>>> 10 GOLDEN RULES OF TRADING <<< | **NEVER LOSE A TRADE AGAIN | MY SOLID FORMULA/METHOD**

SORRY4THEWAIT FOLKS! MY ANTICIPATED & LONG OVERDUE:

10 GOLDEN RULES OF TRADING

Now before I discuss allow me to strictly emphasize that there are three types of traders as some of us know already:

- The HODLer

- Swing-Trader

- Day-Trader

SO on that note you must understand that my 10 rules will always net you a RoI so as long as you do not deviate from one of these 3 methods. You cannot HODL one day; day trade the next, and swing-trade the next. If you're switching up your main method than the rules won't work. Now I prefer to avoid day-trading because it's much riskier, much more time consuming, and not worth it IMO. My preference is of course HODLing (IF i had to choose) but let's be realistic for a second: unless you're filthy rich and have a shitton of crypto, (a whale) than HODLing can be counter-productive and some would argue not be worth it at all.

It's also important for me to note that my 10 Rules apply to Swing-Trading & HODLing mostly; but can be applied to either 3 individually so as long as you don't deviate. Now I'm not saying you can't do all 3. Just not on the same exchange! If you want to HODL; do it with one exchange/wallet if you want to day-trade, use another, or if you simply want to learn how to make money and you're not well off a.k.a. the majority of us than I highly suggest you swing-trade as your main course but in reading the rules you will come to find that some of them are aggressive methods to rapidly produce a profit, while others are safeguards to prevent losses. That's all brokering is in a nutshell.

The biggest thing I had trouble / difficulty with in making this post was determining which order the rules should be in.

I've always known them; hell I created them. They're my formula & rule-book/guideline as well as practically my 10 Commandments of Market Trading that I adhere to and are responsible for any/all success I've had as a crypto trader. I can only hope that in sharing them with the community; that others will learn and appreciate this guide and it will one day make them a shitload of money. That's the best case scenario. Worst case scenario is at the very least you will learn what mistakes not to make and NEVER lose substantially on a trade EVER again.

But they're all equally important in my eyes although some would argue that others are more important than the rest therefore ordering them from most-important to least-important (1-10) was no easy decision so forgive me if I messed up the order in which they should be in but as long all 10 are posted then I'm hoping that will be satisfying/rewarding enough for you guys.

If you're a skeptic who needs proof that these work and won't take my word for it: defer to my earlier posts when I caught #ETH right before the bull run; when I saw #ADA or #XRP's breakout days before it happened. Or the post prior where I predicted through my TA back when BTC was $6,000 a month or so ago that we'd hit a bull-run to 10k before consolidating to upper $8000 range than stagnating between $9-10k for the rest of April. At the bottom there's a buy recommendation for#OMG and you can guess what happened the next day. It broke out from I think $9 - $16.

https://steemit.com/crypto/@a1mtarabichi/usd8400-breakout-threshold-crossed-or-expect-bull-run-to-usd10k-before-reversal-coins-to-look

Check the charts for yourself. Hindsight is always 2020

Now finally, without further ado:

MY 10 Golden Rules

that (as long as you always follow and never deviate from) will ensure you never lose a trade again:

Rule #1

- Trade with your head, not your gut. Do not ever FOMO/FUD!

When you see rapid bearish/bullish movement in the market on a coin/token in your portfolio that makes you start to panic and feel the need to make an impulsive decision or "gut feeling" JUST DON"T until you can take a breath and figure out what's going on. Objectively. I know it's easy to get caught up in your emotions especially with such a volatile market and little to no regulation making the market practically the wild wild west of Wall St. Many of the same rules that apply to brokers/investors when trading stocks are identical to crypto. However, many also don't. It all depends on the context. But most importantly; never make a decision that isn't well-planned, supported by a TA road map, researched, thought over, and carefully considered which brings me to:

Rule #2

- DO YOUR OWN TA/RESEARCH IN ADDITION TO LEARNING FROM OTHERS

ALWAYS take ALL trading advise (including my own) with a grain of salt.

