American Airlines Sounding The Alarm Too

Two months ago I wrote a post calling the tops in the Transports,

I’m Calling The Top In The Transports

The charts are telling me the top is in on the Transports. The iShares Dow Jones Transportation, IYT, is exchange-traded fund that is highly correlated to the Dow Jones Transportation Average. The index includes companies within the trains, planes and auto…I mean trucking sector.

Last Week, Delta became the first airline to sound the alarm. Shares of Delta Air Lines finished 9% lower yesterday after they trimmed their revenue forecast for the fourth quarter. They also cut their growth estimate for revenue per available seat mile by half a percentage point to 3%.

This past week, American Airline, the #1 airline in America said on Thursday that its fourth-quarter revenue and full-year 2018 profit will be lighter than previously expected. American cut its estimate of 2018 earnings per share to between $4.40 and $4.60, down from its earlier forecast of $4.50 to $5 per share. In addition, American said that revenue for each seat flown one mile, a measure of pricing power, rose about 1.5% over the previous fourth quarter. That's about 1% less than American had been forecasting.

Trader Matt Maley sees “a glimmer of hope” in American Airlines, despite its nosedive following its cut in profit expectations for 2018.

The airline’s announcement sent shares down as much as 10.9 percent Thursday. It’s down more than 2 percent Friday morning.

Appearing on CNBC’s “Trading Nation,” Maley noted on Thursday that as the market fell to fresh lows in December, American Airlines managed to hold steady at its prior lows from October, finding resistance around $30.

“Even at the stock’s lowest level in the morning, it did not break below that level,” the Miller Tabak strategist said. “So there’s a little glimmer of hope. If the stock could rally strongly anytime in the near future, we might be able to see a little light on this.”

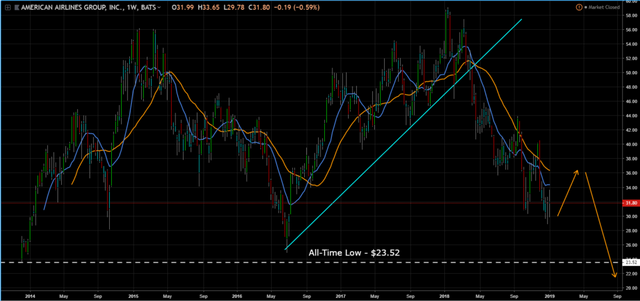

I think America Airlines not only breaks the $30 level, but trades below its all-time low as well within the next two years. This thesis is based on the fact that the global economy is slowing and that the US economy will be in a recession sometime in 2020.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Thank you for the update.

Airlines are having a rough time in the US, do you happen to know why? Wage inflation? Fuel costs?

Posted using Partiko iOS

I think it is mostly revenue as the market has been saturated for some time and thebroutes that had previously been cut to meet supply are coming back online with now many other the lower priced airlines getting involved. In fact, it seems as the line between discount and normal airlines continues to be blurred.

Posted using Partiko iOS

They should be doing great. One of their major costs is fuel and with oils depressed value the past months, I would have thought their profits would grow. The planes I've flown on have been full.