Crypto Scams and how to avoid them

My own work

Introduction

Oftentimes, people come up with complains about how they bought a particular coin that was hot at the time, and, few moments down the line, the same coin's value dropped to miserable lows, robbing them of their capital.

Also, people have bought coins that are not listed on exchanges, and have no prospects of ever getting listed.

Last example for now, people have participated in airdrop campaigns that required them to send some fraction of a valuable crypto asset to a wallet address before getting their rewards.

All three instances above suggest the numerous ways through which crypto scam projects make away with investors' money. At this point, you might ask, "what are crypto Scams?"

What is a Crypto Scam?

In plain English, a crypto scam refers to any attempt by an actor aimed at unjustly obtaining crypto assets from unsuspecting victims. Over time, crypto scams have taken various forms which include:

- Phishing websites

- Email scams

- Fake crypto apps

- Social media scams

- Ponzi schemes

- Fake airdrop campaigns

- Rug pulls/pump and dump schemes

- Fake project contract addresses

Six (6) of the above listed forms have already been explained in details by Professor @yohan2on in his lecture post ( click here to see post ). However, we'll get to explore two additional forms here:

1. Fake airdrop campaigns: Any crypto enthusiast actively participating in airdrop campaigns has in one way or the other come across a fake airdrop campaign. Usually, airdrops are done to create publicity for new crypto projects by offering people free coins to complete simple tasks like social media following and engagement.

However, bad actors do hide under the the guise of airdrop campaigns to rob people of their valuable assets. Usually the fake/scam airdrops would pose as authentic until it's time for the user to claim rewards, then they request that a certain amount of a valuable asset (not the one they are airdropping) be sent to a wallet address provided by them before rewards can be claimed.

Users who fall for their gimmicks often lose their assets with no hope of ever getting them back again.

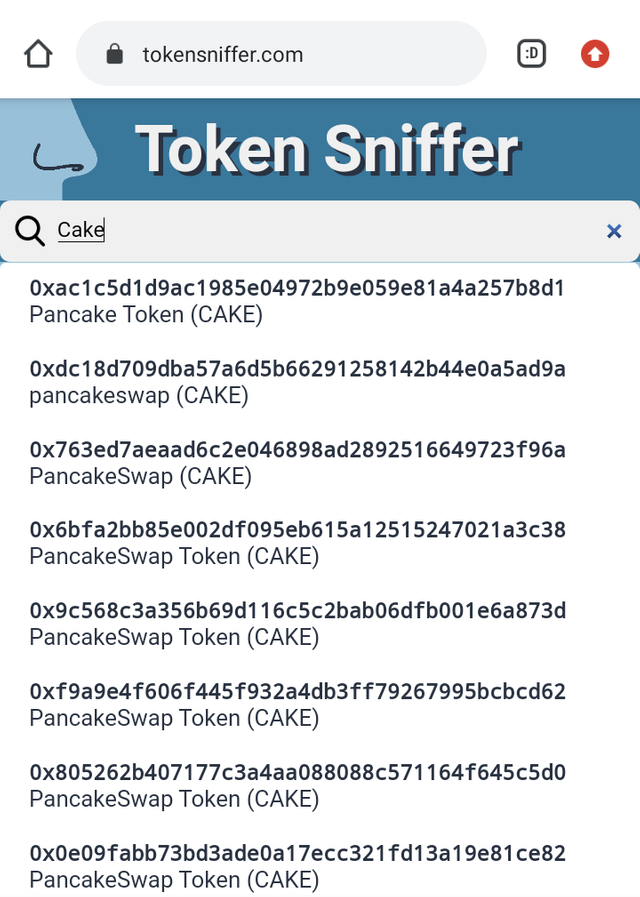

2. Fake contract addresses: This is also a popular channel through which bad actors fraudulently rip people off their valuable assets. They usually create a fake address of an already successful project, with the same name. As such, unsuspecting users get to make transfers to the fake address, thinking it is the original contract address.

Screenshot : http://tokensniffer.com

Screenshot : http://tokensniffer.com

When searched on token sniffer, the several contract addresses with the same names are displayed and user can easily spot the original from the fake. It is always advised that project contract addresses be obtained from project websites or official social media handles.

As shown on the screenshot, when I searched for the pancakeswap token - "CAKE" on the token sniffer website. Several contract addresses popped up bearing the same name. This is the gimmick of bad actors to fraudulently make away with the crypto assets of unsuspecting users who will ignorantly make transfers to these fake contract addresses.

Some Typical Cryptocurrency scams with news references

For my research, I will be looking at the Turtledex protocol, a Binance Smart Chain Project that Rug Pulled With Tokens Worth $2.5M.