NOBODY is a wizard/fortune-teller. The best we can do as traders is use formulas, theories, strategies, news, history, and overall knowledge in general to create not a certainty but basically, to put it blunt: an educated guess. No trader/broker/investor will admit that; because they don't want you to think that their advise might make you lose money. But the truth is nobody knows for sure where/what the market is headed towards. All we can do is use the information we have accrued throughout trial & error as well as history as a barometer to set the standard for the future.

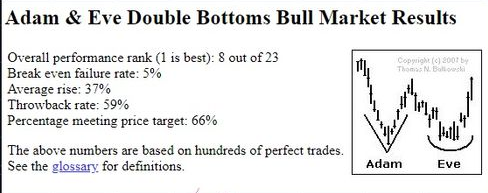

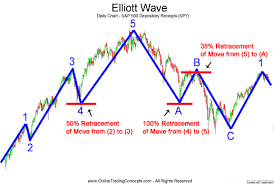

Two important theories I highly suggest you research & learn: Burkowski's theory on Adam & Eve Patterns as well as Elliot Waves These are useful theories/methods developed by successful investors and 9/10 times (when noticed) they are critical in determining chart patterns and has saved my ass more times than I can count. It's also netted me more RoI than I can remember. These are (among many others) trading theories that have netted many large returns for years. I suggest you read up!

Here are the images; accompanied with a brief explanation of how they work, although you can google & learn all about them yourselves.

Now that we know to conduct our own TA at all times; regardless of how much of an "expert" or how much "success" a trader/broker has had, I'll move onto the next rule which ties in with this one in the sense that it's research but really more being active/aware.

I'll explain; just NEVER forget that there is a HUGE element of LUCK INVOLVED when trading. Even the most successful investors are too ego-maniacal to admit that there it wasn't just hard work/determination but luck that helped them get where they are and what they have.

If you're not quite ready for that level of advanced research than start from the bottom; google blockchain. From there learn about Bitcoin, alt-coins, the difference between coins/tokens, the glossary of crypto acronyms; the difference between Moving Average and Exponential Moving Average and why they matter. Learn about the different exchanges, the importance of market cap/volume and it's direct correlation to price. I apologize but I will not go in depth on the basics on this post. That's not what this is. It's not a tutorial but a strategy/formula for people who already know the basics of trading and want to mitigate that risk factor down to an almost non-existent level.

the reason why is because there are dozens/hundreds of Crypto 101 Tutorial videos and blog posts you can learn on your own. So that should go without saying it's a part of this rule: to do that research. If you are expecting me to provide a pot of gold, you're out of luck. There's no "easy way" to get rich; even in crypto. If it was easy, everybody would do it. Unless you bought a shitload of BTC circa 2008-2010 when it was dirt cheap, you've already missed the boat on your chance to win the lottery. Now it's every man for himself/herself with Blockchain, BTC, and roughly 1700 alts in what is now become a mainstream decentralized global economic disrupter.

But if you're already a novice trader who's looking to take it to the next level and is willing to work/commit for it; this is the post for you. Adhere to my 10 rules and you'll always be a successful investor.

Rule #3

- Obtain new announcements/information from important sources as quickly as possible.

Constantly stay up-to-date on ANY major announcements from devs/mods. You know the expression "Buy the rumor, sell the news." Undoubtedly, you've heard it many times before. That's because it's true. The market reacts when a major announcement is MADE, not released. You NEVER want to be the last to find out something CRUCIAL. When I say "important" sources I mean any news relevant: Especially out of South Korea/China/Japan you ALWAYS want to be the first to know if there's any major statement or announcement from a politician, economist, exchange, moderator/developer, etc. (pretty much anyone influential enough to impact the entire market. i.e. Vitalik Buterin)

I was never into really into social media; especially twitter. It was always sort of a "join or die" / "get with the times" kind of thing for me. I use it not for the social aspect but the networking & analytics which can be very useful in determining what works and what doesn't work.

