Sound stock market

INTRODUCTION

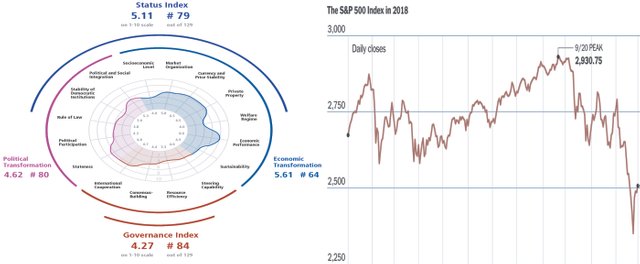

Sound stock market is an indispensable part of an Economy. Without sound and efficient capital market, rapid economic development could be hampered as stock market provides long term funds to entrepreneurs. Stock Market of Bangladesh is still highly speculative and lacks transparency due to poor regulatory framework. In Bangladesh, Financial sector was historically driven by banks and capital market had fewer rules to play as people had mixed perception about the risk pattern in stock market that discouraged them mostly to invest there. But in the mid of ninetieths of last century stock market started to show vibrant behavior that make people interested about the stock exchanges. As the index was rising sharply and everyone was making money, many people started to invest their money to the heated market that made a bigger bubble and finally the bubble bursts. Benchmark index came down to 700 point in November 1997 from its highest 3600 point in November 1996. Thousands of investors lost their money that made them reluctant to invest in the stock market again. It took one decade for them to forget the history of collapse. After that, regulators had taken many steps to stabilize the market. Hundreds of new issues came to the market. Central depository, circuit breaker, online trading, etc. were introduced in the market to attract investors. As a result, the market started to grow again. Investors started to forget the history of 1996 and started to invest again. This time most investors were new and young with little knowledge about stocks and did not care about market risk. They invested their money and finally lost everything when the bubble started to burst in December, 2010 that had started to grow from the year 2009. This time Benchmark index came down to 3616 points in early February 2012 from its highest point 8918 in December 2010. Millions of investors lost their money and came down to the street. This is the small picture of stock market crashes in Bangladesh. In both cases regulators had failed to take proactive measures to not grow the bubble and caused losses for millions of investors when the bubbles burst. When analysts were anxious about the bubbles, regulators were ignoring them and even defended the bubbles.

The recent volatility of the stock market of Bangladesh is an abnormal phenomenon and such volatility tends to economic instability. I believe it will be interested enough to look into the causes of the problem. As such volatility affects mass people (many investors), it is essential to try to minimize such volatility by identifying the causes (esp., Regulatory failure) and solving the problems. In my study, I will try to identify the reasons of this volatility and also to recommend some suggestions to minimize such volatility in future.

Hi and welcome here! When I started on steemit, my biggest problem was to find interesting people to interact with. So, to help newcomers getting started I created a directory with other interesting and or talented steemians to follow or interact with. Feel free to check it out at https://www.steemiandir.com I am sure it will help you find like-minded people. Enjoy your stay here and do not hesitate to contact me if you have any questions!

Welcome to steemit @mahintipu.

Welcome the new steemians. Have a great day!

Welcome to Steemit @mahintipu !

Wish you a great time and much success.

You heard of Partiko already?

A beautiful and easy to use Steemit app for your mobile?

You not only earn steem, you earn Partiko points as well.

Here is the link to come to the download from your app store, for sign in you get 1000 points for free:

https://partiko.app/referral/zanoni

Have a great day

Tom

Posted using Partiko Android