Introduction of Bitcoin And Another Cryptocurrencies In India And Europe

A bitcoin is a virtual currency first introduced in the year 2008 by an anonymous group called Satoshi Nakamoto. It’s an open source peer-to-peer cryptographical system (direct connections without an intermediary) where transactions happen through a public ledger called blockchain, handling users’ data anonymously. Eight years since its introduction, bitcoin is today the most widely used and accepted digital currency

Other forms of crypto-currencies/virtual currencies

Bitcoins are the most sought after cryptocurrency in the market. However there are several other currencies which have gained momentum ever since the concept has been introduced.

Below are some other of cryptocurrencies that exist:

- Ethereum – Ethereum is the second most famous name in the virtual currency market. It somewhat similar to the concept of bitcoins however it possesses some additional attributes. It is purely a blockchain based platform. What makes it special is the Ethereum Virtual Machine. The blockcain in ethereum is used not to store the data of the transaction but to make sure smooth run of a decentralized application.

- Ripple – Ripple is more in the nature of a payment protocol created and developed by a company named Ripple, which is based on the concept of Real time Gross Settlement. It was initially released in the year 2012.

- NEM – Similar to bitcoin, NEM is also a peer-to-peer blockchain platform launched in the year 2015. It uses the unique Proof-of-Importance algorithm , a way to validate transactions and achieve the distributed concensus.

- Litecoin – Initially introduced in the year 2011, litecoin is mostly identical to bitcoin. What makes it stand out is the use of Segregated Witness and the Lightning Network.

Some other cryptocurrencies are bbqcoins and dogecoins which have not gained much significance due to their technical shortcomings and inability to stand out.

Blockchain technology

Most cryptocurrencies are based on blockchain technology. In simple terms, it is a system to transfer and store data or information that is generated while transacting in a cryptocurrency.

A recent Whitepaper on Blockchain2 **1 has broken down the concept of blockchain technology in detail.

As per the paper, “a Blockchain may be described as a tamper-evident ledger shared within a network of entities, where the ledger holds a record of transactions between the entities. To achieve tamper-evidence in the ledger, Blockchain exploits cryptographic hash functions.”

Blockchain technology is at the heart of how cryptocurrencies work. It helps to evade any possibility of fraud and makes any kind of tampering infeasible for the users. It is a support system for the encrypted currency, whereby the transactions are recorded and stored on the ledger. So even if the users are anonymous, it still becomes difficult for anyone to possibly change the data without involving other members on the network.

Bitcoin Pricing

Since pricing in bitcoin transactions is demand based, it is exceptionally volatile. Volumes of trading happen every second. The price of a bitcoin is largely dependent on the trading i.e. demand and supply factors. More the demand, higher is the price.

The prices remained under the range of US$ 300 until late 2015 In the following year, around June 2016, in a positive hunch, the price rose to US$ 755. After March 2017 the prices have only increased.

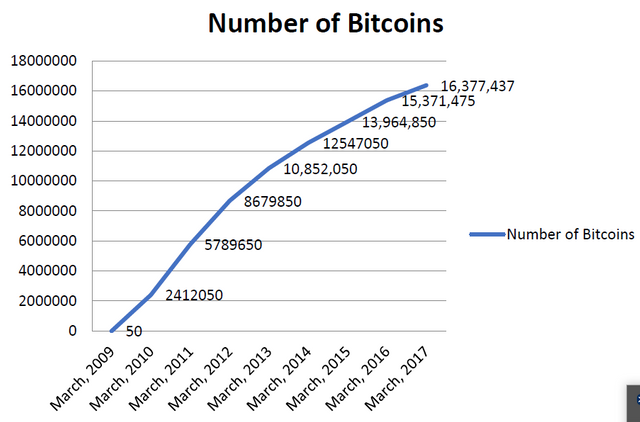

Number of bitcoins

Since 2009 till March 2017, the number of bitcoins in circulation has only increased. The figure has reached to an all-time high 16,377,437 in number.

Market Capitalisation of bitcoins

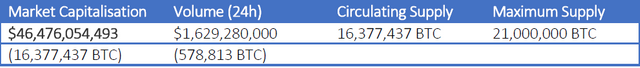

Market capitalization of bitcoin as on 8 June 2017 has been computed to come up at US$ 46,476,054,493, while the maximum supply in the market is limited to 21,000,000 BTC as of now.

Bitcoin Exchanges

Typically, a bitcoin exchange is a business platform that facilitates exchange of bitcoins for another currency including a fiat currency, thereby allowing the users to trade and make profit. Bitcoin exchanges quickly spread in the market in early 2011, as more and more people started exchanging bitcoins, mostly for speculative purposes. Given the high volatility and a ready market without any regulatory intervention, people find it suitable to trade, invest and hold and make profits out of the same.

