he should sell it at the highest price as possible.

There are generally 2 types of prices in the markets. Bid price and Ask price.

- Bid Price:It is defined as the highest price of a commodity. When an investor sells a commodity, if he sells at a bid price, he will sell at the best price of the moment. As the demand for a commodity increases, the bid price usually increases.

- Ask Price:It is defined as the lowest price of a commodity. If an investor is going to buy a commodity, he should buy with ask price. As demand for a commodity decreases, the ask price usually falls.

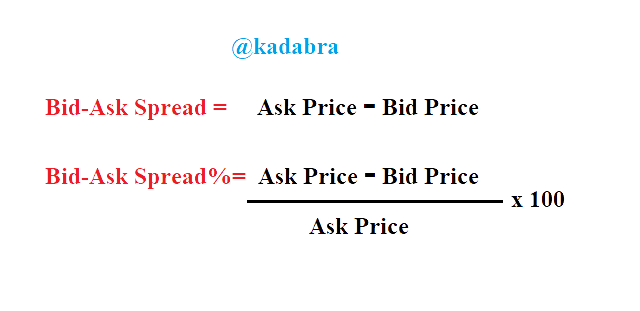

Bid-Ask spread expresses the difference between the ask and bid price of a commodity. The Bid-Ask Spread is calculated as follows:

2-)Why is the Bid-Ask Spread important in a market?

Before buying an asset on the market, an investor who wants to make a profit should consider whether he can resell the asset after buying it. Here we come across liquidity. Market liquidity gives the investor some information about the asset to be purchased. The high liquidity allows the investor to trade the asset quickly and at low cost without significant price changes immediately after purchasing the asset.

The importance of the Bid-Ask spread in the market is also revealed here. Bid-Ask spread and liquidity are interrelated. The low Bid-Ask Spread shows us that the liquidity is high. Likewise, if the bid-ask spread is high, it shows us that the liquidity is low. The bid-ask spread is important to know if the market is more active.

3-)If Crypto X has a bid price of $5 and an ask price of $5.20

In the 1st question, we showed the formula for calculating the bid-ask spread and percentage.

Calculate the Bid-Ask spread

Bid-Ask Spread= Ask price - Bid price

Bid price: $5

Ask price: $5.20

$5.20 - $5= 0.20

Bid-Ask Spread= 0.20

Calculate the Bid-Ask spread in percentage

Bid-Ask Spread %= (Ask Price - Bid Price) / Ask Price x 100

Bid price: $5

Ask price: $5.20

(5.20 - 5) / 5.20 x 100 = 3.84

Bid-Ask Spread % = %3.84

4-)If Crypto Y has a bid price of $8.40 and an ask price of $8.80

Calculate the Bid-Ask spread

Bid-Ask Spread= Ask price - Bid price

Bid price: $8.40

Ask price: $8.80

$8.80 - $8.40= 0.40

Bid-Ask Spread= 0.40

Calculate the Bid-Ask spread in percentage

Bid-Ask Spread %= (Ask Price - Bid Price) / Ask Price x 100

Bid price: $8.40

Ask price: $8.80

(8.80 - 8.40) / 8.8 x 100 = 4.54

Bid-Ask Spread % = %4.54

5-)In one statement, which of the assets above has the higher liquidity and why?

The asset in the third question has more liquidity. The bid and ask prices in question 3 are closer to each other. As the difference between the prices is less, less spread occurs. This creates a more active market. A more active market has more liquidity. A low Bid-Ask spread means more liquidity.

6-)Explain Slippage.

As you know, we can encounter instantaneous price changes in the markets. This is a situation we encounter frequently, especially in the cryptocurrency markets. These sudden price changes can sometimes be in our favor and sometimes against us.

The price change between the time the investor enters the order in the market and the time the order is filled in the market is called slippage. This may cause the trader's trade on an asset to be below or above the desired price.

Slippage can be seen frequently in cases such as high Bid-Ask spread, low liquidity and low volume. Using a limit order while trading in the market can minimize your loss due to slippage.

7-)Explain Positive Slippage and Negative Slippage with price illustrations for each.

Positive Slippage

Filling the investor's order at a more favorable price due to the price change between the order enter and the time the order is filled means a positive slippage. In other words, if the buy order entered by the investor is filled at a lower price than the desired price, or if the sell order entered by the investor is filled at a higher price than the desired price, a positive slippage will occur.

For example: Investor plans to buy SOL at $150. When an order is entered at $150, a $5 positive slippage occurs if the order is filled at $145.

Investor plans to sell SOL at $160. When an order is entered at $160, a $10 positive slippage occurs if the order is filled at $170.

Negative Slippage

Filling the investor's order at a less favorable price due to the price change between the order enter and the time the order is filled means a negative slippage. In other words, if the buy order entered by the investor is filled at a higher price than the desired price, or if the sell order entered by the investor is filled at a lower price than the desired price, a negative slippage will occur.

For example: Investor plans to buy LTC at $250. When an order is entered at $250, a $7 negative slippage occurs if the order is filled at $257.

Investor plans to sell LTC at $240. When an order is entered at $240, a $4 negative slippage occurs if the order is filled at $236.

Conclusion

In this homework, we researched the Bid-Ask Spread/Slippage topics, which are important for trading and answered the questions. Sometimes there are losses or profits that we find very meaningless when trading. Thanks to this course, we have learned why these losses and profits arise. It was a useful lesson.

CC:

@awesononso

Hello @kadabra,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

I noticed that you had paraphrased some points from other sources. Always be as original as possible.

Your definition of bid and ask are incorrect.

Thanks again as we anticipate your participation in the next class.