The Simple Key To "Owning" Term Life Insurance

The purpose of today's article is to highlight the correct type of Convertible Term Insurance you should have IF you are thinking long term and have the determination to own assets (not liabilities).

The most common type of life insurance Americans have is term insurance. The reason why is pretty straightforward. It's super inexpensive. If you are an income earner with dependents or a business owner, there is no reason why you should be without it. (Sadly, so many Americans don't have any coverage or are underinsured! That's a different topic for another day though...)

First, a term policy only covers a specific period of time, hence "Term". The majority of term policies lapse or expire worthless. Within the industry, we are told only 1% of term policies pay out a death benefit. This is according to a Penn State study done in the 1990's. My guess is that the numbers likely haven't changed dramatically for the better. Life insurance companies know this and price the product appropriately considering the risk of paying a death benefit is so low. This is great for consumers who practice short term thinking, but it's counterproductive for long-term financial planning.

Second, because the majority of term policies will lapse or expire worthless, we should classify term insurance as a liability on our balance sheet. What is a liability? It's something that decreases in value or in many cases disappears altogether. Most Americans at the end of their term have nothing to show for it making it a liability. We want to avoid liabilities in order to build multi-generational wealth.

In order to faciliate long-term financial planning that includes a basket of taxable, tax-deferred, and tax-free assets, it's crucial to have the right type of term policy. (See my article on the 3 ways to create tax-free income here: http://bit.ly/taxfree-income)

Thankfully most term policies today have a convertible option. However, not all term policies convert to a Whole Life insurance policy. The majority of term policies sold today convert only to a Universal life policy. You can read about the danger of owning Universal life policies here: http://bit.ly/UL-LIFE.

For the purposes of what I do in my practice with teaching and implementing the Infinite Banking Concept (IBC), a term policy that is convertible to Whole Life is the only type of term policy I'll recommend because it ensures my clients will have the option to convert within the term period to a specific type of Whole Life policy with a PUA rider that can be customized for the Infinite Banking strategy.

It's important to note, not all Whole Life policies will include a PUA rider and not all life insurance carriers who offer a Whole Life policy endorse and are advocates for Infinite Banking. Some life insurance carriers make their whole life products inflexible and do not allocate the appropriate resources for handling service requests that Infinite Banking policyholders will have when taking loans from their policies. This is just one reason why you only want to work with an IBC authorized practitioner. They know which carriers are the best to work with and are dedicated solely to IBC.

