TIB: Today I Bought (and Sold) - An Investors Journal #373 - US Healthcare, Semiconductors, US Interest Rates, US Pharmaceuticals

Stock markets drift but rates markets are looking less nervous. Time to have a go at US health insurance in a "Markets vs Democrats" play. Profits banked in semiconductors and US interest rates.

Portfolio News

Market Drifts

Markets continue to drift as they absorb the mix of Fed, China, North Korea and earnings news.

I wrote yesterday about geopolitical tensions. My observation is that they mostly do not affect markets. They do tend to add to volatility and Exchange Traded Fund products exaggerate that. ETF's allow people to invest in a sector or region or country without much research. Bad headline comes along about a crisis in a region (like India- Pakistan) and instinct is to dump the ETF. I do not mean to add to the clamour that talking heads bring to the stories BUT I am invested in a lot of regions in the world. Hence my commentary.

Example in point. North Korea summit is inconclusive. I look in my portfolios this morning and biggest casualties are Petrobras (PBR), Philippines (EPHE), Vietnam (VNM). No logic other than 3 emerging markets and something did not happen in Vietnam.

China-US Trade Discussions

What I have been noticing is the price signalling about US-China trade discussions from different markets. Corn price is a good bellwether about how the discussions are going. I am going to guess that - not good is the current status.

Yields

The Jerome Powell testimony and the US GDP numbers have had an impact on yields - rising in US for two days in a row

Bank of Japan is under pressure from BOJ board member, Suzuki, to keep at its program for the long haul.

His words seem to provoke a response - yields rise and Japanese Government Bond prices break down from what was looking quite toppy.

Same thing is happening in Europe. Maybe bond markets are beginning to feel a little better (or less worse) about growth data.

Cannabis Carnival

The carnival continues with Martha Stewart joining Canadian marijuana grower, Canopy Growth as an adviser.

Well that got the US talking heads going especially those that are still hung up about the fact that marijuana is still rated as a Schedule 1 narcotic in a number of states. I did share some time ago an advice that said that marijuana investors could be refused entry to US or could be arrested in certain US states. What I do know is when non-THC use is regulated in US, this industry will sky rocket.

Bought

Wabtec Corporation (WAB): US Industrials. Completion of partial fill from the day before. Topping up shares received from GE spin-off

UnitedHealth Group Incorporated (UNH): US Healthcare. Health insurance stocks took a bashing when Democrats introduced "Medicare for All" bills to Congress. This reduces the need for health insurance with a government based system making provision. The big question is can the Democrats get this through both houses and the President? The price pull back brings price back to a more reasonable valuation (16 time price earnings).

With closing price of $242.22, down 3% on the day and 10% on the week, I was looking for ways to construct a trade that would not cost a bomb. A January 2021 250/280 bull call spread had premium around $12 which means forking out $1200 for 1 contract. Now that 5% premium looks fine with 100% profit right there if price gets back to where it came from. Next question was to see if there was a price I would be prepared to buy the stock - say another 10% down from here - say 220. How about selling the spread and a 220 strike put, same expiry? Turns out somebody was prepared to pay me $7.68 for the pleasure. Risk in the trade is price keeps falling well below $220 and I am forced to buy the stock at $220. My thought is $220 is already more than 20% below where it was 5 days ago and 10% from here.

Trade details - bought January 2021 250/280 bull call spread for $11.79. Sold 220 put for $19.50 = -$7.68 paid to me. The chart shows the bought call (250) as a blue ray, sold call (280) as a red ray and sold put (220) as a pink ray and expiry the dotted green line on the right margin.

The maximum profit is below the 2018 highs. The risk area is below the selloff lows and in the region of the early 2018 lows.

This chart shows exactly how a free market capitalist market works. Medical care is expensive and people buy insurance to lay that risk off. With growing economy underwriting income rises. Markets have been rising which means investment income is also rising = good profits for insurance companies especially those with a captive market. Affordable Care Act reinforced that captive market - though that was not its intent. Change the playing field and the economics can change - especially an attack on captive audience.

The trade is predicated on the bills not getting passed as the Republicans can block in the Senate. The bills will be progressively watered down and then it is 2020 election time and expiry happens about the time the next President starts in the job. Of course, Donald Trump can veto bills too and he could land up being the next President anyway.

See TIB361 for the trade structure used for Nvidia trade below - same idea but different timelines.

Sold

NVIDIA Corporation (NVDA): US Semiconductors. Price has not maintained the momentum from the positive earnings move and each day has drifted a little lower closing at $154.26. With options expiry coming up in two weeks I closed out the March 2019 150/160 bull call spread for 151% profit in a few weeks. I have left in place the sold March 2019 130 strike put options and will let that run to expiry. I am quite happy to buy the stock at that level. Now if that put does expire worthless in two weeks, the trade profit will be 338% - thanks CNBC Options Action.

Quick update of the chart which shows the 150/160 bull call spread (blue and red rays).

Price did push over the maximum profit line but my pending take profit orders at that level were not hit. As price has drifted I tightened up the take profit levels. Of course price could reverse and head back over 160 BUT market feels more like a drift lower market.

See TIB361 for the trade concept. This is the same structure as I am using for United Health

Shorts

iShares 7-10 Year Treasury Bond ETF (IEF). With the change in stance from the Federal Reserve, the thesis for being short Treasury Bonds evaporated. I have been waiting for a rising yield day to close this short position. Closed half the remaining position for a 1.4% blended profit. Do have to subtract the cost of paying the dividends and stock borrowing costs. This has been an expensive trade idea. Correct thesis. Probably the wrong vehicle. Held on too long. In this portfolio, I did mitigate some of the losses by averaging into the position after an initial bad entry.

The chart shows the two entry points - one bad (marked X) and one good (marked √). Investing in US banks would have worked (and did) better.

Income Trades

SPDR S&P Pharmaceuticals ETF (XPH): US Pharmaceuticals. Sold March 2019 strike 43 calls for 0.71% premium (0.70% to purchase price). Closing price $42.06 (new trade). Price needs to move another 2.2% to reach the sold strike (new trade). Should price pass the sold strike I book a 1% capital gain.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $142 (3.7% of the open). Price made another one of those spiky moves this time testing going higher - and finishing about where it started - this does feel like it wants to go higher but we do have Friday and the weekend on us. Trade moves are unpredictable over weekends.

Ethereum (ETHUSD): Price range for the day was $8 (6% of the open). Price makes another inside bar finding support above $132. The test was less convincing than Bitcoin but this does feel like it does want to go higher.

CryptoBots

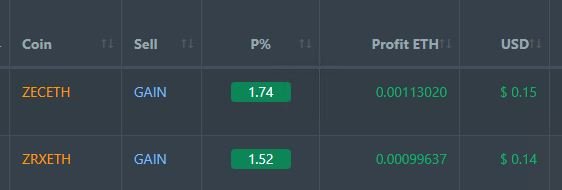

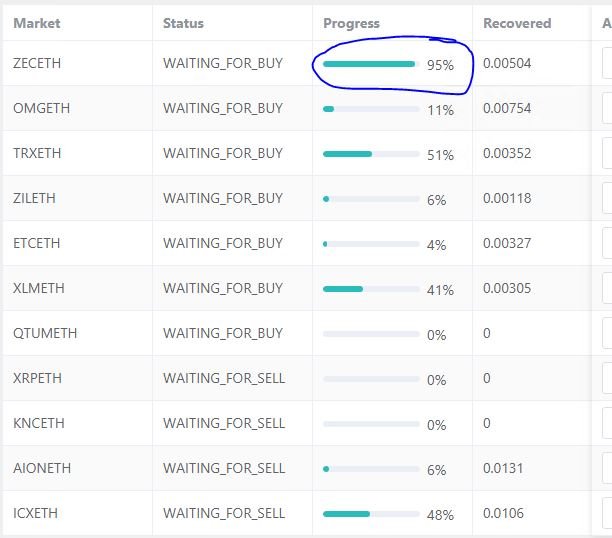

Profit Trailer Bot Two closed trades (1.63% profit) bringing the position on the account to 6.05% profit (was 6.01%) (not accounting for open trades).

