HOW TO FIND SUCCESSFUL AND PROFITABLE ICO - Step By Step Guide (Part II)

In part I of "How to find successful and profitable ICO." I started describing a screening process that should be performed before investing in any ICO. Today I will continue with a list of things to do when choosing which ICO to invest in.

Token Economy

Even If you find a perfect project with a great product, lead by the team of Supermans you can forget about all of that if token economic is not looking good. You don't even have to use some special calculations, but just basic math to see how good is this ICO detail. The ideal ICO token economy would have this kind of parameters:

Percent of tokens for sale

A big percent of tokens will be available for public sale during ICO process. If you see that team is leaving 20+% of tokens for themselves, then think twice about investing in that ICO. Also, check percentage left for future development and check what a cost structure plan for the future is. There is a possibility that future development just means development is the size of the yacht for CEO and his crew.

Discounts

There should be NO special discount on a number of tokens brought. If there is, and you are a just small investor that is not planning to buy enough to get this discount, then you are in unfair position when compared to big whales. If they are getting 50% discount, then you could expect them to sell at the launch (If there are no restrictions). Even if the price is the same as it was for you during ICO, they have 50% of the profit from the day one. Don't mistake this discount with discounts on early buy, which are in my opinion legit. (We will talk about it later)

Market Cap

A total number of tokens and the price would be low when compared to the competition. Just look at the Market Cap!

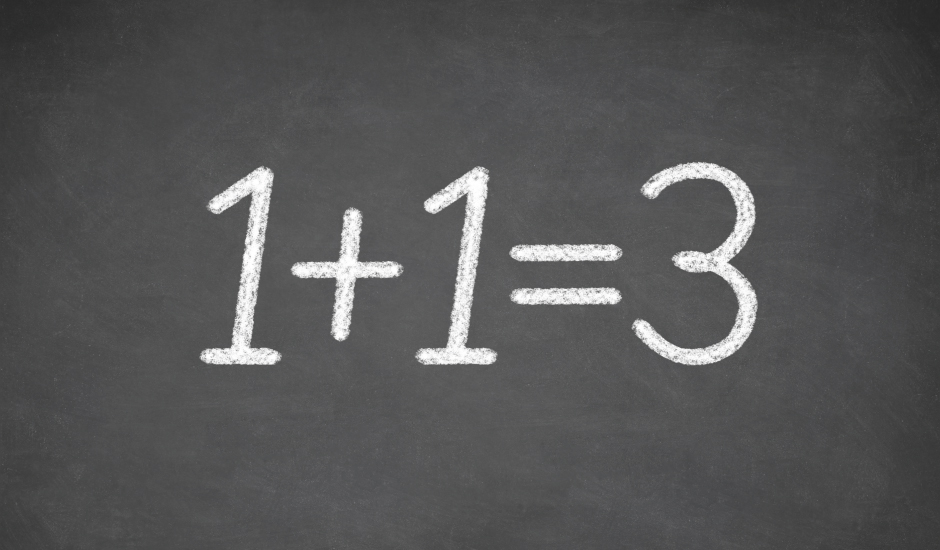

I see that some "investors" don't even get this basic preschool math so I will explain it to them. What you need to calculate is:

NUMBER OF TOKENS X PRICE OF ONE TOKEN = MARKET CAP

If the price of the token is 10$ and there are 1 Million tokens then (if a Hard Cap is reached) ICO will collect 10 Million USD. And if the price of the token is 0.10$ and the number of tokens is 100 Million then they will collect?

Of course, they will collect the same, 10 Million USD. So please when you hear from someone that this or that token is too expensive, and he is looking just the price of one token and not a total amount, slap him over his mouth and teach him this basic math. (I am not calling for any violence in here, it is just irritating hearing things like this, plus it is leaving a bad impression about cryptocurrency investors in global).

All unsold tokens will be burned

Allways look at this detail. Are all unsold tokens going to be burned (destroyed) after the end of ICO? This could easily raise the price of your token for several times even before trading starts. If the company was planning to sell 100 Million tokens, but at the end of ICO just half of that number was sold, and the rest was burned, then these 50 million sold tokens are worth double now.

Buyback program

Sometimes you can find companies that are planning to use part of their future profit to buy back (and maybe destroy) their tokens from the market. If you are a token holder and planning to invest for a long-term, this means more demand, and a higher price for your token, so it is a plus when you see this in ICO info.

Thanks for the part II. That’s indeed baffling to see people talking about a coin/token price being cheap or expensive without understanding what it really means. Again a lot to learn on there for me, thanks for the easy explanation

I think that's just human psychology; they feel they hold "more" by having more tokens, they don't even know how much there are in circulation. That's why most of the winners recently have "low" prices of their tokens, even the ones with large caps

There is truth in that... Especially with new investors, but for the same reason, they lose their money first when bears come and market start bleeding...

Yes, they have weak hands. There are projects I'm invested in that sometimes take a big dip and I don't worry because I know what they're about and the future prospects are solid. But if you don't know exactly what you're investing in, well... you sell at a loss or barely break even and stress out

Almost every day I find someone talking like that... ;)

Hi kriptonoob, from all advises I saw on steemit about ICO, yours are the best, I I cited your articles in my post : https://steemit.com/ico/@cryptoicodealer/from-20usd-to-1800usd-with-the-ico-dent

I added my personal inputs about it, you can have a look. By the way we are waiting for the part 3.

My man kriptonoob, thanks for your easy-to-understand tutorial. I will check out your first post about ICO's also. I think this will help a lot of us do better research before participating in an ICO (or Pre-ICO).

Thank you for your kind words... It is just my opinion, but I think that it could help to many new crypto investors ;)

Sneaky Ninja Attack! You have been defended with a 4.43% vote... I was summoned by @kriptonoob! I have done their bidding and now I will vanish...Whoosh