TIB: Today I Bought (and Sold) - An Investors Journal #447 - A Month Away: What Worked? Did Markets Pay for my Holiday?

Spent the month of July travelling in Europe and left markets to do their own thing mostly. Did the month's investing and trading activity cover my holiday costs?

Portfolio News

S&P 500 closed at essentially the same level for the month - 295 vs 296 (using SPDR S&P 500 ETF (SPY)). Europe closed the month nearly 4% down based on Vanguard Europe ETF (VGK). US Treasuries (using iShares 20 Year Treasuries ETF (TLT)) closed flat. The fireworks came along after August 1.

Portfolio Change

I run 3 main portfolios. I have computed realised gains and losses for each and categorised them into income trades, hedge trades and investing trades.

- In PJC portfolio, income trades made $428, hedge trades lost -$855 and investing trades made $264.

- In Super portfolio, income trades made $971, hedge trades made $593 and investing trades made $462.

- In MC portfolio, income trades made $456, hedge trades lost -$580 and investing trades made $1,005.

Hedge trade losses come from Van Eck Vectors Gold Mining (GDX) index options trade error. Cumulatively this trade is profitable despite this error. I am sure pleased I closed it when I did. Other hedge trades on SPY and QQQ were cash neutral.

The net gains were $2,746 which was not enough to cover even airfares.

How about unrealised gains?

Now it is hard to talk about unrealised gains when the week after the holiday has shown such a bloodbath as the Trump tariffs escalation has created. If it was not for the tariff announcement, my portfolios did go up enough to cover all my holiday costs. Mr Trump fixed that in one spurt of misguided ambition. I guess we also need to thank Peter Navarro who was the only one of his advisers to support the move.

Winners

Best wins come from agricultural commodities banking on delayed planting driving price.

- Cypress Semiconductor (CY): US Semiconductors. 33% profit following takeover.

- Advanced Micro Devices (AMD): US Semiconductors. 42% profit on assigned covered call

- Citigroup (C): US Bank. 1.3% profit on assigned covered call

- Take Two Interactive (TTWO): Video Gaming. 61% profit on January 2021 95/11 bull call spread

- Las Vegas Sands (LVS): Gaming. 270% profit on July expiry 60/65/55 call spread risk reversal

- Bitcoin - 9 winning trades on reversal trading - covered CFD costs by 117%.

- Agricultural commodities (Soybeans, Wheat, Corn) - covered CFD costs by 195%.

Losers

- Capital Product Partners (CPLP): Oil Shipping. 8% loss on price hitting a target exit.

- Ford Motor Company (F): US Automotive. Short term options long trade expired worthless.

- Logmein (LOGM): Technology Service. Short stock trade hit its stop loss. Options trade still open.

- Micron Technology (MU): US Semiconductors. 15% loss on assigned covered call

- Game Digital (GMD.L): UK Video Gaming. 29% loss. Stock sold following a tender offer takeover. The tender offer did reduce the loss.

- US Oil Fund (US): Long options trade = 100% loss. Oil price did not want to go up.

- Consumer Staples Select ETF (XLP): Short trade using options failed on July expiry - some of the trades rolled to later expiries will recover those losses this month

Two trading errors to report

- Gold Miners ETF (GDX) - 68% loss from a trading error which bought puts instead of calls

- Fedex (FDX) - $70 profit from a trade structure which was to go short but I landed up long. I reduced the downside by selling naked puts against the long call spread. That recoverd more than the cumulative losses.

Income Trades

Income trades all worked well with only 3 stocks assigned (Citigroup (C), Advanced Micro Devices (AMD) and Micron Technology (MU). Full raft of trades for August expiry written

Cryptocurency

Bitcoin (BTCUSD): Price range for the month was $4151 (38% of the open). The early part of the month saw the push to a high testing resistance at $13,076 with price then dropping back to trade below support at $9954 and above $8891. The current high is around resistance at $11730 which is lower than the July and June highs.

Ethereum (ETHUSD): Price range for the month was $128 (42% of the open). The front part of the month saw price mirror Bitcoin making highs and lows on similar days. Since that last low, price has traded either side of a level at $222 and is not showing the same strong upward momentum.

Ripple (XRPUSD): Price range for the month was $0.13541 (34% of the open). First day of the month was the high day with price trading to a similar low day as Bitcoin (July 16) and then tracking totally sideways with no momentum in either direction.

CryptoBots

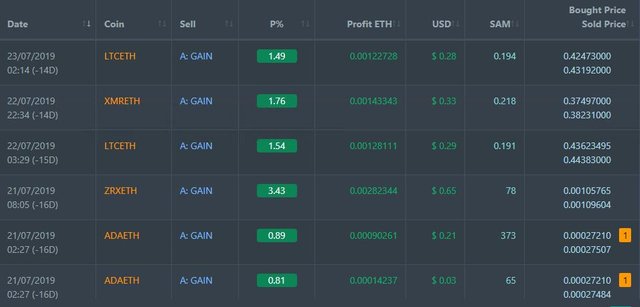

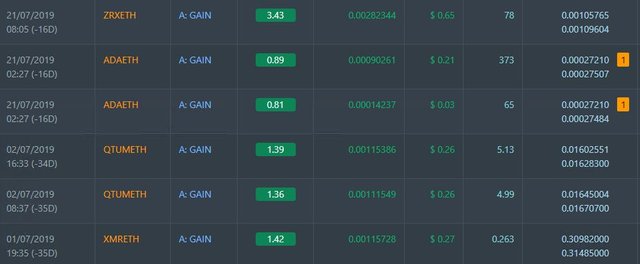

Profit Trailer Bot Nine closed trades (1.57% profit) bringing the position on the account to 9.44% profit (was 9.24%) (not accounting for open trades).

This was a bad month for altcoin trading - no surprise there with Bitcoin advancing so much.

Dollar Cost Average (DCA) list now up to 7 coins after I tried twice to unblock trading my allowing 2 more pairs to trade

Pending list remains at 11 coins - all worse.

PT Defender continues defending 11 coins.

Currency Trades

Outsourced MAM account Actions to Wealth closed out 65 trades for 1.8% losses for the month. Trades open on CADJPY (short) (0.14% negative )

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex and crypto prices

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

July 1 - 31, 2019

Welcome back! Great time to be back as things are surely getting interesting during this last leg of the Summer trading season! Look forward your perspective on these volatile markets!

Posted using Partiko iOS

Thanks - sure has been an interesting time to start again. I have stayed mostly on the sidelines these last few days.

Hi, @carrinm!

You just got a 0.4% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.