ICO Review: DeStream, a Decentralized Financial System for Streamers

My friends often ask me about any ongoing ICOs that I personally find worth investing. Usually, I find it difficult to come up with an immediate answer. The reason is I have no clue about your investment strategy, horizons and decision making, your reasons to buy tokens, whether you see them as speculative short-term investments or long-term value holdings, and there are many more nuances I posses zero knowledge about. And to make it clear, I’m not in financial consulting business and there are good professionals out there who can assist with needs and questions like that.

Yet, I find it inspiring to observe, read and investigate. I get thrilled by uncovering interesting projects and ideas, digging into their business models, forming opinions on different teams and people, and making my estimated on these projects’ market prospects.

That is why I decided to start a series of reviews of the projects that I personally find interesting. Chances are high that you would want to use these essays in your decision making – but please make sure you drink from more than this one well when making your bets.

This post kicks off a series of ICO/TGE reviews of mine. The facts are clear: ICO market has become a normal part of crypto market infrastructure, and every day another one, or two placements are getting launched. Geography of the new projects covers all continents and nearly all sectors of economy. It is impossible to scoop dry an ocean, and for the time being I have no plans of maintaining a full blown calendar of placements or reviewing each and every coin offered to the public. There are certain types of projects that have the highest chances to catch my attention:

Now let’s talk about DeStream

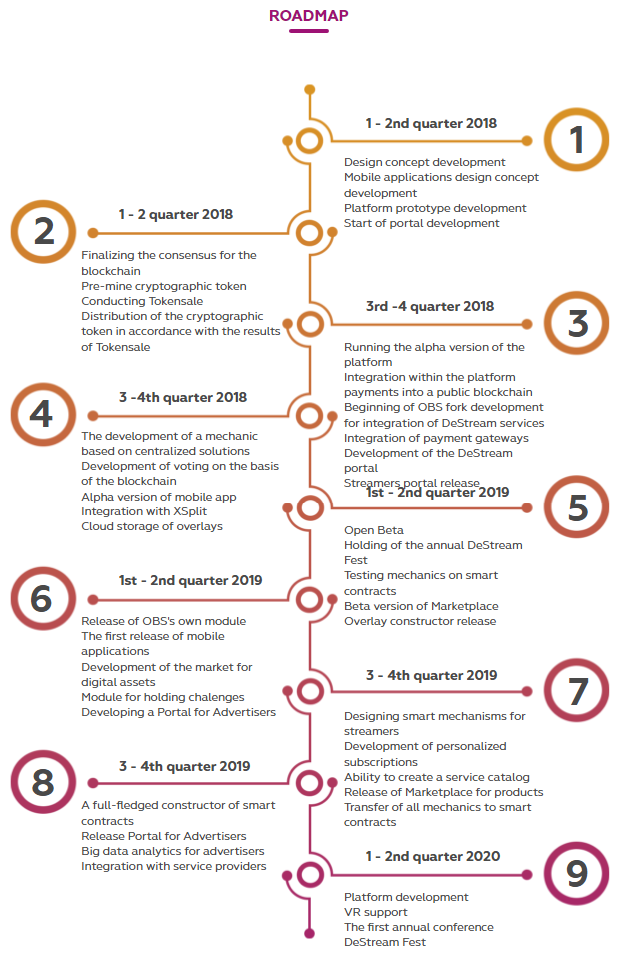

General impression and short conclusion: the projects is definitely not scam, the team looks strong and capable of implementing the plans. The project targets a market which is huge in size, and growing; currently this market is far from structured, and there are good chances the the new player arises to capture a significant share. When going down the road map, the team will definitely face some infrastructure, legal and country specific challenges. Some problems that the project aims to solve don’t have any clear visible solution at the moment; however, they can be overcome. The planned token distribution and fund use look reasonable and fair for token purchasers. Overall, the project looks promising for an investment with one year horizon.Web-site: https://destream.io

Current fundraising phase: closed round with a bonus of up to 50% to last for 22 more days till the end of May, next on June 1 the main round will start.

Key things to read: Whitepaper, Presentation, One pager

Groups and SMM: Twitter (98 followers), Telegram-ru (29 members), Telegram-en (44 members), Facebook (60 subscribers), there is a channel on YouTube as well, where the founders’ presentations are aired, a blog on Medium, KakaoTalk channel and Github section.

Community activity leaves some room for improvement so far, which is not a worrying sign. This looks quite natural for this early stage of the project. Clear absence of boosting and activity inflation indicates good and frank behavior.

The team: Anar Mekhtiyev as СЕО (former Megafon and Letograph ERP producer), Tachat Igityan as CFO (previously was with RIK, Adwizard, RBC Soft and Epsilon – good web-development and marketing background), Alexey Khvostenko as CTO (arrived from Shiva.Digital IT-integrator), Olga Rusakova as PR (background includes MTS cell operator and, Parallels IT corporation).

