Trading Cryptocurrencies @meniya - Crypto Academy / S4W6- Homework Post for @reminiscence01

1. Explain the following stating its advantages and disadvantages:

- Spot trading

- Margin trading

- Futures trading

SPOT TRADING

Spot trading involves going long or short on digital assets like Bitcoin and other Altcoins for immediate delivery. To put it another way, bitcoins are exchanged between market players directly (buyers and sellers). In a spot market, you have direct ownership of cryptocurrencies and are eligible for economic incentives like staking participation.

Spot traders aim to profit by buying assets and hoping that their value will grow. When the value of their assets rises, they can sell them right away for a profit. Shorting the market is another option for spot traders. When the value of financial assets falls, this procedure entails selling them and repurchasing them at a lower price.

ADVANTAGES OF SPOT TRADING

- Trading is more flexible

Transactions last longer in spot trading. Furthermore, the parties concerned have the option of keeping the item until they can find a better deal. - Delivery is brief and only require a few people

As a result, after paying a specified amount of money, the investor can immediately acquire the purchased object. It lowers the risk of counterpart delivery failure by reducing uncertainty.

MARGIN TRADING

Margin trading is a type of trading that allows investors to trade digital assets using funds provided by a third party. Traders have access to a huge sum of capital allowing them to leverage their positions in order to acquire more profit on successful trades.

Margin trading with cryptocurrency allows users to borrow money against their existing capital in order to trade bitcoin on an exchange "on margin." In other words, consumers can borrow funds to improve their purchasing power by leveraging their existing bitcoin or dollars.

ADVANTAGES

- Possibility of asset leveraging

When you purchase assets on margin, by leveraging the value of securities you already hold helps to boost your portfolio. When the price of your investment rises, then there is a high chance of multiplying your rewards. - The ability to profit from a drop in the price of a coin

Short selling is a complex method in which an investor attempts to profit from a share price decline. To sell securities short, you must first borrow stock from a brokerage business, which necessitates the use of a margin account.

DISADVANTAGES

+. Margin can exacerbate your losses as well as increase your earnings

+. It's possible that you won't be able to predict accurately

+. Most exchanges require a trader to own some certain amount in their portfolio before they will be allowed to trade with margin

+. There is an increased chance of liquidating your account

FUTURES TRADING

Futures trading is a type of trading where traders predict the value of a digital asset, whether it will go bullish or bearish within a time frame. Traders can predict the value of a digital currency in the future using cryptocurrency futures, similar to stock and commodity futures. Bitcoin futures are the most well-known sort of cryptocurrency futures contract right now.

ADVANTAGES OF FUTURES TRADING

Investors are able to take part in the markets

Futures contracts can help risk-averse investors. Investors get access to markets that they would not have had otherwise.Liquidity is plentiful

Liquidity is abundant in most futures markets. Traders can now come in and out of the market at any time.The pricing is simple and straightforward

Price Variations are Safeguarded

DISADVANTAGES OF FUTURES TRADING

We have no influence over what happens in the future

the most glaring disadvantage of futures trading is that traders have little or no control over the marketThe Problems with Leverage

When leverage is significant, futures prices can move quickly. Prices might change substantially from day to day or even minute to minute.

2. (a) Explain the different types of orders in trading. (b) How can a trader manage risk using an OCO order? (technical example needed).

Market orders, limit orders, stop-loss orders, and OCO orders are the most frequent forms of orders.