I quickly learned that Twitter is perhaps the best way to obtain headlines/breaking news in finance. Get on Twitter and follow anyone & everyone with enough clout to swing the market in a completely opposite direction using under 250 characters.

Rule #4

- BTC IS KING. Bitcoin is the SUN in the crypto solar system with every other coin & token being planets that orbit it.

(

(

I'll try to keep this short & concise. It's pretty much self-explanatory. When you look at the market as a whole you'll notice that BTC dominance is one of the key factors in traders obtaining market info. While this number changes depending on the volume of BTC vs. the volume of altcoins; remember that generally the entire market is either Bullish/Bearish or stagnant. There's no third option. It doesn't take the wolf of wall st to realize that the patterns of alts move in the same direction as BTC for the simple reason that blockchain makes it so.

So while BTC may be a King; it's still a democracy. Anyone who understands blockchain 101 knows that the value of BTC is based upon it's shareholders. It's only worth 10 grand because of supply/demand. It's not tangible whatsoever. It's not owned by anyone. The intrigue/mystery of Satoshi Nakamoto only adds fuel to the intrigue. So for the foreseeable future; BTC will always be #1 unless a regulated or state-sponsored crypto is released and succeeds the king. Remember though, #BTC was founded and is valued for it's decentralized anonymity. So the odds of a "regulated bitcoin" coming out don't make sense to many people because how can you have something that's decentralized/regulated? Confusing I get it. It will NEVER work that way.

The only thing I could see possibly happening is having a token like #ETH built and released by a government with an exchange so they use transaction fees to tax you. Because taxing your earnings is almost impossible when it's anonymous. But you can always set a percentage on a transaction fee that will go to the exchange in turn going to the government therefore you have not regulation but atleast taxation so the global economy is not disrupted. Infact the opposite; it'll add trillions to boost the GDP of every nation on Earth (that uses crypto) which is a win-win for politicians who want a strong economy & investors who value privacy.

So much for short & concise... lol

Rule #5

- ALWAYS implement stop-losses & sell-limits WHENEVER you make a buy.

This one will be short & concise; I mean it. Whenever you do your research and you feel as if a coin is about to breakout; you're not clouded by emotions & your head is telling you strong buy recommendation than go for it. It's not panic buying/selling if you pre-determine in an objective manner what and how much you intend to purchase and set the limits for not only the percentage in which you can afford to lose but also to not let your greed get the best of you (we're all guilty of it) and SELL once you've surpassed your sell point. Even if the coin keeps mooning; you SELL.

Do not ever FOMO/FUD! If you reach your stop-loss or sell-limit take the profit/loss and walk away with pride. Always trade objectively using your experience/TA/research & NEVER emotions, mood, the opinions of others all of which can cloud your judgement.

Better to be angry that you missed out on potential profits than to lose actual funds. There's a reason why I listed this as Rule #1.

Rule #6

- ONLY invest in coins/tokens you believe in. Read the whitepaper on YOUR ENTIRE PORTFOLIO.

If it's not a product/service you would buy/use than why are you investing/trading in it? If you don't believe in a particular coin or token in your portfolio, than don't invest in it. It's that simple. I think that's pretty self-explanatory.

Rule #7

- Follow Warren Buffet's 70/30 model. (70% HODLing; ledger nano s is a great hard wallet & place to keep it) Do not ever FOMO/FUD!

I cannot stress the importance of this rule. Many disagree, have different strategies/approaches to how they trade. Some of you might be thinking "well fuck that; I'm always all in no risk no gain you said it yourself" yes and no. Let me give you an example. Remember back in November/December 2017 when BTC reached 20k than after those first two weeks in January plummeted with 3 market crashes in 2 weeks? Well I was a dumbass who has 100% of his funds in the market at the time. Needless to say I took a MASSIVE loss and ever since then; even though my returns are smaller, I ALWAYS keep 70% of my BTC in a small diversified portfolio inside a hard wallet again; ledger nano S is the best tucked somewhere safe.

