14 Tips for Planning a Successful ICO

ICOs have absolutely exploded over the last few months, some showing exponential activity just in the last few weeks. In response, we wanted to put pen to virtual paper and offer some insights and learnings not just from running our own ICO but also from what we’ve observed in the ICO space in general. Hash Rush Director of Marketing Craig Ritchie shares 14 tips for anyone currently planning or running an ICO.

1. Do some research on ICO due diligence

If ICO investors consider your project to invest in, they will do a certain degree of due diligence. In other words, they will look into your project’s specifics and determine if it’s a good investment opportunity. So if you want to make sure your project holds up under their due diligence, take a look at what this due diligence consists of. For instance, watch ICO review videos of key influencers or check out their personal Twitter accounts. You should look for what makes them want to invest and what turns them off existing projects. While big claims about your product being the next big thing may appeal to speculators, it won’t get past the serious investors who spend hours on due diligence.

Once you know exactly what ICO investors want from a successful project, satisfy their concerns. For example, verify that your team has LinkedIn profiles that hold up; make sure your roadmap makes sense; or have a professional write up your white paper. There’s many other steps you can take to cater to potential investors.

2. Answer the most important question of ICO planning...

There's one question that surpasses all other questions in ICO planning, and that is: “Why blockchain?”

This is one of the most important questions you can get asked, and indeed a question you should ask yourself over and over. If what you’re doing could be done just as well with a simple database or a different type of technology, then you're just jumping on the blockchain bandwagon. That means there's no reason for you to get involved in the cryptocurrency space — and serious investors will sniff that rat out very quickly.

3. First create your prototype, then launch your ICO

Only launch your ICO once you have a working prototype, no matter how small or how limited its scope may be. For many investors, this is a deciding factor. There are a million great ideas out there, but people want to invest in something tangible. A working prototype gives you a head start over many other projects — and could be a deal breaker.

