Crypto Academy Season 3 - Assignment post for professor @allbert –week 5 by @liasteem

Hi friends, I hope you all are always in good health and happy.

My Greetings to you Prof. @allbert, I am your new student in this class and this week, I hope I can be your student who can answer all the homework questions prof. @allbert give by goodly.

Today is the collection of my homework held by SteemitCryptoAcademy, let's follow me together to learn about "Psychology and Market Cycle" and submitted to prof. @allbert. If it's has mistakes, please correct it. I need your hope.

From the lecture that has been delivered by prof. @allbert , he gave several questions for me to collect again, and some of these questions are;

1-Explain in your own words what FOMO is, where in the cycle it occurs, and why

FOMO or known as the abbreviation of Fear of Missing Out, is a phenomenon that occurs today. The feeling of fear of being left behind or left behind, so that a person can act in a hurry without thinking about cause and effect. In everyday life FOMO is a term given to someone who is jealous of other people's lives. Many of these terms are used to accuse a woman of liking her rich partner's branded bag.

Then what is the definition of FOMO in the cryptocurrency world? FOMO can also be said to feel jealous, envious of seeing other people become rich and have many assets. FOMO is terrible, because it can encourage a market user to want to buy at the peak of the bull cycle (highest price), and if examined carefully about the repeating market cycles, then the bull cycle is the initial cycle of the decline in market prices.

Many market users who are affected by the FOMO state, think that this is the right time to make a decision with the prediction that he will soon be rich and have a lot of assets like most people in the bull cycle. They force themselves to buy in the cryptocurrency market in hopes of giving it a doubled profit on the spot.

Look at the arrow above that says Euphoria, this is the highest peak of a crypto trade made by market users. It is at this highest cycle that people usually believe that they are rich and have many assets. Usually this kind of feeling, driven by greed, but in this cycle is a cycle where big traders take their profits. This cycle is the beginning of a bearish phase.

For other traders have confidence that prices will normalize and stay in position, without knowing that big traders who have bought assets in the Bealif and Thrill cycle withdraw all the assets they traded to seize huge profits, while small fish believe and stay in their positions because it assumes that this phase will not be reversed. So when the bearish cycle starts, the small fish are getting scared and lose a lot of assets and start to get depressed about the situation that the initial forecast will soon become a whale.

FOMO occurs because of misunderstandings about predicting market prices driven by feelings of greed, greed, envy, complacency, and wanting to get big profits in a short time. FOMO occurs because there is the wrong emotional support. When the wrong market psychology influences someone to continue their investment, then the market users have become FOMO, i.e. victims of their own greed.

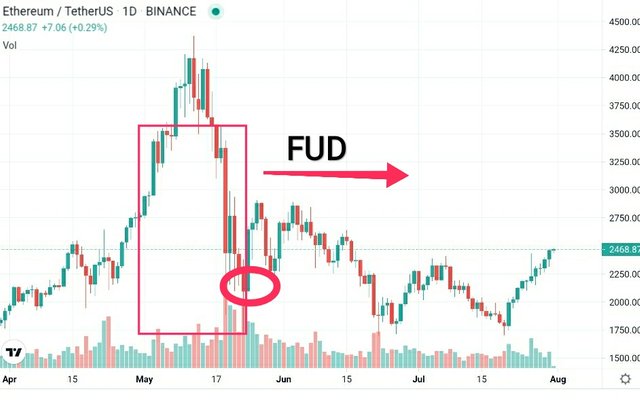

2-Explain in your own words what FUD is, where in the cycle it occurs, and why. (crypto chart screenshot explanations needed)

FUD stands for Fear, Uncertainly, and Doubt. This is one that greatly affects investors in making transactions in the cryptocurrency market. This triggers investors to make fatal mistakes because of misunderstandings about predicting market prices.

A FUD market user, they are afraid to lose bigger assets and fall into poverty. Under these circumstances, it made him think that it was better to be vigilant. Predicting the wrong outcome makes him a FUD.

Look at the cycles that occur until a market user is considered FUD.

FUD greatly affects the emotional sense of a person, especially for novice traders and investors who are just starting their business and are new to the world of cryptocurrency. When they saw the market price starting to decline they were haunted by fear, so they saw a second time the market price was going down, making these little fish start to get scared.

So from excessive fear without knowing the market cycle, they sell all the assets they have on a large scale and bear heavy losses, triggering them to give up and eventually fall into poverty. After all assets are exhausted, what do you want to do? Depression and insecurity will stick to him.