DO NOT KEEP TOO MUCH CRYPTO IN A SOFT WALLET/EXCHANGE. ESPECIALLY IF IT"S ONLY ONE.The difference between a soft/hard wallet is a soft wallet is accessed through a website/exchange whereas a hard wallet is accessed through hardware/software. Now in all honesty; you can shoose to skip this rule if you want. Like I said you shouldn't listen to any broker's advise without doing your own research and drawing your own conclusion. If you're willing to take that gamble than go for it playa! BUT NOT IF YOU CAN"T AFFORD TO LOSE IT!!! Allow me to re-iterate.

NEVER INVEST A PENNY MORE THAN YOU CAN AFFORD TO LOSE!

(

(

Rule #8

- Play it safe during Bear markets. Honestly if I had the option I'd just HODL during bear markets and only swing-trade during bull ones. That's the best way to play it safe. But no risk, no reward right? You can still profit in bear markets! Sometimes surprisingly so!

Usually during bear markets I swing-trade with the high volume, top 5 market cap coins only. While I trade on both BTC & USDT markets during a bullish run; if the market is bearish I only trade in fiat. Simply because if you invest in a coin/token during a bear market and not one but both end up plummeting; you lose your investment twice as fast.

It's much safer / easier / less chaotic & confusing to trade via fiat when BTC is dropping. Because it could drop for months before we see another bull run; therefore this is not the time you want to be taking chances convincing yourself "i'll just get it back if i lose it" because you won't. And even if you do; because the market i bearish, it'll still be worth less than what it was when you lost it.

Rule #9

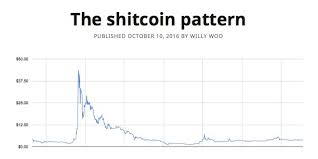

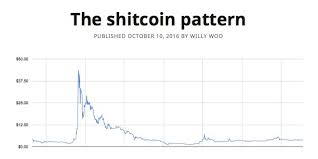

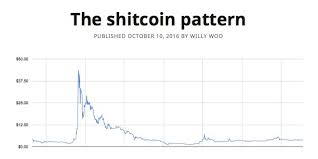

- Avoid high-risk/high-reward trades. Any coin with a market cap below $1,000,000 is a high-risk coin and I avoid it like the plague; UNLESS I'm passionate about the token/coin & believe in the platform.

As for ICOs; I don't even bother. You're better off buying lotto tickets IMO. They are the ultimate high-risk/high-reward investment. Most end up scams or shitcoins; but if you manage to invest the right amount into the right coin i.e. #ADA ; which was only JUST released in OCTOBER 2017; and it's breached the top 5 market cap MORE THAN ONCE with a market cap of over $10 billion. God I wish I had went all in on that one. But that's my point; if you're looking to make a quick buck than investing in shitcoins or ICOs (that you haven't done your due diligence on) is basically gambling with crypto. You might as well head to Vegas & play slots / craps. At least that way you'll have fun before the house takes your money

Rule #10

- Learn from your mistakes! It pains me to say this; but the only way I was able to start earning profit rather than losing it was through losing ALOT in the beginning Don't be greedy. Always remain objective & clear-headed.

I'll conclude this lengthy philosophy with a self-explanatory, simple rule. Whenever you make a mistake; remember it. If you don't think you will; write it down, record it, keep a notebook; do whatever you have to do to understand why you lost on a trade. Because when you understand why you made the mistake you can understand how not to make it. But unfortunately simply "understanding" is not enough. You have to be strict & disciplined when it comes to this rule. The definition of insanity is described as repeating the same action over and over yet expecting a different result. If you feel like you keep losing money over & over than clearly you're repeating the same mistakes and it's your own fault!

Instead of willing to learn from them and change your strategy to fix the underlying problem; you try to consolidate your losses by repeating the same trading methods. Sometimes even more extreme ones. I've seen this more times than I can count. Hell I've done it more times than I can count. Sometimes you just have to bite the bullet and not be so stubborn. Accept the fact that you're not as good as you think are you. Once you humble yourself down a bit; you'll learn so much more.