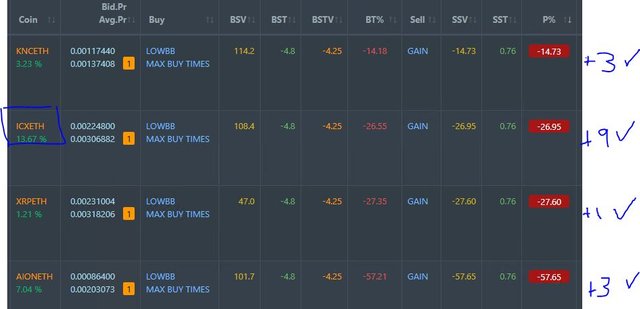

Dollar Cost Average (DCA) list remains at 4 coins with all coins improving and a big jump in ICX.

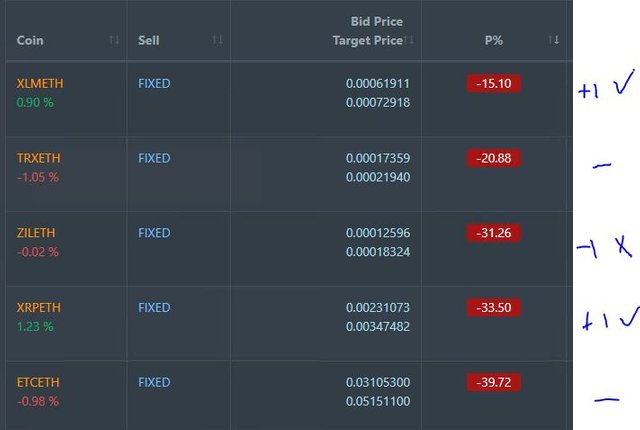

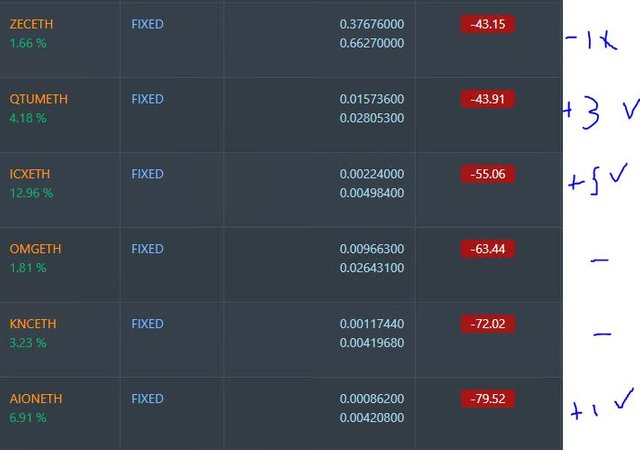

Pending list remains at 11 coins with 5 coins improving, 4 coins trading flat and 2 worse.

PT Defender continues defending 11 coins with a defence trade on ZEC completed. Next ZEC trade should complete its defence.

New Trading Bot Trading out using Crypto Prophecy. No closed trades.

Currency Trades

Outsourced MAM account Actions to Wealth closed out 1 trade for 0.26% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

February 28, 2019

Great setup with the Healthcare sector as they have been consolidating for some time now and still have enough power to not be impacted by any reform mentioned politically which as you already state, have low likey of getting past this government.

Posted using Partiko iOS

I am hoping I read the politics right.

Good news is trade was free and will stay free as long as price stays above $220 minus $7.68