Did you know that each Credit Bureau is a publicly-traded for-profit company? Were you aware of the fourth Credit Bureau called Innovis?

The only way to get unfair reporting on your credit report removed is not by using dispute, but rather

a compliance standard.

The three main credit bureaus

Transunion

Equifax

Experian

the fourth not as well known is

Innovis

This is from Banks.com

The 4th Major Credit Bureau You Probably Overlooked

https://www.banks.com/articles/credit/credit-score/credit-bureau/

Some history on Innovis,

Innovis began as ACB Services, founded by Associated Credit Bureaus (ACB) in 1970.

In 1989, ACB Services was purchased and renamed Consumers Credit Associates (CCA).

In 1997 First Data Corporation purchased CCA and renamed it Innovis, Inc.

CBC Companies purchased Innovis, Inc. in 1999.

Although they have the same parent company, Innovis is different than CBCInnovis, which merged with mortgage credit-reporting agency, Factual Data, in 2019.

Innovis credit reports contain your personal information and credit history.

It does not include your credit score.

Their reports are most often used for pre-screened marketing offers.

Their services are also used by cell phone service providers.

Innovis also collects non-traditional credit information like rent payments, magazine subscriptions and utility bills.

Were you aware,

Each is a "publicly-traded for-profit company" that is subject to some regulations by the government’s Fair Credit Reporting Act?

Here is what Banks.com has to say about this fourth little known credit bureau,

In addition to the three major credit bureaus, there is a fourth credit agency that many haven’t heard of called Innovis. This is a company founded in 1970 under the name “Associate Credit Bureaus (ACB)” and given its current name in 1997.

You can do a credit check with Innovis and receive a copy of their credit report, but that isn’t their primary service. For the most part, Innovis deals directly with businesses to authenticate consumer data, sometimes for use in pre-approved credit and insurance offers. One thing that Innovis doesn’t provide that the other credit bureaus do is a credit score.

Innovis credit reports are generally used to verify identity or prevent fraud as part of a pre-screening measure. Final lending decisions are made according to a combination of your credit history with the other bureaus, your credit score, and Innovis combined.

To get a copy of your Innovis credit report, call the company at 1-800-540-2505 or request a copy by mail at the following address:

P.O. Box 1689. Pittsburgh, PA 15230-1689

Like the three main bureaus, Innovis is required by federal law to provide you with a free credit report every 12 months.

Remember the data breath at Equifax in 2017?

When news of one of the largest data breaches in U.S. history hit in September 2017, a shock wave could be felt across the country. More than 145.5 million Americans were victims of Equifax’s breach, which they failed to disclose despite knowing about the issue for several months. Some credit experts recommend that those affected place an alert on their credit files with the three major bureaus. One expert, however, also recommends notifying Innovis.

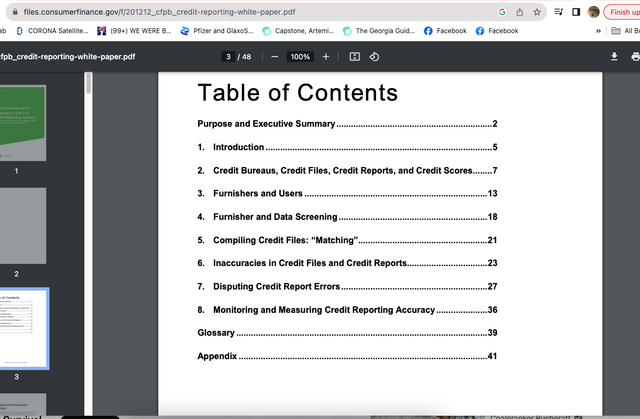

A report put out in 2012 by the government

https://files.consumerfinance.gov/f/201212_cfpb_credit-reporting-white-paper.pdf

NCRA is the National Consumer Reporting Association

On July 20,

2012 the CFPB published its larger participant rule permitting it to supervise companies with annual receipts

from “consumer reporting,” as defined in the rule, of over $7 million. Prior to the rule’s effective date, the

CFPB’s Office of Deposits, Cash, Collections and Reporting Markets (DCCR) consulted existing reports,

industry, and public sources in order to be able to depict key dimensions of, and processes in, the reporting

and disputing of information in the U.S. credit reporting system.

CFPB = Consumer Financial Protection Bureau.

In 1997 these Bureaus all got together and sat a round table and decided to be called the CDIA [the Consumer Data Industry Association]

They said they were going to put a standard in place that

anything being reported to a consumer credit profile must meet compliance standards

to Even Be Reported!

Factual nature =

do I own the account?

is everything verified and complete?

So what is being listed and the factual nature.

In Compliance Standards and whether the information meets those standards

attends to reportability.

Does it have the Ability to be Reported?

There are 5 points of compliance these Credit Bureaus MUST meet

in order to PROVE they meet Compliance Standards.

You see, WORDS Are important and one could say

Words are KEY!

People NOT knowing the laws and standards works against them,

because as I told someone trying to target me once and criticize me for having a degree and grad degree. . .

Knowledge is POWER!

The person targeting me claimed that, that was against God and the Bible,

but I put to you the verse found in Hosea 4:6

My people are destroyed for lack of knowledge: because thou hast rejected knowledge, I will also reject thee, that thou shalt be no priest to me: seeing thou hast forgotten the law of thy God, I will also forget thy children.

The difference between factual disputes and compliance.

The law is set up so the only way to repair credit is by

Factual Dispute.

This means everything else is illegal.

This means the only other way creditors, i.e. civilians. i.e. humans can fight against this entity,

or make a move against what appears to be a much larger existing entity is. . .

to use the Compliance Standard to state "I want these items removed!"

This is not using dispute, but rather Compliance Standard.

If a data furnisher wants to report even someone being late on their bill

there are 5 points of compliance.

Many get away with not meeting them because consumers are not aware that

these entities are NOT following the standards.

If a consumer sends in a letter stating that these items need to be in compliance to be reported,

they must send carbon copies that are handwritten copies through USPS

and the MUST send it to everyone involved with that account that is being reported.

Most do not want that headache, time and feel it is not worth the money to be in compliance

so they must REMOVE it!

So you are no longer working in their realm where the entity's have the upper hand from

the consumer having a Lack of Knowledge,

you are now operating under protection where the consumer points out the Obvious. . .

it Doesn't Even have the ABILITY to be reported as per. . .

CONSUMER CREDIT REPORTING: COMPLIANCE GUIDELINES

From CDIA [Consumer Data Industry Association]

See the Consumer Compliance Handbook: Fair Credit Reporting

from the Federal Reserve found here,

https://www.federalreserve.gov/boarddocs/supmanual/cch/200611/fcra.pdf

Reportability vs the factual nature of what they are reporting.

See the word play and how they use it to their advantage if you are Not aware of the Standards?

The bottom line is. . .

So the consumer sending a letter to the credit bureaus that states,

"These items do not have the ability to be reported because they are not

in compliance with the Compliance Standards for Credit Reporting Agencies."

Therefore, anything not being reported under Metro 2 compliance jeopardizes The Integrity

of WHAT is being reported

which Makes it Mandatory to be deleted!

What is Metro 2?

Metro 2 is a file format used by credit bureaus to report credit information to lenders. The format is established by the Consumer Data Industry Association (CDIA) and it is used to report credit information on consumers, including credit accounts, payment history, and public records.

#CreditBureaus, #TransUnion, Equifax, #Experian, #Innovis, #ComplianceStandards, #RepairYourCredit, #IncreaseYourCreditScore

More Sources,

https://www.innovis.com/

https://www.nerdwallet.com/article/banking/3-reports-havent-frozen-yet