OKAY FOLKS! Whew that was lengthy! Took me almost 4 hours to write! But I do believe it was most definitely:

I hope that this reaches & helps as many of you as possible. Even moreso I hope you guys read it thoroughly and abide by them so that you can obtain those profit margins you deserve!

Thank you all! Have a wonderful evening! Peace & Love

P.S. If you enjoyed this post; or believe in my strategy, or the knowledge you learned from my rules serves you well, than do share it with others. Obviously I do not have the reach to share it with everyone and I would love to help as many as possible. I am a firm advocate and believer in Karma afterall :)

Constantly stay up-to-date on ANY major announcements from devs/mods. You know the expression "Buy the rumor, sell the news." Undoubtedly, you've heard it many times before. That's because it's true. The market reacts when a major announcement is MADE, not released. You NEVER want to be the last to find out something CRUCIAL. When I say "important" sources I mean any news relevant: Especially out of South Korea/China/Japan you ALWAYS want to be the first to know if there's any major statement or announcement from a politician, economist, exchange, moderator/developer, etc. (pretty much anyone influential enough to impact the entire market. i.e. Vitalik Buterin)

I was never into really into social media; especially twitter. It was always sort of a "join or die" / "get with the times" kind of thing for me. I use it not for the social aspect but the networking & analytics which can be very useful in determining what works and what doesn't work.

I quickly learned that Twitter is perhaps the best way to obtain headlines/breaking news in finance. Get on Twitter and follow anyone & everyone with enough clout to swing the market in a completely opposite direction using under 250 characters.

Rule #4

- BTC IS KING. Bitcoin is the SUN in the crypto solar system with every other coin & token being planets that orbit it.

(

(

(

(

I'll try to keep this short & concise. It's pretty much self-explanatory. When you look at the market as a whole you'll notice that BTC dominance is one of the key factors in traders obtaining market info. While this number changes depending on the volume of BTC vs. the volume of altcoins; remember that generally the entire market is either Bullish/Bearish or stagnant. There's no third option. It doesn't take the wolf of wall st to realize that the patterns of alts move in the same direction as BTC for the simple reason that blockchain makes it so.

So while BTC may be a King; it's still a democracy. Anyone who understands blockchain 101 knows that the value of BTC is based upon it's shareholders. It's only worth 10 grand because of supply/demand. It's not tangible whatsoever. It's not owned by anyone. The intrigue/mystery of Satoshi Nakamoto only adds fuel to the intrigue. So for the foreseeable future; BTC will always be #1 unless a regulated or state-sponsored crypto is released and succeeds the king. Remember though, #BTC was founded and is valued for it's decentralized anonymity. So the odds of a "regulated bitcoin" coming out don't make sense to many people because how can you have something that's decentralized/regulated? Confusing I get it. It will NEVER work that way.

The only thing I could see possibly happening is having a token like #ETH built and released by a government with an exchange so they use transaction fees to tax you. Because taxing your earnings is almost impossible when it's anonymous. But you can always set a percentage on a transaction fee that will go to the exchange in turn going to the government therefore you have not regulation but atleast taxation so the global economy is not disrupted. Infact the opposite; it'll add trillions to boost the GDP of every nation on Earth (that uses crypto) which is a win-win for politicians who want a strong economy & investors who value privacy.

So much for short & concise... lol

Rule #5

- ALWAYS implement stop-losses & sell-limits WHENEVER you make a buy.

This one will be short & concise; I mean it. Whenever you do your research and you feel as if a coin is about to breakout; you're not clouded by emotions & your head is telling you strong buy recommendation than go for it. It's not panic buying/selling if you pre-determine in an objective manner what and how much you intend to purchase and set the limits for not only the percentage in which you can afford to lose but also to not let your greed get the best of you (we're all guilty of it) and SELL once you've surpassed your sell point. Even if the coin keeps mooning; you SELL.

Do not ever FOMO/FUD! If you reach your stop-loss or sell-limit take the profit/loss and walk away with pride. Always trade objectively using your experience/TA/research & NEVER emotions, mood, the opinions of others all of which can cloud your judgement.