Also bitcoins are not backed by any particular asset or security, because of which its value is not driven by any factor but demand and supply in the market.

Business Model

Not much later after the inception of bitcoins, bitcoins exchanges quickly spread into the market. Since then several bitcoin exchanges in India and elsewhere have come into picture.

At a preliminary level, a bitcoin exchange is simply a common platform to the users for the purpose of buying and selling while matching mutual needs, in order to earn profits.

For instance take an idea of a stock exchange, where a person has an account and he buys stock, by paying consideration in money, from a person who wants to sell it. Stock exchanges provide a place for buyers and sellers where they can trade. On similar lines, a bitcoin exchange works by essentially providing ‘service’ to its users, however unlike stock trading where a broker may as well come into picture and charge commission in return for his services, in case of bitcoin exchanges, there is no third party involvement, this service is provided by the exchange itself which thereby charges commission for the trade conducted and earns revenue. A basic business model of a bitcoin exchange is reiterated in the chart below.

Regulatory Status in India

The Reserve Bank of India has neither declared bitcoins as illegal in India nor has it accepted bitcoins as a currency. The RBI has only stated the risks that are associated with virtual currencies and cautioned that people dealing in it should do so at their own risk.

Legal Status of Bitcoins

Currency?

Currency 4 is generally defined as tokens used as money in a country. In addition to metal coins and paper bank notes, money orders, traveler’s checks, it also includes electronic money or digital cash.

To fit in this definition, which is not exhaustive,

▪ Either bitcoin has to be physical and movable, and fungible. It is movable and fungible but not physical.

▪ Electronic money or digital cash may include bitcoin but then it needs a legal backing from an authorized entity, which is not the case in India as of now.

“Currency” includes all currency notes, postal notes, postal orders, money orders, cheques, drafts, travellers cheques, letters of credit, bills of exchange and promissory

notes, credit cards or such other similar instruments, as may be notified by the Reserve Bank, as per Section 2(h) of Foreign Exchange Management Act, 1999 5

• As is evident from the above definition, bitcoin doesn’t fit in any of the illustrative names, however if RBI wants, it can certainly notify it to be included in the above definition.

• RBI hasn’t notified bitcoin as legal tender in India and therefore it couldn’t be termed as real currency for the time being.

Coins?

Provisions under law:

Coins in India are governed by the Coinage Act, 2011.

Section 2(a): "coin" means any coin which is made of any metal or any other material stamped by the Government or any other authority empowered by the Government in this behalf and which is a legal tender including commemorative coin and Government of India one rupee note.

Explanation.--For the removal of doubts, it is hereby clarified that a "coin" does not include the credit card, debit card, postal order and e-money issued by any bank, post office or financial institution; (b) "commemorative coin" means any coin stamped by the Government or any other authority empowered by the Government in this behalf to commemorate any specific occasion or event and expressed in Indian currency;

On study of above, bitcoin is certainly not metal or even any other material for that matter. Moreover, it’s not legal tender. If it was to become e-money in the near future, still it could not be coin as per the Coinage Act, since e-money is specifically excluded from the above definition. Consequently, bitcoins cannot be considered as coins now or in the days to come.

Digital currency

• Apart from traditional currency or real currency, there’s another kind called digital currency. On a broader level, it is an electronic based currency holding similar attributes of a real currency, involving prompt payment and transaction settlement.

• There are two forms of digital currency: Virtual currency and crypto currency.

Virtual currency v. Cryptocurrency

Digital currency is largely backed and regulated by the Central Bank, more like electronic money. Virtual currency, on the other hand is unregulated and decentralized. Financial Crimes Enforcement Network’s ruling on ‘Application of FinCen’s regulations to virtual currency mining operations ’ clarifies that virtual.

currency is a medium of exchange that operates like a currency in some environments but does not have all the attributes of a real currency. It does not hold any legal tender status anywhere6. Similar view was expressed in European Central Bank’s publication, ‘Virtual Currency Schemes’7.

❖ Bitcoins could be termed as virtual currency- they have been categorized as such by ECB8. They are decentralized, unregulated and have few attributes of a real currency.

Then there are crypto-currencies and non-crypto currencies. Since, bitcoin is purely based on crypto-graphical system, where you have a private and a public key, and each transaction gets recorded on the ledger, it is said to come under the definition of crypto-currency.

Decentralized currency9

Currency is further classified into centralized and decentralized. Those which are governed by a central repository or a designated entity for sake of trust over transactions taking place are termed as centralized currency. Bitcoin doesn’t work like that. Transactions in bitcoin happen on a decentralized P2P system, where all entities operate independently, and hold the entire risk of dealing in the same.

Share your thoughts guys and i will reply you back

Regards,

Bitcoin Newser