Circle of Competence

Defining your circle of competence and staying within it, is an extremely important and yet often overlooked concept of investing. The great Warren Buffet cites this as one of the single most important factors of his success.

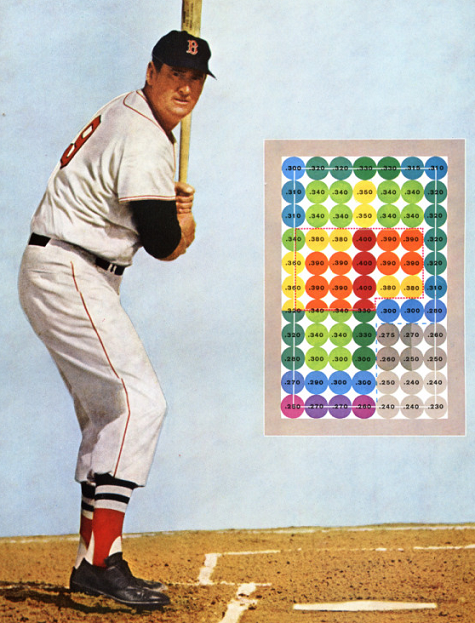

Ted Williams is considered one of the greatest baseball players of all time, who is especially known for his incredible batting ability. He wrote a book called the Science of Hitting. In it, he included the a picture of himself, and the strike zone divided up based on his batting average in that area. He said, that as long as he waited for the pitches in the sweet spot he could bat .400.

In baseball, you don't have to swing at every pitch. This is just like investing. There are thousands of opportunities out there, but you don't have to "swing" at all of them. The trick to investing according to Warren Buffet is to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot.

Excerpt from Buffet's 1996 letter to shareholders:

Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note that word "selected": You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.

Defining what your game is, and where you have an edge in the market is enormously important. Over the years, people start to develop knowledge in certain areas, it is smart to use this to your advantage. Buffet defines this as a person's circle of competence. It is better to focus in on your circle of competence, rather than try to focus on everything at once.

If you want to be more successful in investing, business, and life in general, then the big takeaway here is to find your advantage, define your circle of competence, and stay within it.

Sources

Berkshire's chairman's letter, 1996-

http://www.berkshirehathaway.com/letters/1996.html

Warren Buffet talk about circle of competence-

thanks for education post bro like your post.☺