TIB: Today I Bought (and Sold) - An Investors Journal #316 - China Small Caps, Cybersecurity, Alaska Oil

Mid-term Elections hardly ruffle US markets. A little more bottom fishing in small caps in China and a new entry in cybersecurity to replace a stock that could be taken over. 56 Percent Club shows the impact of the selloff

Portfolio News

Market Jitters - Mid Terms

US markets traded positive despite the election uncertainty

In my portfolios there was a marked divergence between Europe and the US. The US markets seem quite comfortable with likely outcomes which suggests to me that the chances of a clean sweep for either side is not on the cards.

Europe seemed to have a different view with stocks mostly down, especially banks. With energy a big part of the Eurostoxx 50 the lower oil price did not help.

Takeovers In after hours news emerged that CommScope would make a bid for set-top box maker Arris (ARRS). Price jumped 22% but not as high as the indicative offer price of $31 per share. Arris has been part of a cord cutting investing theme in my portfolios. This bid will allow me to exit with a small profit.

https://www.cnbc.com/2018/11/06/commscope-near-to-buying-arris-for-more-than-31-a-share-sources.html

I missed this earlier rumour article from October 25. Just as well as price had not moved above my entry price on the rumour - now it has with more deal specifics emerging.

There was also news that cybersecurity firm, Symantec (SYMC) has been approached to be taken private. Price jumped well ahead of my entry point but sadly also above the covered call levels I wrote last week.

Bought

iShares MSCI China Small-Cap ETF (ECNS): China Small Caps. With the bounce in markets, I averaged down my entry price in this China Small caps ETF.

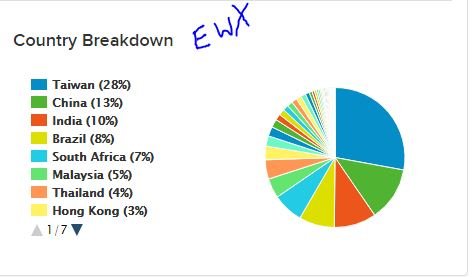

Since the 2016 lows, China Small Caps have tracked the S&P 500 (red line) and diverged with the tariff tantrum breaking out in early 2018. I doubt the differences in valuations warrant a 30 percentage gap between the two markets. I did present the chart for iShares Emerging Markets Small Caps (EWX) yesterday. They look remarkably similar even though China is only 13% of the EWX ETF. Buy either and you will see similar performances at the top level.

Palo Alto Networks, Inc (PANW): Cybersecurity. Palo Alto share price was smashed in the tech selloff. Jim Cramer has posted this as an Action Plus idea. I added in a small parcel. During the day there was talk that competitor Symantec (SYMC) could be taken private. Its share price jumped 22% following the news which takes its price above the covered call strike price I wrote earlier this month. That means that my Symantec stock will be assigned and I am switching horse with this trade. I am exposed also to cybersecurity through the HACK ETF and through FireEye (FEYE). This sector is unlikely to be going down - I spent a good slice of my day protecting one of my websites from Russian hackers.

88 Energy (88E.AX): US Oil Explorer. 88E explors for oil in Alaska and is now the largest holder of US oil reserves listed on the ASX. They ran a Share Purchase Plan and I took up an allocation of shares to prevent dilution. In dollar terms, the amount was small. I am not adding more as Alaskan oil is a lot more expensive to produce than Permian Basin shale

56 Percent Club

Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately. Why 56%? A friend was spruiking an investment scheme on Facebook and asked if anybody could point to a 56% investment - yup - I have a few.

First is the table of stocks. I have highlighted ones that are new to the club in Yellow. I have also marked up whether they have gone up or down since last time.

What stands out?

- The list has shrunk by 4 stocks (12 vs 16). There were no sales in September

- US Banks continue to dominate the top of the list with JP Morgan (JPM) holding its place on top. Of the 3 banks, 1 went up in a selloff month and 2 down.

- There was only one new entrant, with cybersecurity supplier FireEye (FEYE) returning to the list.

- 2 of last month' s new entrants fell from the list in the aftermath of cannabis legalization in Canada and the tech selloff - marijuana pharma (Aphria - APH.TO) and one in media streaming (ROKU).

- This was a much weaker stocks month with 2 risers, 9 fallers and 1 new entrant on a shorter list.

- Biggest mover up was Russian gas supplier, Gazprom NEFT (GAZ.IL). Biggest faller is Japan Small Caps ETF (DFJ)

- Dropping off the list are Canadian marijuana pharma (Aphria - APH.TO), US media streaming (ROKU), European mid caps (DJMC), Australian cobalt explorer, Cobalt Blue (COB.AX) and Australian lithium producer , Galaxy Resources (GXY.AX). This leaves only one resource stock on the list, De Grey Mining (DEG.AX), which will begin to behave as a hedging trade if gold price rises.

- None of the stocks were bought in the last 12 months

On the options side same deal with Puts marked in red text - i.e., for trades where I am expecting the market to go down.

What stands out for me:

- Selloff hit hard with the list shrunk by 5 since last time (14 vs 19) with only one sale (list would have been 15).

- There is a new leader in Eurodollar 3 Month Rate puts replacing offshore driller, Gulfmark Offshore (GLF)

- 5 new entrants in US pharma retailing, European pharma, European Insurance, and 3 new puts on South Africa, S&P500 and Nasdaq.

- The rise of the Puts shows the impact of the market selloff and the early success of the hedge trades put in place during October

- Dropped off the list is US airline, Delta (DAL) which I sold in-the-money options.

- Biggest casualty for the month is oil with 4 oil and oil drilling stocks dropping below 56%. Also fallen were Japan, French Insurer Axa (CS.PA), cybersecurity (FEYE), US regional bank (ZION) and US technology (XLK)

- Fastest riser is Consumer Select Sector ETF (XLP) rising 31% with new entrant Walgreens Boots Allicae (WBA) debuting up 92%.

- The notable risers this month are the hedging trades on South Africa and US Markets overall.

- 9 out of 14 positions were bought in the last 12 months.

- 3 risers, 6 fallers/flat and 5 new.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $82 (1.2% of the low). I suggested yesterday that there was some momentum in price which pushed to break up above the $6450 level and to test the resistance level (dotted red line).

That momentum has flowed through today with a decisive break over $6500.

Ethereum (ETHUSD): Price range for the day was $13 (6.3% of the low). I thought price was in drift mode and could settle back to $200 or push to $220 which was the Tether rumour spike. Drift became a spike with price pushing to clear $220 during today's trade.

There is a lot of congestion between $222 and $228. That is an old zone - I put the rectangle back in today.

CryptoBots

Outsourced Bot No closed trades. (221 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-67%), ZEC (-62%), DASH (-65%), LTC (-49%), BTS (-52%), ICX (-79%), ADA (-69%), PPT (-79%), DGD (-80%), GAS (-83%), SNT (-57%), STRAT (-72%), NEO (-80%), ETC (-57%), QTUM (-75%), BTG (-72%), XMR (-36%), OMG (-66%).

Most coins moved up 1 or 2 points with no coins down. GAS (-83%) is solo as the worst coin. ADA (-69%) and LTC (-49%) improved a level

