TIB: Today I Bought (and Sold) - An Investors Journal #398 - Offsore Oil Drilling, South Africa, US Technology, Altcoins

Quiet day for markets. Trades are all about taking profits in offshore oil and technology and protecting capital in South Africa, my homeland.

Portfolio News

Market Rally

US markets went into drift mode ahead of earnings

Under the surface, financials were the strongest performers and they report first. Maybe the market is beginning to sense that things are not as bad on earnings as they feared. There are enough talking heads suggesting banks are relatively undervalued - 13 times price earnings vs market 19.77 times. Treasury yields inch higher too especially at the long end.

European markets welcome the Brexit delay - markets hate uncertainty. Of course it depends which headline you believe. The numbers said markets went up BUT it was not broad based.

Good article on how the tide has changed on the Brexit debacle, especially for the hard right of the Conservative Party. .

Sold

Technology Select Sector SPDR Fund (XLK): Price closed at $76.28, far enough above the sold leg of a 65/75 bull call spread to hit profit target. Trade made 94% profit since November 2017 and is the last of a series of call option trades since 2015. I hold the stock in one portfolio. I will review my thoughts on this as earnings season progresses.

Tidewater Inc (TDW): Offshore Oil Drilling. Formerly Gulfmark Offshore. Partial fill to close December 2024 Strike 100 call warrants. 65% profit on first tranche since December 2017. These warrants were issued when Gulfmark Offshore emerged from Chapter 11 bankruptcy in November 2017. Bankruptcy warrants often provide strong asymmetric returns - example Stone Energy (now Talos Energy). These are no exception. With closing price of $23.81 there is a long way to go to reach strike. See TIB142 and TIB143 for the initial rationale.

Of note is this trade happened on the day the Ensco plc (ESV) and Rowan merger was completed to create a 73 rig well funded offshore oil drilling business. I hold stock and options in ESV as well.

https://www.worldoil.com/news/2019/4/11/ensco-and-rowan-merge-to-form-enscorowan

Shorts

iShares MSCI South Africa ETF (EZA): South Africa Index. Closed out sold leg of 56/45 bear put spread for 46% loss since August 2018. 45 put left to run to expiry. With closing price of $56.69 and some upward momentum, I was not confident that price would close below $56 at expiry next week.

Quick update of the chart shows that price was on the red arrow price senario but bounced off the lows with the world recovery from the December selloff. It did only stick its nose above $56 a few times only - the challenging part is, it has chosen to do that again in the week before expiry.

Now I am convinced the core problems facing South Africa have not changed and they have a disruptive period ahead of new elections. I have got a bid out for a replacement trade as far out in time as I can buy (October 2019). Liquidity is low. This time I will make the trade a ratio spread to fund the bought put premium. Example 57 strike put is $5.10 (last trade). I can sell 2 47 strike puts for $2.60 each = cash neutral trade on a 1:2 ratio.

[Means: Ratio Spread. Sell more options than one buys with sold premium funding bought premium. ]

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $378 (7.1% of the high). Well I got that wrong. Price did not want a rest, it wanted to run away from the heady heights above $5000 and retreated to the support level just under. The last reversal low at $4778 is under threat (blue arrow).

This article suggests that volumes are at similar levels to the 2017 run. Maybe the FOMO traders are back. There are some doubts about the reliability of the volume data used in the 2017 comparison. Take it with a pinch of salt

https://www.newsbtc.com/2019/04/12/bitcoin-ethereum-crypto-bull-run/

Ethereum (ETHUSD): Price range for the day was $17 (9.6% of the high). I did say the next few hours were key - Break the low and price will drop back to test $160 - it did exactly that with a low of $160.53. If price does not hold here, the next soft support level is around $143

CryptoBots

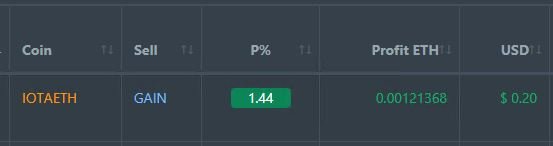

Profit Trailer Bot One closed trade (1.44% profit) bringing the position on the account to 8.0% profit (was 7.98%) (not accounting for open trades).

New Trading Bot Trading out using Crypto Prophecy. One new trade opened on ENG - maybe a little early on the RSI Stochastic indicator (lower window)

Currency Trades

Outsourced MAM account Actions to Wealth closed out 1 trade on USDJPY for 0.02% loss for the day. Trade was profitable but did not cover swap costs. Trades open on AUDCAD (0.26% positive)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

April 11, 2019

Earnings for the banks should be good as there was still a bit of volatility during the quarter of recovery the markets had and that is often the signal of profits for most of them.

Posted using Partiko iOS

Agreed - I have a few hedge trades short though

Chevon buys Anadarko, expect more buyouts...oil just taking a breather.

And that brings my APC holding into profit. Nice for me as the deal is cash and CVX stock which gives me a lower entry into CVX if I choose to go that way.