Image source

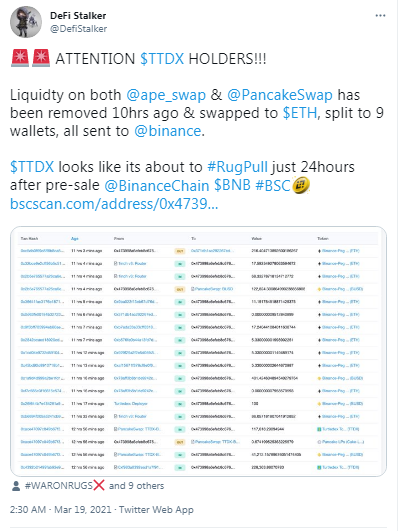

Turtledex posed as a decentralized platform for storage, offering to help users “keep data and preserve files without needing to keep them on their computer.” Following their unique proposition, potential users embraced the projects and they were able raise funds through a presale of their token - TTDX.

After the presale, liquidity pools were opened on two of Binance Smart chain's major Decentralized exchanges (DEXs): Apeswap and Pancakeswap. The Turtledex protocol's native token (TTDX) were fixed in these liquidity pools and were made open for circulation on March 18th, 2021. Users staked their valuable cryptos in exchange for TTDX from these liquidity pools.

The listing of TTDX on Apeswap and Pancakeswap made news and buying pressure intensified, causing the TTDX token to soar in value. However, just 24 hours later, a Twitter account reported that the liquidity previously provided to the two BSC DEXs have been removed and sent to an exchange. This was an obvious sign of a rug pull, as the owner's intention for such a drastic action couldn't have been for the users' best interest.

Image source

Note: When liquidity is removed for a new project like this, it implies that there is no possible way to transact with the token any more. Since trades on Decentralized exchanges are made against liquidity pools, it means that those who bought the TTDX token will not be able to sell them or convert them for other crypto assets.

The effect of this foul play is usually a market abnormality that leads to a massive drop in the value of an asset, leaving holders with tokens worth much lesser than the purchase value.

Below are links to publications on my research subject:

Reference link

Reference link

Reference link

To what extent have Crypto scams affected the Crypto space?

Image source

Crypto Scams have caused a lot of negative effects on the crypto space, ranging from a reputational damage to a general lack of trust in the good that cryptocurrencies represent. The victims of these scam schemes, who are mostly uninformed newbies, develop a bad impression about cryptocurrencies and go ahead to make bad public relations about cryptocurrencies based on their experience.

The effect of this might look small at face value, but in the actual sense, it poses a delay on the fulfilment of the broad goals of cryptocurrencies - to make people transact value in a trustless manner.

Furthermore, it slows down adoption. As a result of the numerous activities of bad actors in the crypto space, many nations have a negative view toward cryptocurrencies. Owing to the fact that cryptocurrencies are not subject to government regulations, the activities of bad actors in the crypto space has further reduced the chances of cryptocurrencies being used globally without being opposed by various governments.

Governments often come against cryptocurrencies with the same line of argument, that it is a tool for crime and fraudulent activities. Such wouldn't have been the case if these bad actors had not caused so much reputational damage to cryptocurrencies.

Will regulations in Crypto add value to the Crypto space?

Image source

Regulations in the crypto space would bring a sense of security and restore trust to the space, making people have more confidence in their dealings around cryptocurrencies. However, regulating cryptocurrencies would entail robbing it of the very spice that makes it unique - uncensorable.

By submitting to be regulated, cryptocurrencies can no longer be termed decentralized, and the power will gradually shift away from the users, into the hands of the government through crypto-related policies.

The main aim of Cryptocurrencies is to be independent of the state and to democratize the financial system, bringing the power to the people and the financially marginalized. Making cryptocurrencies subject to regulations would only make it an equivalent of a fiat currency built on blockchain.

Also, regulating cryptocurrencies will not mean that there won't be any more scams. Oftentimes, the major enabler of scams is ignorance. When it is obvious that a majority of persons do not understand how a thing works, it is almost certain that bad actors would step in to make something off that ignorance.

Even in the largely regulated centralized Finance world, credit card scams, Ponzi schemes, etc., are still very present. People are still being dispossessed of their valuable assets by bad actors.

Instead of regulations, what would work better for the crypto space would be a huge investment Education, where people are fed with the right knowledge about the workings of blockchains and Cryptocurrencies. With this solid knowledge base, people's confidence in the benefits of cryptocurrencies can be restored, and they can fish out scam projects before they are half-way close.

Conclusion

Scams are almost inevitable in any financially promising venture. The crypto space, just like every other scam-prone sector, has had its hit from bad actors who prey upon ignorant market participants.

The bad consequences of these scams are heavy on the crypto space. Hence, educating the crypto market participants, instead of regulating cryptocurrencies, would be a more optimal approach towards combating crypto scams.

Thank you for reading...

Hi there! If you read to this point, I am sure you enjoyed the article. Let's take this further, I'd like to connect with you on a more personal level. Feel free to hit me up on any of my social handles below:

Hi @pangoli

Thanks for participating in the Steemit Crypto Academy

Feedback

This is excellent work. Well done with your research study on Crypto scams.