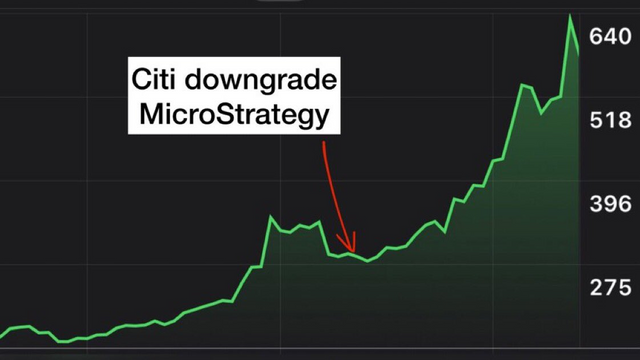

Remember when Citi downgraded MSTR? Oops

So you had a bad day

Remember a few weeks or was it months now? I can't recall exactly, but a bit of time ago Citi decided it was time to downgrade MicroStrategy.

The reason was pretty simple, it had to do with their bitcoin involvement.

While Citi acknowledged that the move had been very good for the stock, they didn't like the risk potential that a crash in bitcoin would present.

For that reason they told their clients to sell it and stay away.

Unfortunately for them, that was about 100 percentage points ago.

Sees:

(Source: https://twitter.com/BTC_Archive/status/1352941292351795202/photo/1)

While the idea behind the downgrade made sense, I am not sure how long their clients are going to remain their clients when they keep telling them to miss out on 100% moves.

The stock market averages about 8% returns per year, that means it takes roughly a decade to make that kind of return, on average, compounded.

Citi basically just cost their clients a decade worth of their investing wealth in a single swoop.

Oops.

MicroStrategy on the other hand feels pretty good about putting bitcoin on their balance sheet:

(Source: https://twitter.com/1e9petrichor/status/1352946631059116032/photo/1)

That is the first day they put bitcoin on their balance sheet compared with where their stock is today.

They gained a ton of market cap from this move, almost a 6x move from the time they bought until now.

At this point it looks like MSTR is having the last laugh.

They rarely get it right.

The great thing about this is as MSTR the business does well, they use that money to buy more bitcoin.

It's a major sink for bitcoin.

We need Elon to follow this guy.

If someone told me to sell, that would be a good indicator to keep. idk.

It depends on who and why for me.

Yes! I agree

Thanks @jondoe, I like your profile. I find always good information

Glad you enjoy.