Bitcoin exchanged gains for consolidation at the opening of Wall Street

As you well know my main thematic line deals with Bitcoin price action behavior, sharing the different approaches disclosed in the main news portals is something I like, this because I think we must have contextualized information and be prepared for any decision we make when trading in the cryptocurrency market.

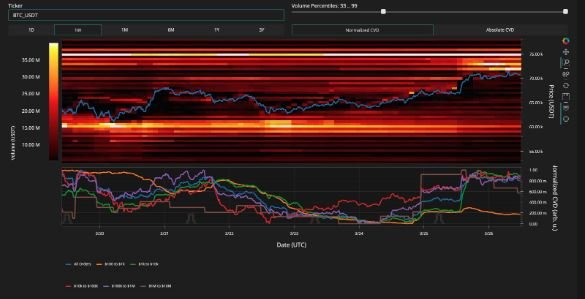

In the last article shared by William Suberg for the Cointelegraph portal he referred that, "Bitcoin seemed hesitant about where to go now after making sudden gains in the last 24 hours", indeed if we observe the price returned to stagnate in the $70,000 area.

On the other hand, Bitcoin's price action has been hovering around the important all-time high of USD 69,000 from 2021, however "the lack of supply liquidity below the spot price kept the chances of a return to lower support levels in place."

In this regard, "With last week's close at USD 68.9k and last month's close at USD 61.1k we could (and should) see one or both of those levels being reached relative to the candle close/open on Sunday."

In Rekt Capital's view of BTC price patterns around block reward halving events, "With the next one scheduled for mid-April, Bitcoin should be in the midst of its "pre-halving pullback" phase, with a subsequent "post-halving re-accumulation" phase"

SOURCES CONSULTED

Cointelegraph. Bitcoin lacks support above $60K, chart shows as BTC price halts gains. Link

OBSERVATION:

The cover image does not belong to the author: @lupafilotaxia, the image was taken from: Cointelegraph