Crypto Academy Season 4 (Week 1) - Homework Post for @awesononso (The Bid-Ask Spread)

On this occasion, I will try to answer questions from the homework given by professor @awesononso, as for this week's class related to The Bid-Ask Spread.

1. Properly explain the Bid-Ask Spread.

The Bid-Ask spread is a term that we often find on Limit orders. This term is closely related to the Ask price and the Bid price in the cryptocurrency market where the transaction will be made. So the relationship between the Bid-Ask spread can be found by finding the price difference between the ask price and the bid price. The Ask price is the lowest price for a cryptocurrency asset that sellers are willing to sell, while the bid price is the highest price buyers are willing to pay.

For more details, let's look at 2 examples of ask price waves and bid prices on cryptocurrency pairs below.

- KNC/BTC

We can see in the picture above that the green wave is called the Bid price while the red wave is called the ask price. And we can see the difference in the distance between the bid price and the Ask price, this difference in distance is called the Spread.

From the picture above, the gap between the Ask price and the Bid price is very wide so it can be said that the KNC/BTC pair above has low liquidity, this is all due to the lack of transactions made by sellers and buyers in that market.

let's compare it to the 2nd cryptocurrency pair.

- ADA/BTC

We can see from the picture above that the difference between the bid price and the ask price is very small. so that it can be said that the ADA/BTC pair above has high liquidity, this is all due to the large number of transactions carried out by sellers and buyers in that market.

2. Why is the Bid-Ask Spread important in a market?

The Bid-Ask Spread is a very important term that traders must know because by knowing the spread, a trader can find out the liquidity of the cryptocurrency market. so when the cryptocurrency has high liquidity it will speed up transactions that occur because there are very many people who make buying and selling transactions on these cryptocurrencies, it can be marked by the distance between the ask price and the bid price is very small, as in the example of answer number 1 above, namely the ADA/pair BTC.

So knowing the liquidity in the cryptocurrency above greatly affects a trader's transactions. we can say from the comparison between ADA/BTC compared to KNC/BTC in answer number 1 above, if someone makes a buy/sell transaction, the ADA/BTC pair will be executed faster.

The concept of Bid-Ask Spread even though it is said to be very simple but has a positive impact and is very useful for a trader who wants to start buying and selling transactions.

3. If Crypto X has a bid price of $5 and an ask price of $5.20,

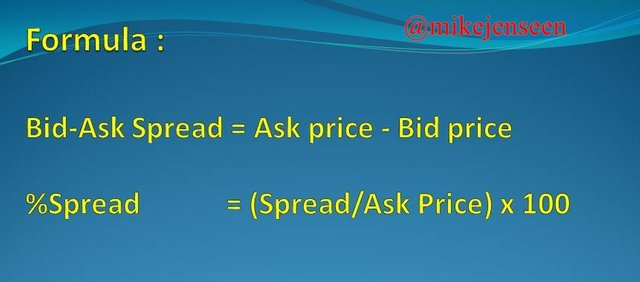

Before we start counting questions number 3 and number 4, let's look at the formula below.

edit from PowerPoint

edit from PowerPoint

a.) Calculate the Bid-Ask spread.

Bid-Ask Spread = $5.20 - $5

Bid-Ask Spread = $0.2

b.) Calculate the Bid-Ask spread in percentage.

%Spread = ($0.2/$5.20) x 100

%Spread = 3.85%

4. If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

Bid-Ask Spread = $8.80 - $8.40

Bid-Ask Spread = $0.40

b.) Calculate the Bid-Ask spread in percentage.

%Spread =(0.40/8.80) x 100

%Spread = 4.54%

5. In one statement, which of the assets above has the higher liquidity and why?

So the conclusion of the comparison between Crypto X and Crypto Y is, Crypto X has high liquidity. due to the low spread resulting from the calculation of only $0.2, it can be ascertained that the small distance between the ask price and the bid price is so that in Crypto X the transaction process that occurs will be faster.

6. Explain Slippage.

Slippage is an event that occurs due to 2 causes, namely price fluctuations that occur in cryptocurrencies every time, and low liquidity of cryptocurrencies. Slippage occurs when a trader places an order at the desired price, but due to low cryptocurrency liquidity the order is executed late and cryptocurrencies experience an increase or decrease in price, so orders are executed not at the price desired by traders, this can be an advantage or a loss for traders. traders.

For example when I want to buy ADA/USDT at a price I see $2.3. however due to low Liquidity the price has decreased to $2.1, this is all due to my order being executed late and the price of ADA/USDT fluctuating. an example of a trade like this is called Slippage, from an example of a trade like this I have lost $0.2.

7. Explain Positive Slippage and Negative slippage with price illustrations for each.

Positive Slippage

Positive Slippage is a situation in which traders are favored when placing orders and late execution. The key point to understand is

Late executed Buy Orders are at a lower price than the original order price

Late executed Sell Orders are at a higher price than the original order price

example :

On a buy order, I want to buy 100 EOS with the pair EOS/USDT for $468 due to low liquidity the price has decreased and my order was executed at $460 so I made a profit, as for the slippage: $468 - $460 = $8. so i get profit $8

On a sell order, I want to sell 1 BNB with the pair BNB/USDT for $404.5 due to low liquidity the price has increased and my order was executed at $407 so I made a profit, as for the slippage: $407 - $404.5 = $2.5. so i get a profit of $2.5

Negative Slippage

Negative Slippage is a situation where traders are disadvantaged when placing orders and late execution. The key point to understand is

Late executed Buy Orders are at a higher price than the original order price

Late executed Sell Orders are at a lower price than the original order price

example :

On a buy order, I want to buy 100 EOS with the pair EOS/USDT for $468 due to low liquidity the price increased and my order was executed at $472 so I suffered a loss, as for the slippage: $472 - $468 = $4. so I ran into $4.

On a sell order, I want to sell 1 BNB with the pair BNB/USDT for $404.5 due to low liquidity the price has decreased and my order was executed at $400 so I incur a loss, as for the slippage: $404.5 - $400 = $4.5. so i lost $4.5

Conclusion

The Ask-Bid Spread is very useful in helping traders to know the liquidity of cryptocurrencies in the market. By knowing the benefits of spreads, a trader can minimize the occurrence of Slippage before trading. Slippage is a situation when the price that is first ordered does not match when the asset is executed, this is all due to low liquidity in the market. Although Slippage can be said to be like 2 sides of a coin, it can be profitable and can also be detrimental to traders.