US Treasury Bonds Yields are Starting to Invert and What it Represents

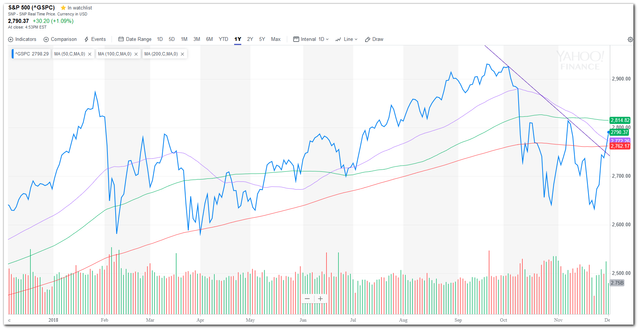

Hello Steemians! About a month ago, I posted my thoughts on the stock market and talked about the correction that the stock market is undergoing. Let's take a quick look at how the S&P 500 is doing.

For the past month, volatility was high and you can see how the index whipsawed from the low of 2600+ to the high of 2800+. Yesterday, the index rose sharply on optimistic news regarding the trade war truce between USA and China. For those who only read the headlines, it may seem like a very positive news. But if you have the impression that the trade war is over, then you might want to read the details. The temporary cease fire is only for 90 days, after which, the possibilities of new tariffs remain high.

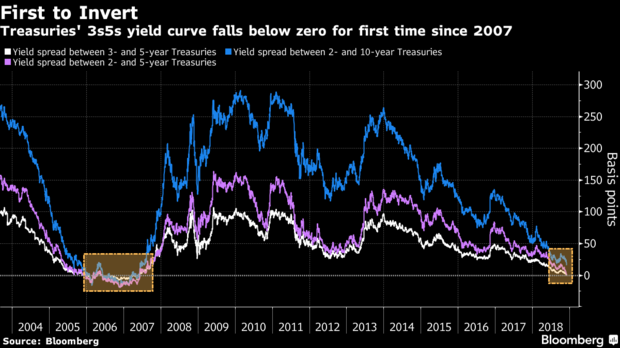

Treasury Yields Inversion

Another important event happened quietly in the background amidst the cheers in the stock market. The spread between 3- and 5-year yields fell to negative 1.4 basis points Monday, dropping below zero for the first time since 2007. This means that longer term bonds are yielding lesser returns are as compared to shorter term bonds. The implication of this phenomenon is that market participants are getting less bullish on the longer term future. I quote Ray Dalio's book, "A Template For Understanding Big Debt Crises"

Typically, in the early stages of the top, the rise in short rates narrows or eliminates the spread with long rates (i.e., the extra interest rate earned for lending long term rather than short term), lessening the incentive to lend relative to the incentive to hold cash. As a result of the yield curve being flat or inverted (i.e., long-term interest rates are at their lowest relative to short-term interest rates), people are incentivized to move to cash just before the bubble pops, slowing credit growth...

This is a sign that the market is topping (reaching its peak) and as market moves in cycles, what follows after a top is usually a depression. In addition, the inversion of yield curve has preceded all 9 of the previous USA recessions. The good news is recession does not come immediately after yield inversion, there is usually a lag of 6 months to 2 years based on past statistics.

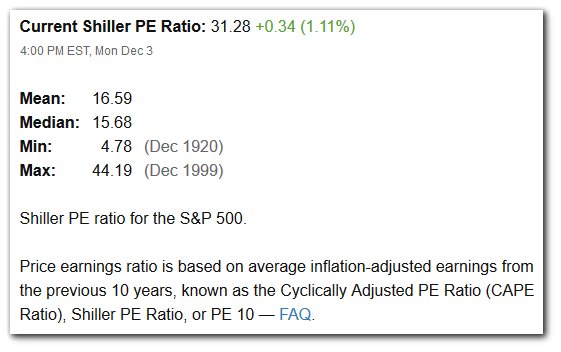

Shiller PE and Buffett Indicator

Let's again look at where the Shiller PE and Buffett Indicator are standing.

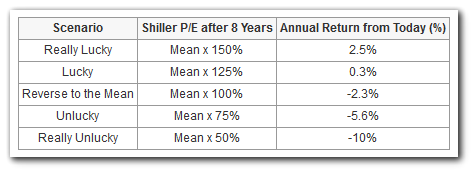

1 month ago, the Shiller PE was around 30. Now it is a little higher at 31. We are still greatly overvalued based on this metric. As a refresher, the Shiller PE tends to revert to its mean on the average over 8 years. At the current level, it is still likely that we will lose 2.3% annually if it does go back to mean after 8 years.

Next, lets take a look at the Buffett Indicator. Based on source from GuruFocus, we are still significantly overvalued.

As of 2018-12-03 (updates daily):

The Stock Market is Significantly Overvalued. Based on historical ratio of total market cap over GDP (currently at 136.7%), it is likely to return -1.5% a year from this level of valuation, including dividends.

Conclusion

Markets move in cycles, holding a relatively contrarian view, when the mainstream media are sounding all bearish, I believe that there will be a short term stock market bounce to all time high. However, we need to keep in mind that the market is still overvalued with signs of upcoming recession. Thanks for reading and let me hear your thoughts on the stock market.

