Tiny Stock hitting its stride in a potential $18B market

Company Presentation

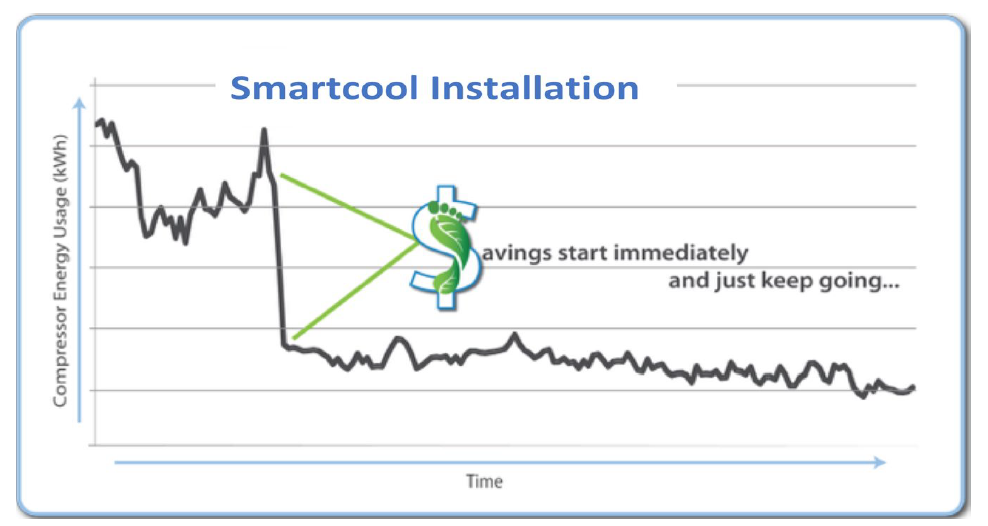

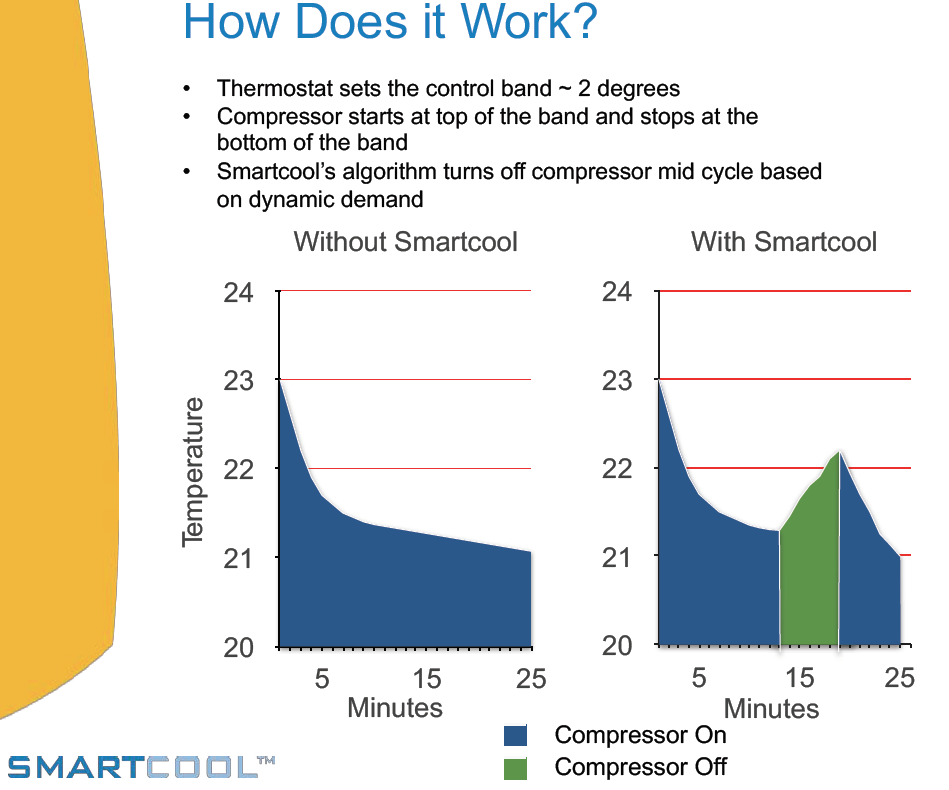

A few months ago I read an article that introduced a tiny company (market cap <$10M- note: market cap is the stock price X the number of shares of stock outstanding ) with an incredible opportunity in an untapped market. The company is Smart Cool Systems and they are a UK company that has a redesigned product that is positioned to lead the world toward a 15-40% energy savings for air-conditioning. The founder took the company back over and they redesigned their system together with sourcing its production in China, leaving them with cost reductions of around 90%! They have been installing systems all over the world and are doing it in a very smart way. They've installed over 30,000 system in commercial buildings.

It looks like they have their own in-house sales staff for the UK home region, but in other regions they are partnering with HVAC service providers. These partnerships will allow them to keep their staffing level low (and costs) while tapping into the existing customer base of these large service providers. It seems brilliant to me.

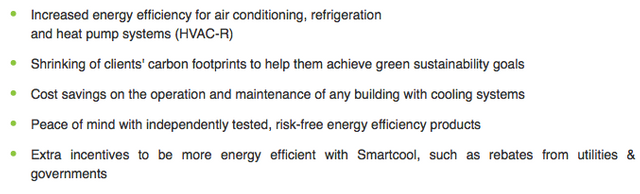

From their website, this is what they hope to achieve with their systems:

In addition, they can be retrofitted into current/existing buildings or installed in new construction.

This month they also announced the introduction of their home system ECOhome, which they say can achieve energy reduction in home air conditioning of 40%! Imagine the impact this small company can end up providing the world.

