Akropolis – The Blockchain Pension Solution Built for the Future

“The decline of Rome was the natural and inevitable effect of immoderate greatness. Prosperity ripened the principle of decay; the causes of destruction multiplied with the extent of conquest; and as soon as time or accident had removed the artificial supports, the stupendous fabric yielded to the pressure of its own weight.”

Edward Gibbon The Decline and Fall of the Roman Empire : https://amzn.to/2IagCzW

At the center of every major Roman town was the Acropolis, a fortified structure on a hill which served as the last line of defense against invaders. In dire times, the city’s wealth would be stored for protection within its walls. The Acropolis ensured that once the tide of war had receded, the city would have the funds to rebuild again and restore its glory.

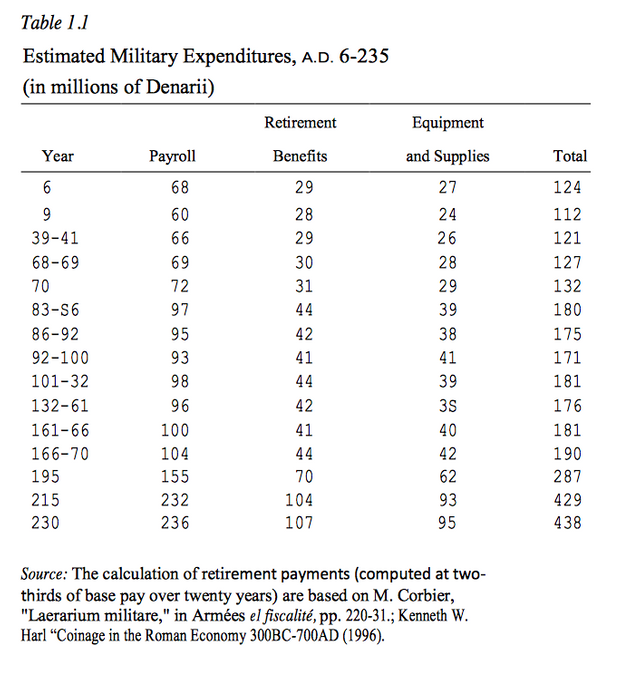

While its thick walls kept cities safe, Vast military campaigns led to exploding military costs for Rome and a reliance on mercenaries. The modern pension was also born of this time, as any soldier who served 20 years was given assurances by the emperor that they would be taken care of for the rest of their lives. As the empire grew on the feasts of conquest and plunder, so too did the costs of supporting veteran soldiers in their old age. In just over two centuries, benefits for soldiers grew more than three times.

This cycle could not continue forever and eventually the Roman empire collapsed under its own largesse. The currency was debased to almost worthlessness and the population of the Roman empire, once boasting more than a million people in Italy alone, fell by almost 90% once the government collapsed and was no longer able to provide services.

We face similar threats today.

The biggest financial threat ever to appear in human history has already begun to manifest itself closer towards reality. The Great Financial Crisis (GCF) of 2008 was just a small bump in the buildup to the coming pension calamity. Numerous studies confirm that we are in the early phases of the greatest crisis globally since the 1930’s Great Depression. Unless major changes are made, it will be inevitable and will sever the fabric of our world economically and culturally.

Everything about our way of life could change dramatically: when and where you retire, where your money is stored, how well you can take care of your family. Billions of people around the world are at risk of poverty and other negative factors that stem from war, rioting and social unrest. Modern society is under threat.

This is not a claim made lightly. In fact, this reality has been confirmed by decades of research by some of the brightest minds in the world. Currently, our pension systems face an unsolvable problem and the effects of are just starting to show, however, with time it will only exacerbate itself and every major city, town and village will eventually be caught up in it. No society in human history has ever countered its effects and stood the test of time, economic collapse is the only outcome.

As with the Romans before, the entire world is facing a growing pension crisis. Trillions of dollars are being misallocated to prop up a system which is mortgaging the future to meet today’s obligations. The causes of this crisis are increased lifespans and longevity, which are creating massive unfunded liabilities for pension funds worldwide.

Pensions will fail, or be bailed out by the government.

True to its name, Arkopolis’ mission is to build a defensive core infrastructure that leverages the transformative power of blockchain, big data and machine learning to address a pressing real world problem that has no current solution and will impact every individual, be they a part of the pension system or outside of it.

GROWING OLD

The root cause of the pension crisis is actually a byproduct of modern technology pushing the limits of human life with advances in genetics, medicine, and increased standards of living. Children born in 2007 are already expected to live on average to 103 in most developed nations. This represents an almost doubling of longevity since modern welfare programs were instituted in the the first half of the 20th century. Unfortunately, our pension systems have not adjusted quick enough to meet these ever growing requirements.

In Laurence Kotlikoff and Scott Burns’ book entitled The Coming Generational Storm: What You Need to Know About America’s Future they argue that currently there are 8 workers to every 1 retiree, however, by 2050, this number is set to shrink to 4 to 1 and “simple arithmetic will note that this is not sustainable over the long run.” In countries such as Japan, retirees can start drawing their pensions at just 60 years old, and with children born today expected to have an average life span greater than a century, retirees will need considerably more savings to provide for 45 years of future income. Kotlikoff and Burns’ solution to this funding problem is to “raise income taxes by 17 percent, raise payroll taxes by 24 percent, cut federal purchases by 26 percent, and cut Social Security and Medicare benefits by 11 percent.” A truly untenable solution in the current political environment.

As more people retire, pension funds will have to support a growing ratio of retirees to contributors. Andrew Biggs wrote for the WSJ that “The ratio of active public employees to retirees has fallen drastically, according to the State Budget Crisis Task Force. Today it is 1.75 to 1; in 1950, it was 7 to 1. This means that a loss in pension investments has three times the impact on state and local budgets than 40 years ago.”

More so, the majority of people do not have enough money saved to retire early and live through our growing lifetimes. The National Retirement Risk Index (NRRI), based on data from the U.S. Federal Reserve’s Survey of Consumer Finances shows that more than half of Americans will not be able to maintain their pre-retirement standard of living in retirement. This savings gap will most likely have to be filled by government social programs and pensions.

Society is simply not built for the young to support so many of the older generation. Great advances will occur in technology by 2050 leading to increased industrial output and commercial growth. However, it’s not possible to say what the impact of this great shift in the average age of the population will have on production capacities and their effect on GDP.

WSJ : https://www.wsj.com/articles/the-hidden-danger-in-public-pension-fundsthe-hidden-danger-in-public-pension-funds-1387141006

NRRI : http://crr.bc.edu/wp-content/uploads/2014/12/IB_14-20-508.pdf

UNFUNDED LIABILITIES

Even now governments are feeling the strain of their aging citizens. Pension programs designed to provide for seniors in the elder years are all slowly going bankrupt globally. It’s not that politicians and other informed citizens do not know or understand the problem, it’s that bringing about changes to the existing system would put millions of people at risk of poverty and cause great political upheaval.

The bulk of this threat lies within what are known as unfunded liabilities. These are commitments pensions have made to their contributors for future payment and care. The bulk of the unfunded liabilities comes from city and state pension systems. There are two major types of pension funds, defined benefit (DB) and direct contribution (DC).

Direct Benefit funds are typically what workers were given up until the end of the 1980’s, in which companies promised to pay a certain percentage of final salary to the worker. In DB schemes, the managing institution bears the financial risk, taking a commitment to pay out the promised benefit levels regardless of the total value of entire assets managed. In case the total value of accumulated assets is greater than liabilities, it is considered “overfunded,” if the DB scheme has liabilities greater than assets, it is “underfunded.”

DC funds are more typically what is used today, where the funds distributed total the amount contributed by the employee and employer. DC funds depend on the level of aggregated assets, and it shifts the risk from the fund to the individual contributors. Generally, DC funds are governed in some respect by their contributors who get to choose where to orient their funds for investment. These types of funds are similar to individual savings schemes, however, usually participants cannot remove their funds until retirement.

The majority of pension underfunding occurs with DB funds, because as lifespan has increased, the amount of workers to pensioners has declined and rates have been falling for several decades, they have not been able to match rising liabilities to returns, forcing them to divert wages, reduce productivity investments and other measures to stem the pension deficit. This has been a more palatable route versus capping or reducing benefits for retirees. Pensions funds were extremely disaffected by the 2008 GFC, with the OECD estimating declines of over $5.4 trillion, or 20% in the resulting crash. As 60% of all OECD pensions are DB schemes, the resulting decade has only witnessed moderate growth for DB funds and their funding levels remain low.

In the United States, city and states have been the most underfunded. For example, Chicago, for instance, has over $35.7 billion owed to different funds, Massachusetts owes $82.9 billion to pay pensions ($39.6 billion) and retiree health care benefits ($18.6 billion), and Portland owes $12 billion. Many pension funds base their assumed rate of return on extremely lofty projections, Chicago, for example, has twice reduced their assumptions, originally down from 8%, then 7.5% and now 7%.

This trend is not limited to the US, in Europe, Germany has the highest amount of unfunded pension liabilities (481 billion), then the United Kingdom (365 billion) and France (241 billion). According to David McMillan, Chief Executive Officer, Aviva Europe “Europe needs to save an extra €2 trillion a year to close the pension savings gap.” Huge increases in savings rates and government intervention will be necessary to chip away at these growing liabilities.