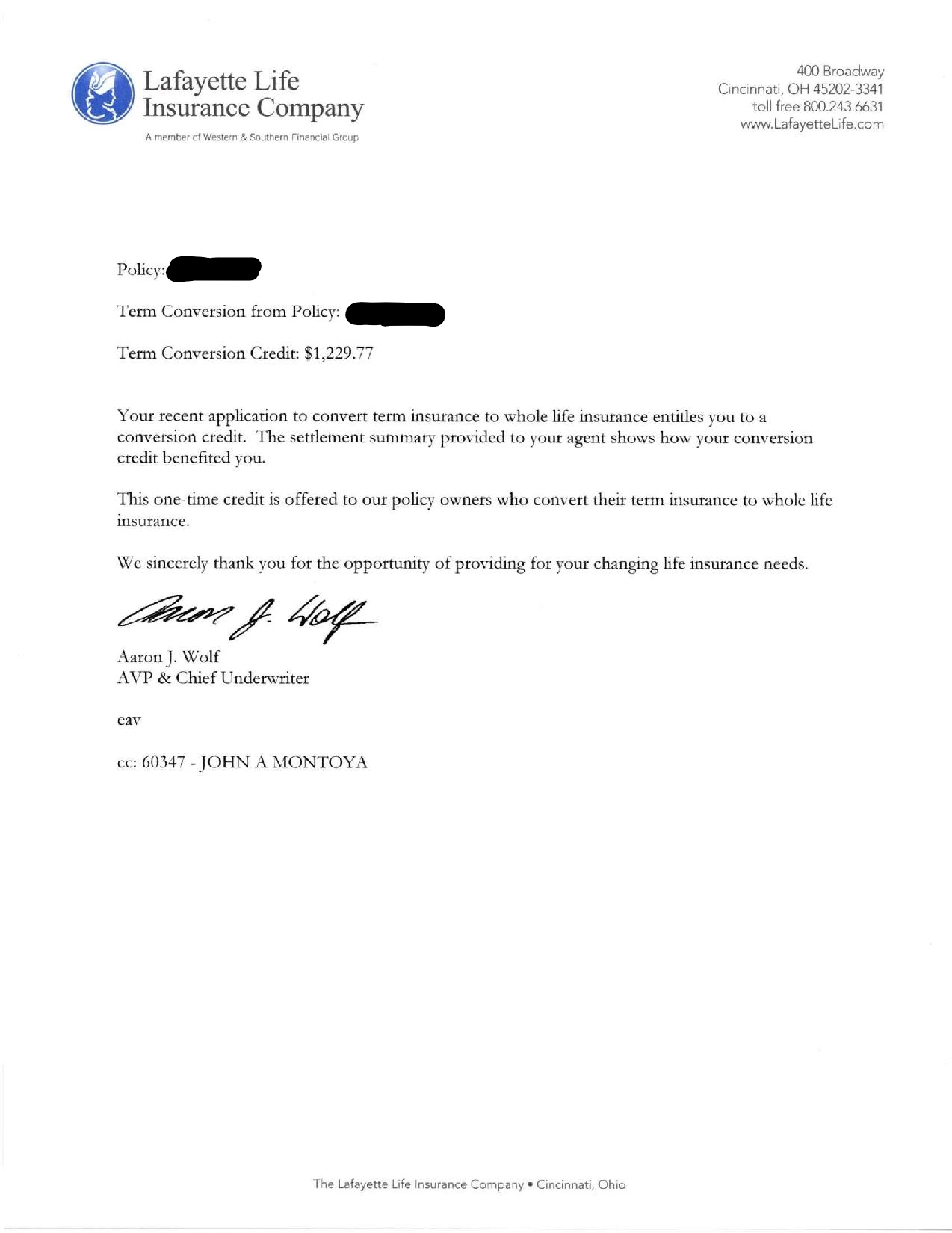

Below is a letter I received from Lafayette Life Insurance Company after I completed a term conversion of a $2 million 20 year term policy I had purchased 4 years ago to IBC designed Whole Life policy. I had already completed a prior conversion so I used the remaining death benefit for conversion. (Note: I own multiple IBC term and whole life policies from different carriers.)

Please note the $1229.77 credit I received upon conversion to a Whole Life policy. This amount equals the $102.48 x 12 months I had paid in premium over the previous year. Essentially, the last 12 months of my term policy was free.

Often I'll get asked if you have to convert the entire term policy. The answer is no. Depending on the size of the term policy, multiple Whole Life policies can be converted. The most important detail is having the right type of term policy for conversion, especially if you are interested in Infinite Banking.

The next question I'll get asked is how much death benefit is needed? That answer depends on your situation. I can tell you that it's important to first get enough death benefit protection for your family or business needs which an advisor can help you to determine. From there the amount of term insurance needed for a future conversion will have to be reverse engineered.

To determine how much death benefit is needed for a conversion, I must first have an idea of how much future premium you plan to fund into an IBC policy, how many years you will fund the plan, and at what age you plan to do the conversion. Then given your current age and some information about your health I can solve for how much death benefit would be needed on a term policy now in order to accommodate a conversion later.

If it sounds complicated, don't worry. It's not. The main thing to focus your attention on is having a long term plan for acquiring assets and realizing that life insurance, if you have the right type and the right strategy, is an asset with more benefits than you probably realize. You can learn more here: http://www.CashValueBanking.com

If you have questions about your own situation or would like to request a time to connect with me, please visit my calendar here: http://www.vcita.com/v/john.montoya.

Thank you,

John A. Montoya

JLM Wealth Strategies, Inc.

(925) 386-6639 Office

Infinite Banking® Authorized Practitioner

Bank On Yourself® Authorized Advisor

CA Life#0C42222

http://www.jlmwealthstrategies.com

Hi all. I know this topic is pretty old, but to me, this life insurance sounds too good. Plus, bitcoin has become very popular these days, and many companies have started investing in cryptocurrency. A friend of mine is a big fan of bitcoin, and he also started getting interested in insurance policies. He found this site https://www.lifeinsuranceblog.net/5-million-dollar-life-insurance-policy-cost/, which taught him everything he needs to know about life insurance and investing in it. Now he's trying to buy some pretty big insurance there for his bitcoin savings.

Different types of insurance always remain relevant, but in my opinion funeral insurance has become very profitable. the funeral itself, which is very beneficial for all family members, so as not to incur unforeseen expenses at inopportune moments for this.

Hello there. Choosing Ambetter as your insurance provider ensures that you are protected from unexpected medical expenses, have access to quality healthcare services, and can live a healthier lifestyle. With Ambetter, you can rest easy knowing that your health and well-being are in good hands. And when an insured event occurs, all you need to do is contact ambetter and experienced support representatives will do everything possible to ensure that the client receives the medical care he needs.