Lending Club 5 Year Portfolio Update

Lending platforms became a very intriguing platform to many investors when they first began in 2006. The buzz was well advertised by many news outlets and quickly caught on with many investors. Out of curiosity, I decided to give it a spin to find out what it was all about.

I began with a modest amount of $1000 back in July of 2013. I would occasionally check up on the investment to manually choose individual notes to invest in. It was fun at first but quickly became repetitive, and time consuming. So, I decided to set up the auto investing option and let the system take over.

Auto Invest And Allocation Settings

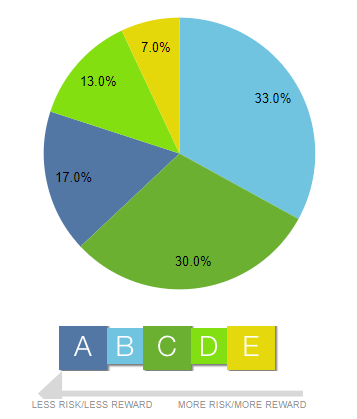

The auto invest options were set the following way:

Investment Amount Per Note: $25

Note Term: 36 Months

Strategy Filter: Not Set

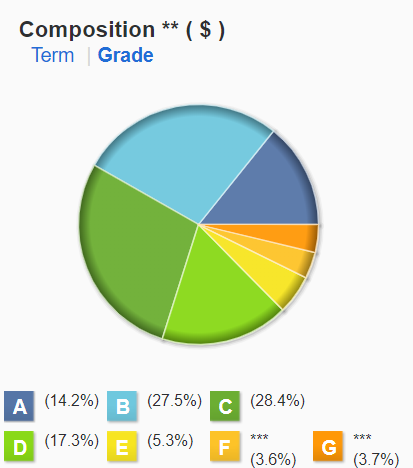

Today, the allocation looks more like the chart on the right. Notice the difference between the desired allocation and my current? That’s part to do with my current withdrawal of some funds out of the platform. As the higher-grade notes perform, the lower grade notes are going late and some charging off. As a result, the portfolio’s allocation is showing more lower grade notes as there are no fresh notes to replenish the paid off performing notes.

In order to keep the returns in line with expected returns, you should continue to deploy more funds to keep the balance in allocation. Otherwise, you may be left with more lower grade notes as they are paid off much slower than the grade A notes. This results in tipping the scale towards lower grade notes as time goes on.

How I Calculate My Lending Investment Return

Calculating ROI for lending platforms accurately is complicated. Too many variables that need to be accounted for in order to reach an accurate rate of return. Variables such as the time a loan take to generate, notes that are non-performing, notes defaulting, recovered notes, fees, the list goes on.

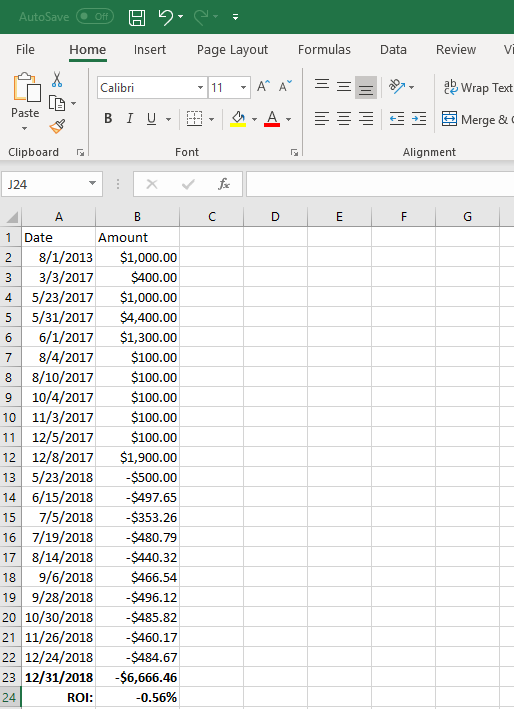

An excel formula called XIRR (Extended Internal Rate of Return), was my method of choice which is used to find the rate of return for financial instruments where multiple transactions were made at different points in time. Many argue that this method is the most accurate to measure returns for P2P lending investments.

It’s a very straight forward method and accurate in calculating how much you earned in interest from the day you made your deposit without the micro details of the note’s performance. The formula uses your deposits, withdrawals, dates, and total value to determine your return. So, it is important to get all your transaction dates from statements for an accurate measurement.

(Click here to download a sample of the “XIRR Spreadsheet for P2P Lending” attachment.)

The Return on Investment

The first 4 years from 2013 to end of 2016, my ROI was 8.76%. After reviewing my returns at the end of 2016, I decided to invest $9,500 more into the platform. I also made adjustments to my allocation, adding to lower grade notes to try to gain higher returns.

The adjustments in allocation were minimal, at least that’s what I thought. How bad could it get, right? Boy was that a mistake.

