Stagflation: Bullish for GOLD, SILVER and Bitcoin

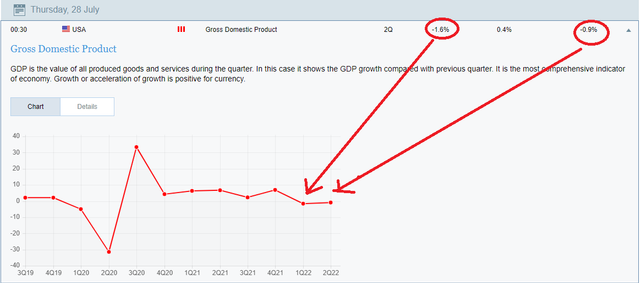

The economy is a huge mess in the U.S. First, they have record-high inflation causing the prices of everything to skyrocket. I think we all know the detail by now, as the FED continued to raise rate hoping that would tame inflation. But it turned out the rising interest rate has caused credits to contract. Many companies reported a decrease in revenue and the employment rate started to decline slightly (employment rate is a lagging indicator). Lo and behold, the recession is here as the GDP shows consecutive 2 quarters of negative growth; that’s the definition of recession. When you have high inflation and recession, that’s stagflation.

[Image source: fxpro.com]

What does that entail for markets, then?

Normally the FED will raise the rate until the rate is about as high as the CPI inflation rate. But, the recession has already hit, which means further rate hiking could worsen the economy. The worst-case scenario is the recession will be turned into a depression which is a severe and prolonged downtrend in economic activity. The Great Depression was the only depression in American history and it lasted for 10 years.

Markets have already started to react to the possible shift in Fed policy. Silver, gold, and the rest of the commodity sector on COMEX have started to trade higher. The market has rallied every time the Fed attempted to reduce or end its debt monetization operations.

2016: The U.S. economy slowed, forcing the Fed to scale back its "QT" plan. Gold increased in price from $1050 to $1350 (+29%). Silver increased by 50% ($14 to $21). Bitcoin went up from $430 to $775 (+80%)

2019: The Fed had to change course on raising interest rates in order to sustain the stock and fixed income markets after a liquidity crisis. Gold price went from $1200 to $1550 (+29%). Silver increased from $14.5 to $19.5 (+33%). Bitcoin went from $3600 to $14000 (+290%).

2020: The Fed to saturate the market with liquidity through QE and helicopter money. Gold went from $1450 to $2050 (+41%). Silver increased from $12 to $30 (+150%). Bitcoin went from $4350 to $12000 (+175%).

When the Fed makes another pivot, a similar 30-40% rally from current levels would result in a COMEX gold price in the $2200-2300 range, and silver possibly above $25. Now is a good time to stack gold, silver, or BTC.

In the near Future, the Present Federal Reserve System will be a thing of the Past...

The Present bears witness of the Past, and the Future shall make all things Clear...