Better to be angry that you missed out on potential profits than to lose actual funds. There's a reason why I listed this as Rule #1.

Rule #6

- ONLY invest in coins/tokens you believe in. Read the whitepaper on YOUR ENTIRE PORTFOLIO.

If it's not a product/service you would buy/use than why are you investing/trading in it? If you don't believe in a particular coin or token in your portfolio, than don't invest in it. It's that simple. I think that's pretty self-explanatory.

If it's not a product/service you would buy/use than why are you investing/trading in it? If you don't believe in a particular coin or token in your portfolio, than don't invest in it. It's that simple. I think that's pretty self-explanatory.

Rule #7

- Follow Warren Buffet's 70/30 model. (70% HODLing; ledger nano s is a great hard wallet & place to keep it) Do not ever FOMO/FUD!

I cannot stress the importance of this rule. Many disagree, have different strategies/approaches to how they trade. Some of you might be thinking "well fuck that; I'm always all in no risk no gain you said it yourself" yes and no. Let me give you an example. Remember back in November/December 2017 when BTC reached 20k than after those first two weeks in January plummeted with 3 market crashes in 2 weeks? Well I was a dumbass who has 100% of his funds in the market at the time. Needless to say I took a MASSIVE loss and ever since then; even though my returns are smaller, I ALWAYS keep 70% of my BTC in a small diversified portfolio inside a hard wallet again; ledger nano S is the best tucked somewhere safe.

DO NOT KEEP TOO MUCH CRYPTO IN A SOFT WALLET/EXCHANGE. ESPECIALLY IF IT"S ONLY ONE.The difference between a soft/hard wallet is a soft wallet is accessed through a website/exchange whereas a hard wallet is accessed through hardware/software. Now in all honesty; you can shoose to skip this rule if you want. Like I said you shouldn't listen to any broker's advise without doing your own research and drawing your own conclusion. If you're willing to take that gamble than go for it playa! BUT NOT IF YOU CAN"T AFFORD TO LOSE IT!!! Allow me to re-iterate.

NEVER INVEST A PENNY MORE THAN YOU CAN AFFORD TO LOSE!

(

(

Rule #8

- Play it safe during Bear markets. Honestly if I had the option I'd just HODL during bear markets and only swing-trade during bull ones. That's the best way to play it safe. But no risk, no reward right? You can still profit in bear markets! Sometimes surprisingly so!

Usually during bear markets I swing-trade with the high volume, top 5 market cap coins only. While I trade on both BTC & USDT markets during a bullish run; if the market is bearish I only trade in fiat. Simply because if you invest in a coin/token during a bear market and not one but both end up plummeting; you lose your investment twice as fast.

It's much safer / easier / less chaotic & confusing to trade via fiat when BTC is dropping. Because it could drop for months before we see another bull run; therefore this is not the time you want to be taking chances convincing yourself "i'll just get it back if i lose it" because you won't. And even if you do; because the market i bearish, it'll still be worth less than what it was when you lost it.

Rule #9

- Avoid high-risk/high-reward trades. Any coin with a market cap below $1,000,000 is a high-risk coin and I avoid it like the plague; UNLESS I'm passionate about the token/coin & believe in the platform.

As for ICOs; I don't even bother. You're better off buying lotto tickets IMO. They are the ultimate high-risk/high-reward investment. Most end up scams or shitcoins; but if you manage to invest the right amount into the right coin i.e. #ADA ; which was only JUST released in OCTOBER 2017; and it's breached the top 5 market cap MORE THAN ONCE with a market cap of over $10 billion. God I wish I had went all in on that one. But that's my point; if you're looking to make a quick buck than investing in shitcoins or ICOs (that you haven't done your due diligence on) is basically gambling with crypto. You might as well head to Vegas & play slots / craps. At least that way you'll have fun before the house takes your money

Rule #10

- Learn from your mistakes! It pains me to say this; but the only way I was able to start earning profit rather than losing it was through losing ALOT in the beginning Don't be greedy. Always remain objective & clear-headed.