There are no fake personalities in the team and those listed have no signs of fabricated bios, founders are open to communication and have solid reputation in their respective areas. So, no red flags here.

Advisors: key areas such as marketing, business development, legal and partnership expansion are covered. Two international advisors are onboard, Rick K. Dong from Korea and Eldwin Wong from East-South Asia.

The Project’s Core

DeStream is developing a decentralized financial ecosystem for the streaming market. The project founders were wise enough not to throw a gauntlet to streaming companies and avoided competition with Twitch, Youtube, powerful Asian media companies and many new centralized and decentralized streaming projects.The problem that the project aims to solve is in connection with payments in the streaming industry between donors (which are advertisers, donators and spectators) and recipients (gamers/streamers).

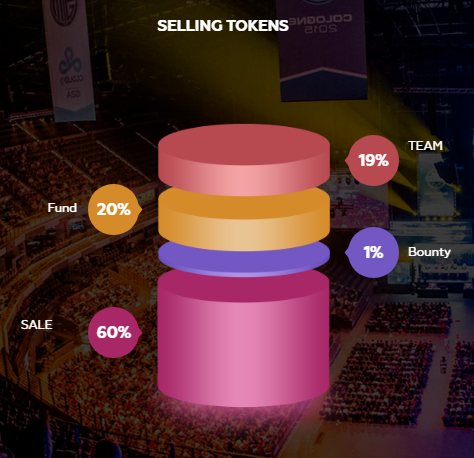

The project will issue 6bn tokens, 3.6bn of which (60%) will be offered in the tokensale. Token distribution looks adequate and reflects current expectations and preferences of the market – the team’s share is limited by reasonable 19%, and bounty spending are nearly non-existent.

The Fund section needs some clarification: this is a liquidity pool that will allow the project operate on Day One, despite whatever delay may occur on the way from donors/donators. In case some slowdown takes place while fiat transaction from the outside counterparty is being processed, the project will fill the streamer with tokens from the pool immediately. This mechanism will be assisting withdrawals as well: fiat funds will be kept in order to fill streamers’ requests to take the money outside the system. Effectively, this means that 20% (or even 25% given the team’s stake) of all tokens will be permanently reserved as working capital. The project anticipates to raise between $5.5-12mn in the tokensale:

Soft cap: $5.5mn

Target cap: $9.0mn

Hard cap: $12.0mn

The difference is rather big but it rings no worrying bells. Given that 17% of the budget is allocated for development of the system, it translates into c. $1mn at the soft cap level which would mean enough resources to produce a solid MVP. All additional funds above the soft cap would fuel PR/marketing and speed up adoption of the system.

There are two facts about DeStream I would point out: (i) the project will be based on Stratis blockchain rather than on massively popular Ethereum which, in my opinion, gives good chances for developers to progress faster and aim for better customization of their solutions, (ii) DeStream claims that is will charge only 0.77% in commissions compared to 10% we have discussed earlier.

Payment systems for streamers and gamers are not new to the market. I’m not that deep into the topic, that’s why I simply copy a comparative chart put together by the project. The only valuable addition on my side is name of those competitors above their logos – I’m sure it’s difficult to recover all brands from those pictures)) The chart clearly indicates that there will be way better functionality in the system as compared to existing players.

Surprisingly enough, there is not much to read about streaming market in open access. There is one good piece in Russian Forbes (I presume even Google Translate will do the work good enough to browse throw the main points). Here are several quotes from the article:

«In the video games streaming segment, a rare for tech market situation can be seen when about 80% of the field (measured by traffic and number of spectators) is occupied by a dominating leader, Twitch, the company acquired by Amazon in 2014 for $970mn, another 17% taken by YouTube Gaming and Facebook, and the rest 3% spread between independent players. It is important to understand that Twitch dominated in the “western” part of the world, namely in the US, Europe, Latin America, Africa and Middle East. Meanwhile, most of the Asian economies (Japan, Korea and Singapore) have strong domestic players presented, and in China there is no market leader at all, and the market is equally shared by Douyu, Huomao, Zhanqi, Huya, PandaTV and QuanumTV».

«According to the open stats, [Twitch’s] top 100 streamers have as much as 400,000 subscribers who together pay as much as $2mn a month.»

«A large chunk of this stream are direct donation to gamers – a brief overview shows that even mediocre players can earn as much as hundreds or even thousands dollars per month. In a year of its existence, Cheering donation program helped to raise as much as $12mn (of which only $10mn landed in gamers’ hands).»

Conclusion

I highly recommend you having a look at DeStream, have a chat with the team and study the project’s materials. You should always have your own opinion about the project and the product and keep in mind that blockchain is a new environment that contains multiple risks and surprises, and many of them will come from the regulatory side.

I wish you have strong Xses despite all the headwinds!

You can contact me in

Nice review

Thank you

U block steemit full inspirasi sofia 👍👍 i like u my page. Follow me back and vote me. Thank's.

Congratulations @sofiapaskal! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP