February 2019 Expense Update

The importance of understanding where every dollar went was crucial to reaching FIRE (Financial Independence Retire Early). It’s a tradition reviewing and documenting my expenses every month. I feel fortunate to have picked up this habit at an early age which has greatly benefited me in my life. Today, thanks to free online tools such as Personal Capital, it makes tracking your finances much easier and quicker than it was when I first began.

In pursuit of growing the LBF dividend portfolio to generate $1,000 in dividends per month, my desire to free up cash flow to invest as much as I can has been growing. A dollar here and a dollar there can add up quickly!

When first going FIRE in August of 2015, I spent more of my free cash flow on shopping and food. For 3 years I simply enjoyed myself with this new-found freedom in my life. I spent a lot of time on self-development as well. During this time, I have come to realize much more about myself in terms of what brings me joy. Thinking back, I realized some of the most joyful moments in my life came when accomplishing goals, the satisfaction coming from solving problems and building wealth. Perhaps my turbulent past had a profound influence because my habits of saving and seeking a good deal has not changed since FIRE.

So here are my expenses for the month of February.

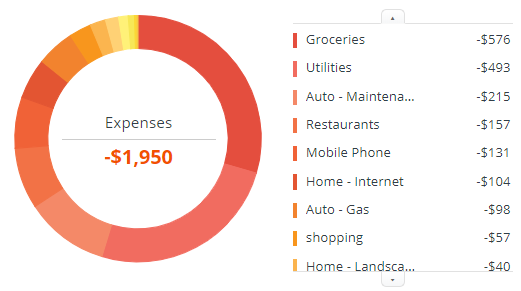

Expenses

Groceries: $576

Utilities (Water, Gas, Electric): $493

Auto (Maintenance): $215 - I have two cars. The repair was done on my 20 year old car which is beginning to show some sign of age. Car required some minor repairs but afterwards runs amazing! I will probably have to replace this car pretty soon.

Restaurant: $157

Mobile Phone: $131

Internet: $104

Auto (Gas): $98

Shopping: $57 - I actually spent around $120 more on shopping but using free gift cards I received from Swagbucks and Amazon I was able to keep this low for the month.

Home (Landscape): $40

Petcare: $34

Postage & Shipping: $25

Media/TV: $16

Insurance (HOI): $7

Office Supplies: $3

Total: $1,950 (-10.3% Decrease from prior month)

It is amazing not having a rent or mortgage payment. I was no different than anyone else prior to FIRE with my largest expense being housing expense. This is no longer the case and boy does it feel liberating. There are profound health benefits that come with such a burden being lifted off of your life.

To accelerate the growth of the LBF dividend portfolio income and having the expenses under control will be crucial to meeting this goal.

I do have some large tax coming due next month which will make my expenses dramatically higher then the current. All large expenses coming due are always anticipated at least 6 months prior, so I feel well prepared. You should always make sure you have an emergency fund to guard against those unexpected expenses. My emergency fund as of today covers at least 6 months of expenses. However, I have been contemplating if 1 year worth of emergency funds is more appropriate when living FIRE. I will write about this more later.

How are you doing with your expenses? Are you satisfied with your results for the month? I would love to hear from you guys. Thank you for reading.

Follow me at my website: www.LifeBeyondFIRE.com

Note: I recently created a separate page with all the recommended sites and services that helped me reach FIRE in my life. Feel free to check them out if your interested in resources that may help reaching FIRE.

Congratulations @insidelook! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!