Stride has made liquid staking possible in Cosmos

Defi keeps evolving and new innovations that improve capital efficiency and yield keep coming. One of such innovations in the Defi field is liquid staking. We have heard of Lido and stETH, one of the pioneer protocols that introduced liquid staking originating in the Ethereum Ecosystem.

Lido. Liquid staking protocol for ETH (stETH)

Lido. Liquid staking protocol for ETH (stETH)

Now, Cosmos has a main liquid staking protocol called Stride and this article will focus on how Stride with it’s liquid staking services has contributed in making DEFI more capital efficient.

Brief outline of the liquid staking process on Stride

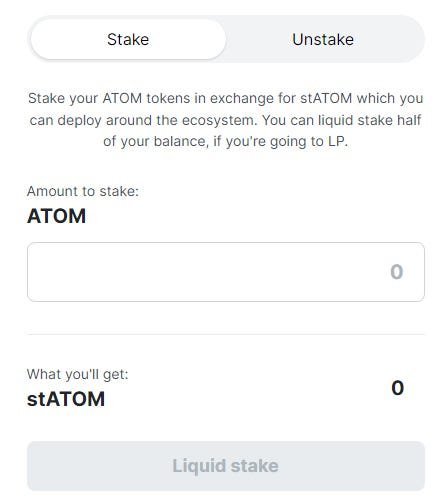

Stride enables liquid staking. Here, users lock their crypto depositing it on Stride while Stride will stake user’s crypto on the host chain, ie, Cosmos Hub (availing services of its partner validators), and allow users to mint liquid version of their staked crypto on their Stride account.

This liquid staked crypto keeps accumulating staking rewards every epoch and the user is free to use this liquid staked crypto in DEFI.

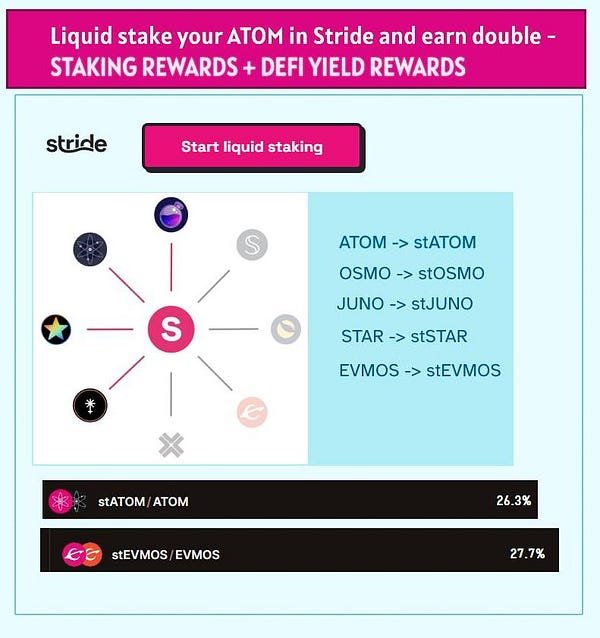

Stride’s liquid staked crypto is denoted by “st” and the protocol provides its liquid staking services to many Cosmos project tokens like — OSMO, JUNO, ATOM, EVMOS, LUNA, STAR. Stride’s liquid staked version of these cryptos are — stOSMO, stJUNO, stATOM, stEVMOS and stSTAR.

Advantages of Liquid Staking over traditional staking

This way Stride has made staking easy for users. The protocol stakes users’ crypto with performing validators. So users’ crypto earns staking rewards and the liquid staked crypto can be used in DEFI applications to earn further yield.

So, let’s understand the advantages of liquid staking with an example.

User stakes ATOM on Stride and receives stATOM. Now, the user is earning staking rewards with stAtom accumulating the staking rewards and growing. Pretty cool!

Traditionally users had to stake ATOM by themselves doing their own research on performing validators and this ATOM would be locked.

So the staked Atom was not available to be used in DEFI and users had to choose between either losing out on DEFI yields (if their ATOM is staked) or losing out on staking rewards (if they used ATOM on DEFI).

Users also cannot get their liquid ATOM immediately once staked as the stake unbonding period in Cosmos is 21 days. So users have to wait 21 days after unbonding to receive their unstaked Atom along with procured staking rewards.

Stride makes it possible for users to stake their Atom to performing validators and use their staked ATOM; stATOM in DEFI and earn further yields.

This makes user’s ATOM more capital efficient, as it’s utilised to earn maximum possible rewards.

User’s can redeem their ATOM back anytime, although it will still take 21 days for users to get back their ATOM along with their staking rewards as that’s the unbonding period prevalent in COSMOS.

Compounding yields further using stATOM on DEFI protocols

Now, let’s see how stAtom can earn us yields besides just staking rewards.

Crescent Network has some derivative based raged pools like ATOM/stATOM and EVMOS/stEVMOS. These are same pair pools which are low risk pools to provide liquidity to as impermanent losses can’t happen with prices of these tokens going to remain the same.

This way LP providers in Crescent can earn LP rewards of LP ATOM/stATOM and LP EVMOS/stEVMOS maximising their earnings of ATOM and EVMOS.

Once users yield farm their LP rewards they earn CRE as well.

See how stATOM and stEVMOS have contributed to making DEFI more capital efficient.

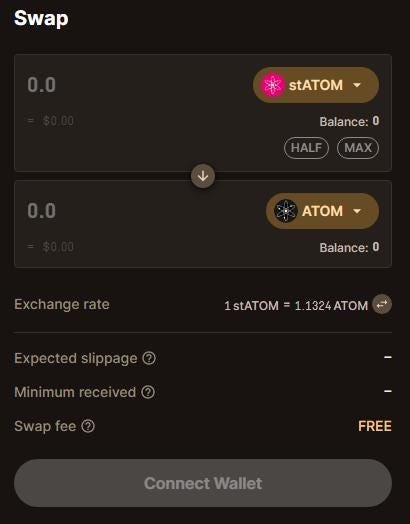

stATOM conversion to ATOM can happen immediately with a swap!!

Now, since users can swap their stATOM for ATOM and stEVMOS for EVMOS in Crescent Network, users can convert their stATOM and stEVMOS to ATOM and EVMOS immediately, if they require it urgently.

So there is no need to wait for 3 weeks to get their liquid crypto along with their staking rewards back.

So, another advantage due to liquid staking is the possibility to swap the staked crypto to their unstaked version immediately which was otherwise not possible in traditional staking

Conclusion

Stride liquid staking protocol frees Cosmos digital assets to earn both liquid staking rewards and DEFI yield rewards, which makes these digital assets more capital efficient!!

So, begin your DEFI journey in Cosmos, liquid staking your Cosmos based digital asset on Stride here — https://stride.zone/

You can read my Articles in these platforms -:

Publish0x — https://www.publish0x.com/@greenchic

Medium - https://medium.com/@kikctikcy