Projects/Services I am working on:

You can find me in these communities:

Hello, @culgin! I was brought here by @crypto.piotr who made me aware of your kind support for one of his latest contests. I'm stopping by just to say Thank you!. It will be a pleasure to follow you.

Best wishes!

Hi @ravijojla, thanks for stopping by my blog. @crypto.piotr is an awesome guy and I am happy to help. I have given you a follow as well because you seem to be quite active on Steem.

Cheers!

Posted using Steeve, an AI-powered Steem interface

Thanks @ravijojla and @culgin

Did you guys watch a LEGO MOVIE? they used to sing:

Everything is awesome, everything is cool when your part of a team

Everything is awesome, when you're living out a dream

Everything is better when we stick together

Cheers guys :) Piotr

I saw the lego movie, if the song is true and contagious, jajajajajajajaja, good luck friend.

Hehehhe, this sounds so great and so true.

Lately I'm stepping on LEGO parts, but haven't watched the movie yet.

Thank you for recommending it, @crypto.piotr :-)

Thank you, @culgin! I love my stay on the platform :-)

Take care!

Hi @culgin

This link you provided at the very beginning is redirecting to exacly same content but on steempeak. I figured you may like to know about this little mistake you did.

Yeah. We're definetly heading towards recession and we may repeat unfortunate events from 2008. Just this time around it may be more painful.

ps. Is Shiller PE an important indicator? I never heard about it (feeling so silly now).

In 2008 it all started with property market crashing.

Now perhaps we will see same scenario , but in China. That's what some "experts" predict.

But I've a question: don't you think that introducing STO and tokenization of real assets will push most markets to another all-time-high?

Property market is a bubble in most countries. But with tokenization of properties this bubble can grow even bigger and we may experience another rapid growth of property prices in many most comercial cities. Those properties will most likely be empty, but it will not stop prices from growing.

What do you think?

Yours

Piotr

Hi @crypto.piotr,

It was not a mistake. Steempeak.com is built on Steem platform and it is a much more user friendly platform than Steemit.com. I deliberately leave that link so that more people will know about SteemPeak. And seems like it is working ;)

Shiller PE is an interesting metric developed by Nobel prize winner Robert Shiller. It is definitely worth taking a look.

STOs make it easier to bring tranditional assets to the market. It may generate some hype but it is going to be highly regulated and I don't think it will reach the peak of it's hype in the next couple of years. I am anticipating a deep recession in less than 2 years. While I hope I am wrong, I have to say that the market moves in cycles and a bull run doesn't last forever

Posted using Partiko Android

Hi Culgin

I will definetly check it out. Does it have night-mode build in?

When I mention mistake, I really ment it. Just click on that link and you will see that you will be redirected to:

https://steempeak.com/investing/@culgin/my-thoughts-on-the-stock-market-again

instead of:

https://steempeak.com/investing/@culgin/my-thoughts-on-the-stock-market-now

ps.

I will read more about Shiller PE. Thank you.

I also heard once that during "good times" banks are willing to loan money to each other easily. But whenever crisis is coming they are lowering this sort of activity.

Apparently right before crisis in 2008 amount of loands between banks dropped badly. Which suggest that they were building reserves and preparing for the worse. Isn't same thing happening now?

We're on the same page here.

Cheers, Piotr

Hi, SteemPeak has night mode. And I am really linking to

https://steempeak.com/investing/@culgin/my-thoughts-on-the-stock-market-again

instead of

https://steempeak.com/investing/@culgin/my-thoughts-on-the-stock-market-now

Haha..

Thank you for the informative post, you have a talent for putting complex thoughts and ideas into a digestible piece.

Thanks for reading!

Posted using Partiko Android

Hi@culgin. I have come to your blog to say thank you for supporting @crypto.piotr in his efforts to support new Steemians. I read your blog about the stock market. As you pointed out, too many people are going to be excited about the TEMPORARY halt in the China trade war, not realizing what is going to follow.

Thanks for dropping by my blog! Indeed, many people are too caught up by the headlines and ignoring the small details. The devil is often in the details

Posted using Partiko Android

Thank you @blueeyes8960 for mentioning my name.

It really seem that current Trade war is put on hold just for short time. I bet US administration want to focus on their south boarder and deal with China once they will clean up this mess. And then they will hit China hard again.

Hopefully Im wrong. But it does look like it.

Cheers, Piotr

I hear you a 100%, i have been following the guys at Hedgeye (especially when they had a one month free trial), thy are highly bearish, as am I. Yes, bonds are starting to anticipate another monetary easing with a recession. I bought some treasuries

Good move to diversify into bonds! And thanks for sharing insights from Hedgeye :)

Posted using Partiko Android

Thank you so much for participating the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

Congratulations @culgin! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Hi @culgin!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 3.386 which ranks you at #7116 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 226 contributions, your post is ranked at #31.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Congratulations,

you just received a 11.82% upvote from @steemhq - Community Bot!

Wanna join and receive free upvotes yourself?

Vote for

steemhq.witnesson Steemit or directly on SteemConnect and join the Community Witness.This service was brought to you by SteemHQ.com