Are Bitcoin Maximalists Right?

It is hard to believe that, by 2017, 95% of the total value of the cryptocurrency market was constituted of Bitcoin. In the first days of 2018, this share had fallen below 40 percent.

As seen in the chart above, Bitcoin dominance has been fluctuating in recent years. The share of Bitcoin increases when optimism prevails in the market and decreases when the opposite happens. Currently, Ethereum has also reached a dominance rate of about half that of Bitcoin, with a share of 18.9%.

Although Bitcoin's throne seems to be shaken by Ethereum and other altcoins, some people do not mind this situation. These people, called Bitcoin maximalists, do not find it necessary to invest in coins other than Bitcoin. Many features make Bitcoin special in the cryptocurrency market.

- The first and oldest cryptocurrency has been around for over a decade and has proven to be an excellent store of value.

- The most liquid cryptocurrency, large fund holders can buy and sell Bitcoin without causing much volatility in price.

- Aside from dollar-indexed cryptocurrencies, the most bear market-resistant cryptocurrency.

- Inflation rate halves every 4 years and the total number is limited to 21 million.

- Its value doubles every year on average due to dwindling supply and constantly rising demand.

According to Bitcoin maximalists, there is no need to invest in other cryptocurrencies when there is a cryptocurrency with such superior features. Higher altcoin returns during the bull market are not enough to motivate Bitcoin maximalists. Because the returns of altcoins are not stable and there is no guarantee that they will be successful in the long run.

On the other hand, altcoins also have advantages compared to Bitcoin.

- Altcoins such as Steem, which work with the proof-of-stake consensus algorithm, do not cause high energy consumption.

- Low transaction costs make it possible to perform a large number of transactions on them.

- Blockchains such as Ethereum, Ada, and Solana are more suitable for smart contract transactions.

From the investor's point of view, financial performance stands out as the determining criterion. To form a clear opinion on this subject, I compared the price performance of early cryptocurrencies released in 2011, 2012, 2013, and 2014 with Bitcoin. (Data Source: Wikipedia)

To keep the article at a readable length, I included the first half of the cryptocurrencies released in 2014. In the charts, the price of the relevant altcoin is shown separately in dollar terms and on a Bitcoin basis. If the yellow line has risen over time, it means that the corresponding altcoin has gained value against Bitcoin. By the way, I would like to point out that the scale of the graphics is logarithmic.

Litecoin has lost value regularly against Bitcoin since 2011, although there have been occasional fluctuations. Litecoin investors, however, made serious profits in dollar terms.

Namecoin, launched in 2011, has regularly lost value against Bitcoin.

Peercoin, which was released in 2012, also lost value regularly against Bitcoin. Still, patient Peercoin investors made considerable profits in dollar terms.

Dogecoin, which launched in 2013 as a joke, has maintained its value against Bitcoin and surpassed Bitcoin's price performance by far in 2021.

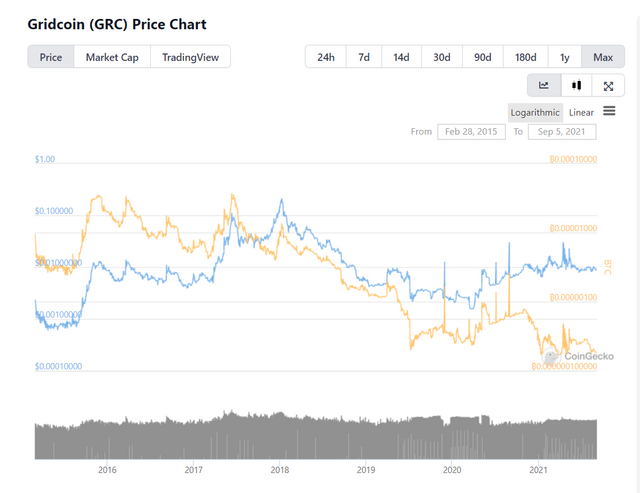

Although Gridcoin was at par with Bitcoin until mid-2017, it lost value regularly afterward. Still, it generally satisfied its investors in dollar terms.