In fact, this bearish cycle is not an option to sell all assets, but if you are patient enough and know the current market cycle, then he does not need to be FUD. Because usually a bearish cycle is the beginning of a bullish cycle, where asset prices start to rise.

FUD also occurs because of misunderstandings about predicting market prices. They don't understand and are pressured by the wrong emotional feeling, that is, they don't want to be poor, even though they can be patient until the bearish cycle stops and the bullish cycle will soon occur.

FUD is driven by feelings;

- Afraid of being poor

- Misconceptions about predicting market prices

- Does not understand Psychology and the market cycle

- Lack of patience

3- Choose two crypto-assets and through screenshots explain in which emotional phase of the cycle it is and why. Must be different phases

From the homework given by prof. @allbert , who has to determine two cryptocurrencies, then I choose the highest row of currencies in cryptocurrency.

*BTC/USDT

*ETH/USDT

OK, I will describe one by one.

*BTC/USDT

Look at the chart below

On the chart we can clearly see how the emotional cycle of traders and investors works. There is a green line that indicates investors and traders make purchases, while the red line shows sales that really make this hand want to stroke the chest. What a pity.

Last April was noteworthy history for traders and other big investors, as the price of cryptocurrencies at that time soared. Let me explain through the graph above.

It was April, the 11th to be exact, which was when the asset sold at its highest price, i.e. 0.6+k, and this was a huge bullish cycle for market users. They have a lot of fun and make that moment the day they get big profits and attract the attention of other market users to join in buying assets at that time or this cycle is done by FOMOs.

After the whales were satisfied with the huge yields, they began to draw back their assets massively because considering the profit they had earned was already more than the first purchase. After studying this we can know what will happen next. Right on April 16th, the minnows who wanted to get rich quick like the whales that pulled assets on the 11th yesterday started buying shares at $60k , as their FUD got more scared and sold off all assets until a bearish cycle occurred at $29k. Assets are depleted, they feel depressed and devastated.

Let's look at last July 21, small fish who have given up, who can't wait to stop, whereas if they observe and understand the market cycle without being driven by wrong emotions, they will feel the same way as whales who make big profits. last April. Since July 22 we can see that the Bullish cycle started.

In this chart we can see that, even though the bearish cycle is over and now it is in the Bullish cycle, the market users should not become FOMO or FUD just for the sake of satisfaction. However, market psychology like this should be able to prevent higher asset losses. We can see in the chart above that Bitcoin was at $60k.

Even because of the bearish trend that is often the friend of market users, this month the price of Bitcoin fell to below $30k.

- ETH/USDT

In the graph above we can see the various phasesand different from the phase that occurs in the BTC/USDT chart above. It is clear where FOMO and FUD occur. We can observe that the price of ethereum at first was at $15k, then due to the influence of Psychology on a market user, the rotation of the actual market cycle is the same.

At the beginning of the chart there was great expectation for market users of the price increase that would occur in the increase in the price of ethereum. Then the big investors and traders started adding assets and adding more so that the value of ethereum rose and rose again until it reached a euphoric cycle. In this cycle, large investors and traders take profits and withdraw their assets according to their experience and understanding of market cycles.

Then FUD emotionally came and invested their assets in a euphoric cycle, even though this cycle was the beginning of a bearish cycle. Vice versa, FUDs are also afraid of losing their assets to sell all of their assets, even though if they have an understanding of the market cycle and do not misunderstand in predicting market prices, then it is possible for them to be at the beginning of the Bullish phase.

