How to Protect Your Investments in Any Phase?

so that, hopefully, you avoid the danger traps.

Many people don't recognise an economic cycle. So before recession hits, they fail to exit the market in time. On the other hand, they try to "time" the market, but ended up missing opportunities.

The economic cycle has four stages:

Expansion. This is the starting period of a "bull" market when the overall economy grows a healthy 4 to 5 percent.

Peak. The economy grows more than 5 percent. That's when inflation sends prices up and doomsday prophets show up in social media, talking about asset bubbles. On the other spectrum, we have late enthusiasts announcing a "new normal". Market goes into a state of "irrational exuberance".

Contraction. Economic growth slows but isn't negative. Most investors termed this as correction/adjustment period. Everyone enters a depressing "bear" market.

Trough. The time has come for recession when the economy, on the whole, bottoms out. We'll also have more experts coming out with predictions that it will continue for years.

Now, if you have a certified financial planner or investing broker, that's good. But, I don't. So, I follow these guidelines to hopefully do better in each phase of the economic cycle in the crypto economy:

Expansion

Focus on small-cap assets and/or emerging markets.

In the early stages of an expansion, small-cap assets grow the fastest. That's because small companies are nimble enough to take advantage of a market turnaround.

If we look at Steem Dollars (SBD), its market cap was hovering at about $3 to 4 million in July 2017 after increasing 80 percent from previous month. Towards the end of the year, it grew more than 10x times to $36 million and beyond.

Emerging markets also grow faster in the early stages of an upturn. Although emerging markets are risky, as the economy improves, that risk is worth it.

Nano (previously known as RaiBlocks) was sitting at only $4 million in July 2017, increased 4x times to $16 million the next month, and then shot up exponentially to $1.4 billion and beyond. During that period, digital currency that's instant and zero-fees are sold like hot cakes.

Later on in the expansion, add mid-cap and large-cap assets. Larger companies do better in the late stages of a recovery.

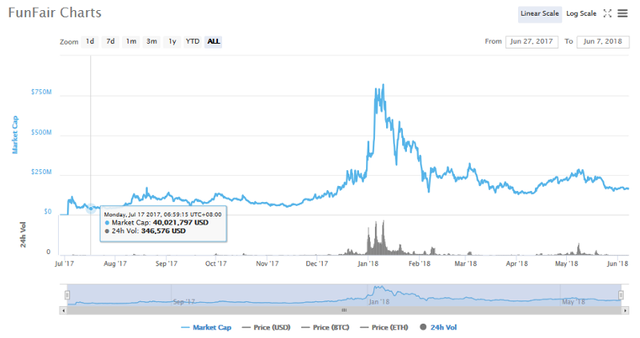

Take for example, FunFair (FUN) in July 2017 with a market cap of about $40 million. It stabilizes after growing more than 15 percent in a few weeks to $46 million. The growth continues at a slow but increasing rate through the year until it reaches the next phase and a new cycle.

Peak

Sell everything, especially junk assets. Increase the proportion of cash because at the time of writing, cash is still king. Turn these profits into the safest investments (e.g. savings bonds or corporate bonds). As interest rates fall, a switch to corporate bonds provides a higher return with greater risk.

Contraction

Sit tight and pray. If you haven't sold your assets by the time the economy contracts, it's probably too late. But if you don't realise your paper loss, it's never really a loss. So always invest what you can afford losing.

You may want to catch the rebound when it occurs, but "bear" in mind the danger of catching falling swords. Most investors sell when the contraction is already well underway and don't buy them until it's too late. You need to control your FOMO and FUD.

Look at Achain (ACT). If you've entered before the peak, you should be breaking-even now with your investment, as we move away from contraction phase.

Trough

Start adding new assets. They should be cheap during a recession. Depending on your comfort zone, weigh the price against the time duration.

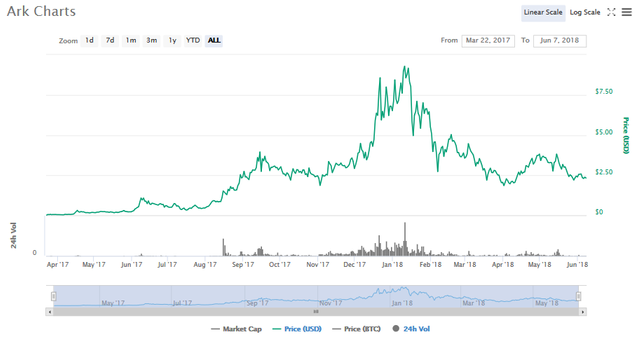

For example, the $2.50 price tag of Ark today is almost the same as the price during October 2017, which was eight months ago. If you're comfortable with that, you can start adding, knowing the peak was about $9. Otherwise, you can always wait out because no one can "time" the market exactly for a good entry price.

As you can imagine, it's incredibly difficult to identify the peak and the trough, more so in a highly speculative and volatile crypto market. The percentage increase hardly adds up.

Besides, every one else is bragging about how much they're making, while at the same time, people are whining about how much they've lost. That's why timing the market is almost impossible. Instead, be conservative and never have 100 percent of your investments in any one asset class.

Make sure your investments are diversified. Gradually shift the proportion of your portfolio to stay in tune with the cycle. I only hodl assets that I believe the project team has good execution with good business idea. Most importantly, don't be greedy - take it, or leave it.

Get your post resteemed to 72,000 followers. Go here https://steemit.com/@a-a-a

Nice way to relate economic cycles with cryptocurrency trading.