The Prime coin also performed far behind Bitcoin.

Ripple has satisfied its investors by performing at par with Bitcoin.

Nxt and Aurora have regularly lost value against Bitcoin.

Aurora

Dash, which was released in 2014, gained serious value against Bitcoin, and then showed a parallel performance with Bitcoin.

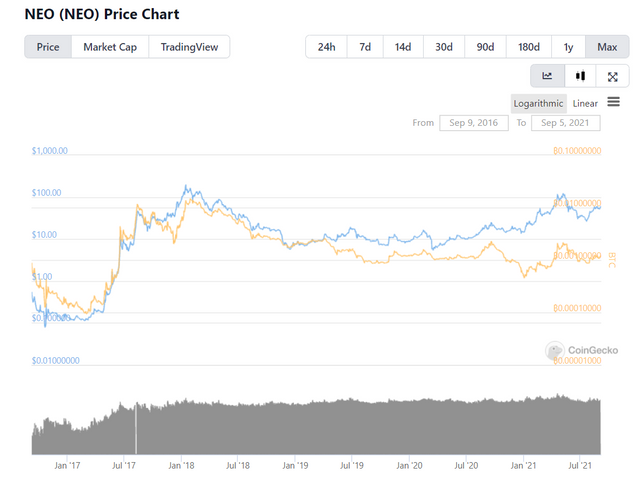

Neo is one of the coins that gained value against Bitcoin.

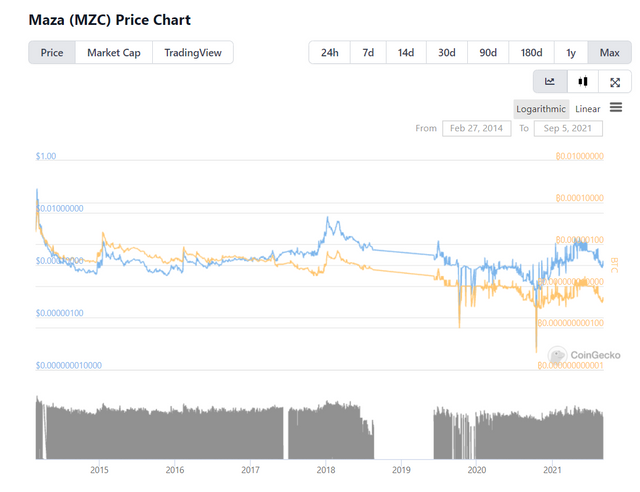

Maza, another coin of 2014, has lost a lot of value against Bitcoin.

Conclusion

The relative results I got when I examined the price development of the first 12 altcoins that emerged after Bitcoin:

- 8 of the altcoin was outperformed by Bitcoin.

- 3 of the altcoins outperformed Bitcoin (Dogecoin, Dash, and Neo) Especially Dogecoin and Neo had an impressive performance.

- One of the altcoins (XRP) performed closely with Bitcoin.

- All of the altcoins provided serious returns to their investors in dollar terms.

I think underperforming cryptocurrencies also had strong stories at the time, but their relative performance hasn't even come close to Bitcoin. The data including the early altcoins justifies the Bitcoin maximalists.

On the other hand, those who own Dogecoin or Ethereum, which came out in 2015, have increased their wealth many times over time, even based on Bitcoin price.

As a matter of fact, it seems quite difficult to decide on this issue. As in other areas of life, every choice has advantages and disadvantages. Fortunately, there is no obstacle to investing in both Bitcoin and carefully selected altcoins.

Thank you for reading.

Image Source: https://crello.com/

Well done friend from research Altcoins have a smaller investment market as compared to Bitcoin. As of April 2021, Bitcoin has a 60% share of the overall cryptocurrency market.. The point emphasized in your publication is interesting.

!sbi status

Hi @bilimkurgu!

Structure of your total SBI vote value:

Take Control! Include

#sbi-skipin your text to have us skip any post or comment.