My TIMM Trading Pit Commentary - Wk Of 4/8/19

TIMM (Traders’ & Investors’ Mentor Market) provides the tools analysts need to share their insights in a central location, TIMM becomes a market where traders and investors can shop for the insights they’re looking for.

The Trading Pits are, in some ways, the main meeting place for TIMM. Here you will see folks sharing insights and asking questions about markets.

Commentary from this past week includes:

Which means the Euro can move higher.

Which means the US dollar can move lower.

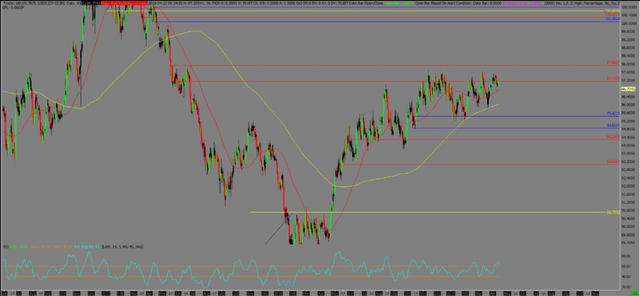

Which means that the S&P 500 can move higher.

Bonds continue to break down from monthly and weekly supply above.

Gold futures breaking down...because the recent pivot high (red) didn't take out the previous pivot high (yellow), going long before price gets back to the daily demand would be a low probability trade.

On Tues I posted a set-up on oil on a 2 min chart. Price never pulled back, although I moved my entry higher that day, I cancelled the order at the end of the day. However, the level was still valid and hit today.

The Dow futures continues to drop.

Missed this trade set-up on oil to go short probably by a tick. If I take the trade, will probably move entry a bit higher.

Gold futures couldn't quite make it to the zone, if price is going to go lower, must get pass the level in the red rectangle.

Gold futures approaching a 60 min supply zone.

Nikkei dropping from a 4 hr supply zone.

If price can pull back on the DOW futures, I'm going to take it short, based on the 2 min supply zone.

DOW futures fallen from daily supply.