Code Talks: Libra and PPIO

Introducing PPIO Code Talks — An open platform for high-quality presentations and discussions on blockchain technology.

PPIO Code Talks is an open platform for high-quality presentations and discussions on blockchain technology with the aim of engaging the community and spreading ideas. The following is an adaption of a slideshow presentation given on June 29 by PPIO’s Chief Technical Architect Bruce. Talks were also given by other prominent members of the Shanghai blockchain and internet industry.

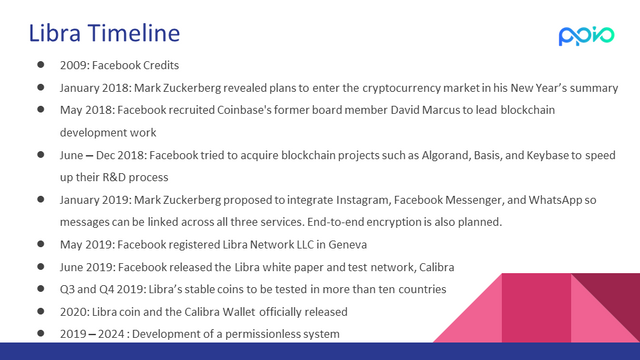

In the past, Facebook has increasingly revealed its ambitions to enter the file of cryptocurrencies, and with the announcement of Libra and the publication of the Libra whitepaper, their ambitions have been revealed.

Libra’s mission is to create a simple, borderless currency and financial infrastructure that serves billions of people.

There are three important things to consider regarding their goals. First, there are 1.7 billion people worldwide who do not have access to banking services. Facebook CEO, Mark Zuckerberg, pointed out in his personal letter that there are approximately 1 billion people who currently do not have bank accounts in the world but have mobile phones. Second, cross-border transfers are expensive, averaging almost $200 per transfer with an average 7% transfer rate. Third, current cryptocurrencies lack stability and the blockchain lacks scalability. Because of this, Facebook, via the Libra Foundation, has adopted a series of methods to ensure its future Libra token is both stable and scalable.

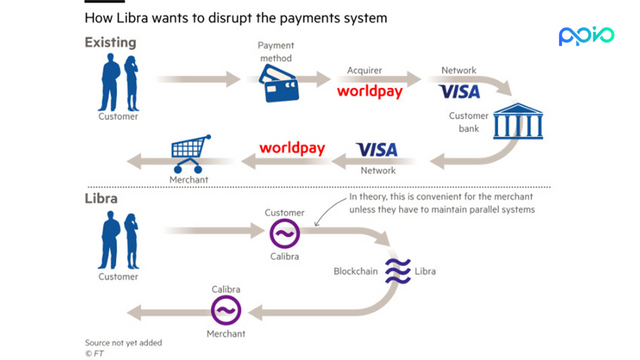

So how does Libra intend to recreate today’s payment system? Libra is a cryptocurrency that users can buy from an exchange or in an application built on the Libra blockchain. According to their white paper, anyone who holds Libra can exchange their Libra for fiat currencies based on the current exchange rate — not unlike exchanging money from one currency to another when traveling. This cryptocurrency differs from Bitcoin in that it uses asset reserves as a guarantee and that price will not be affected by speculative activities.

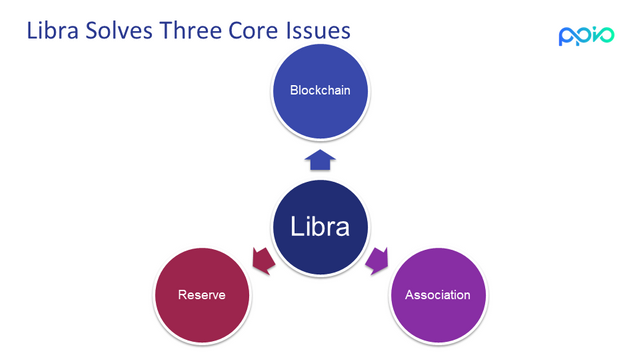

In the face of various problems and doubts, Libra has proposed solutions relating to three key aspects: blockchain technology, reserve functions, and governance association.

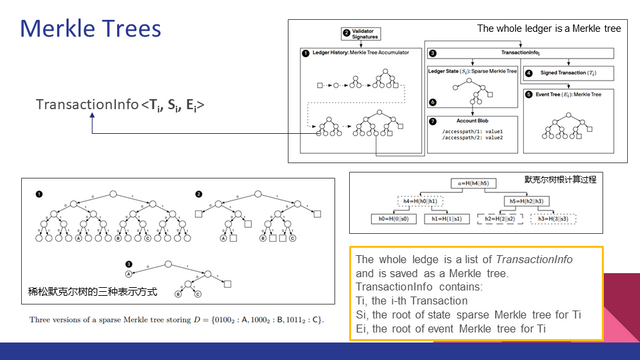

Currently, Libra’s blockchain uses the Byzantine Fault Tolerance (BFT) consensus mechanism. This approach builds trust in the network, and even if some of the certifier nodes (up to one-third of the network) are corrupted or fail, the BFT consensus protocol is designed to ensure that the network remains up and running.