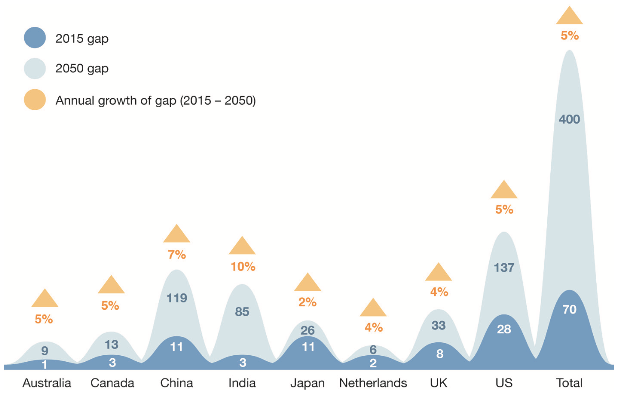

Globally by 2050, the savings gap across all sectors, public, private and personal, will grow to an astounding $400 trillion according to the WEF. Currently, the savings gap is around $70 billion, with this amounting to around 1.5 times the GDP of all major developed and developing countries. However, deficit growth will be largest in China and India, which are expected to be at 7% and 10% respectively.

Continued underfunding also forces DB funds to divert a larger portion of their assets to meet participant payment demands, depriving future pensioners from their accumulated savings. They are bound by their foundation documents which require the dual mandates of meeting current pensioner payment demands, while at the same time accumulating assets for an ever growing future pool of retirees. This process of asset transfer to current pensioners at the expense of future ones is known as intergenerational wealth transfer. It is one of the greatest threats to society globally and represents wholesale theft from today’s workers.

It is such a powerful issue because as liabilities increase, the possibility for social unrest also rises. Private and public DB pensions facing collapse will have to turn to city, state, and federal governments for taxpayer funded bailouts. In order to close the funding gaps, massive tax increases will be instituted to provide emergency funding. The scale of tax revenue needed to support this was described by the California Policy Center, in their study entitled “The Coming Public Pension Apocalypse, and What to Do About It,” : http://californiapolicycenter.org/the-coming-public-pension-apocalypse/

“A city that pays 10% of their total revenues into the pension funds, and there are plenty of them, at an ROI of 7.5% and an honest repayment plan for the unfunded liability, should be paying 17% of their revenues into the pension systems. At a ROI of 6.5%, these cities would pay 24% of their revenue to pensions. At 5.5%, 32%.”

These figures are staggering. How many funds can guarantee a net positive return of 6.5% or even 5.5 for the next 10-20 years? It’s impossible. Currently, global markets have enjoyed continued growth for almost a decade since the GFC. At some point the business cycle will turn over and a major recession will impact a majority of OECD states. Accumulated assets will lose value and funds will quickly face disastrous funding issues and the only way to prop up these failing systems will be with government intervention using taxpayer revenues.

The trustees who manage pensions are not personally liable for any losses incurred or funds appropriated from future use. They are gambling with contributor funds and playing a losing game. Even the cautious ones cannot foresee the extent of wealth destruction the next recession or market crash will cause. Eventually, the liabilities will catch up and force drastic changes to fill the gaping savings gap.

Based on the above research, unless carried out at the federal level, taxpayers are facing +100% tax rate increases and would either have to suffer through rate hikes, or vote with their feet and redomicile to more favorably taxed areas. If government has to step in and provide bailouts and a significant portion of the population moves, it would only further strain revenue burdens and create a self-propagating cycle of destruction. Those working aged persons who remain would be pitted against retirees, with demands by the former for easement and the latter for continued benefit payment. There will be no winner in this intergenerational conflict. Millions of retirees will lose their source of income or working aged adults will have to give up a greater amount of their current income to support overburdened systems.

If this issue is to be solved, it will require a multi-faceted approach on the part of pension funds, their contributors, politicians and their constituents to enact bold changes. Outside of the political realm, Akropolis stands to provide a major solution for the funds themselves.

A Decentralized Solution

Akropolis is the brain child of Anastasia Andrianova, or Ana as she likes to be called. A year ago at the Ethereum Developers Conference in Cancun, Mexico, which I was lucky enough to attend, the genesis of Akropolis occurred. Ana had just started bringing on the first team and advisory members. Amongst the sweaty T-shirt clad group of developers, she was carving a path towards creating Akropolis.

The core concept of Akropolis lies in building a direct contribution pension platform using asset tokenization, where traditional financial assets are secured on a blockchain in the form of a token. These digital tokens cannot be duplicated, destroyed or stolen, making it easy for financial institutions to transfer value. It is a great use case for the blockchain and technology which is already being implemented by banks, funds and other financial entities. Akropolis will leverage this trend by developing a platform to allow pension funds, asset managers, and users to benefit from the transparency, safety and cost reducing qualities of the blockchain.

