Donald Trump's Tariff Plan: The Almost - Masterpiece

How Trump Almost Succeeded In Stimulating the American Economy

Any individual who is up to date with global economics is aware of the biggest ongoing situation: the trade war. The trade war, initiated by the United States under Donald Trump, is quite possibly one of the biggest international issues that threatens diplomacy across the most important trade hubs of the world. It was initiated with tariffs on Steel imports from the EU, meaning, to import steel to the United States of America, an exporter from the EU would have to pay a tariff to the US government. This has been a fundamental issue causing wariness across economies.

Outline of the Issue

The first thing that must be noted is a standard occurrence when it comes to taxes and corporations. A corporation might be paying the tax, but the burden of tax almost usually always ends up on the end-consumer. Whether or not they know they’re aware of this is a different issue for concern. So with the exact same logic as this operates, the exporter would not bear the full cost of the import tariff, rather, they would pass it on the American entity purchasing the tariffed product. This entity in return will pass on the burden to their customers (who are also probably companies), and this cycle continues until finally the cost of the tariff is spread amongst the general public who end up consuming these products, directly or indirectly. So while the aim of this is to create additional revenue for the United States government, the end result is just another form of hidden taxation on the American people, or a fancy way of taxing them while keeping them under the illusion that it is auxiliary funds for their own welfare.

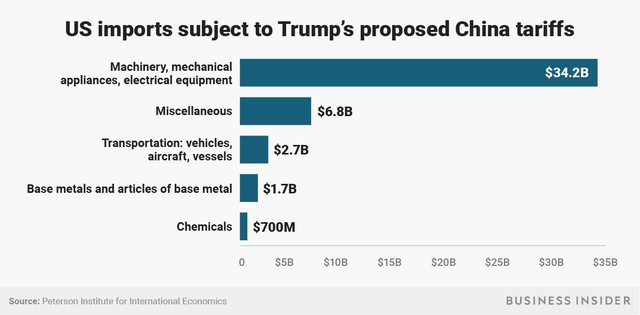

So far, the tariff has spread from the EU to China, with over $100 billion worth of trade being affected. China hit back with a counter tariff on $50 billion worth of American imports to their country. Whether it was previously planned or Trump’s massive ego clouded his judgment (wouldn’t be the first time), he threatened to impose a tariff of 25% on over $200 billion of Chinese imports to the USA.

The only positive outcome regarding the trade war was when Donald Trump met Jean Claude Juncker of the European Union. The talks were fruitful to both parties as Trump and Juncker both declared the two economies (The EU and USA) would work towards removal of all tariffs, staving off the trade war between the EU and America.

Reason For the Tariff

Donald Trump has candidly spoken of the reason he instigated such a situation. He says the United States faces $500 billion in trade deficits and their intellectual property was robbed by the Chinese. Now while the first statement is not refutable, the second definitely is.

American intellectual property, in his context, refers to that belonging to American corporations. These same corporations pay millions of dollars in legal advice for various business matters. I find it very tough to believe that they weren’t aware of the protectionist policies of the Chinese government which includes the requirement for foreign companies to share their intellectual property with the Chinese state. Foreign companies in China must be well aware of these norms before they ever laid the first brick to their factories in China. Hence, Trump’s criticism of this is hardly justifiable if you take the time to think logically.

When it comes to Europe, Trump surely couldn’t be pointing to the Cambridge Analytica fiasco where the personal information for millions of people was obtained without consent, considering the fact that his campaign for Presidency was one of Cambridge Analytica’s clients. Since the dusk of World War II, Europe has always been one of if not ‘the’ strongest ally of the United States. Even Congress Speaker Paul Ryan, an avid supporter of Trump, was worried that he was antagonizing the closest allies of the country.

The Almost - Masterpiece

While a lot of criticism surrounds the move for imposition of tariffs, it was almost a master stroke by the President in strengthening the country’s economy. First off, the tariff does not just hurt Chinese producers, it hurts American companies too. Apple, Amway, Avon, Dell, J.C.Penny’s, and Wrigley are just a few of the thousands of American corporates with manufacturing operations in China. All of their production which is sent to the United States comes under the purview of the tariff. This leads to an overall increase in the price of the products sold by these companies.

Cutting the corporate tax was just a prequel to the series of events leading to the trade war. It was meant to provide relief to companies incorporated in the United States. This, coupled with the tariff, was meant to draw American companies back home to set up their manufacturing units and create jobs and value in their own economy. But this backfired for one specific reason: failure to provide individual tax relief to the taxpayers of the United States.

Let me explain this with the example of Dell. A Dell Inspiron, which costs $400, is produced in China. With the imposition of the tariff, the Dell now costs $450. The increase in price makes it less desirable to American customers. But with tax relief to individuals, the government is increasing their real income enough for the price to be affordable or justifiable to the consumers. Further, it can be played off as simple inflation. But, without the taxpayers receiving any consolation for these price increases, Trump has left them hanging, unable to bear these extra costs. If some sort of tax reform aimed at individuals was on the agenda, it would see that demand does not suffer, as well as creating an environment where the smaller American companies that produce in China can come back home to set up their plants and stimulate employment and the economy. This move obviously wouldn’t work the big players like Apple and Dell (using them as an example was purely to show the demand contraction) because the costs of labor in the United States would probably outweigh the import tariff. This is because minimum wage in China is 20 Yuan or just under $3 an hour, while in the US, the average is $7.25.

Conclusion

While this was almost a brilliant move to stimulate the American economy without any debt obligations, the greed of tax collection got the best of the government, rendering their plan of action as a purely revenue guided scheme, rather than a focused development oriented scheme. Trump has turned friend into enemy and criticized the incumbent leaders of all the countries with which America shares cordial diplomatic relations. With the exception of his best pal, Vladimir Putin, Trump seems to be out on a mission to undermine the authority of every Prime Minister, President, and Chancellor that does not agree with his actions and ideology.

Leave any feedback/criticism in the comments below.

Thanks for Reading