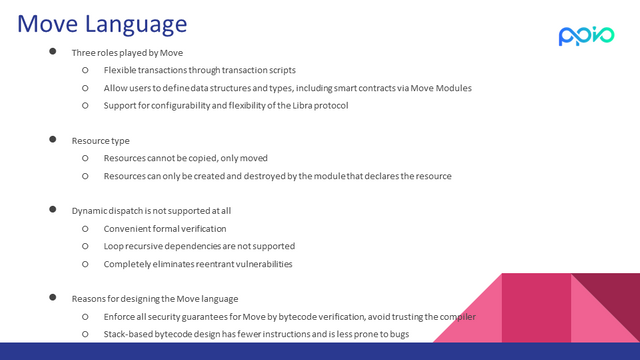

Although Facebook’s BFT mechanism is not technically innovative, the highlight is the use of the Move programming language, a new programming language specifically designed for smart contracts to ensure the security and reliability of these contracts.

Libra’s blockchain relies on 100 nodes for initial governance, an approach that is being questioned by many blockchain believers. For now, the project is being operated in a licensing manner, however, in the next five years, it is hoped that it will turn to non-permitted governance. Furthermore, the implementation of consensus nodes will reduce the dependence of the founders leading the way to a more decentralized platform. Both measures are supposed to ensure absolute security and will guarantee the stability of the network.

From the perspective of reserve function, Facebook strives to maintain Libra’s value. The white paper shows that Libra’s approach to maintaining stability is to tie Libra’s value to fiat currencies, similar to the SDR in the current International Monetary Fund. The assets in the Libra Reserve are held by custodians, which are distributed around the globe to ensure the security and dispersion of assets.

Many people mistakenly believe that Libra is the currency of Facebook. To be precise, Libra is not owned by Facebook, and its management association is a non-profit organization based in Geneva, Switzerland, known as the Libra Association. Facebook has secured 27 partners for Libra, and all the companies that make up the Libra Association’s charter are called “founders” and require a $10 million investment to join. The daily decision-making in an organization with 27 high-profile partners is relatively simple: each founder gets one vote regardless of the amount they invested. All important decisions require 2/3rds or more of the votes in order to be approved.

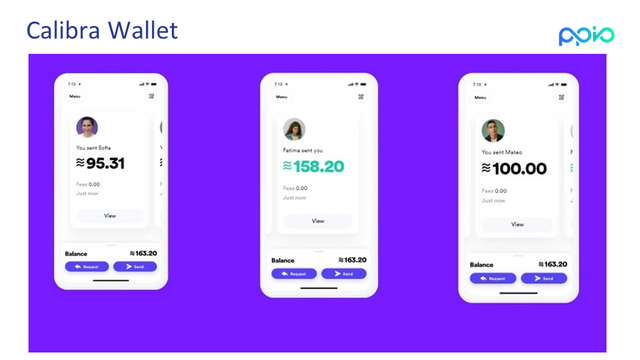

In addition, Facebook will charge financial fees through the provision of financial services by its Calibra service. In short, Calibra is essentially a digital wallet. If the concept of blockchain is used, Libra is a chain, and Calibra is a DApp on the chain. Facebook has 2.7 billion users, which is its biggest advantage in terms of adoption of Libra and the acceptance of blockchain technology by the public.

Even though Calibra is a digital wallet it is different from most cryptocurrency wallets in that it is a managed wallet. This means that users can generate a large number of deposited funds in their wallets, and Facebook will have a pool of funds to pay.

Some of the greater interest in Calibra stems from two important points: its safety and privacy — both which Mark Zuckerberg has repeatedly emphasized. However until it launches, no one can tell just how safe or private it will be.

In the past, one of the important reasons for the popularity of bitcoin and cryptocurrencies was that they could bypass government regulation. Critics immediately noticed that cryptocurrencies would be used for nefarious purposes including money laundering, terrorist financing, underground banks, and capital outflow. In the future, how Libra will fight against money laundering and counter-terrorism, as well as how it will respond to regulatory and privacy challenges, will be of great notice.

Source: Financial Times

Regardless of the above critique, Libra shows us the infinite possibilities and future opportunities for cryptocurrencies and the digital economy. As for PPIO, Libra has a lot of implications.

First of all, the importance of stabilizing coins to a real-world service is unquestionably important. Secondly, the permission blockchain adopted by Libra, that is, the initial licensing governance which gradually will turn into non-permitted governance. This gradual shift from a centralized to a decentralized service is very similar to our three stages of decentralization which we covered in our article: Why We Designed PPIO In Three Stages. The development partners and users to build the Libra platform is of great notice as PPIO is also in the process of cultivating a greater community. Only with users, miners, and other roles in the PPIO community working together can we build a functioning and healthy ecosystem that makes what we do a reality. We are looking forward to see how Libra develops from here.

Share your thoughts with our Discord community or on our Github.

Congratulations @omnigeeker! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!