How To Catch A Falling Knife - Investment Strategies

There's blood in the water in these crypto markets. Many are fearful. But another crowd sees a different picture in the charts: opportunity. These recent lows present a fantastic chance to get into crypotocurrencies at prices not seen since over a year ago. Now, whether or not you think those year-old prices were over-inflated to begin with is your own decision to make. But let's assume you already know you want to put some money into crypto today. What does that trade look like?

If you're like most people, you pick a random day at a random price that "feels good" and just click the buy button and purchase as much as you are comfortable with picking up. Some investors call this "trying to catch a falling knife." It's a method, but I'd like to share two other strategies that I think work much better. Regardless of which strategy you choose, the most important rule is this: never trade on emotions! Don't trade because you are angry, don't trade because you are feeling lucky, don't trade because you feel like the market has bottomed out. You need to be as cold and calculating as a computer when planning and executing your trades.

Catching a falling knife is no easy task, but here are two strategies I believe work better than randomly guessing the bottom.

Planned Purchases

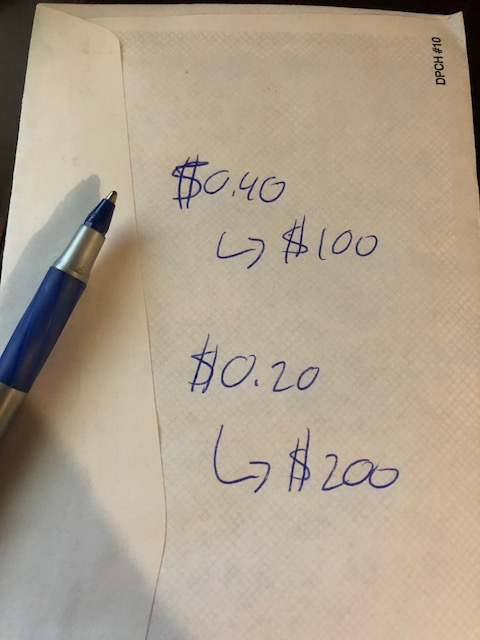

Think about a price that you'd be thrilled to buy STEEM (or any other asset, for that matter). For me personally, this price is $0.40. I also like $0.20. How did I pick these numbers? It was a mix of the historical prices and the difference from what STEEM is today. There is no right answer here - the only wrong answer is not to have a price. These prices are your entry points. Now pick a dollar amount that you will invest at each price. Now wait for that price to hit, and then as soon as it does, execute your trade. Even better, put in your limit order now and just walk away.

That's it. That's method 1. Make a plan and commit to it, no matter what the market does.

There is one big problem with this strategy. There is no guarantee that the market will ever sink to your entry points, so you may never end up buying any crypto. Personally, I am OK with this, but if you definitely want to get into crypto now no matter what, then my second strategy will be a good fit.

Dollar Cost Averaging

Do you drive a car? How often do you get gas? Once a week? Last year in the US where I live, the price of gas fluctuated between about $2.25 and $3.25 a gallon. I probably paid, on average, about $2.75 a gallon. I know this because I spread my gas purchases out. If I had a giant tanker in my back yard, I could have purchased all my gas at once. But then I'd be risking buying it all at $3.25 a gallon.

When you purchase a huge chunk of an asset at once, you are trying to "time" the market, which is generally a fools errand and essentially amounts to gambling. There is a better way, and it's basically to invest your money the way you buy your gas: a little at a time, all spread out over a long timeline.

To do this, pick two variables: the amount of money you are willing to invest, and the amount of time you are willing to wait on the market to "bottom out". Divide the amount of money by the number of weeks (or days), and purchase that small amount of STEEM once each week at a set time on a set day no matter what the price happens to be.

For example, let's say you have $300 and you want to be invested over 12 weeks. This would work out to $25 every week. So you pick Monday afternoons as your investment window, and for 12 weeks you buy $25 worth of STEEM. Sure it's less exciting than trying to time the market all at once with your entire $300, but you'll end up in better shape in almost every market.

A Few Scenarios for Comparison

Let's take 3 hypothetical future markets and compare them against the three approaches: just buying a lump sum today, dollar cost averaging it, or sticking to planned purchases.

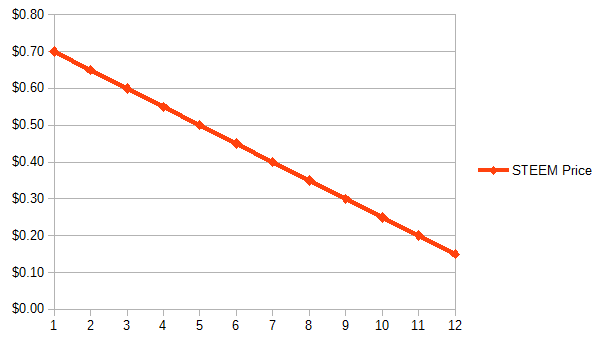

Scenario 1:

| - | Lump Sum | $ Cost Avg | Planned Buys |

|---|---|---|---|

| Gain/loss in $ | -$255.00 | -$169.63 | -$112.50 |

| # of STEEM | 429 | 876 | 1250 |

In this scenario the market just continued to tank. My first method of planned buys worked out the best, with the largest ending amount of STEEM and the smallest lost in dollar terms. But notice that the dollar cost averaging also ended up with nearly double the amount of STEEM in their wallet as lump sum, just by sticking to a disciplined strategy of buying $25 worth of STEEM each week no matter the price. It really works well if the market continues to fall, and if you end up holding until it recovers, you'll have a huge amount more STEEM in your wallet to show for it.

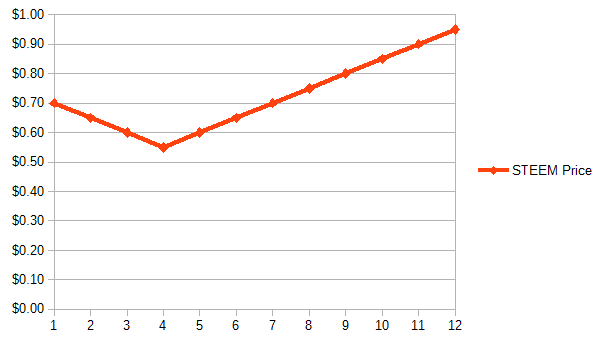

Scenario 2:

| - | Lump Sum | $ Cost Avg | Planned Buys |

|---|---|---|---|

| Gain/loss in $ | $107.14 | $103.97 | $0.00 |

| # of STEEM | 429 | 425 | 0 |

In this scenario, the market dips a bit more, but then rises. If the dip was deeper, dollar cost averaging would have been the best bet by far. If the dip was shallower, the lump sum would have been your best bet. But mostly by luck I happened to make a hypothetical situation where dollar cost averaging and lump sum are nearly identical in their performance. I think the peace of mind of knowing I had a plan that would adapt to a sour week would make it worth the couple STEEM I'd lose if I picked dollar cost averaging over lump sum. Also note that in this scenario, we never hit $0.40 so my first method doesn't lose any money, but it also doesn't end up with a single STEEM to show for it.

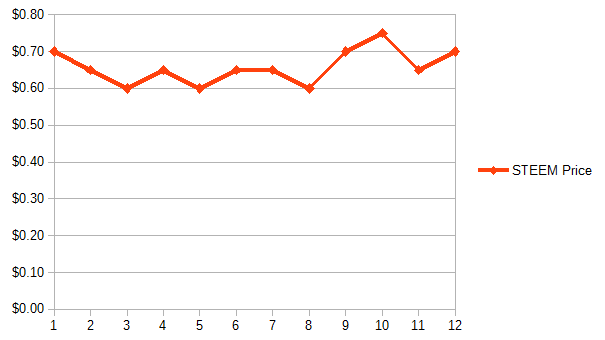

Scenario 3:

| - | Lump Sum | $ Cost Avg | Planned Buys |

|---|---|---|---|

| Gain/loss in $ | $0.00 | $20.45 | $0.00 |

| # of STEEM | 429 | 457 | 0 |

This is the most interesting example to me. In a flat market, you'll actually come out ahead with dollar cost averaging! If you purchased all the STEEM in week 1, you'd still have $300 in week 12. With dollar cost averaging, you're able to build your wealth over time. If the market had never gone above $0.70, or if the dips had been more severe, dollar cost averaging would look even better! My planned buying strategy also never kicks off in this example.