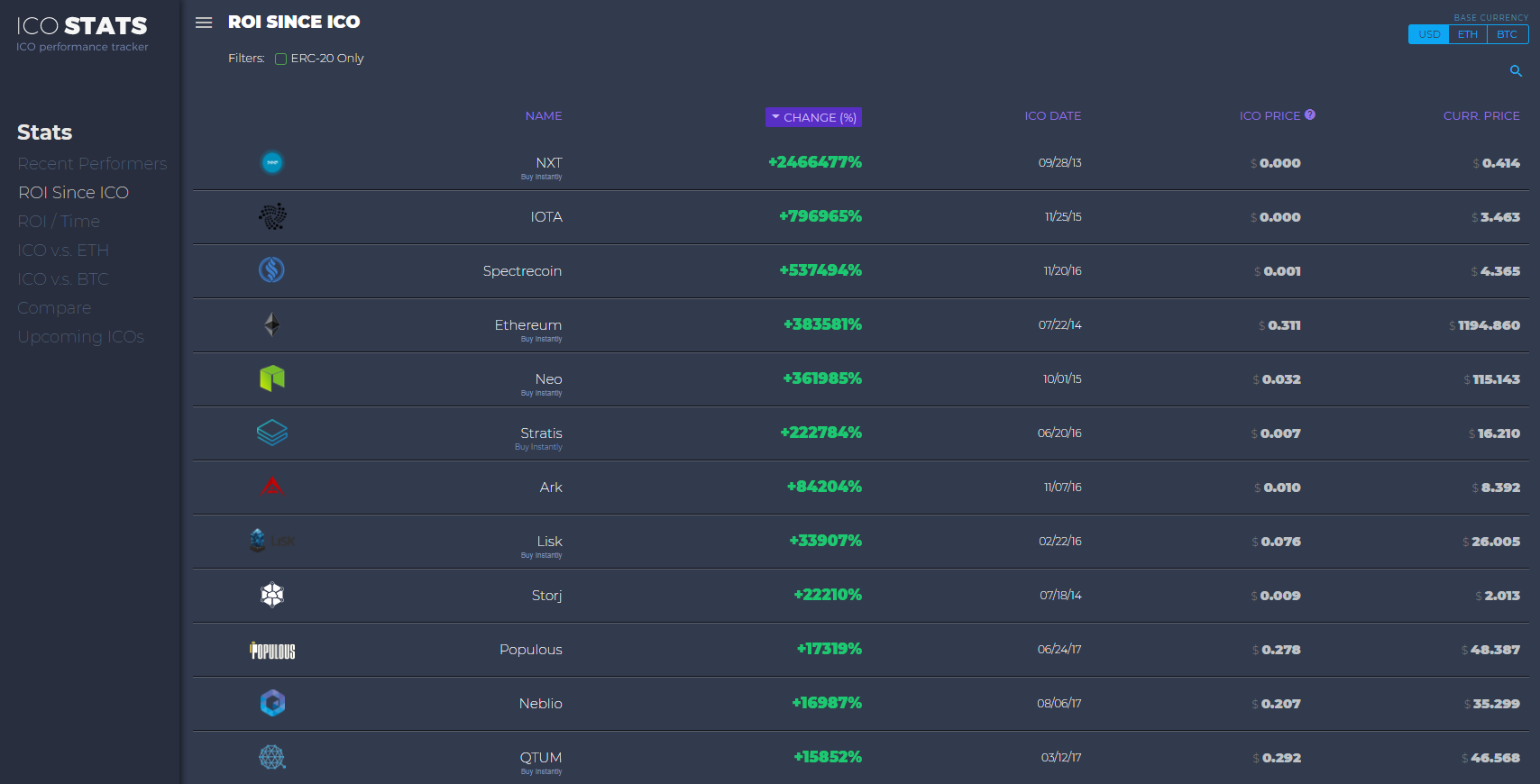

4. Set up a strong community team for 24/7 coverage

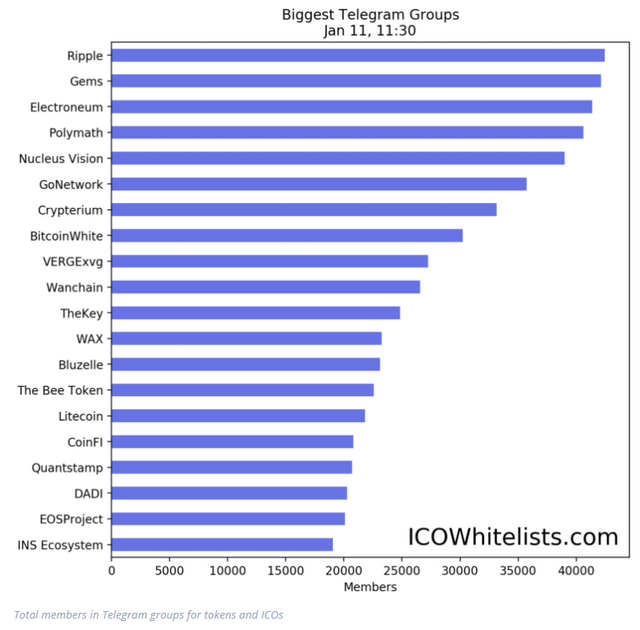

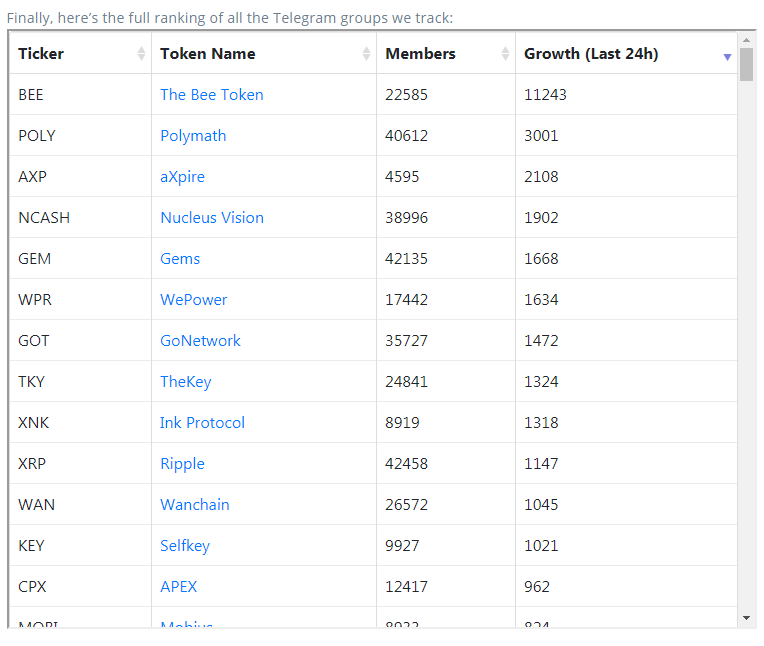

A large proportion of people who have started getting into ICOs since December 2017 are get-rich-quick amateur speculators who want to imitate the (multi-million dollar) gains investors like Ian Balina have achieved. This means they have probably not read your white paper. They might not be interested in what you're trying to achieve. And perhaps they don't fully understand what you're trying to do. And yet, they are frenzied by the promise of easy money, and afraid to miss the chance to participate in your ICO. This results in numerous questions about your entire project, putting a heavy strain on the people in your team responsible for community management. If you're lucky enough to do as well as projects like Electroneum (> 40,000 Telegram users) or e.g. Quantstamp (> 20,000 users), one person alone cannot manage the thousands of messages you'll receive every hour. If you want to cater to all of these people — which you should — set up a community team that can cover your communication channels 24/7.

5. Understand and adhere to local rules and regulations

Make sure you have a thorough understanding of the regulatory framework for ICOs in your region, and make sure your project sticks to it. If you can’t run an ICO due to legal restrictions, consider relocating your business. Some ICOs have moved operations to more crypto-friendly countries (for instance, some Chinese companies have registered in Singapore or Hong Kong). Intelligent investors are not going to want to put their money into something that might not be legally sound.