They have created an innovation for an area like air conditioning that has not seen substantial efficiency improvement in 20 years. And they a program that allows their customers to fund the installations from the energy savings the system provides over a 36 month period. You then directly see the savings in your monthly energy bill.

The stock trades in the US over the counter (OTC) as SSCFF. It's hanging around $0.05/share. Their latest earning press release noted that sales grew from $26,854 in Quarter ending June 30, 2016 to $261,784 in the quarter ending June 30th 2017; an increase of 875%! For the same quarterly periods, their operating loss was reduced from $419,697 to $211,881, approximately 50% reduction. Smart Cool looks to take advantage of growing global trends of companies wanting to reduce their energy usage, increase their green footprint and at the same time find new ways to reduce their operating costs. This looks like a trend that Smart Cool is fully positioned to serve and a potential $18B market.

As an investor, I'm always looking for overlooked investments that have great value propositions and Smart Cool looks to have a bright future. Check out their website and their company presentation posted there. You can also find good explanations for how they achieve their energy savings. Please do your own research and make your own conclusions. It's your money, not mine. But when I see an incredible opportunity, it just seems right to share it with others to consider.

Good investing

Cheers for good info about stock market. I might check up Smart Cool later :-)

A good time to seriously look them up. They dropped to $0.046 today and they should be reporting their latest quarterly earning soon. Why would anyone be selling them at a time when they could start to really perform, I'm not sure.

Definitely buying cheap in for promising crypots is the way.

I use to do daily trading but it is not worth the stress and sleepless nights.

Better to buy in cheap expanding portfolio and hold.

Buying value cheap is a great way to make a lot of money. The key is to buy when no one else wants to.

Cryptos a completely different ball game. As awareness continues to come into the crypto market, and the market fills up with speculators chasing positions that are moving, it becomes more important to learn some technical trading to help guide when to be in and when to be out of a position. I built a long term portfolio that I'm not selling. Others I'm researching I'm going to start doing a little trading. Nothing like day trading and watching all day. I have a job to attend to, which is only healthy.

Meanwhile, I'll continue to invest my monthly retirement savings into incredible positions like Smart Cool and HIVE. If you haven't read my article on Hive, please do. It's a bet on blockchain: https://steemit.com/investing/@morseke1/an-incredible-investment-with-maximum-leverage-to-blockchain-growth

I hold all my portfolio too.

It is also good to mine early some promising new coins. It doesn't cost much and you can literally make up to 100-1000 times profits later if one of them hits the bul's eye.

Congratulations @morseke1! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPHello companion @morseke1.......it's constantly extraordinary to see your report and dependably have speculators to take the correct choice for your post you extremely completed an awesome work.

upvoted and resteem

Thank you very much!!

Hey friend @morseke1.......it's always great to see your report and always have investors to take the right decision for your post you really done a great work.

upvoted and resteem

Thank you for voting and resteeming. I'm trying to add value through my investing research and want as many as possible to benefit!

this is great investing sir and thanks for sharing this, this is something new to me. Marry Christmas..

You're very welcome and Merry Christmas to you and your family as well!

yes, it was a great christmas for me and how's yours??

We had an orchestra and choir at our midnight mass last night that was pretty awesome.

at midnight?? ow, that is amazing to know.

Great information. Thanks for sharing you research! resteemed by @phdmoon

thanks for upvote

A nice idea, we can use your daily publications on this subject, to be certain to make the right decision.....

marry christmass.

Thank you- I agree with your write-up, I have invested 1K already in this company. Its good to see a company that solves energy efficiency problems and helps to save the plant, along with making money!

As they continue to add service providers partners to their network and revenues accelerate, I'm hoping they work on paying down their debt. They have a fairly high level, but usually this is so that they don't dilute shareholders by selling more shares. I also can't wait to see their most recent quarterly earnings that should be reporting the last week of December.

How cool is this ! Energy efficiency should be one of the things most of the companies should focus.Why is this company "small" when they have such great ideas ?

Thank you for this nice post = )

All companies start with an idea and it's really hard to build it into a successful business. I understand they have been around for 20 years and their product cost was high, meaning the design was not optimized for cost and it was costly to manufacture. The founder is a successful entrepreneur and it was being run by someone else. The founder came back, took the company over and his team redesigned the product to reduce the cost and then have manufactured in China and now their profit margins are very high. If my memory serves me right, something like >90% gross profit. Now they have a product with a good price they can sell in the market and earn a high profit, they just need to keep building their global partner network and increase sales. They have built up a small amount of debt. Something like $450,000. I hope in the next year they are able to turn positive earnings and have the cash flow to start paying down the debt. Once they have this under control, there is nothing stopping them from growing and building substantial cash flow.

My guess is if they are successful and get to great cash flow, someone will end up buying them.

I just hope that the ideas won't change if the company gets bought.It's very unique for companies to have products which are that energy efficient. I wonder if they plan to expand the business and maybe make something else which is gonna be as energy efficient as the product they already have.

That's a great point. If we see them expand, then I see them as trying to go it alone without being acquired. We have some clues of this. Last month they released their first consumers product for home air conditioning that reduces energy use by 40%. Imagine if they take off with commercial side this year and then get a second shot with the consumer market.

Honestly, I feel like the competition is gonna become bigger as well. If other big companies see the success of a smaller company than them which made an awesome product they may want to create something similar themselves.How are they going to do that ? Maybe by buying the idea/recipe or maybe they gonna try to engineer something themselves.

In anyway this is a win win for the people because they are getting the biggest advantage imo.

I completely agree and good for investors too. More completion means the market is growing and so is awareness. I'll take whatever the market will give me and I think it will be a good gift:)

great idea @morseke1