A Great Way To Play Oil Higher Is Through The ETF, XOP - Part 2

Two weeks ago, I discussed a great way to play the rise in oil was through the ETF, XOP:

A Great Way To Play Oil Higher Is Through The ETF, XOP

Oil prices (WTI) hit $60 on last week and is now up 30% year-to-day. One week ago, OPEC canceled their planned meeting in April, effectively extending supply cuts that have been in place since January until at least June. Prices have been further supported by U.S. sanctions against oil exports from Iran and Venezuela.

One way to get involved with oil is through the SPDR S&P Oil & Gas Exploration & Production ETF, XOP seeks to provide investments and exposure to the oil and gas exploration and production segment consisting of Integrated Oil & Gas, Oil & Gas Exploration & Production, and Oil & Gas Refining.

The set-up was the following:

Daily Chart (Entry Time Frame) – price has been in a $3 range since January. But since price is lower on the bigger timeframe range, the chart suggest if price pulls back to the daily demand at $27 to go long with a first target at $35.

On Tuesday, price finally broke out of the range.

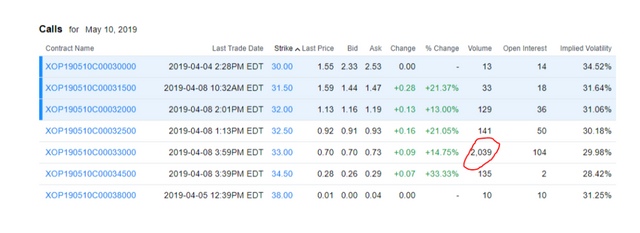

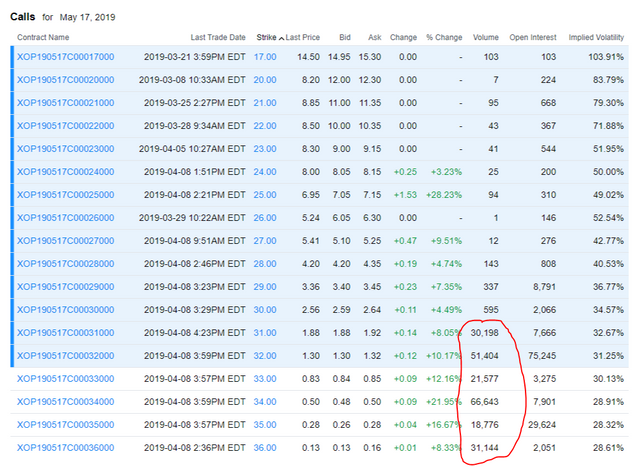

You see, the Smart Money bought a ton of May call options on Tuesday across multiple strike prices.

So the trade set-up is no longer valid. I personally don’t know if price gets to $27 before it gets to $35. In addition, if price does make its way down to $27 in the future, the circumstances might of change.

So one way to slice into the trade to go long is to buy price on a pull back to the 4 hr demand zone with the target remaining at $35 which would still offer a Reward:Risk of at least 3 to 1.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Supply disruption is the driver for now. Quick chart of Oil Shippers. Frontline (FRO) up 50% in less than 2 months. NM and STNG lagging a bit but also up

Wow, great insight..I completely forgot about the shippers...do you pay attention to the Baltic index at all.

Not really other than through the investments I have in dry shipping. Really waiting for the China trade deal to see if that starts to move again.

Interesting bets but the momentum is in their favor from a number of demand and supply angles!

Posted using Partiko iOS

It's also a seasonal thing as well working in their favor.