I'll conclude this lengthy philosophy with a self-explanatory, simple rule. Whenever you make a mistake; remember it. If you don't think you will; write it down, record it, keep a notebook; do whatever you have to do to understand why you lost on a trade. Because when you understand why you made the mistake you can understand how not to make it. But unfortunately simply "understanding" is not enough. You have to be strict & disciplined when it comes to this rule. The definition of insanity is described as repeating the same action over and over yet expecting a different result. If you feel like you keep losing money over & over than clearly you're repeating the same mistakes and it's your own fault!

Instead of willing to learn from them and change your strategy to fix the underlying problem; you try to consolidate your losses by repeating the same trading methods. Sometimes even more extreme ones. I've seen this more times than I can count. Hell I've done it more times than I can count. Sometimes you just have to bite the bullet and not be so stubborn. Accept the fact that you're not as good as you think are you. Once you humble yourself down a bit; you'll learn so much more.

OKAY FOLKS! Whew that was lengthy! Took me almost 4 hours to write! But I do believe it was most definitely:

I hope that this reaches & helps as many of you as possible. Even moreso I hope you guys read it thoroughly and abide by them so that you can obtain those profit margins you deserve!

Thank you all! Have a wonderful evening! Peace & Love

Really good write up.. the only one I'd slightly amend would be #6, "only invest long-term" in coins you believe in. I understand the philosophy of not getting stuck in position with coins you don't like because you'll be more apt to FUD and sell at a loss, but there are certain scenarios wherein the short term it's best to capitalize on shit coins that you don't want to hold.. Like I certainly don't want to hold Tron long term for example... but I took some small positions a few weeks ago to dump during the main net runup. I 100% agree with all of the others, especially the part about being angry about missing profits over losing actual funds.. this is the one I can never get my friends to understand, will definitely link this article over and print it out and staple it to their face! :)

Thank you sir. I appreciate it =D I agree it's a bit vague but there's a reason for that. I figured that if you REALLY truly believed in the whitepaper/roadmap for ANY crypto then it doesn't matter where it ranks on the list because you'd expect it to last long-term. Also "long-term" is subjective in the market (for now atleast) because everything is so new/volatile/exciting. We have tokens like Iota or Cardano that are still babies/in their infancy yet shift in and out of the top 5 market cap constantly.

Now it's volume is over $150 million for Cardano and double that for IOTA. They were both released in 2017 and neither are even a year old. So the top 5 could be completely different this time next year. With the exception of the shitcoins/jokes like (and i'm not making this up, this coin exists) Ponzicoin lmao, they all have potential.

As of now no one knows for certain what is long-term; with the exception of Bitcoin (even so...) almost every coin can be overthrown by another coin/token with a better product/service. There's already talk of #EoS possibly overtaking #ETH. They said the same for #BCH before the hard-fork; although that never happened.

Personally I don't believe so but I wouldn't be surprised to see it happen. That's pretty much why I wrote it the way I wrote it. Because of that uncertainty of the future (long-term that is) of cryptocurrencies.

But then again you make a valid point about Tron which is why I wrote for rule #2 you should take ALL trading advise with a grain of salt; including my own. I agree with you on that sentiment. There's money to be made with coins like Tron, Verge, WAM, and many others that you definitely don't want to hold long-term. But you never know; maybe Tron will land on the moon one day. Although it's highly unlikely; same can be said for many things we never saw coming/expected in the market. You clearly know your shit. Thanks for the comment! Followed/Upvoted :)

Really good article to read...keep it up

Thanks sir.

very informative; great guide for novice traders.. i've never seen someone more technical.. i'm impressed. upvoted/followed.

Thank you sir. That means a lot. You have no idea :)

Greetings! I am a minnow exclusive bot that gives a 4X upvote! I recommend this amazing guide on how to be a steemit rockstar! I was made by @EarthNation to make Steemit easier and more rewarding for minnows.

This post was upvoted and resteemed by @resteemr!

Thank you for using @resteemr.

@resteemr is a low price resteem service.

Check what @resteemr can do for you. Introduction of resteemr.