Akropolis’ platform is novel as they propose a dual currency solution, the external token AKT and internal stable coin AIT. The former’s supply will be fixed and subject to market forces, while the latter’s value depends on the user’s currency. AKT will be used for access to the platform, payment of premium fees, purchasing platform data and as a stake for incentives. AIT on the other hand will represent a chosen currency, and after a user deposits funds onto the platform, they will be represented by the stable coin. Additionally, they will be distributed as staking rewards.

The users of Akropolis, non-institutional investors, will be able to use the platform’s basic services for free as a way to easily onboard clients. Complex services and other developed add-ons will be available for purchase on their marketplace. One of the services I like is that governance issues can be handled easily through smart contract voting. If a pension fund is starting to misallocate capital or force significant reductions, a snap vote could be held to determine future actions.

The biggest value add though will be the transparent fee structure, encoded into a smart contract which can be verified independently. Many funds front load, back load, tack on subsidiary fees, management fees and many other types of administrative costs that destroy the original investor capital. Fee reduction leads to exponential greater returns over a long enough time scale. Thus a reduction of even %1 in fees could provide pensioners hundreds of thousands extra.

For pension funds, Akropolis makes it very easy to onboard clients, as their documentation and KYC information stays in one place. More so, record keeping becomes easier as the full extent of investor assets are kept on-chain, simplifying audits and saving millions in compliance costs. Intermediaries suck huge amounts of capital out of funds through fees charged, Akropolis will help reduce their necessity through employing AI and machine learning. Additionally, use of the platform will reduce regulatory costs for interaction with fund managers.

Fund performance will be completely transparent, making funds and managers more accountable for their actions. Users will be able to choose based on a variety of metrics and asset classes, allowing sound investment decisions.

TEAM

As mentioned before, the team is led by Anastasia Andrianova, an experienced fund manager with close ties to the industry and its senior members. She will be the connection between the aging pension funds and this new technology platform and I 100% believe that she will excel in this. An issue I have though is that Ana has never run a tech company and this is her first startup. Her background is in the corporate finance world, a completely different environment and culture. However, with time I think she will adapt to the difficulties of managing a startup business.

Akropolis’ blockchain is being developed by Sigma Prime, an Australian based IT firm. Three of their staff members are listed on the Akropolis website. I would expect more developers to appear post-ICO.

The advisory board for Akropolis is stacked. More so, I can assure that everyone listed there is or has actually contributed significant amounts to the project. With people like Ian Grigg (Partner at Block.one (EOS), Architecture Consultant at R3, Financial Cryptographer, Inventor of Ricardian Contract), Ros Altman CBE (UK Minister of State, Department for Work and Pensions (2015-2016) and Saber Aria (Prime Block Capital) all providing value add, I believe there will be a high possibility of success for Akropolis.

Legal & Audit

Gibraltar based law firm Isolas is providing legal support. They the most experienced firm for the jurisdiction and have worked with many other ICO’s in the past years. Price Waterhouse Cooper provides auditing services.

Conclusion

As someone who has supported Akropolis from day one, I firmly want to see this project succeed. If successful it could help the industry reduce billions in fees and administrative costs that are currently eroding the long term value of investor assets. Akropolis will bring more transparency to a vastly bloated system. Asset tokenization is a key part of the future and settlement procedures will eventually implement this novel technology. By being ahead of the trend, Akropolis takes a leading view on the tech pension funds and asset managers necessarily must provide for their clients in the coming decades.

I earlier wrote about another pension project called Auctus, but I reviewed them poorly because of their lack of connection to traditional finance. Their team was solely made up of developers and lacked any senior team member with extensive pension experience. Ana and Akropolis are the opposite, they have very deep ties to existing funds and managers, what will be key for them though will be to build the right team of developers and engineers who can build an amazing product. As such, I hold Akropolis in higher regard than Auctus because of the connections Ana has. She has already lined up pension funds to pilot the program and is an industry expert. These qualities are not easily found and lead me to believe Akropolis is setup for long term success.

For more information

website: https://akropolis.io/

whitepaper: https://link.akropolis.io/whitepaper

telegram: https://t.me/akropolis_official

facebook: https://www.facebook.com/akropolisio/

twitter: https://twitter.com/akropolisio

jtwale : https://bitcointalk.org/index.php?action=profile;u=1727454

Hi! This is jlk.news intelligent bot. I just upvoted your post based on my criteria for quality. Keep on writing nice posts on Steemit and follow me @jlkreiss to get premium world news updates round the clock! 🦄🦄🦄