Stocks And High Gains: Is That An Investing Myth To Bust?

One of the “memes”, strong and general beliefs in the investment world is that stock markets are yielding better than bonds or money markets. Especially on longer terms, in 5-10-15 or more years. Is that true?

From coal mines to Apple

Difficult to say because in older times stock market indexes were calculated differently than today. Contained fewer stocks, or the dividends were not included. The proportions of the different industries in the index can be very different today. How can the old coal or steel industry be compared with Apple and Netflix?

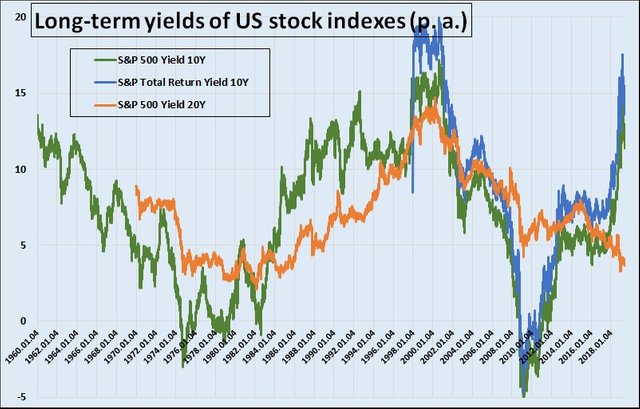

Allegedly one of the most used American indexes, the S&P 500 index of large-capitalization stocks, has approximately its actual form from the 1950s. So I calculated the 10 and 20 years backward yield of the index to see, first, if it is positive.

The bulls had the overhand

The result is not bad, the 10 years backward yield of the S&P 500 was mostly positive in the last 59 years. (Green line.) It fell only for shorter periods of time below the zero-line. First, a couple of times in the 70s and 80s. Then, a long-long “hausse” period (bull market) arrived and negative yields weren’t experienced until 2008. Not even in the bear market after the dotcom-bubble fell the 10-years backward yield below zero.

The “normal”, every day, generally used S&P 500 index is a Price Return (PR) type index. That means it doesn’t contain the dividends companies are paying out. There is another index, the S&P Total Return (TR), which is growing continuously with the dividends. But I could find data of this on only from 1988.

What means the dividend?

The average 10-years yield of the S&P 500 index, without dividends, was 6.8 percent from 1998 until today. The S&P 500 TR index, with dividends included, had a return of 8.9 on average. So much means dividend payout for the investors. The 20-years yield of the S&P 500, was 7.0 percent.

The next question is: Were these yields much higher than the inflation or the bond yields? Is it worth to risk our money in such a dangerous asset class?

Maybe that is not the place to ask that this question where all people have cryptocurrencies. Cryptos are definitely more volatile and risky than large-capitalization American companies.

(Photo: Pixabay.com)

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Congratulations @deathcross! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP