Investments plan for 2019

Yale University

Since it's founding in 1701, Yale has been dedicated to expanding and sharing knowledge, inspiring innovation, and preserving cultural and scientific information for future generations.

It is the first university to reveal investments plan for 2019. The second-largest endowment in higher education posted a 12.3 percent investment gain on the strength of its alternative investments.

Asset Allocation

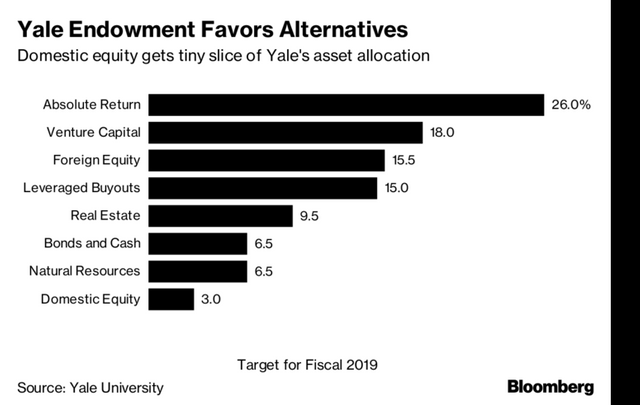

Yale continues to maintain a well-diversified, equity-oriented portfolio, with the following asset allocation targets for the fiscal year 2019:

Absolute return 26.0%

Venture capital 18.0%

Foreign equity 15.5%

Leveraged buyouts 15.0%

Real estate 9.5%

Bonds and cash 6.5%

Natural resources 6.5%

Domestic equity 3.0%

Yale targets a minimum allocation of 30% of the endowment to market-insensitive assets (cash, bonds and absolute return). The university further seeks to limit illiquid assets (venture capital, leveraged buyouts, real estate, and natural resources) to 50% of the portfolio.

Yale’s spending and investment policies provide substantial levels of cash flow to the operating budget for current scholars while preserving endowment purchasing power for future generations. Approximately a quarter of spending from the endowment is specified by donors to support professorships and teaching. Nearly a fifth is dedicated to scholarships, fellowships, and prizes. A quarter is available for general university purposes. The remaining endowment funds are donor-designated to support specific departments or programs.

The Yale Investments Office

Led by Chief Investment Officer David F. Swensen and operating under the guidance of Yale's Investment Committee, the Investments Office manages Yale's Endowment.

Totaling $29.4 billion on June 30, 2018, the Endowment contains thousands of funds with a variety of purposes and restrictions. Approximately three-quarters constitute true endowment - gifts restricted by donors to provide long-term funding for designated purposes. The remaining one-quarter represents quasi-endowment, monies that the Yale Corporation chooses to invest and treat as an endowment.

During the decade ending June 30, 2018, Yale's investment program added $4.5 billion of value relative to the results of the mean endowment. The University's 20-year market-leading return of 11.8 percent per annum produced $27.1 billion in relative value. Over the past 30 years, Yale's investments have returned an unparalleled 13.0 percent per annum, adding $31.6 billion in value relative to the Cambridge mean. Sensible long-term investment policies, grounded by a commitment to equities and a belief in diversification, underpin the University's investment success.

The university’s longer-term results remain in the top tier of institutional investors.

Nice post!

Posted using Partiko Android