Conclusion

I hope I've opened your eyes to the beauty of dollar cost averaging. I firmly believe that it is the single best strategy for investing when you're certain you want to invest. There is one major downside to this approach, however. That would be transaction fees. If you are paying a set amount per trade, then you will eat into your profits, especially if you have a small amount to invest each week. For example, if you were buying stocks at a brokerage, a $4.95 commission on a $25 trade would instantly set you back 20%! Since crypto can be bought and sold much more cheaply, and since it also typically charges fees as a set percentage of the entire transaction, this isn't as big of a concern when it comes to buying STEEM and other coins. But beware if you are applying this strategy to purchasing stocks or anything else with high transaction fees.

Hopefully this was helpful to you, and if you have any questions, please let me know in the comments and I would be happy to answer them!

@DollarsAndSense is a father, veteran, participant in the rat race, freelance writer, and volunteer EMT. Want to read an example of how not to invest your money?

The 3 stupidest things I ever did with my money

Unless otherwise noted, all text and pictures in this post are my own and may not be reused without my permission.

Join us @steemitbloggers

Animation By @zord189, Divider By @jaynie

if you're not sure and won't act...that's probably when you should be sure and acted

https://medium.com/@patrickmcfly/the-time-i-wrote-about-nothing-and-became-a-millionaire-1-year-later-6a7b0e12fb4f

"Soft contrarian" signals - yep! Hearing them loud and clear these days :)

@dollarsandsense, I'm interested in the same topic as you, let's spin it together. I signed on to you, I hope you'll sign up for me. Always glad to meet new people!

Well written (as always) and great advice!

Hops back on the FOMO train

If only I had the money; any money I get I buy food with it

I have a feeling that one day you’re going to be making some actually money off of this place 😉 you’ve got all the makings of a dolphin 🙂

Thanks, but on an average of 25 cents a day it will take many years to get that far. We'll see

I did not have a way of going about any of this. You have brought many things to my attention in your post. Makes me feel I am behind in all this lol. Better late than never. Thank you for the tips. Lot's to keep in mind here.

Glad it was good food for thought! The most important thing, even if you discard everything else I wrote, is to separate your trading from your feelings. Make a plan and stick with it! Don’t panic if the market keeps falling. Have a plan up front about how much you are willing to lose.

IMHO, crypto-currencies are currencies. They are not a classic investment. The long term value in crypto is our ability to buy and sell things. Crypto can help us move money around.

I would not consider it an investment.

STEEM is a bit different. SteemIt is a game that people play with STEEM. The game isn't any fun until one's upvote is worth two cents.

I would not "invest" in crypto. The real benefits of crypto will emerge as people create more and more things that we can trade with crypto.

At this point in our economic world, cryptos are the best thing going. Investments for the future should consist of cryptos and PMs (AFTER you have met your preps goals). any investment is partly luck, skill and a crap-shoot in general. Knowing that and having 40 years of stock experience, I put my farthings in cryptos. Pick any of the top ones at present, and dollar cost average from now until the SHTF. During that period, I doubt anyone will be interested in long term returns and it will be a tad too late for preservation of capital.

That’s not a bad idea... just dollar cost average with no end point. That’s what I do every week with a dividend index fund. Should really think about doing that for crypto too.

Jump neck deep into LTC today and then cost average on a set schedule from now on. Forget the other cryptos...except Steem to power up on.

Get out of stocks as fast as you can and into PMs to retain the value. Better to watch the crash from outside the financial system.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by DollarsAndSense from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

a dont have a good tacktick but a did my research befor a got inn. feel ok whit it a have a 5 years plan on it, so. . box mining had a interview whit McAfee just now he is "a bit strange" but its a interview its all on the mass adaptions..regard less what you are doing falling knife or not we are all good.

howdy sir dollarsandsense! man I love it when you number cruncher guys and investors explain things to us who are numbers challenged, great job!