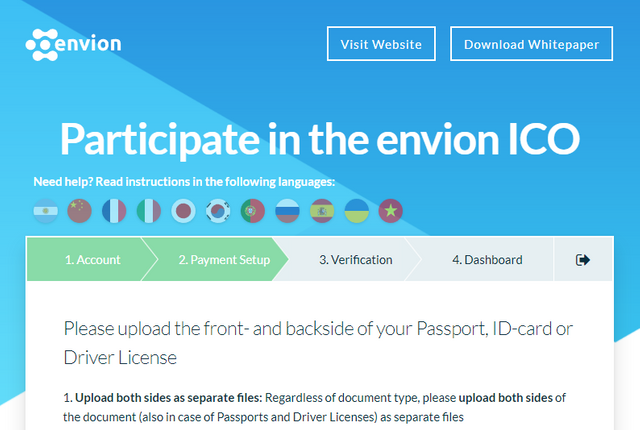

6. Get legal counsel and set up a proper Know Your Customer (KYC) process

Make sure you budget for legal counsel and do your KYC correctly. The cryptocurrency space is in constant flux and new laws and regulations can come into existence almost overnight. You don’t want to be caught off-guard halfway through your crowdsale because you skimped on lawyer fees. Find out what is required for what you are planning, and if necessary, approach experienced organisations such as Bitcoin Suisse to run this side of things on your behalf. Do everything by the book — in the long run it will be worth it.

7. Think about the values for your project

Get your team together and discuss (and decide on) the values for your project. For instance, do you want to be part of crypto's original philosophy of distributing wealth and gains among the many? Then you may want to set a maximum individual cap (of e.g. 0.5 ETH) so that many people can participate in your ICO with small amounts. On the other hand, if your main goal is to grow quickly, you may set a minimum cap and make sure many 'whales' participate. There's no right or wrong way to do this, but make sure you think about all of this beforehand and let it inform your decisions.

8. Set up a maximum individual cap for the first 24 hours of your ICO

If you do want to give everyone a fair chance, run with a max individual cap for the first 24 hours of your public token sale. This allows everyone a chance to participate. If after the first day the hard cap has not yet been reached, then open the floodgates by removing the cap. But if you have a solid project, a strong team, a detailed roadmap and of course a prototype to prove the concept, then don’t worry: you will get funded.

9. Don't change your token metrics halfway through your ICO

You should not change your token metrics or the terms of your ICO mid-way through the process. If you absolutely have to, then communicate your announcement very carefully. For instance, while their ICO was live, Experty announced they were going to peg the cost of ETH at $705 by taking an average price of the preceding 30 days. Although they prefaced this decision with “We are locking the ETH value to provide the same token price throughout the ICO”, and kept their hard cap at the same level, the reaction from the community was terrible.

FUD is rampant in the crypto world, and even if your bottom line remains the same, just appearing to shift the goal posts once live can really upset your investor community. Experty have a great product, a very strong team and their overall raise figures have not changed. However, their choice of wording when messaging this change (brought about by the rapid increase in ETH price) no doubt caused a lot of headaches for their community managers, since all investors saw was: “we’re valuing your ETH at $705”.

10. Determine your hard cap and communicate it clearly

Determine the hard cap you need for your project and be explicit about it from the start. If your project only needs $10 million to get to market, investors and the influencers they follow will be raising eyebrows and seeing red flags at your $50 million hard cap. And for a growing number of influencers in this space, $30 million seems to be the magic number beyond which a lot of investors get concerned. Do you really need to raise more? Have you considered that the high cap might deter investors who see such a high hard cap as a potential risk on future growth?

11. Run a pre-sale with conservative bonuses

Run a pre-sale with a portion of the hard cap and then allocate conservative bonuses. Providing additional tokens as percentage bonuses for early participants will attract some investors, but they can become counterproductive when the bonuses are too high. Consider locking bonuses for a certain amount of time after launching on exchanges to discourage immediate dumping.