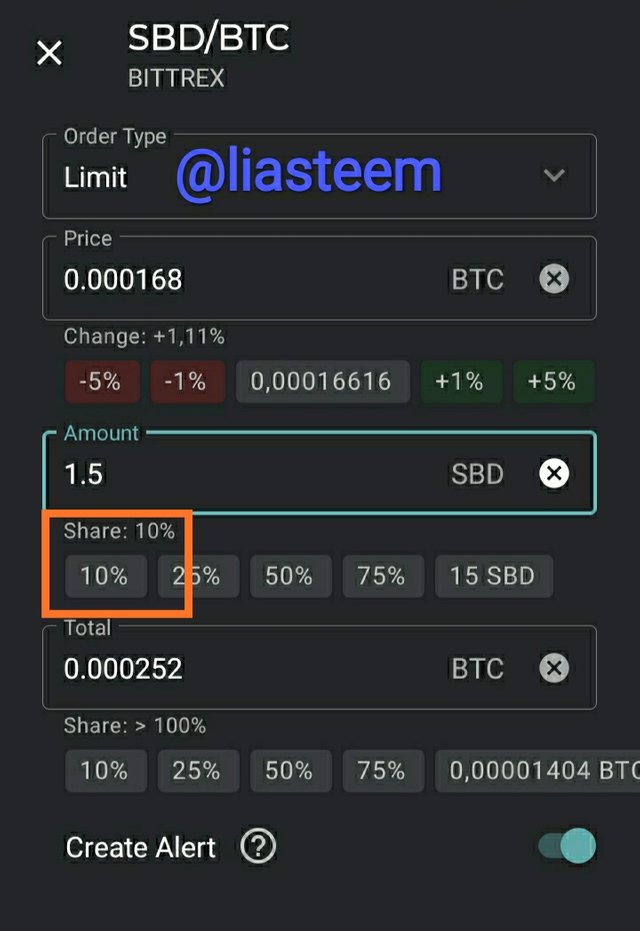

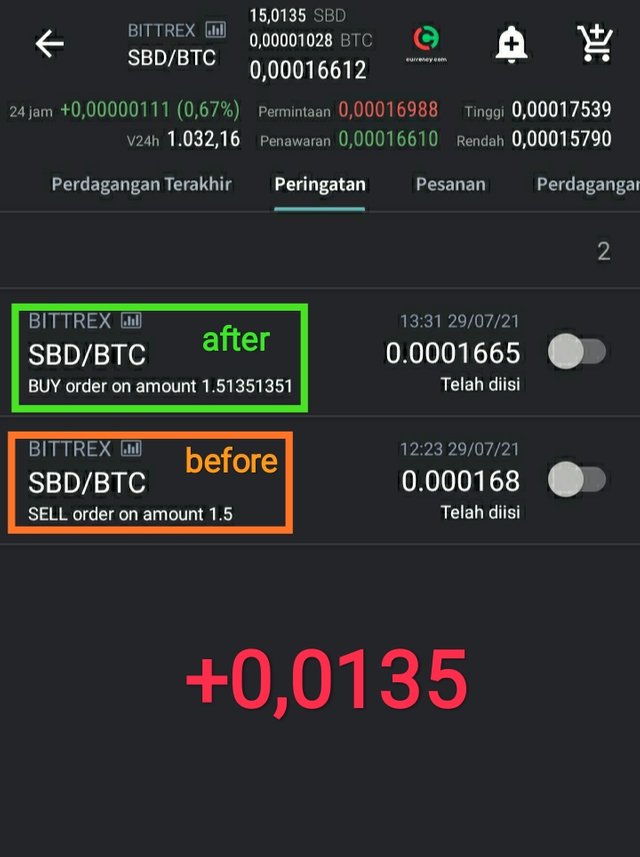

4- Based on the analysis done in question 3, and the principles learned in class, make the purchase of 1 cryptocurrency in the correct market cycle. The minimum amount of 5USD (mandatory), add screenshots of the operation and the validated account.

On this occasion, I want to show you how to predict market prices so as not to lose money. I sold my asset for 1.5 SBD with a nominal Btc price of 0.000166166 in the market. I try to use my opportunity when the market price is in a bearish cycle at that time. Due to time, I only sold it a little at a profit of 10% of the market price, i.e. 0.000168

Then after the prices of the two markets were determined, I went to see the market charts that I had set, it took time for the prices we were bidding to be bought by other market users.

After a while, then I again saw that my assets were sold at 10% profit.

This is the value of my assets of 1.5 SBD before selling them on the market, and the value of my assets increased to 1.5135 SBD with a total profit of 0.0135 SBD.

From the description above, we can conclude that being FOMO or FUD is a choice. However, it is better to face market cycles that change from time to time so that we market users should be able to understand Psychology and Market Cycle which can benefit ourselves, so we don't need to be FOMO or FUD because of our misunderstanding about the world of cryptocurrencies. Learning from mistakes is wisdom, but falling into the same hole is foolishness.

Everything that happens in the market cycle is influenced by the hope process, then turns into optimism, and then rises again to belief so as to produce various sensations that are influenced by the psychology of investors and traders.

From the lectures of prof. @allbert I understand more and feel very happy, because as a new student and even a beginner in trading, I can minimize losses in the market cycle and don't make me FOMO or FUD.

Thank you very much for my great teacher prof. @allbert , wish you always in good healthy.

Thank you also to all Steemian who have joined this lecture and see you next time.

All screenshots of the graph above, I took myself and from my own account

CC; Prof. @allbert