Kin: An Investor’s Perspective

As an investor, I am obsessed with finding assets that are:

- Currently undervalued

- Will have widespread utility — (i.e., demand)

To understand utility, consider Bitcoin, which should be 190 times dead already. Bitcoin lags technologically, but is the leader as the store of value and medium of exchange in crypto. It is the base currency in most exchanges and is the entry-drug for muggles into crypto. Put simply, we can consider that Bitcoin’s mountain-peak price has been sustained by the demand backing it. Accepting this, let us take Kin through a similar future demand filter.

What is the latent potential behind Kin?

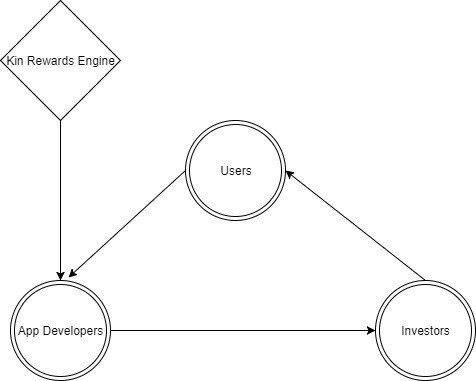

Kin is designed for use in a shared economy — between investors, developers and app users. The Kin Rewards Engine (KRE) incentivizes app developers to port their apps or build new ones in the Kin Ecosystem.

Flow of Kin in the ecosystem

In this model, Kin becomes the base currency used by a growing number of apps that support in-app purchases (think games, stickers, ride-shares, VIP-rooms, premium content, etc.). Users needing to make purchases will have opportunities to earn Kin within Kik, and later on, in other digital services.

How big is this level of demand? In-app purchases are normally done in a compulsion loop, and with a “points currency” to maximize waste aversion and purchases from users. Some industry insiders expect app revenues to surpass $100 billion by 2020, with current in-app purchases comprising 48% of the revenue. Is this big? No, it is massive potential demand! Simply being adopted by Kik as the first of many developers, Kin could become the most widely used cryptocurrency ever.

What are the risks that Kin needs to overcome?

- To work as an in-app currency, Kin needs to find a blockchain that can handle this many transactions without lag. This is a major hurdle to overcome as lag is not an acceptable compromise in UX.

- The Kin must prove it can properly decentralize itself and be immune to current and future regulations.

- The Kin Rewards Engine is potentially a double-edged sword, and the demand it creates must be greater than the daily inflation it simultaneously creates.

- The KRE must attract developers and major apps for this to succeed, and maintain equilibrium between developers, users and investors.

Should you invest in Kin? (The magic question)

Smart investors do their own research, ignore the hype and FUD, weigh their own risks and rewards and objectively decide whether to get in.To quote Jake Brukhman of CoinFund, mainstream cryptocurrency adoption will likely happen by offering mainstream consumers a chance to interact with digital currencies in compelling ways, within apps they love.

If Kin is able to attract major developers and create a rich community where Kin becomes the accepted “Bitcoin for apps,” the demand will rival any cryptocurrency we know. This demand will not come from speculation, but from daily use of many popular apps.The magic word is “IF.” I am willing to bet this happens sooner than later and am part of the few who got in early on Kin.

With in-App purchases, what's wrong with the current credit-card model? While it's not perfect, it's not clear what problem KIN is solving and whether that represents sufficient value to the disrupt the status quo.

good afternoon sir @hitwill

I have read your post to this post.

this is your first post.

I am very impressed with you.

all your posts are very useful and very useful.

I can learn a lot from your posts.

thank you very much to tian @hitwill

I am very happy to follow you.

You give me many lessons.

thank you very much sir @hitwill

good afternoon sir @hitwill

I have read your post to this post.

this is your first post.

I am very impressed with you.

all your posts are very useful and very useful.

I can learn a lot from your posts.

thank you very much to tian @hitwill

I am very happy to follow you.

You give me many lessons.

thank you very much sir @hitwill