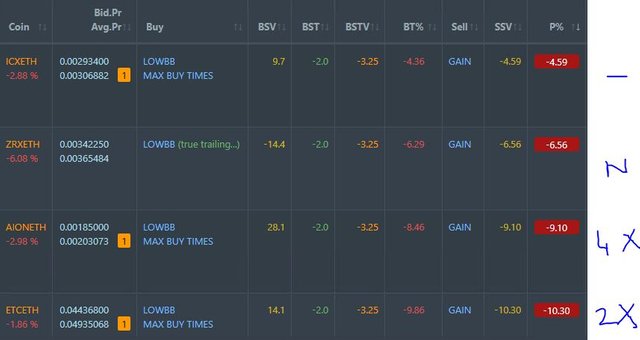

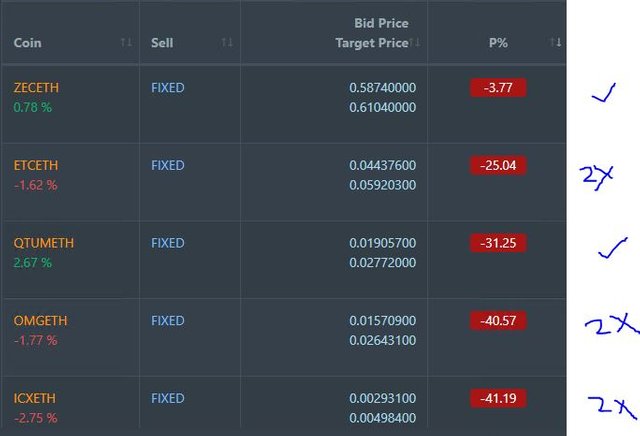

Profit Trailer Bot No closed trades.

Dollar Cost Average (DCA) list increased by one with ZRX coming onto the list. I changed the cutoff threshold for entry to DCA and also the price entry for potential rebuys.

Pending list remains at 7 coins with 2 coins improving and 5 worse.

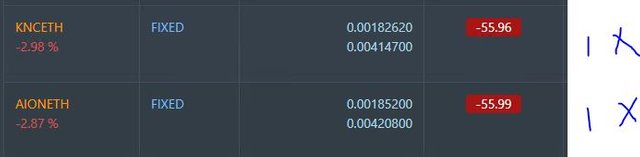

PT Defender continues defending 5 coins.

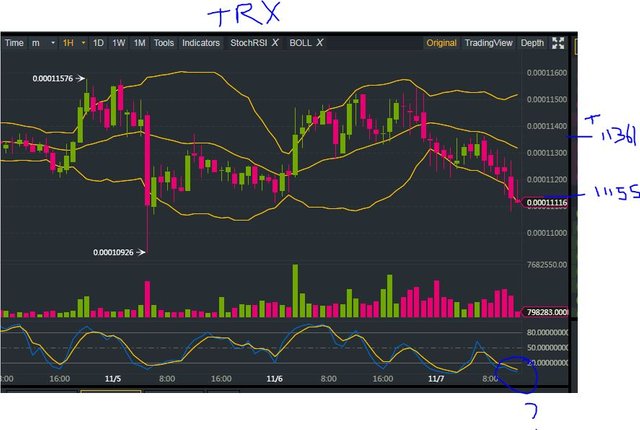

New Trading Bot Trading out using Crypto Prophecy. DCA type trade on NXS closed out for 2.16% profit at the mid Bollinger Band point. Trade on ONT from prior day also closed for 1.83% profit. This leaves the original NXS trade in place and a PIVX trade. Added two new trades on ELF and TRX both a little impatient.

Chart for ELF shows why I was prepared to bend the normal RSI Stochasitc rules - price has been in a wide band and has reached the lower end. Trade aim is to get back to the top.

Currency Trades

Forex Robot I wrote yesterday that this could be a good time for the robot to close a bunch of trades to reduce the swap cost and bank some profits. Statement comes in this morning and the bot has closed down all the trades - all 122 of them to book a net 2.14% loss. I have checked the bot is still running though I cannot find any information from the bot supplier.

Outsourced MAM account Actions to Wealth closed out 1 trade for 0.01% loss for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and CNBC. All other images are created using my various trading and charting platforms. They are all my own work

Takeover image embedded in feature image by Nick Youngson CC BY-SA 3.0 Alpha Stock Images

http://www.nyphotographic.com/

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Prophecy provides a useful tool to identify oversold and overbought coins -

https://mymark.mx/CryptoProphecy

November 6, 2018

I think that as concerns from the elections in the US and trade wars die down, more corporate news will take over the trend. If this news continues to be led with more M&A and buybacks, it could lead to a strong Q4 for equities.

Markets had decided what the outcome was going to be. Democrat control of the house will slow down the trade rhetoric and limit any moves that require legislation. Asia stocks are already moving that way