HyperQuant: How Blockchain is trying to Create Financial Services

How effectively does an ordinary user manage cryptocurrency assets? Is it possible to bring down risks, increase profit, and learn professional trading?

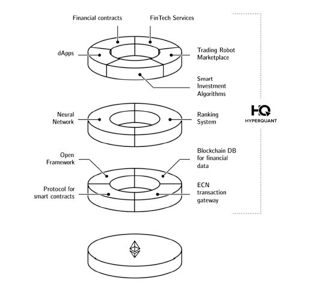

Figure 1. HyperQuant is a platform for traders and developers of financial applications

The developers of HyperQuant offers a platform for fintech projects built on blockchain and machine learning technologies. The architecture is based on Ethereum smart contracts, various frameworks, and third-party dApps (decentralized apps) for HyperQuant integration with new projects.

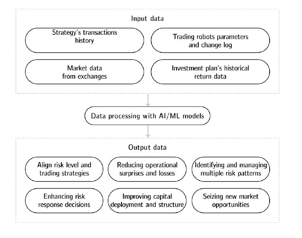

Figure 2. The principle of app operation

How does the HyperQuant platform work? Who will benefit?

The goal of the project is to ensure fast transactions, beneficial transfer of assets, secure wallets for cryptocurrency storage.

The developers have implemented several tools for beginners.

1. TWAP algorithmic order is a tool for order creation (requests for purchase or sales of cryptocurrency assets). The algorithm takes into account the current price, market dynamics, trading strategies, and the number of assets in investor's portfolio. Transactions are concluded as many times as the beneficial terms are followed. For instance, in short-term trading buy and sell orders may be placed each second. A trader has to set the volume (the number of coins) and optimum price.

2. VWAP algorithmic order is a tool for automatic trading at a set price in a certain period of time. An investor sets the price range, time interval, and the number of assets. The other work is done by AI. The algorithm will be beneficial for the trading of high-risk assets.

**3. Market-making algorithms **are the automatic selection of the lowest from all possible volumes of the transaction, the best prices (taking into account risks and tendencies of the market development). The algorithm takes into account the margin between the best selling and buying prices (calculates the bid-ask spread), accelerates placement of assets on the exchange and withdrawal of profit.

4. Risk management system is a solution automatically compare the risks for the investor. The tool takes into account the number of assets and trade placement interval set by the investor, predicts adverse situations, and regularly tracks the current situation. The strategies of HyperQuant trading is built on the machine learning technology, that's why the app favorably differs from trading bots.

5. Hedging is an automatic reduction (hedging) of exchange risks. The HyperQuant platform tracks the price of each asset in user's portfolio. In case of a sharp change in the exchange rate HyperQuant offers to sell (buy) an asset at an optimum price.

6. AI-based financial adviser is a neuronet which analyses user's trading history, current market condition, and new cryptocurrency assets. Pieces of advice of the "financial adviser" allows beginners to avoid underestimation of risks, create a beneficial strategy, and quickly begin to earn on trading.

7. Electronic Communication Network (ECN) is a tool for simultaneous trading on several exchanges using various strategies. SOR (smart order routing) chooses the best platform for placement of a buy (sell) order, while the user has to set terms.

8. Trading Bot constructor is a set of templates which helps to automate trading in the cryptocurrency market. The solution is suitable for experienced full-time traders. Trading Bot is created in several clicks, utilizes embedded analytics tools, and collects statistics and data about cryptocurrency markets.

Figure 3. The app architecture based on Ethereum

HyperQuant may be used as an assistant in daily trading and for the creation of trading bots and platforms. For instance, analytical tools may be connected with websites for market reviews and a mobile app for trading.

Figure 4. The work of AI-based financial adviser

The module structure may be utilized by the developers of financial dApps, analytics, and experienced traders. It'll serve as an addition to traditional trading platforms. Tokens of the project give the access to services of HyperQuant. They may be exchanged for other cryptocurrency assets.

How is the ICO of HyperQuant going? What will be with the project next?

The team has issued 320 million HQT which are ERC20 compliant. The price of 1 HQT is 0.00028 ETH. Hard Cap is 41 143 ETH. The ICO will be launched in July of 2018 (dates are to be determined). Unsold tokens are going to be "frozen" for 2 years.

45% of HQT will be sold in the ICO. 30% is a reserve fund. 15% is a reward for the development team. 9% is for advisers and partners. 1% of tokens will be invested in Bounty.

Roadmap of the project begins with the work with primary data in 2015-2016. 2017 is devoted to the launch of the alpha version.

The beta version adapted to private customers and B2B sector will be launched this year and next.

HyperQuant website: https://goo.gl/4Jc6yc

WP: https://hyperquant.net/en/wp/

TG: https://t.me/joinchat/AyLwZkMYopaGJkCck8S3Hw

Author on BCT: Melnikof https://bitcointalk.org/index.php?action=profile;u=1152502