Decentralised vs Centralised Exchanges: Pros & Cons

Decentralised vs Centralised Exchanges: Pros & Cons

The cryptocurrencies community is raising the volume rapidly. Along with this, there are a lot of issues that make the new crypto players feel confused. One of the most common issues mentioned here is “digital asset exchange” and its moral problem as well – the dilemma of centralization and decentralization. By making this, the author would like to help the readers, especially the new members of the community, have an overview of the situation. From the hope that it could help you to decide which is the suitable types of digital asset exchange depend on the pros and cons of each.

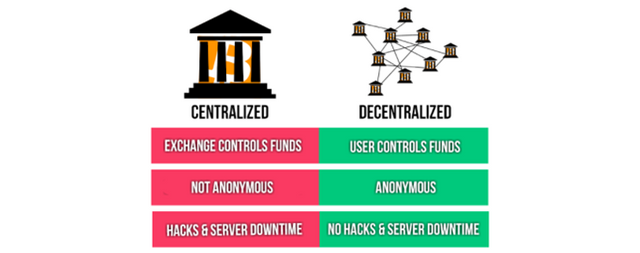

Firstly, it should be the full understanding of what a digital asset exchange is. In the simplest way, a digital asset exchange is a platform for buying, selling, transferring, storing and do whatever with the digital currency. Because of the rising in interest in the cryptocurrencies, there are more and more digital asset exchanges. However, all of them are classified into 2 main forms: centralized and decentralized exchanges.

A centralized exchange routes all traffic through a trusted third party and acts as a matchmaker between peers in an open market system. In general, it is a website/platform that handles the trading of bitcoin to fiat or other cryptocurrencies. With centralized exchanges, the KYC registration is compulsory. The funds you invest are kept on wallets handled by the exchange. You are not given the access to a private key. This means you do not have the control over your funds. Whenever you want to do a transaction, you need to use the key to authorize the exchange of processing. As one of the world famous crypto exchange, Huobi Pro is a good example of a centralized exchange, in which the user could do whatever transactions of LTC, ETH, BCH, ETC, etc. using Bitcoin (BTC) and USDT.

You could sign up this link for trading at any time:

https://www.huobi.br.com/en-us/topic/invited/…

Because of its advantages, this is the kind of exchanges most new crypto players are familiar with:

- Better liquidity: since the transactions are not occurring directly from peer to peer, there is always a large amount of free “cash” in the form of liquid crypto assets available to make trades quickly.

- Easier to use: they are intuitive as they resemble more familiar systems.

- Adherence to regulations: it is controlled by a third party and they usually offer a wide range of advanced trading features, such as the ability to create synthetic positions, set up limits, etc.

- The speed of the transaction: because of the high liquidity, it owns the high speed of transactions too.

However, there are always the disadvantages which go hand in hand with these above benefits. That could take the risk for your digital asset. Therefore, a decentralized exchange should be in your consideration. It is perhaps truer to the cryptocurrency ethic of a peer-to-peer interface. The exchange simply acts as a platform for users to trade funds directly with one another. That means it does not rely on a third-party service to hold the customer’s funds. The process can be achieved by creating proxy tokens or assets or through a decentralized multi-signature escrow system.

As be seen, decentralized exchanges have some advantages: - Security: because there isn’t a single point to attack, security is less of an issue at the exchange level.

- Anonymous: the transaction is not controlled by the third party and there is no one except traders can contact together. They also don’t need to show up themselves.

- Run by users: the user can easily trade their fund by themselves.

Because of its profits, in particular, recent comments from There creator, Vitalik Buterin implied that centralized exchanges should be a thing of the past. As an example, Bancor has all these above advantages of decentralized exchange. However, most recently, hackers were able to hack Bancor and stole US$23.5 million ETH, and BNTC. This is not the good news and they are doing the investigation on the details of the hack in order to trace the stolen funds and make it more difficult to be liquidated.

With the develop of blockchain technology, although the liquidity is split and dispersed in different centralized crypto assets exchanges, the decentralized crypto assets exchanges will be more and more popular. However, in the meantime, Decentralized and centralized crypto assets exchange will both exist due to the differences in transaction experience: decentralized crypto assets exchanges may target more on the users of distributed applications and provide simple and user-friendly services of token exchanges, while centralized crypto assets exchanges may target more on investment-oriented and transaction-driven users and provide the best trading experience.

Therefore, the crypto players, especially the new ones, should understand closely about the pros. and cons. of each digital asset exchange. From then, based on their demand, they could make the appropriate decision for their fund. The author hopes that this writing with the aim of giving the overview of this issue by the simple way is helpful for anyone who is going on to reach the target of crypto playing.

#HuobiPro #centralisedexchangesvsdecentralisedexchanges #centralisedexchanges #betterliquidity #regulations #speed