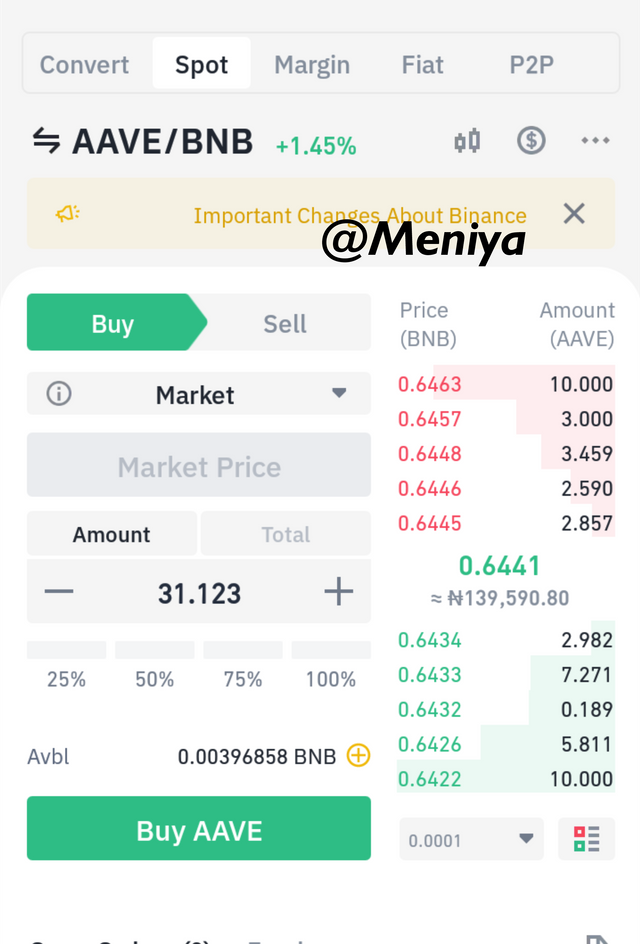

A market order is an immediate purchase or sale of a security. This form of order ensures that the order will be fulfilled, but it does not guarantee the price of fulfilment. This type of order takes place close to the current market price be it the bid/ask price. Market order fills with the current trading price.

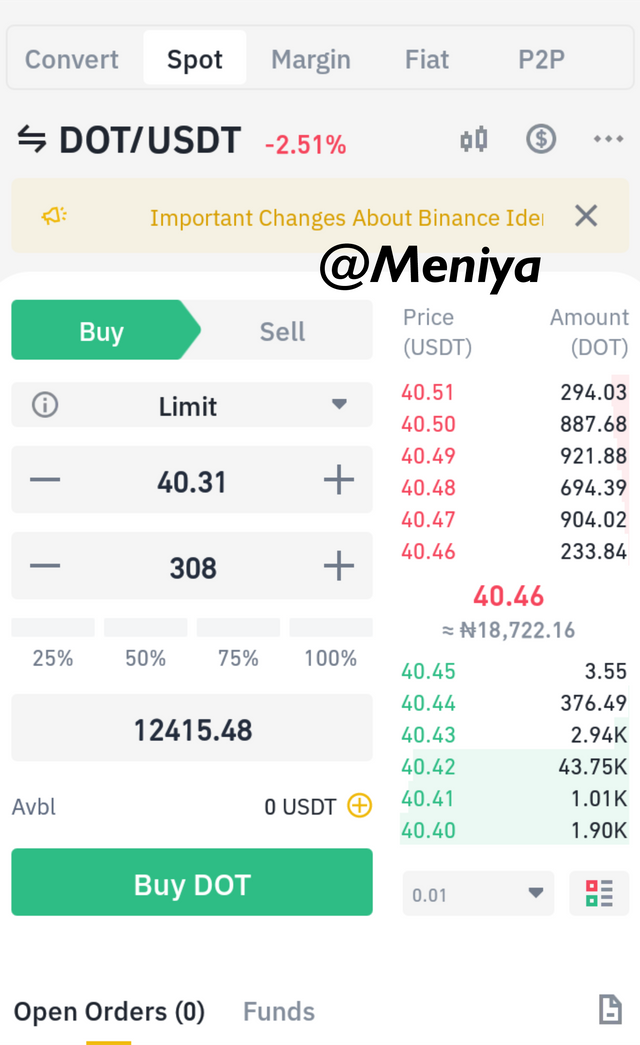

A limit order is used to purchase a digital asset at a stipulated price. when a buy limit order falls below the limit price, your order will be filled and when a sell limit order falls above the stipulated price your order will be filled.

