Crypto Academy Week 14 Homework Post For @stream4u - Technical: Reverse Strategy | Crypto Prices & Market Source: Review Of Coingecko.

on this occasion I will try to answer questions from the homework given by professor @stream4u, as for this week's class is related to crypto price inverse strategy and market sources (Review Of Coingecko), well I will try to answer some of the questions that are given in homework this week

source from coinmarketcap and edit

Technical Details About Reverse Strategy

The reverse strategy is a method of graphical analysis of a cryptocurency which is carried out in the opposite direction of the market. on the reverse strategy to buy one of the cryptocurrencies to be used as an investment asset when the market is in a bearish phase. This is called the opposite direction of the market because when the cryptocurrency value goes down a trader must buy the asset with the prediction that the graph goes back up and becomes a bullish phase. It is during this phase that traders benefit if the readings of the bullish and bearish phases are precise and accurate

The reverse strategy is usually in a long bullish or bearish phase, usually a decline or increase in prices of around 20% or more, this is where the reverse strategy method is used, at times like this traders must be calmer in trading if they take wrong steps they will experience losses, at least observe first. beforehand the graph for 24 hours. to be able to make decisions when we have to enter the market. entering the right market is at the opening and closing of that phase.

In doing the reverse strategy it does have a big risk, so to minimize all traders must set a stop loss to reduce the risk of large losses. In reverse strategy, experience in analyzing the market is needed, it can be said that this requires a lot of patience and courage to enter the market.

Reverse Strategy Example [Tron (TRX)]

in the chart above, several signs have been given to make it easier for us to explain when is the right time to enter to buy the cryptocurrency, we can see that the end of the bearish phase is bullish at this time when investors are busy investing, causing the opening of a new phase, namely bullish when a trader manages to enter the time which is right, which is close to the opening and closing of this phase, then a trader has succeeded in carrying out a reverse strategy. but if the prediction of entering the market is not quite right and still experiencing a bearish phase it is expected to set a stop loss and start planning to enter a new market according to the analysis

About Coingecko

What is Coingecko?

Coingecko is a free site that provides various information related to cryptocurrency. At Coingecko, someone who is familiar with cryptocurrency can dig up the latest information related to charts, prices, crypto ranking, coins circulating on an asset, and other things that are needed by cryptocurrency users. The Coingecko platform is quite well known among traders because it is frequently visited thanks to complete information and is updated all the time

How Can Coingecko Benefit You in the Crypto Market?

Coingecko really helps me to find various information about cryptocurrency, such as when someone wants to invest in one of the cryptocurrencies, of course he learns first such as doing fundamental analysis and technical analysis, all of which can be found on Coingecko.

on coingecko if someone wants to do technical analysis they can find a cryptocuurency chart on this platform. It can be said that the information obtained on Coingecko is very complete, so it really helps me and other traders

Explore COINGECKO features with information.

coingecko is a place to find information about cryptocurrency. So let's explore coingecko's features

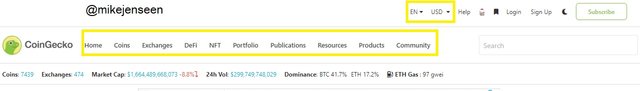

The image above is the initial appearance of Coingecko and has several subtitles making it easier for users to find information

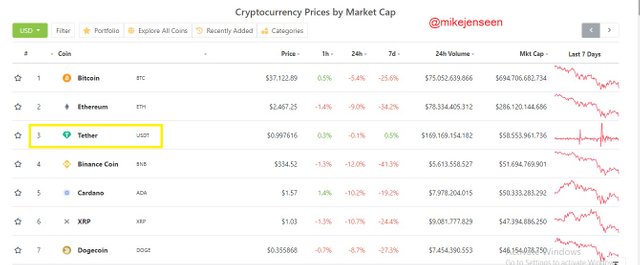

The image above is a cryptocurrency ranking that we can see by selecting sub (coins) then selecting the market cap rank. if we want to see information about the coins in the market cap rank we choose one of these cryptos [Example: Theter (USDT)]

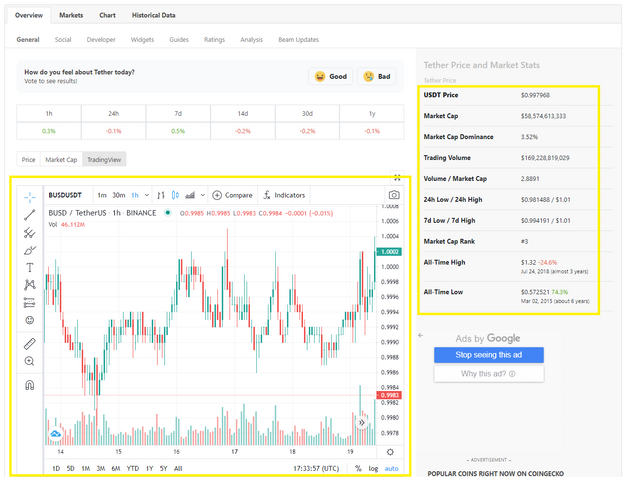

The image above provides information about the selected cryptocurrency such as price, rank, coin supply, and cryptocurrency charts so that it makes it easier for users to get to know the coins they want and can analyze the market from the charts provided

the image above is a trusted cryptocurrency exchange rank. to find it we can select sub (exchange) and then select a spot

