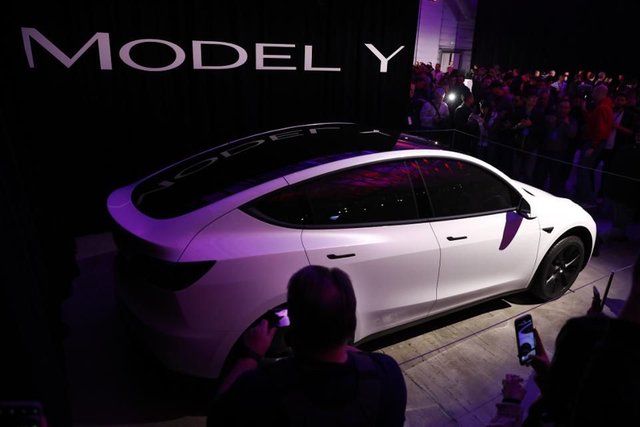

Tesla's Model Y Introduction Left The Stock Market Wanting More

Well, it looks like a Tesla. That was my reaction to photos from Tesla's Model Y unveiling last night in Hawthorne, California. As Tesla shares sell off this morning in an otherwise buoyant tape for the Nasdaq, the market is clearly underwhelmed by its first look at the Model Y.

Looking like a Tesla is not a bad thing, in my opinion. I have referred to the Model S as the “car of the decade” in previous Forbes columns, and I still instantly notice one when I pass one on the highway. Distinctive styling is a plus for an automaker, but having that styling draw looks because the cars are rarely seen is only a positive for luxury and ultra-luxury car makers.

As Tesla has moved into the higher-end of the mass-market auto sector with the Model 3, scarcity is no longer a benefit to the company, and certainly is not helping Tesla’s stock. The “air pocket” in U.S. sales of the Model 3 in the first quarter is the subject of some debate, but Tesla’s pricing actions clearly show a management team--or maybe just Elon Musk, I really do not have insight into how decisions are made in Palo Alto--that is quite concerned over Tesla sales volume.

They should be.

Tesla doesn't have the financial wherewithal to withstand a sustained downturn in demand. Also, those hoping the introduction of the Model 3 in China would help smooth out Tesla’s sales volume missed the fact that BEV sales there have plunged dramatically, as I noted in my Forbes column Wednesday. NIO, Tesla’s most direct competitor, has seen deliveries of its ES8 in China (thus far NIO’s only market) plummet from 3,318 in December to 1,805 in January and decline again to only 811 in February.

It’s a tough time to be selling cars anywhere around the world, and that leads me to the key disadvantage facing Tesla. Differentiation is the ultimate selling point for any consumer products company, and that is certainly true for automotives. Why buy a Ford instead of a GM? Why buy Nike instead of Adidas? There has to be differentiation on some level other than price. If it’s price only, the volume players will always win, and Tesla’s single-plant assembly setup in Fremont clearly puts them at a disadvantage to massive manufacturers such as GM, Volkswagen and Toyota.

But what really differentiates a Tesla? You fill it with electricity, not gas. That's it.

As someone in his third decade of following autos I am huge believer in the value of the inside of the car. When I first drove a Model S I was blown away by the “UX,” but that was more than five years ago, and Tesla’s competitors are now able to copy its screen-based vehicle operation. There’s no moat there. As automotive engineering has long since ditched most hydraulic and pneumatic functions in favor of “by wire” systems, there is no reason the driver should not be able to control all aspects of vehicle operation from the cockpit. That’s exactly what’s happening.

So, the “gee whiz” factor is becoming less of a differentiating factor for Tesla as each new model is introduced. That’s where differentiation between Tesla’s own products is so important and why Tesla’s Model Y introduction was so disappointing to The Street. The design is too reminiscent of the Model 3. Cannibalization is a real fear.

Tesla shares are languishing today below the $280 level they first attained in September 2014. Ignoring all the roller coaster moves in the share price, on a longer-term basis Tesla stock has been an absolute dog, especially versus the Nasdaq. With a quarter century of experience following auto stocks under my belt, I can understand why Tesla bulls fight any mention of valuing the company versus its peer group, automotives, given their chronically low valuations.

You can yell “it’s a tech stock, it’s a tech stock,” about Tesla all you want, however, but when that stock massively underperforms other tech stocks (see table below for Morningstar performance data,) it becomes increasingly difficult for institutional portfolio managers to own it. That is exactly what the market is showing as it sells off Tesla yet again today, and there was certainly nothing from Musk last night--no teasers on financial performance or first quarter delivery figures--to stem that tide.

frome : Jim Collins