Millenial Investing Using Robinood App - DON'T SLEEP

Stock brokerage app Robinhood bills itself as “a stock brokerage built with the needs of a new generation in mind.” Robinhood lets traders buy and sell individual stocks for $0 a trade. In doing so, the company hopes to capitalize on the vast, largely untapped market of would-be Millennial investors.

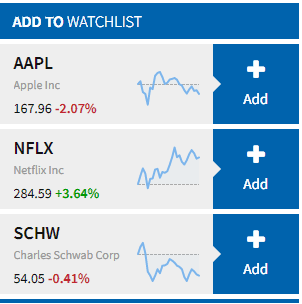

The app was officially launched on Apple Inc.’s (AAPL) App Store in December of 2014, giving many on its 500,000 person-long waitlist the chance to try it out. It is now also available for Android devices via the Google Play Store.

Getting Started with Robinhood

To sign up for the app, users must fill out an application. Once accepted, users are sent a brief video that explains the app, how to make trades and how they can get away with $0 trades. The Millennial targeting really shines here: the video is a quirky blend of “The Wolf of Wall Street” and “Too Many Cooks.”

The entire introduction takes about 80 seconds because the app is simple: users can only buy or sell at market price, or make limit orders, stop loss orders and stop limit orders. Short selling, trading options and margin accounts and other trading tools aren’t available yet. Users can invest as little as they like, thanks to no minimum account requirements.

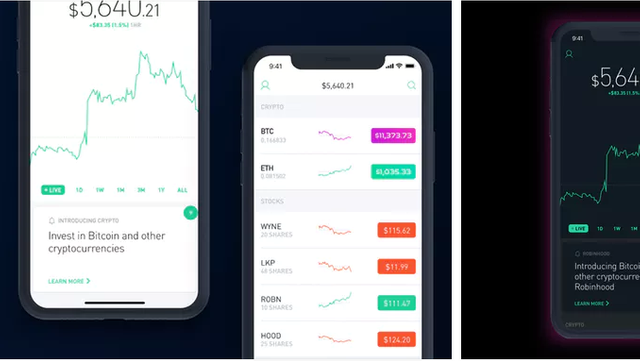

The interface itself is very sleek, minimal and flat, and it changes color depending on stock and user portfolio performance. Overall, it’s easy on the eyes and fits nicely with the design themes of the latest iOS.

There are other convenient features as well, such as the ability to add stocks to a watch list, view basic information about individual stocks—volume, market cap, etc.—and review your trading history and portfolio performance.

Are $0 Trades a Good Idea?

Many of today’s most successful industry disruptors (for example, Netflix Inc. (NFLX), Uber, Etsy, AirBnB and so on seem to satisfy two purposes: streamlining a popular product or service by eliminating excessive features and expenses, and catering to the next generation of the DIY-inspired, independent Millennials.

Robinhood seeks to carve out its niche by helping Millennials learn to invest without the dizzying additional features or price tags of traditional discount online brokerages like E*Trade Financial Corp. (ETFC) ETRADE Financial Corp. , Scottrade, or any of the many others out there.

However, some critics worry that giving inexperienced investors the ability to buy and sell stocks with minimal effort and knowledge could be a bad idea.

“Why's this a good idea? People shouldn't buy individual stocks. Why make it easy cheap mobile?” tweeted The New York Times tech columnist Farhad Manjoo.

Millennials also have unique personal finance challenges. With a lack of accessible, high-paying jobs coupled with the burden of dealing with their slice of $1.2 trillion student loan debt, many Gen Y-ers simply can’t afford to gamble their money on the stock market.

Gaging the Viability of $0 Trades

If Robinhood hopes to compete with the likes of Charles Schwab Corp. (SCHW) Charles Schwab Corp. and E*Trade, it will have to find a way to turn a profit.

“With ultra cheap trades comes insanely thin margins (if any at all),” writes Blain Reinkensmeyer, Head of Broker Research at StockBrokers.com. “Which means compromises will have to be made somewhere, whether it is customer service, tools, research, or similar. There is a reason why [traditional brokerages] all charge high rates but combined house tens of millions of overall ‘happy’ clients.”

For now, the app stays afloat for mainly two reasons. First, the business itself is extremely lean: no physical locations, a small staff, no massive public relations campaigns. Robinhood also generates interest off of unused cash deposits from user accounts according to the Federal Funds rate.

Second, venture capitalists such as Index Ventures, Ribbit Capital, Google Ventures, Andreessen Horowitz, Social Leverage, among others, have invested more than $16 million in the app.

According to Barron’s, Robinhood plans to implement margin trading, eventually charging 3.5% interest for the service. E*Trade charges 8.44% for accounts under $25,000. Phone assisted trading will also be available at $10 per trade in the future.

In the end of September 2016, the company announced the launch of Robinhood Gold, an advanced version of the platform that was initially priced at a flat fee of $10 a month at the time of the announcement. Robinhood Gold currently provides a possibility to trade pre- and after-hours, a line of credit and immediate access to proceeds as well as immediate deposits.

Originally, Robinhood planned to make money off of order flows – a common tactic used by discount brokerages in the 1990s to generate revenue. According to the company's FAQ, Robinhood backpedaled on the idea because it executes orders through a clearing partner and, as a result, receives little to no payment for order flow. The company is willing to return to its original plan in the future if it receives order flows directly or begins to generate a lot of revenue from them.

“Clients should be prepared for a wild and bumpy ride as Robinhood attempts to establish itself as a legitimate player in the brokerage space,” Reinkensmeyer states. “The original iPhone was slow, bulky, but ‘cool.’ It wasn't until later iterations several years later, i.e. iPhone 4 and beyond, that Apple had proven the product and truly had a game changer on its hands.”

The Bottom Line

Robinhood isn’t the first brokerage to tout the $0 trade, but it appears to be the first that understands the Millennial mindset. The app may have trouble winning over experienced investors who may be turned off by its stripped down features. However, it could see widespread adoption once funding and platform availability increases. In the meantime, Robinhood will continue to play an important role in the movement toward democratizing markets and making investing more accessible to everyday people.

DON'T SLEEP CHECK OUT ROBINHOOD TODAY

@

good post

Thanks!