Homelend’s P2P Lending Methods—Revolutionizing Mortgage Lending

In my last article on Homelend, I'll dive into one of the more fascinating bits of their whitepaper, which is their methods for lending. They've taken the three most popular types and broken them down with blockchain technology, allowing for the potential of their plan coming into fruition.

You can see more of my articles by going to my blog, where I've detailed out the whitepaper in attempts to distill the information.

Methods for Lending

Homelend has introduced a platform that hopes to take the mortgage industry to the next level. How? By devising three P2P lending methods that will be used on its platform: auction, pooling, and pure crowdfunding.

Middlemen and intermediaries will be cut out of the process, since the following lending methods will be controlling and executing on behalf of the financial resources with something know as a smart contract. Also, each method splits mortgage loans into what is known as “slices”, and these methods differ depending on the specific approach to a pre-approved mortgage loan.

Let’s quickly go through these three P2P lending methods, shall we?

Please note, each of the images below were taken directly from the Homelend Whitepaper

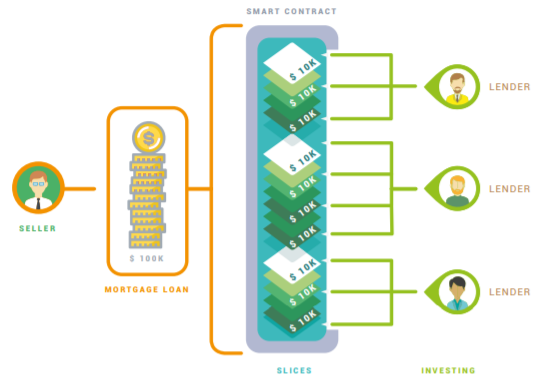

Crowdfunding Method

This is the most basic, and therefore simple way to fund mortgage lending. "Slices" of an investment opportunity will be discovered by potential investors, who are being exposed to an increase in real estate opportunities with blockchain technology revamping the space.

On the other hand, the borrower’s pre-approved mortgage loan will be distributed into small portions, where different lenders will be able to finance the loan by simply putting money into these “slices”. This implies that the size of the loan gotten by borrowers is equal to the amount of funds invested by lenders.

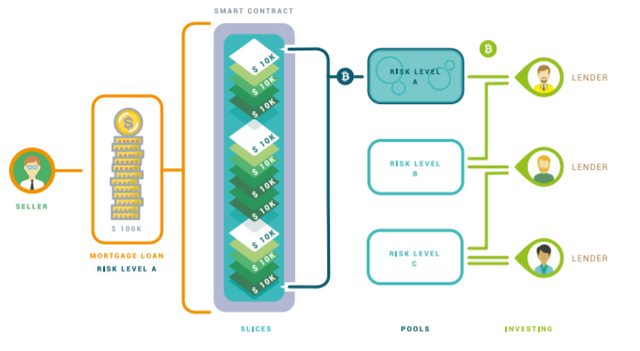

Pooling Method

With the pooling method, while there is a bit of economic flexibility added to it, however, it is quite complex from a technological point of view. Unlike the pure crowdfunding, the pooling method allows lenders to be able to invest money via smart contracts before the pre-approval of a specific mortgage loan. Though the investment is done under the same “slices” system, the smart contract gives lenders the chance to pre-buy the “slices” before they have been created properly.

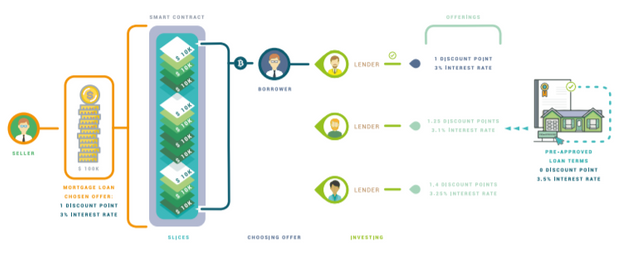

Auction Method

Unlike the pooling method, no financial buffering is involved with the auction method which is developed as an alternative to the pure crowdfunding method. However, the major difference between the auction and crowdfunding method is that borrowers can be offered better options by lenders, other than those that the platform has pre-approved.

Conclusion

The real estate market is a massive portion of the financial industry, and like the financial markets, slowed down by a lack of digitization of their bureaucratic processes. With all the paperwork and manpower required to keep the home lending cogs greased and spinning, time and money are inevitably going to be wasted.

If a company like Homelend were to come along and effectively put the real estate market on the blockchain, we'd see massive improvements in its functionality, and the common person would see the benefits as well. With all the methods for lending outlines above, real estate investments could be afforded with relative ease, and the wealth could potentially distribute in an organic matter.

The processes involved in mortgage loaning can be a bit daunting, but with Homelend’s platform and these amazing P2P lending methods, the mortgage industry is about to witness a revolution that will be televised.

For more information of the Homelend ICO and team, check out their website and whitepaper.

Disclaimer: As with all investments, you should do your own research. The information provided in this article is focused primarily on bringing the facts out of the white paper to supplement your due diligence. Please do your own research and make up your own mind.

Links:

Homelend Website

Follow Homelend's Twitter

Join the Homelend Telegram Group

Follow the official Homelend Blog

Read the Homelend Whitepaper

Author BTT Profile

ANN Thread

Congratulations @maxwellfreeman! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes

Congratulations @maxwellfreeman! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes

I'm sure this project will be a great idea because clients of mortgage companies need to have such opportunities. The mortgage has an important role in this global business which is why there are so many companies in the world today. All of them are involved in order to make it easier for customers to buy property. If difficulties arise, there is always help from Mortgage Advice Cardiff, which has a lot of experience and closed successful projects in order to be able to help with similar situations for those in need. This is my number one solution.