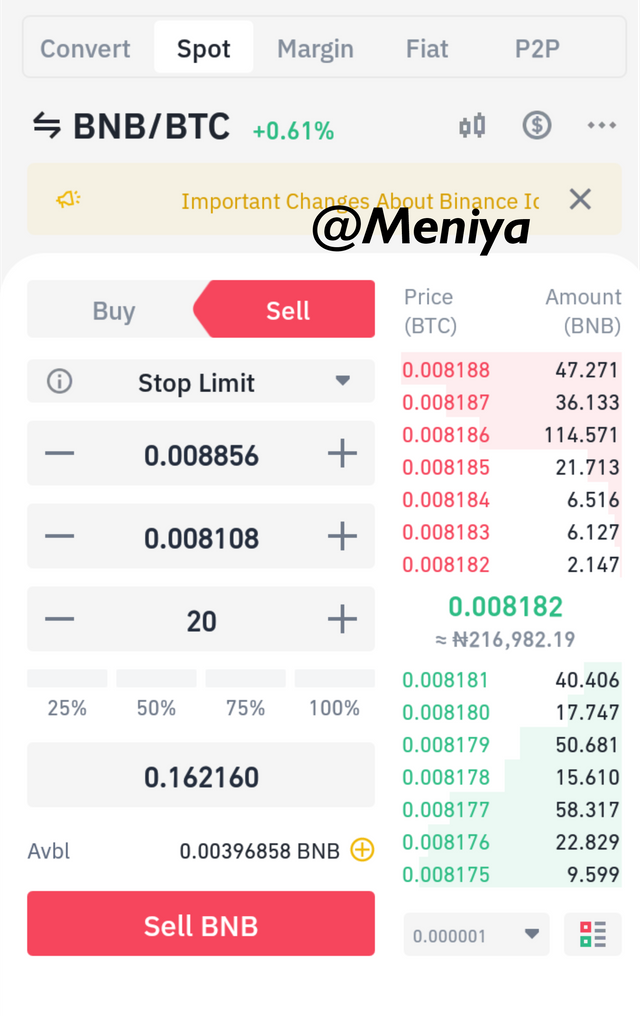

A stop order also referred to as a stop-loss order, is used to purchase or sell a digital asset when the traded has a certain price in mind.

A buy stop order is used by traders to place a price way higher than the present market price. Typically, investors use this type of order to limit a loss or safeguard a profit on a coin they've sold short. A sell stop order is one that is placed below the current market price. Typically, investors use a sell stop order to protect a profit or reduce a loss on a stock they hold.

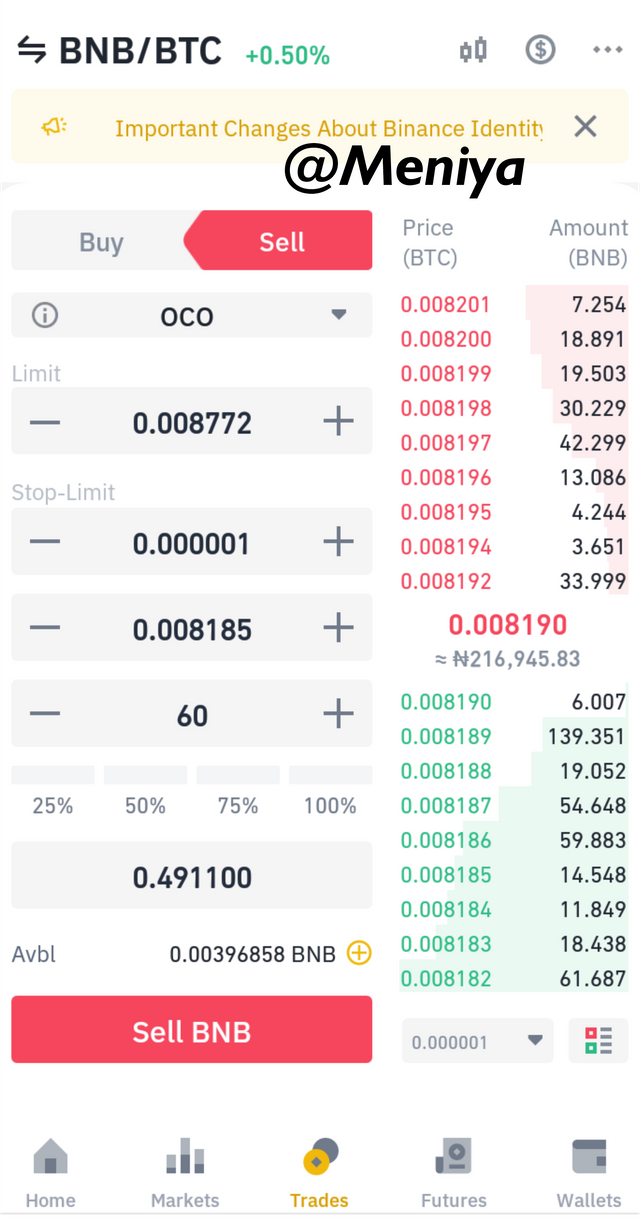

A pair of conditional orders known as one-cancels-the-other (OCO) orders stipulate that if one order executes, the other is immediately cancelled. On an automated trading platform, an OCO order combines a stop order and a limit order. The other order will be cancelled as soon as the price gets to the stop or limit price. OCO orders help traders to minimize risk and take a position in the course of trading. Traders can successfully trade breakouts and retracement with the use of the OCO order type. sell stop

3. Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

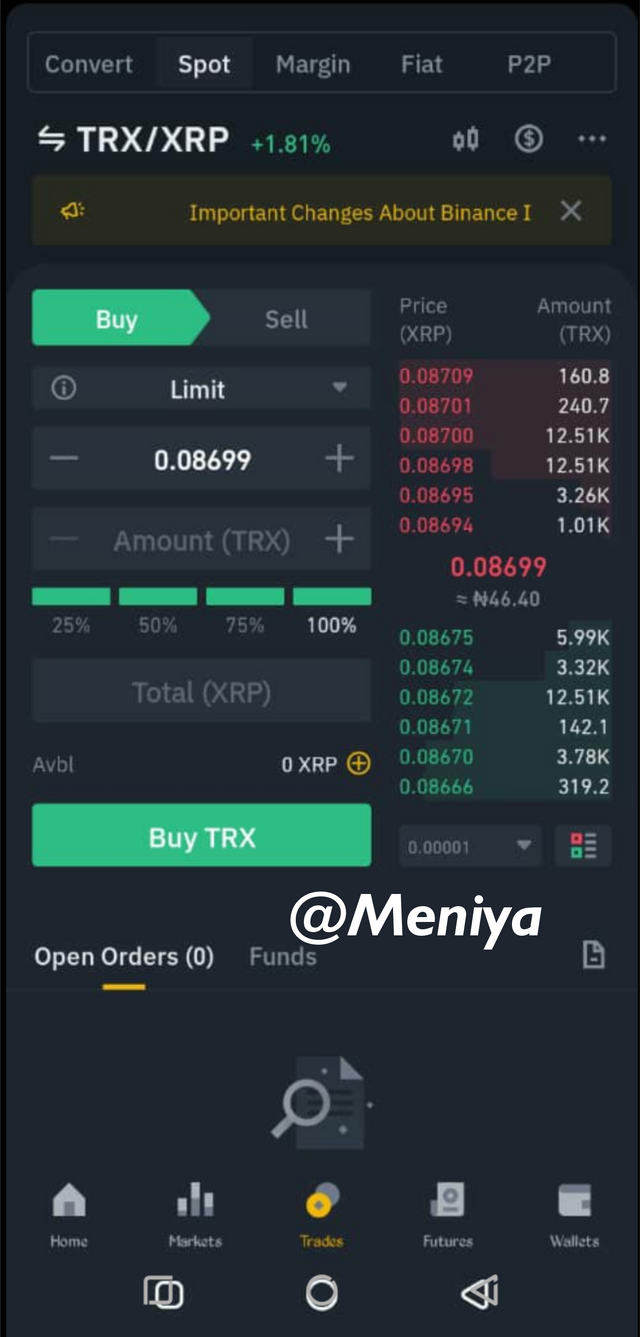

A trading pair between Tron (TRX) and Ripple (XRP)

Login to your Binance account and click on the wallet as shown in the picture below.

Then click on spot and ensure that the underlying asset needed to carry out the trade is available

Here I will be using ripple to purchase TRON (TRX).

Then click on the homepage and you will find the trading interface, click on it, click spot as we will buy this coin using spot

Click the currency pair at the top to chose the pair you want to spot trade on. After that, the search bar pops up where you can either enter the base currency or the quote currency and all the trading pairs will show up, then click on your preferred coin. Our preferred coin is TRX/XRP.

Then select the execution mode which ours will be limit order to buy TRX.

4. Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto assets. The following are expected.

i. Why you chose the crypto asset

ii. Why you chose the indicator and how it suits your trading style.

iii. Indicate the exit orders. (Screenshots required).

A moving average is a technical analysis tool that smooths out price data by calculating the normal price that is regularly updated. On a price chart, a moving average creates a single, flat line, eliminating any variances produced by random price changes.

The moving average can be applied in different ways. It's important to examine the moving average's angle. A price is said to be ranging when it is largely moving horizontally for a long duration, it isn't trending, but when it engages in a longer period of highs or lows it is said to be trending.

Hello @meniya, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observation

Question 3 and 4 lacked some vital points and screenshots

Recommendation / Feedback:

Thank you for participating in this homework task.