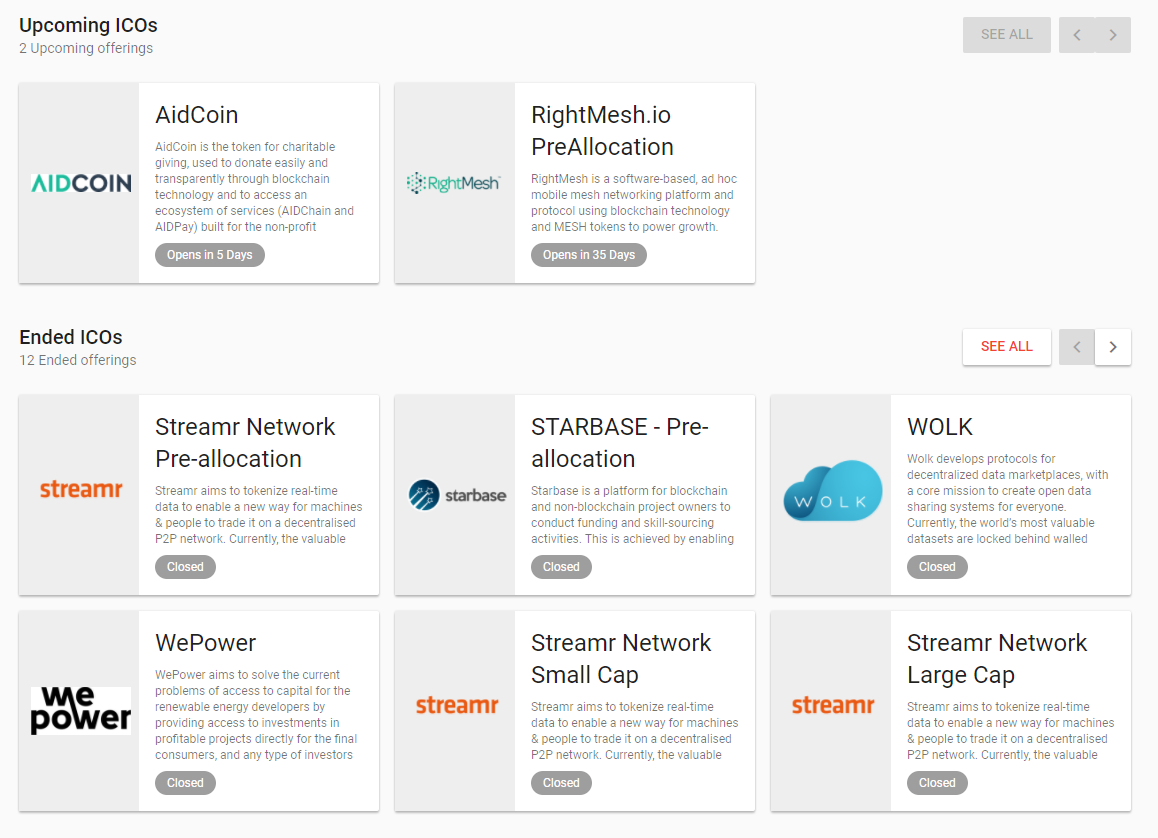

12. Allocate some of your budget to exchange listings

People want to know when and where they can sell their tokens. Or if they missed your ICO, they want to know when and where they can buy some tokens. Not everyone is in it to flip for a quick profit… those who missed your crowdsale will want to get in “on the rebound”, as Balina calls it. By reserving some of your budget (which you can even add to your soft cap) for (the still exorbitant) exchange listing fees, you can commit to specific exchange listing dates and satisfy both the flippers and the hodlers.

13. Draft and publish a comprehensive FAQ

Before you start your ICO, make sure you have a comprehensive FAQ ready and widely available for anyone to see. Link to it from your website, and in pinned messages on Telegram, Twitter, Facebook and other communication channels. This will make the life of your community managers easier, as people WILL ask these questions, over and over:

- When is the token going to be on an exchange?

- Is the the white list open?

- Where can I find the white list URL?

- What is the hard cap?

- Where can I see how much has been sold already?

- Can people from [my country] participate?

- What is the total supply of your tokens?

- What is happening to unsold tokens?

- Where can I read the white paper?

- How much is the pre-sale bonus?

- Do you think this coin will 10x?

- When moon?

14. Test your systems thoroughly before the ICO launch

And finally, test your systems before you pull the trigger. There’s just no excuse anymore for making simple mistakes such as not having enough capacity to send out more than 1,000 emails for white list registrations; not having DDOS protection; not checking that your web forms work properly; having country list dropdowns that aren’t alphabetised… the list goes on and on. There are hundreds of successful ICOs that have set precedents you can follow, so make sure you follow their lead. Clean up these small issues to make your team ready to handle real problems, so you don’t have to sweat the small stuff.

And that’s it! If you follow these tips AND your project is not a quick blockchain cash-in (but is something that adds genuine utility to the space), you will likely succeed. Your ICO will be picked up by influencers and reviewers, you will make the grade on investor spreadsheets, you will start going viral on Telegram and Discord channels, and there's a really good chance you'll meet your funding goals. There’s a lot of money in this space going to solid ICOs, and there’s never been a better time to launch an innovative blockchain project. Best of luck to you!

This article was written by the team behind Hash Rush. Hash Rush brings real hashing power to the world of RTS gaming, allowing gamers to earn valuable cryptocurrency rewards while playing. If you want to learn more about Hash Rush, take a look at our website, follow our blog or join our newsletter.

You deserve the UpVote friend, enjoy it!!

https://steemit.com/life/@racoo/3t91m7-an-algorithm-for-making-a-cup-of-tea

Ico token are best token.thanks for sharing informative artical

You got a 8.61% upvote from @upmyvote courtesy of @hashrushgame!

Sneaky Ninja Attack! You have been defended with a 10.05% vote... I was summoned by @hashrushgame! I have done their bidding and now I will vanish...Whoosh

Informative Post thanks for sharing :)

Thanks for information

You got a 2.89% upvote from @yourwhale courtesy of @hashrushgame!

Dtube Success story! Must watch and ReSteem

Join SKARA Bounty Program today and get rewarded with SKARATs! check it out https://www.skaratoken.com/bounty-program more join the Telegram> https://t.me/joinchat/GXWv8xIAxcYDZM4tA4cX4Q

great post