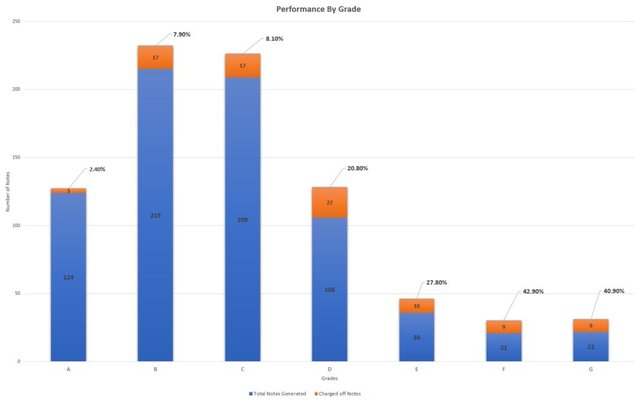

"Click image for larger view."

The chart above shows all notes generated since the opening of the account till the end of 2018. All notes below grade C absolutely performed horribly as shown in the chart above. Grade B and C performed pretty much similarly. Grade’s D to G is pretty much Junk. Many borrowers in this grade class didn’t even make a single payment. The only grade that is a reliable performer is grade A. Currently, the grade A notes listed have interest rates between 6-8%. If those notes perform as the ones in my portfolio have resulting in a 2.4% charge off, you’re looking at 4-6% possible return.

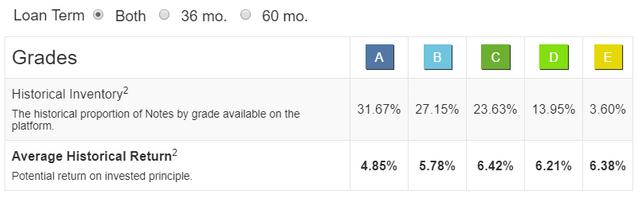

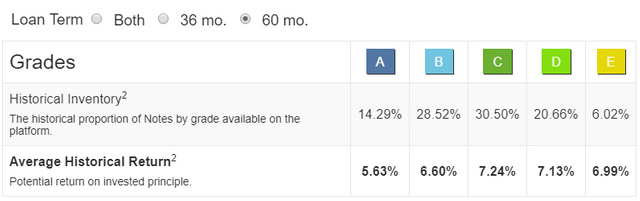

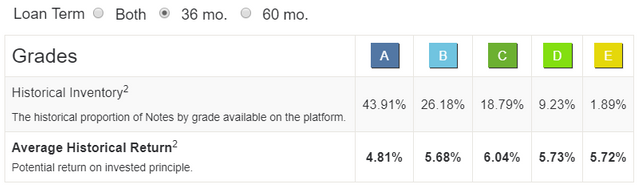

Average historical returns for notes with both 36 month and 60 month combined show as follows.

Data shows your returns become noticeably higher as the term gets longer.

The shorter the term the lower the return.

Large portions of the A grade notes turn over quickly. They get paid off sooner than the term, resulting in higher fees. This requires the investor to continuously reinvest into fresh A grades to hedge against lower grade notes that have high rate of default. Without the balance in A grades, your returns may result much lower. Which is what has resulted in my portfolio.

From the moment I noticed a large amount of Charge Offs, I decided to withdrawal some funds. In one month, without the reinvestment of funds my A grade notes fell from 17% to 14%!

So, what is my ROI?

"Click image for larger view"

As of December 31, 2018, my ROI was -0.56%.

Life happens for people. Looking deeper into the details of the charged off notes, there was no single indicator that stands out why people stop making payments. Many with good credit history, long work history, and even those with low credit card utilization rates were in the list. I assume that life happens to people and there is nothing you can do about that besides being well prepared for the bumps in life.

Credit card companies send mass fliers for credit cards for a reason. This is a statistical game for the banks. The only hedge against notes charging off is performing grade notes to cushion the loss.

Important Lessons I Learned Investing In P2P Lending

A small amount of charge offs can dramatically hurt overall returns. Especially, if borrowers never make a single payment!

Focus on top borrowers in grade A and B.

Automated investing may invest in notes you would otherwise not invest in, so stick with manual investing with more customized filtering.

Do not invest in any notes below C grade.

Consider note terms with 60 months for higher returns.

Conclusion

You win some and you lose some. What’s most important is what you learn from the experience and continue to grow. It was my fault for not evaluating the risks properly. If I were to continue investing in this platform my allocation would be much more conservative. I would invest 80% of my notes in A and B grade notes. Perhaps the remaining 10% would be in C and under strict circumstance D. This would probably result in a return between 5-8% realistic return adjusted for risk. The illiquid nature and the many moving parts to this type of investment can be negative to some. P2P lending is for long term investors.

I also believe using the manual investing method may result in better returns. This makes the investment less passive but spending few minutes every 2-4 weeks may be well worth it for this asset class. I may continue investing manually to see if I can hedge against some of the junk notes in my portfolio. I will keep you guys updated.

If you guys wish to give it a try, check them out and don’t make the same mistakes I made! Otherwise, it's a good platform for those seeking to diversify their investment portfolio. Thank you for reading.

Follow me at my website: www.LifeBeyondFIRE.com

Sponsored ( Powered by dclick )

Introducing DCLICK: An Incentivized Ad platform by Proof of Click. - Steem based AdSense.

Hello, Steemians. Let us introduce you a new Steem B...

This posting was written via

dclick the Ads platform based on Steem Blockchain.