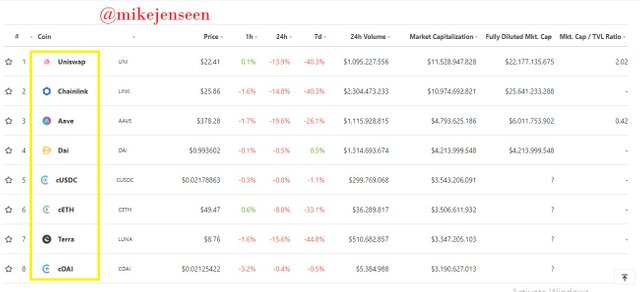

the picture above is the rank of DeFi Coins. to find it we can select sub (DeFi)

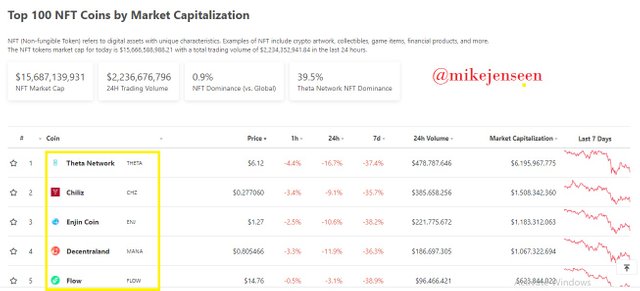

the picture above is the rank of NFT Coins. to find it we can select sub (NFT) then select Coins

Weekly Price Predictions For Crypto Coins : Litecoin (LTC)

Basic Information of Litecoin (LTC)

Litecoin (LTC) is one of the oldest and most popular altcoins of all. This coin has many similarities with bitcoin, but this coin was made as a form of modification or development of bitcoin, namely by having several differences which are expected to be useful for investors and cryptocurrency miners. The differences include transaction speed, costs, and inventory. so that with the advantages of Litecoin it can correct the shortage of bitcoin

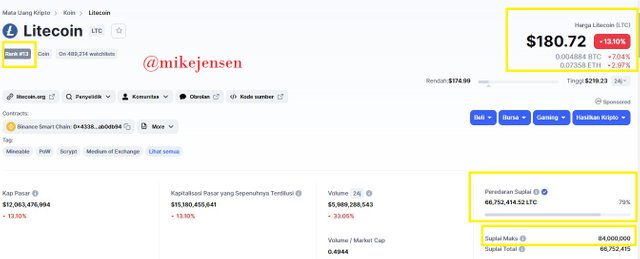

From the picture above, as we all know, the maximum supply of Litecoin is 84,000,000, while the current circulating supply is 66,752,414. Litecoin is ranked 13th in the market. and it was priced at $ 180.72 when I opened CoinMarketCap

Why Litecoin (LTC)

Litecoin is one of the oldest cryptocurrencies and is very popular so I think it is one of the most valuable assets in the future, even though at the moment the price of Litecoin is falling. but I think this asset will be more developed in the future

Technical Analysis [Litecoin (LTC)]

I first took a Litecoin chart on coinmarketcap for me to observe and I studied the market movements. the graph is as below.

As for the data that I get from the graph, the current LTC price is $ 181.44. LTC chart is in a bearish period if we look at other cryptocurrency charts also in a bearish period. if in the reverse strategy the end of the bearish period will start the Bullish period is this an opportunity to enter the market. let's find other data.

We can see from the image above that I have found the support and resistance levels, which are red, I mark the support levels, while the green color is resistance. If we look at the chart, the support level has increased every month, namely March, April, and May, if we look at the current tipa tipa chart is experiencing a bearish phase.

So in my opinion for the next week if we see the last candle after the green is squeezed directly in red then the chart will continue to fall in 3 days around $ 150 and after that it will be in a bullish period and I expect it will increase back to around $ 185.

Conclusion

In doing any analysis, a trader must understand the basic concepts of the analysis, such as reverse analysis, first understand the basic concept, then try it when you fail, don't give up, because failure is the best experience. Coingecko is a place to find information before analyzing the method you are using.

Cc: @stream4u

Cc: @steemcurator02

Thank you for joining The Steemit Crypto AcademyCourses and participated in the Homework Task.

thank you very much for taking participate in this class

Grade :7