COT reports?

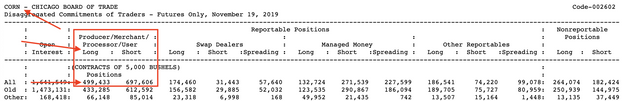

The Commodity Futures Trading Commission (Commission or CFTC) publishes the Commitments of Traders (COT) on a weekly basis. COT reports provide a breakdown of open interest for futures.

Open interest is the total number of outstanding derivative contracts, such as futures that have not been settled for an asset.

If a buyer and seller come together and initiate a new position of one contract, then open interest will increase by one contract. Should a buyer and seller both exit a one contract position on a trade, then open interest decreases by one contract.

The CFTC releases the data each Friday which contains the positions on Tuesday.

The Disaggregated reports are broken down by

- Agriculture

- Petroleum and products

- Natural gas and products

- Electricity

- Metals and other physical contracts

And then further into the following trader classifications

- Producer/Merchant/Processor/User

- Swap Dealers

- Managed Money

- Other Reportables

For our questions we are interested in the Disaggregated reports and then further in the Producer/Merchant/Processor/User classification for futures only.

Will the CFTC report more or less than the previous amount on Friday, March 5?